At BFC Tax Accountants, we understand that navigating the costs of bookkeeping services can be challenging for businesses.

The average price for bookkeeping services varies widely based on several factors, including business size, transaction volume, and service level required.

In this post, we’ll break down the key elements that influence pricing and explore different pricing models to help you make an informed decision for your company’s financial management needs.

What Drives Bookkeeping Service Prices?

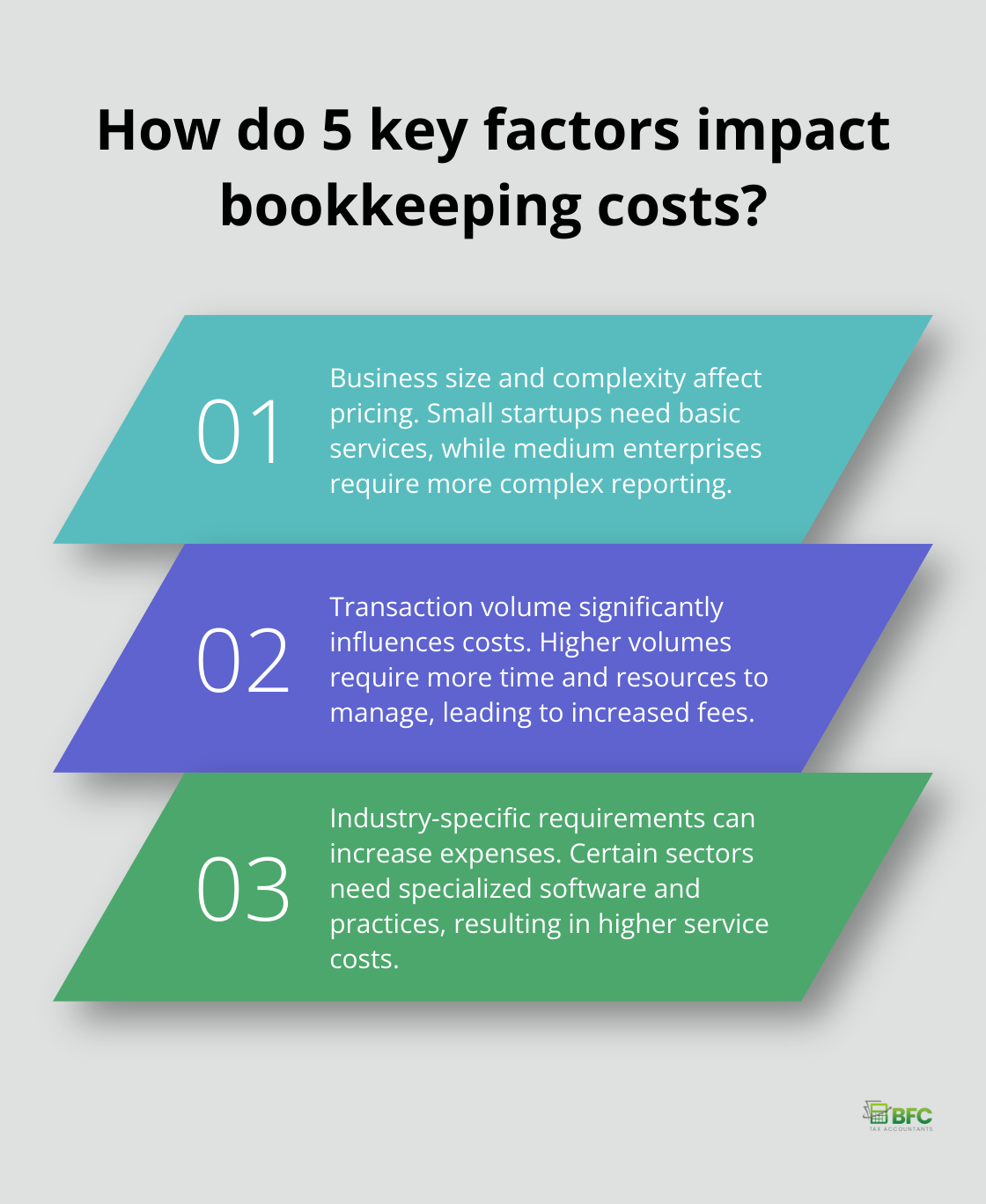

The cost of bookkeeping services varies widely. Several key factors influence pricing, and understanding these elements will help you estimate and budget for your bookkeeping needs more accurately.

Business Size and Complexity

The size and complexity of a business directly impact bookkeeping costs. A small startup might only need basic transaction recording and monthly reconciliations, while a medium-sized enterprise could require more complex financial reporting and analysis. As business structures become more intricate, bookkeeping costs tend to increase.

Transaction Volume

The number of financial transactions a business processes affects bookkeeping costs significantly. Price Volume Mix Analysis can help businesses understand the impact of volume on their financial performance. A retail store with numerous daily transactions will likely pay more than a consulting firm with fewer monthly invoices. Higher transaction volumes require more time and resources to manage, which leads to increased service fees.

Industry-Specific Requirements

Some industries have unique bookkeeping needs due to regulatory requirements or specialized accounting practices. Construction professionals, for example, often require specialized software solutions and best practices to master the art of bookkeeping. These specialized services can increase the overall cost of bookkeeping.

Service Level

The depth of service required plays a crucial role in pricing. Basic bookkeeping services (like data entry and bank reconciliations) are generally less expensive than comprehensive services that include financial analysis, budgeting, and forecasting. Advanced services often require more skilled professionals, which translates to higher rates.

Geographic Location

Location significantly impacts bookkeeping costs. Urban areas with higher costs of living typically have higher service rates. For instance, bookkeeping services in Toronto or Vancouver are often more expensive than in smaller cities or rural areas. However, with the rise of remote work and cloud-based accounting software, geographic barriers are becoming less of a factor in pricing.

These factors work together to determine the final cost of bookkeeping services. As we move forward, we’ll explore the various pricing models used by bookkeeping service providers and how they align with these influencing factors.

How Much Do Bookkeeping Services Cost?

Hourly Rates: Flexibility with a Catch

Many bookkeepers charge by the hour, with rates typically ranging from $30 to $110. This model offers flexibility, especially for businesses with fluctuating needs. However, it can create unpredictable budgeting. The actual rate can vary based on factors such as expertise and location.

Monthly Flat Fees: Predictability for Your Budget

Flat monthly fees have gained popularity. Small to medium-sized businesses can expect to pay between $500-$2,500 monthly for outsourced bookkeeping services. This model provides predictability for your budget and often includes a set package of services.

Per-Transaction Pricing: Pay for What You Use

Some bookkeepers offer per-transaction pricing, which can benefit businesses with low transaction volumes. This model can prove cost-effective for businesses with sporadic activity but can quickly become expensive for high-volume operations.

Project-Based Pricing: Ideal for One-Time Needs

For specific tasks or catch-up work, bookkeepers often use project-based pricing. This could range from a few hundred dollars for a simple project to several thousand for more complex work.

When selecting a pricing model, consider your business’s specific needs and financial situation. The value of accurate and timely financial information cannot be overstated. Investing in quality bookkeeping services can save you money in the long run by avoiding costly errors and providing insights for better business decisions.

Now that we’ve explored the various pricing models for bookkeeping services, let’s compare the costs and benefits of in-house versus outsourced bookkeeping solutions.

In-House vs. Outsourced Bookkeeping: A Cost Comparison

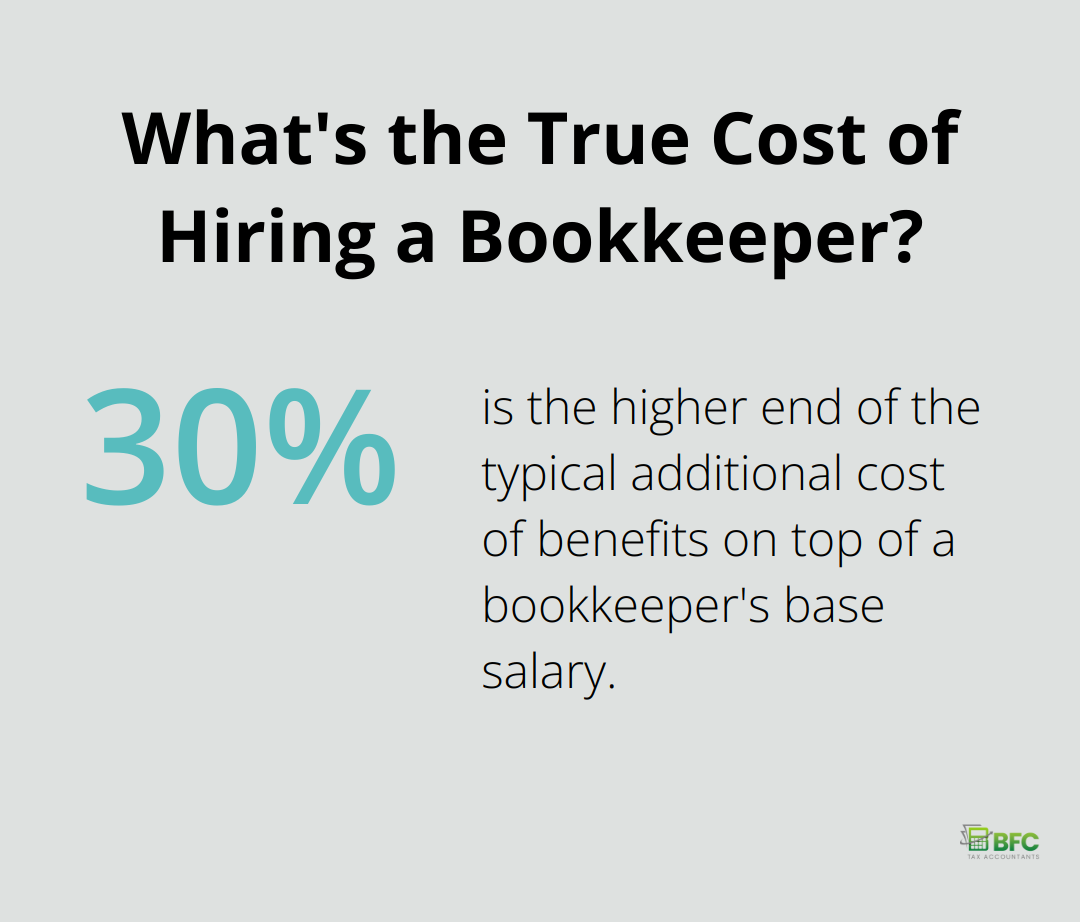

Salary and Benefits Analysis

In-house bookkeepers in Canada command an average annual salary between $45,000 and $55,000 (according to PayScale data). This base cost increases when you add benefits, which typically contribute an additional 15-30% to the total compensation package. For small businesses, this expense can consume a significant portion of the operational budget.

Hidden Expenses of Internal Bookkeeping

The costs of in-house bookkeeping extend beyond salaries. Accounting software subscriptions range from $300 to $5,000 annually, depending on system complexity. Hardware costs for a dedicated workstation add another $1,000 to $2,000 upfront. Ongoing training to stay current with changing regulations and software updates can cost $500 to $2,000 per year.

Outsourcing Cost Benefits

In-house accounting offers more control, direct communication, and tailored solutions, but it can be costly and resource intensive. Monthly fees for comprehensive outsourced services typically range from $500 to $2,500. This figure includes access to advanced software and a team of experts without the overhead of full-time employees.

Scalability Advantages

Outsourcing offers unparalleled scalability. As your business grows, you can adjust services without the complexities of hiring or training new staff. This flexibility proves particularly valuable for seasonal businesses or those experiencing rapid growth.

Access to Specialized Expertise

Outsourced firms often provide increased efficiency and accuracy. By outsourcing bookkeeping, you leverage the expertise and specialized software of professional bookkeeping services. This level of expertise can be prohibitively expensive to maintain in-house. Companies like BFC Tax Accountants offer this specialized knowledge as part of their service package.

The decision between in-house and outsourced bookkeeping depends on individual business needs. However, the trend increasingly favors outsourced solutions for their cost-effectiveness and flexibility. As businesses focus on core competencies, partnering with specialized financial service providers can offer both economic and strategic advantages.

Final Thoughts

The average price for bookkeeping services varies based on business complexity, transaction volume, and service level. Businesses must weigh the benefits of in-house versus outsourced bookkeeping, considering cost-effectiveness and scalability. Professional bookkeeping services offer long-term advantages, including accurate financial records and improved decision-making capabilities.

BFC Tax Accountants provides tailored bookkeeping solutions to meet diverse business needs. Our comprehensive accounting services cater to businesses in Barrie, Ontario, and beyond, offering a range of financial management options. We strive to align our services with your business goals, ensuring optimal financial health.

Selecting the right bookkeeping service requires careful consideration of your specific needs and budget. The best choice supports your business’s financial health and growth potential. Investing in quality bookkeeping services can lead to cost savings and increased efficiency in the long run.