At BFC Tax Accountants, we understand that offering the right bookkeeping services can make or break a business. That’s why we’ve compiled a comprehensive list of bookkeeping services to offer your clients.

From essential tasks to advanced financial management and industry-specific solutions, this guide covers it all. Whether you’re starting out or looking to expand your service offerings, you’ll find valuable insights to help you meet your clients’ diverse needs.

What Are the Core Bookkeeping Services?

Accurate Transaction Recording

The foundation of bookkeeping is the precise recording of all financial transactions. This process captures every dollar that flows in and out of a business. Modern accounting software streamlines this task. QuickBooks Online, rated 4.5/5, is ideal for small businesses with a technology budget, while Wave, rated 4.0, suits sole proprietors and very small businesses.

Timely Bank Reconciliations

Regular bank reconciliations detect discrepancies and prevent fraud. A study by the Association of Certified Fraud Examiners highlighted the importance of bank reconciliations in detecting fraudulent activity. Monthly (or even weekly) reconciliations maintain tight control over finances.

Efficient Payables and Receivables Management

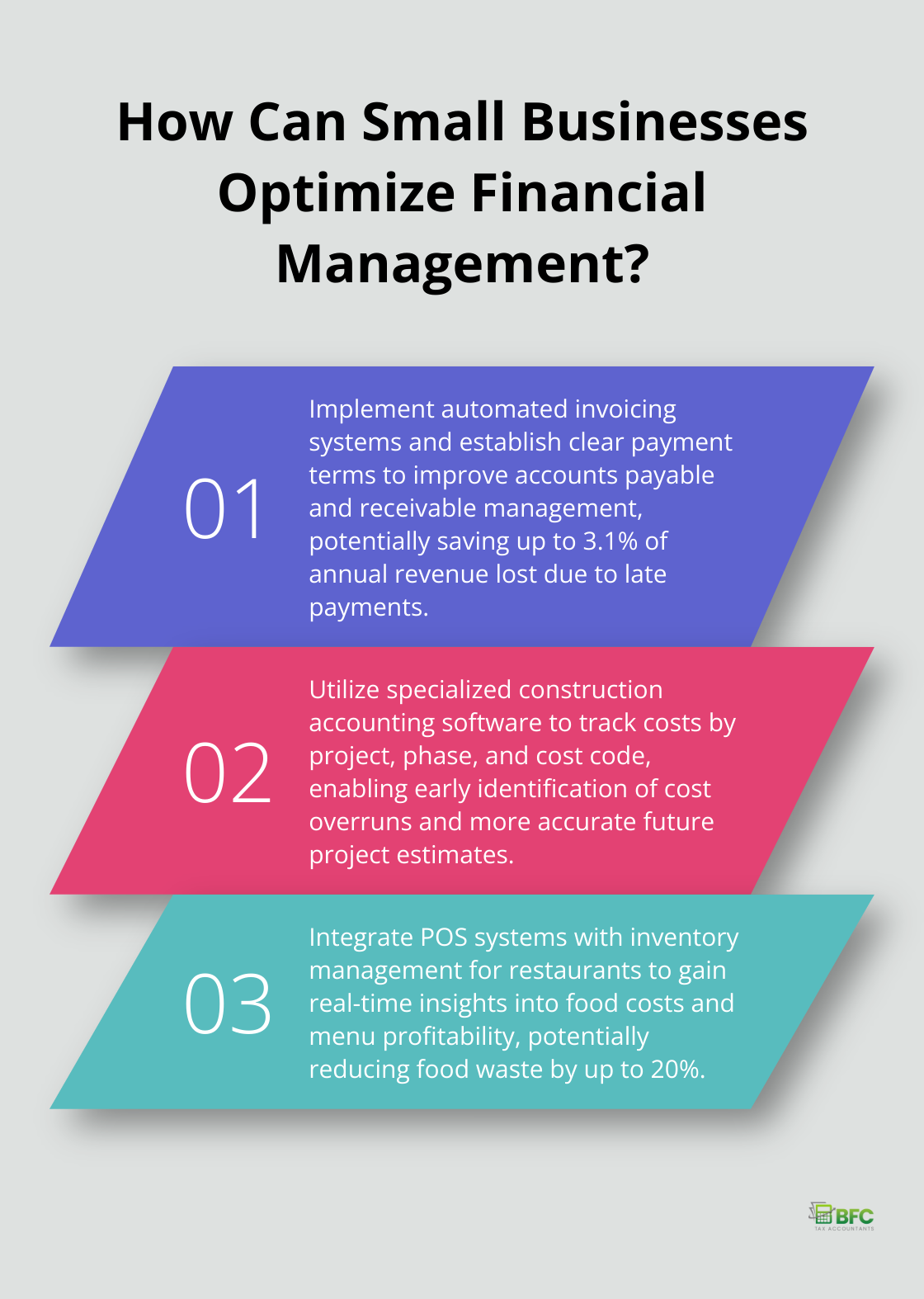

Effective management of accounts payable and receivable is essential for healthy cash flow. Late payments can cost businesses up to 3.1% of their annual revenue due to lost time and resources chasing payments (according to a Sage report). Automated invoicing systems and clear payment terms significantly improve this process.

Comprehensive Financial Reporting

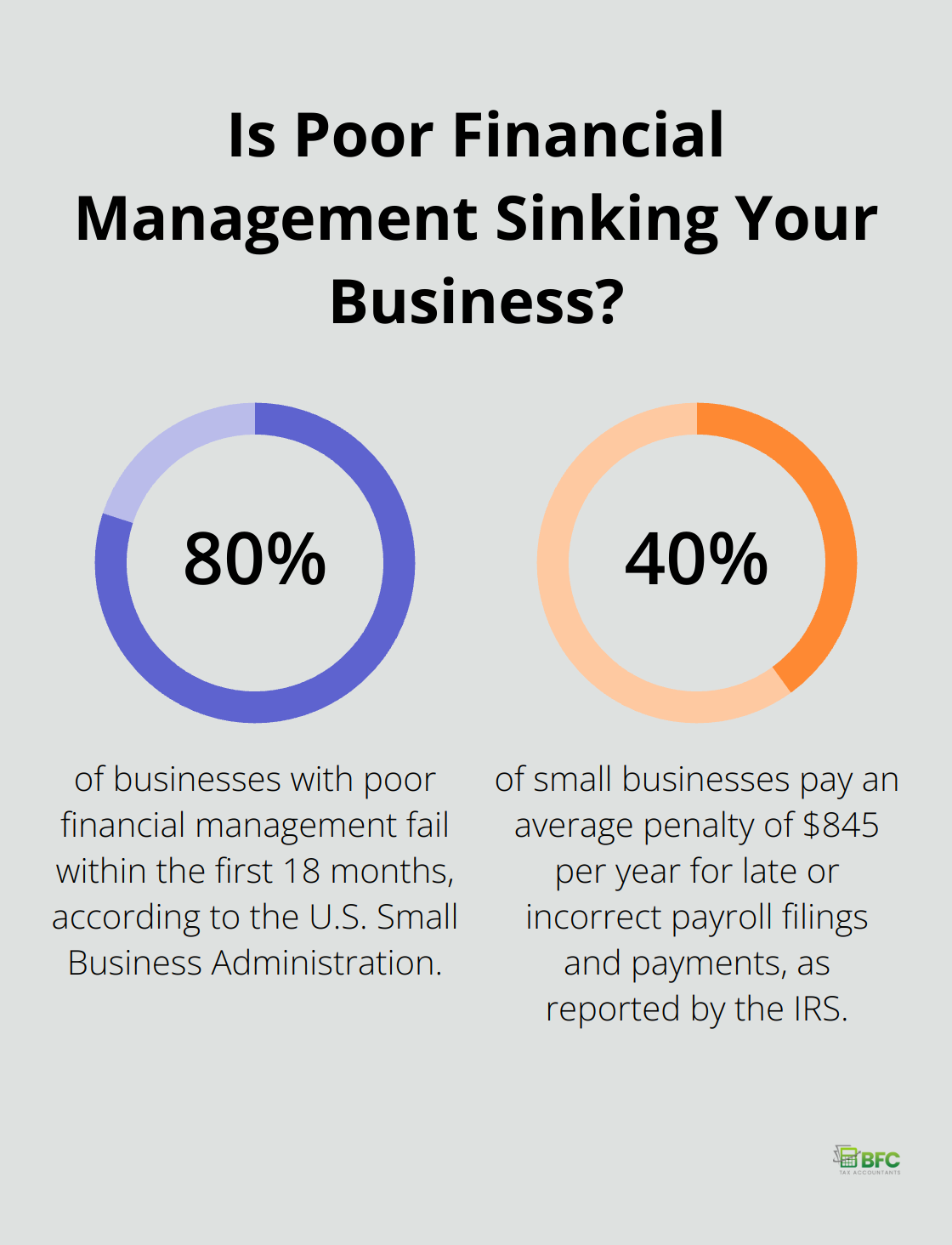

Accurate financial statements provide a clear picture of a business’s financial health. The U.S. Small Business Administration reports that businesses with poor financial management have an 80% failure rate within the first 18 months. Regular financial reporting helps identify trends and informs decision-making.

Streamlined Payroll Processing

Payroll is often complex and time-consuming. The IRS reports that 40% of small businesses pay an average penalty of $845 per year for late or incorrect filings and payments. Outsourcing payroll to experts (or using specialized software) ensures compliance and saves valuable time.

These core services form the bedrock of solid bookkeeping practices. They maintain financial clarity, ensure regulatory compliance, and drive informed decision-making for business growth. While DIY bookkeeping might seem cost-effective initially, professional services often pay for themselves through improved efficiency and reduced errors.

As we move forward, let’s explore the advanced bookkeeping services that can take your financial management to new heights.

How Can Advanced Bookkeeping Services Boost Your Business?

Advanced bookkeeping services can significantly impact your business’s financial health and growth potential. Let’s explore how these services can transform your financial management.

Cash Flow Management and Forecasting

Cash flow management is the lifeblood of any business. A U.S. Bank study found that 82% of business failures result from cash flow problems. Advanced bookkeeping services use sophisticated tools to track cash flow in real-time, identifying patterns and potential issues before they become problems.

Forecasting takes this a step further. It analyzes historical data and market trends to project future cash flows. This allows businesses to make informed decisions about investments, hiring, and expansion. For example, a retail business used forecasting to time their inventory purchases perfectly, reducing carrying costs by 15%.

Strategic Budgeting and Financial Planning

A well-crafted budget serves as a financial roadmap. Advanced bookkeeping services don’t just create budgets; they design flexible financial plans that adapt to changing business needs. This approach involves setting realistic goals, monitoring progress, and making data-driven adjustments.

A survey by the National Federation of Independent Business revealed that businesses with detailed financial plans are 30% more likely to achieve growth targets. This highlights the importance of strategic financial planning in driving business success.

Inventory and Fixed Asset Management

For businesses with physical assets, proper management is crucial. Advanced inventory management services help maintain optimal stock levels, reducing both stockouts and excess inventory. They use specialized software to track inventory turnover rates, helping businesses make informed purchasing decisions.

Fixed asset management goes beyond simple depreciation calculations. It tracks the lifecycle of assets, from acquisition to disposal, ensuring businesses maximize their value. This approach has helped manufacturing businesses reduce equipment downtime by up to 20% through better maintenance scheduling.

Tax Preparation and Filing

Tax compliance is complex and ever-changing. Advanced bookkeeping services stay up-to-date with the latest tax laws to ensure businesses remain compliant. They don’t just prepare taxes; they proactively identify deductions and credits that might otherwise be missed.

Advanced bookkeeping services provide more than just number crunching; they offer actionable insights that drive businesses forward. These services can be tailored to specific needs, ensuring businesses have the financial clarity and strategic support to thrive in today’s competitive landscape.

As we move forward, let’s explore how industry-specific bookkeeping services can address unique challenges in various sectors.

How Do Industry-Specific Bookkeeping Services Address Unique Challenges?

Retail: Mastering Inventory and Sales Tracking

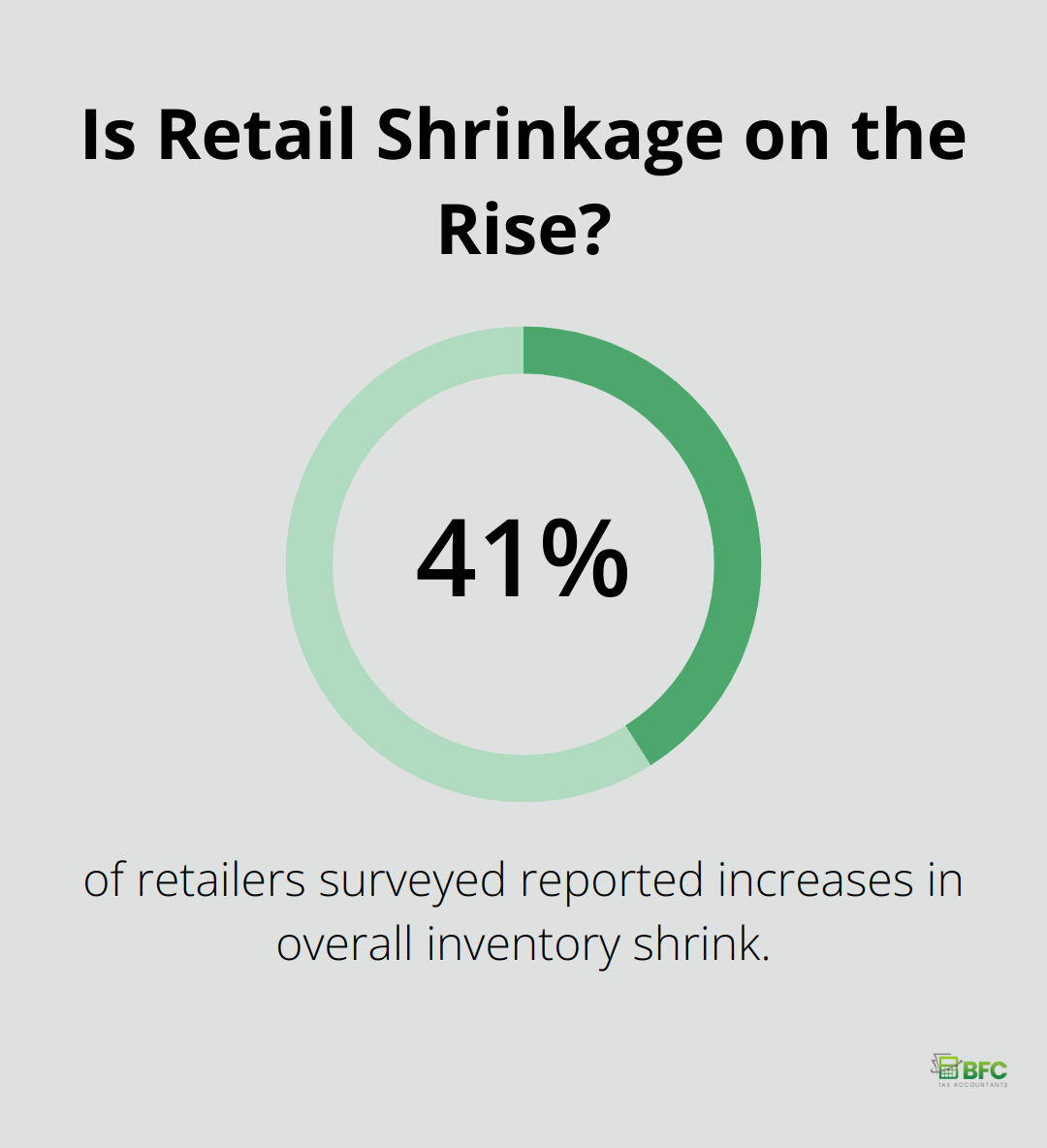

Retail businesses require precise inventory management to maintain profitability. 41% of retailers surveyed reported increases in overall inventory shrink. Advanced inventory tracking systems integrated with point-of-sale (POS) data can significantly reduce these losses.

A mid-sized clothing retailer implemented a real-time inventory tracking system. This resulted in a 20% reduction in stockouts and a 15% increase in sales. The system allowed for automatic reordering of popular items and helped identify slow-moving stock for clearance sales.

Construction: Accurate Job Costing for Profitability

In the construction industry, precise job costing determines profitability. The Construction Financial Management Association identifies inaccurate job costing as a leading cause of contractor failures.

Specialized construction accounting software tracks costs by project, phase, and cost code. This level of detail allows contractors to identify cost overruns early and adjust estimates for future projects. A residential builder using such a system improved their project profitability by 12% within the first year of implementation.

Healthcare: Navigating Complex Billing and Coding

Healthcare providers face unique challenges with complex billing codes and insurance requirements. Claims rejection rates have varied over the years, with Medicare having the highest denial rate at 4.92% in 2013.

Specialized medical billing and coding services can significantly improve reimbursement rates. A small medical practice that outsourced its billing saw a 15% increase in collections and a 30% reduction in denied claims within six months.

Non-Profit Organizations: Fund Accounting for Transparency

Non-profit organizations require transparent financial management to maintain donor trust and comply with regulations. Fund accounting is essential for tracking restricted and unrestricted funds separately.

Specialized non-profit accounting software generates the detailed reports required by donors and regulatory bodies. A local charity using such a system increased its grant funding by 25% due to improved financial transparency and reporting capabilities.

Restaurants: Integrating POS and Inventory Management

Restaurants operate on thin margins, making accurate financial management essential. The National Restaurant Association reports that food costs typically account for 28-35% of restaurant sales.

Integrating POS systems with inventory management provides real-time insights into food costs and menu profitability. A family-owned restaurant implemented such a system and reduced food waste by 20% (directly improving their bottom line).

Industry-specific bookkeeping services provide more than number tracking; they offer actionable insights that drive business success. These specialized services help businesses optimize operations, improve profitability, and stay compliant with industry regulations.

Final Thoughts

Bookkeeping services have evolved beyond simple number-crunching. The range of bookkeeping services to offer now includes essential tasks, advanced financial management, and industry-specific solutions. These services maintain financial health, ensure compliance, and drive informed decision-making for businesses of all sizes.

Success depends on tailoring services to meet each client’s unique needs. A one-size-fits-all approach no longer works in today’s diverse business landscape. Specialized services for industries like retail, construction, and healthcare provide invaluable insights that directly impact a business’s bottom line.

At BFC Tax Accountants, we offer comprehensive, tailored bookkeeping services. Our team of experts in Barrie, Ontario, provides professional accounting and tax services designed to meet the unique needs of individuals and businesses. We help our clients navigate their financial landscape with confidence through personal tax planning, corporate tax solutions, and specialized bookkeeping packages.