At BFC Tax Accountants, we understand that managing finances is a critical aspect of running a successful small business. Bookkeeping services for small businesses can be a game-changer, freeing up valuable time and ensuring financial accuracy.

In this guide, we’ll explore the benefits of professional bookkeeping and help you choose the right service for your needs. Whether you’re a startup or an established company, mastering your financial management is key to sustainable growth and success.

What Is Bookkeeping for Small Businesses?

The Foundation of Financial Management

Bookkeeping forms the backbone of financial management for small businesses. It involves the systematic recording and organization of financial transactions. At its core, bookkeeping tracks every dollar that flows in and out of your business.

Key Tasks in Small Business Bookkeeping

Small business bookkeeping encompasses several essential tasks:

- Recording sales and expenses

- Managing invoices and receipts

- Reconciling bank statements

- Preparing financial reports

These activities create a clear financial picture of your business, not just maintain records.

A survey by Wasp Barcode Technologies reveals that many small business owners lack confidence in their accounting and finance knowledge. This highlights the need for proper bookkeeping practices or professional services.

Distinguishing Bookkeeping from Accounting

While often confused, bookkeeping and accounting serve distinct functions:

- Bookkeeping focuses on recording daily transactions and maintaining financial records.

- Accounting involves analyzing, interpreting, and reporting financial data to guide business decisions.

Bookkeeping lays the foundation for accounting. Without accurate bookkeeping, accounting becomes speculative.

The Power of Effective Bookkeeping

Good bookkeeping does more than keep you organized. It:

- Provides insights into your cash flow

- Helps identify business trends

- Reduces stress during tax season

For small businesses in Barrie, Ontario (and beyond), implementing solid bookkeeping practices proves crucial. Whether you handle it in-house or outsource to professionals, good bookkeeping sets the stage for financial success and growth.

As we explore the benefits of professional bookkeeping services in the next section, you’ll discover how these services can transform your financial management and drive your business forward.

Why Professional Bookkeeping Matters

Time is Money

Small business owners often juggle multiple responsibilities. Bookkeeping, while essential, consumes significant time. Professional bookkeeping services free up this time, allowing you to focus on core business activities.

Accuracy Equals Compliance

Mistakes in financial records lead to costly penalties. Professional bookkeepers maintain accurate records, which ensures compliance with tax laws and regulations. This accuracy not only avoids penalties but also provides peace of mind.

Data-Driven Decisions

Professional bookkeeping gives you access to real-time financial data. This information proves crucial for making informed business decisions. For instance, a cash flow analysis reveals the best times for major purchases or investments. Regular financial reports enable you to spot trends and make strategic choices.

Growing with Your Business

As your business expands, your financial management needs increase. Professional bookkeeping services scale alongside your growth. Whether you add new revenue streams or expand to new locations, a professional bookkeeper adapts their services to match your evolving requirements. This scalability ensures that your financial management remains robust, regardless of your business size.

Expert Guidance

Professional bookkeepers offer more than just number crunching. They provide expert guidance on financial matters (such as tax planning and cash flow management). This expertise can help you navigate complex financial situations and make informed decisions about your business’s future.

Professional bookkeeping is a strategic investment in your business’s future. It transforms financial management from a tedious task into a powerful tool for growth and success. The next section will guide you through the process of choosing the right bookkeeping service for your small business.

How to Select the Ideal Bookkeeping Service

In-House vs. Outsourced Options

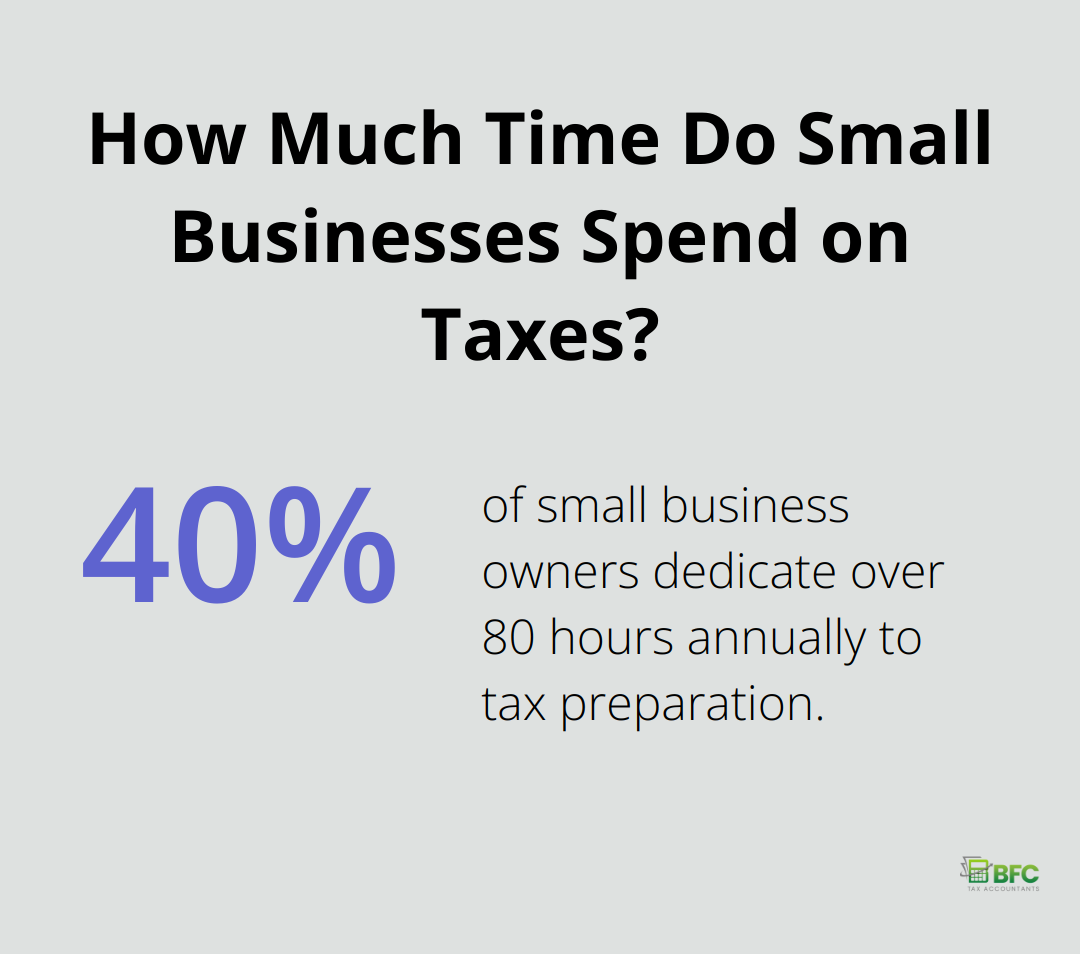

The first decision involves choosing between in-house bookkeeping and outsourcing. In-house bookkeeping provides direct control but demands significant time and expertise. A survey by Score reveals that 40% of small business owners dedicate over 80 hours annually to tax preparation. Outsourcing to professionals frees up this time, allowing you to concentrate on core business activities.

Essential Features of Quality Bookkeeping Services

When evaluating bookkeeping services, prioritize providers that offer cloud-based solutions. This technology reduces IT costs, creates more flexibility and efficiency, improves security, boosts performance, and enhances the potential for innovation and development.

Try to find services that offer scalability. Your chosen provider should adapt as your business grows. Look for companies that provide various accounting packages tailored to different business sizes (from startups to enterprises).

Key Questions for Potential Providers

Before committing to a bookkeeping service, ask about their experience with businesses in your industry. Industry-specific knowledge can prove invaluable. For example, if you operate in retail, a bookkeeper familiar with inventory management and point-of-sale systems will add more value.

Inquire about their communication style and frequency of financial reporting. Regular updates facilitate informed decision-making. Clear, jargon-free communication from your bookkeeper can help bridge any knowledge gaps in accounting and finance.

Cost Considerations and ROI

While cost matters, it shouldn’t be the sole determining factor. Professional bookkeeping can save money by catching errors, maximizing tax deductions, and providing insights for better financial decisions.

Consider the potential costs of mistakes in DIY bookkeeping. Professional services ensure compliance and accuracy, potentially saving you from costly penalties.

Final Thoughts

Effective bookkeeping forms the foundation of financial success for small businesses. It provides insights, enables informed decisions, and positions your business for growth. Professional bookkeeping services for small businesses offer a strategic advantage through accuracy, compliance, and expert guidance that transform financial management.

The right bookkeeping service is a crucial step in your business journey. We recommend providers that offer cloud-based solutions, industry-specific expertise, and clear communication. The cost of professional bookkeeping should be viewed as an investment in your business’s future, potentially saving you from costly errors and penalties.

At BFC Tax Accountants, we understand the unique challenges faced by small businesses in Barrie, Ontario (and beyond). Our comprehensive bookkeeping services meet your specific needs, whether you’re a startup or an established enterprise. We offer expert guidance, cloud-based accessibility, and personalized solutions to help you navigate financial management complexities and focus on your business growth.