Cash flow and budget are two essential aspects of any business, especially in Ontario, where the economy is dynamic and competitive. Cash flow is the movement of money in and out of your business, while budget is the plan of how you intend to spend and save your money. Managing both effectively can help you achieve your financial goals, avoid cash shortages, and prepare for growth and investment opportunities.

In this article, we will share some best practices and strategies for managing your cash flow and budget in Ontario, based on our experience as professional accountants serving clients in Innisfil, Barrie, Simcoe County and the rest of Ontario.

Understand your cash cycle

The first step to managing your cash flow and budget is to understand your cash cycle, which is the time it takes for your business to convert its resources into cash. Your cash cycle consists of four stages:

- Cash inflows: This is the money that comes into your business from sales, investments, loans, grants or other sources.

- Cash outflows: This is the money that goes out of your business to pay for expenses, such as rent, wages, taxes, supplies, inventory, debt repayments or dividends.

- Cash surplus: This is the excess of cash inflows over cash outflows in a given period. You can use this surplus to invest in your business, save for emergencies or reward yourself.

- Cash deficit: This is the shortfall of cash inflows below cash outflows in a given period. You may need to borrow money, sell assets or reduce expenses to cover this deficit.

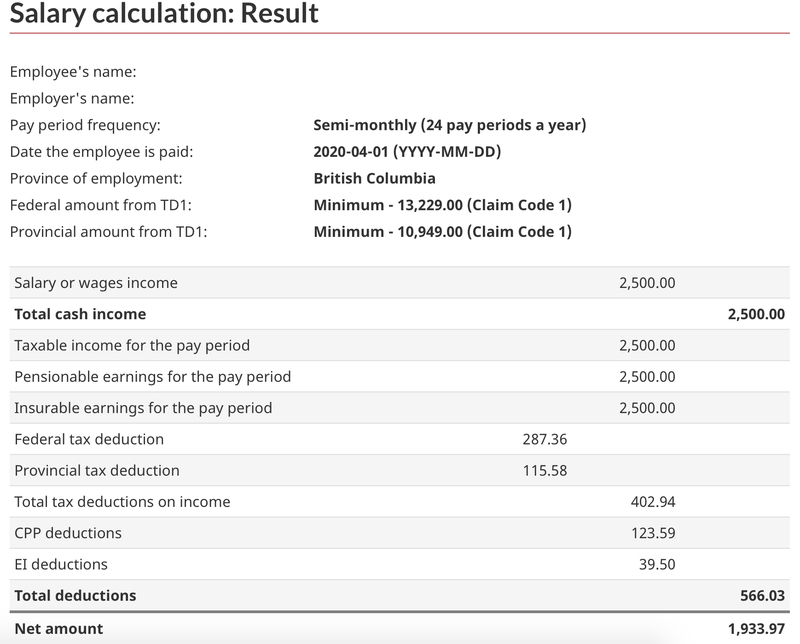

To calculate your cash cycle, you need to track and measure your cash inflows and outflows on a regular basis, such as weekly, monthly or quarterly. You can use accounting software, spreadsheets or a simple ledger to record your transactions and generate reports. You can also use tools like CIBC’s Budget and Cash Flow Calculator to get a big-picture view of your cash flow and budget.

Plan ahead and forecast

The second step to managing your cash flow and budget is to plan ahead and forecast your future cash needs and sources. This will help you avoid surprises, prepare for contingencies and seize opportunities. To plan ahead and forecast, you need to:

- Set realistic goals: Based on your past performance, market trends and industry benchmarks, set realistic goals for your sales, expenses, profits and growth. Make sure your goals are specific, measurable, attainable, relevant and time-bound (SMART).

- Create a budget: Based on your goals, create a budget that outlines how much money you expect to earn and spend in a given period. Your budget should include both fixed costs (such as rent) and variable costs (such as supplies) that depend on your sales volume. You can use CPA Canada’s Planning, Budgeting and Forecasting resources to learn more about creating a budget.

- Monitor and adjust: Compare your actual results with your budget on a regular basis and identify any variances or discrepancies. Analyze the causes of these variances and adjust your budget accordingly. You may need to revise your goals, increase your prices, reduce your costs or seek additional funding.

Optimize your cash flow

The third step to managing your cash flow and budget is to optimize your cash flow by increasing your cash inflows and decreasing your cash outflows. Some strategies to optimize your cash flow are:

- Accelerate your receivables: Collect payments from your customers as soon as possible by offering incentives for early payment, issuing invoices promptly, following up on overdue accounts or accepting online payments.

- Delay your payables: Negotiate longer payment terms with your suppliers or creditors by offering discounts for bulk orders, requesting credit lines or paying by credit card.

- Manage your inventory: Keep an optimal level of inventory by ordering only what you need, selling off excess or obsolete stock or using just-in-time delivery methods.

- Reduce your expenses: Cut down on unnecessary or wasteful spending by reviewing your expenses regularly, shopping around for better deals or outsourcing non-core functions.

- Seek external funding: If you need more cash to grow or sustain your business, seek external funding from sources such as banks, investors, government programs or crowdfunding platforms.

Get professional help

The fourth step to managing your cash flow and budget is to get professional help from an accountant who can provide you with expert advice and assistance. An accountant can help you:

- Set up an accounting system: An accountant can help you set up an accounting system that suits your business needs and preferences, whether it is cloud-based, desktop-based or manual. An accounting system can help you record, organize and report your financial transactions and generate useful information for decision-making.

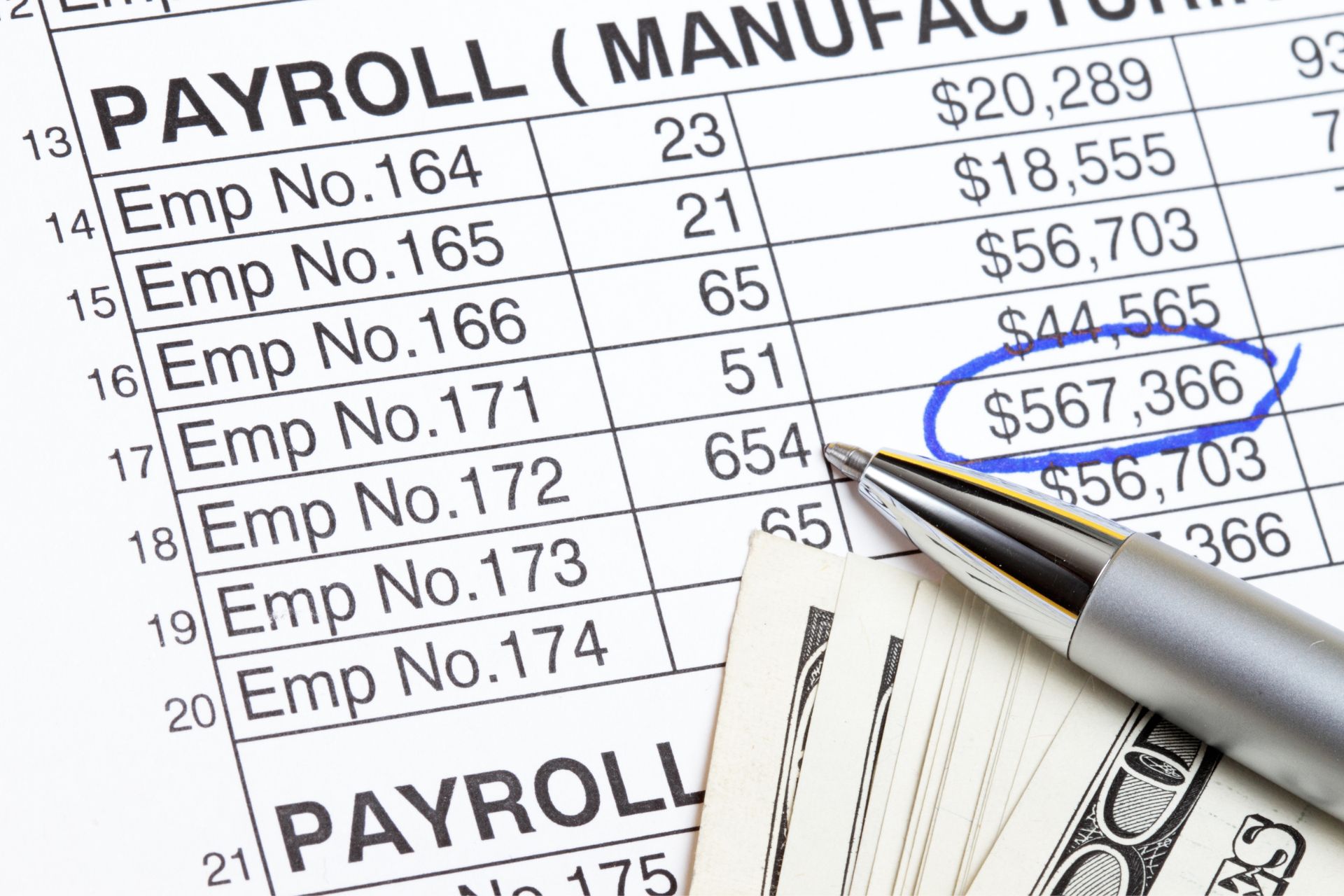

- Prepare financial statements: An accountant can help you prepare financial statements, such as income statements, balance sheets and cash flow statements, that show the financial position and performance of your business. Financial statements can help you monitor your progress, evaluate your results and communicate with stakeholders.

- Analyze and interpret data: An accountant can help you analyze and interpret the data from your accounting system and financial statements, using tools such as ratios, trends and benchmarks. An accountant can help you identify your strengths, weaknesses, opportunities and threats and provide recommendations for improvement.

- Comply with tax laws: An accountant can help you comply with tax laws and regulations in Ontario, such as filing tax returns, claiming tax credits or deductions, paying tax instalments or resolving tax disputes. An accountant can also help you plan ahead and minimize your tax liabilities.

Contact us today

We are a team of experienced and qualified accountants who specialize in serving small and medium businesses in Innisfil, Barrie, Simcoe County and the Greater Toronto Area. We offer a range of services, such as bookkeeping, payroll, taxation, business advisory and more. We are committed to providing you with personalized, reliable and affordable solutions that meet your needs and expectations.

Contact us today to schedule a free consultation and find out how we can help you achieve your financial goals.