At Kyei Baffour, we understand that navigating Canada’s tax system can be complex. Understanding Canada Revenue personal tax rates is essential for every Canadian taxpayer.

This guide breaks down federal and provincial tax brackets, explains how to calculate your tax liability, and highlights key credits and deductions that can impact your overall tax burden.

Understanding Canada’s Progressive Tax System

How Progressive Taxation Works

Canada’s progressive tax system means that the more you earn, the higher your calculated income tax will be. This approach aims to distribute the tax burden equitably across different income levels.

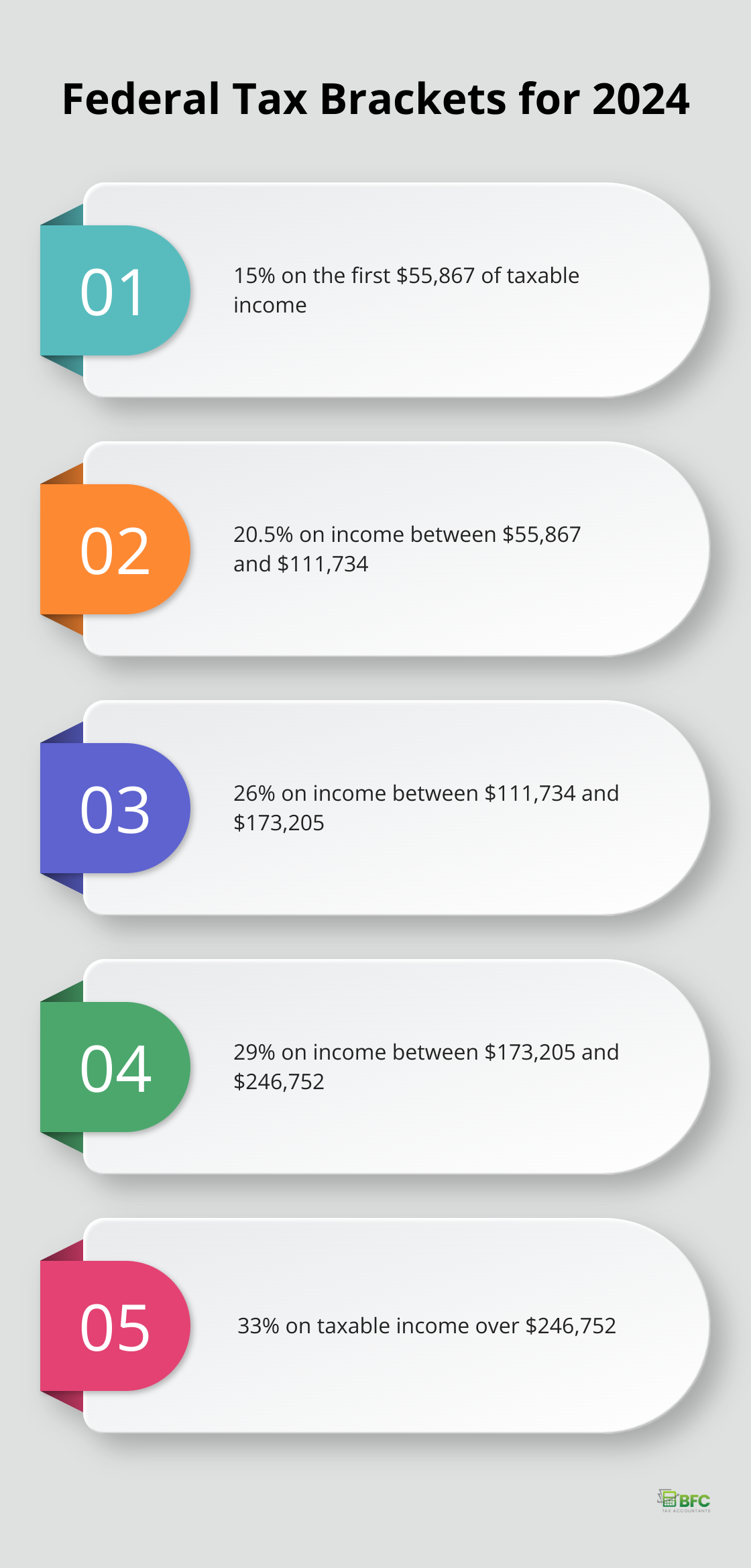

Federal Tax Brackets for 2024

For the 2024 tax year, the federal tax brackets are:

- 15% on the first $55,867 of taxable income

- 20.5% on the next $55,867 (up to $111,734)

- 26% on the next $61,471 (up to $173,205)

- 29% on the next $73,547 (up to $246,752)

- 33% on taxable income over $246,752

These rates apply to taxable income (total income minus allowable deductions).

Calculating Your Federal Tax Liability

To determine your federal tax liability, apply the appropriate tax rate to each portion of your income within a specific bracket. For example, if your taxable income is $80,000, you would pay:

- 15% on the first $55,867 = $8,380.05

- 20.5% on the remaining $24,133 = $4,947.27

Your total federal tax before credits would be $13,327.32.

The Power of Tax Credits

After calculating your base federal tax, various tax credits can reduce your overall tax burden. The basic personal amount ($15,705 for 2024) is a non-refundable tax credit available to every Canadian. This credit alone can reduce your federal tax by up to $2,355.75 (15% of $15,705).

Other common credits include:

- Canada Workers Benefit (up to $1,428 for singles, $2,461 for families)

- Climate Action Incentive (varies by province and family size)

- Digital News Subscription tax credit (up to $75 in savings)

Strategic Tax Planning

Understanding Canada’s progressive tax system allows for effective financial planning. For instance, if you’re near a higher tax bracket, contributing to an RRSP can lower your taxable income and potentially keep you in a lower bracket. The RRSP contribution limit for 2024 is 18% of your previous year’s earned income, with a maximum of $31,560.

As we move forward, it’s important to consider how provincial and territorial tax rates interact with the federal system to determine your total tax obligation.

How Provincial Tax Rates Impact Your Overall Tax Bill

Canada’s tax system combines federal and provincial rates, creating a complex landscape for taxpayers. While federal tax rates remain consistent across the country, each province and territory sets its own rates and brackets. This results in significant variations in the total tax Canadians pay based on their location.

Provincial Tax Rate Variations

The differences in provincial tax rates can be substantial. Tax rates in Canada vary by province and territory, with each jurisdiction setting its own specific rates. This means two individuals with identical incomes could have very different tax bills based solely on their province of residence.

Some provinces apply a flat tax rate regardless of income level. Others use a progressive system with rates ranging across different income brackets. These variations lead to significant differences in after-tax income for Canadians across the country.

Combined Federal and Provincial Tax Rates

To fully understand your tax obligation, you must consider the combined federal and provincial rates. For high-income earners, the combined federal and provincial tax rates can vary significantly depending on the province.

Let’s consider a practical example: an individual earning $100,000 in Ontario. Their combined federal and provincial marginal tax rate would be different from someone living in Alberta. This difference can translate to thousands of dollars in tax savings annually.

Quebec’s Distinct Tax System

Quebec operates a unique tax system within Canada. Unlike other provinces, Quebec collects its own income taxes and provides its own set of tax credits and deductions. This means Quebec residents often face a different tax calculation process compared to the rest of Canada.

One key difference is that Quebec residents receive a tax abatement of a percentage of basic federal tax. This abatement offsets the fact that Quebec doesn’t receive certain federal cash transfers that other provinces do. However, Quebec’s provincial tax rates are generally higher to compensate for this abatement.

Impact on Financial Planning

Understanding provincial tax rates is essential for effective financial planning. For individuals considering relocation, the tax implications can be significant. A move from a high-tax province to a lower-tax one could result in substantial savings (or vice versa).

Businesses must also factor in provincial tax rates when making decisions about where to operate or expand. The differences in corporate tax rates between provinces can impact profitability and investment decisions.

As we explore the intricacies of Canada’s tax system, it becomes clear that provincial tax rates play a crucial role in determining your overall tax burden. In the next section, we’ll examine how various tax credits and deductions can further impact your effective tax rate and potentially reduce your tax liability.

How Tax Credits and Deductions Can Lower Your Tax Bill

Understanding Tax Credits

Tax credits directly reduce the amount of tax you owe. The basic personal amount ($15,705 for 2024) is a non-refundable tax credit available to every Canadian. This credit can save you up to $2,355.75 in federal taxes.

Other valuable credits include:

- Canada Workers Benefit: Low-income workers can receive up to $1,428 for singles or $2,461 for families.

- Climate Action Incentive: This credit varies by province and family size (potentially offering hundreds of dollars in savings).

- Medical Expenses Tax Credit: You can claim eligible medical expenses that exceed the lesser of $2,635 or 3% of your net income.

Leveraging Deductions

Deductions reduce your taxable income before tax rates apply. Some key deductions include:

- RRSP Contributions: You can contribute up to 18% of your previous year’s earned income (maximum $31,560 for 2024) to lower your taxable income.

- Child Care Expenses: You can deduct up to $8,000 per child under 7 and $5,000 per child aged 7-16.

- Moving Expenses: If you moved for work or school, you might deduct eligible moving costs.

Strategic Planning for Tax Savings

To optimize your tax situation, you must plan strategically. For instance, timing your RRSP contributions wisely can keep you in a lower tax bracket. Similarly, grouping medical expenses in a single tax year might allow you to surpass the threshold for the Medical Expenses Tax Credit.

The Importance of Professional Advice

While online tax software can help, personalized advice from a professional accountant who understands Canadian tax law nuances often yields better results. Tax professionals can identify all applicable credits and deductions, ensuring you don’t miss out on potential tax savings.

Staying Informed About Tax Changes

The tax landscape changes annually. What worked last year might not be the best strategy this year. You should stay informed about new credits, deductions, and changes to existing ones. Professional guidance can help you navigate these changes and maximize your tax savings.

Final Thoughts

Canada Revenue personal tax rates form a complex system that impacts every Canadian’s financial well-being. The progressive federal tax structure, combined with varying provincial rates, creates a unique landscape for each taxpayer. Understanding tax brackets, credits, and deductions allows for informed financial decisions and potential tax savings.

Tax credits and deductions serve as powerful tools to reduce tax liability. The basic personal amount, Canada Workers Benefit, and strategic use of RRSP contributions can lead to substantial savings. Timing these actions wisely and grouping certain expenses often yields significant benefits.

Professional guidance can help navigate the intricacies of the Canadian tax system. At BFC Tax Accountants, we offer expert tax services tailored to individual and business needs. Our team can assist you in maximizing tax savings while ensuring compliance with current regulations (which change annually).