Construction bookkeeping is a complex and vital aspect of running a successful construction business. At BFC Tax Accountants, we understand the unique financial challenges faced by contractors and builders.

Construction bookkeeping services play a crucial role in managing project costs, tracking progress, and ensuring compliance with industry regulations. This blog post explores why these specialized services matter and how they can benefit your construction company.

Why Is Construction Bookkeeping So Complex?

The Project-Based Nature of Construction

Construction bookkeeping stands out as a unique challenge in the financial world. It goes beyond simple tracking of income and expenses. For construction companies, each project functions as its own financial entity. This requires separate books for every job, with individual tracking of costs, revenues, and profits.

A medium-sized construction firm often manages 10-15 projects simultaneously. Each project demands its own set of financial records, which complicates the maintenance of a clear overview of the company’s overall financial health.

The Juggling Act of Multiple Job Costs

Construction projects involve a vast array of expenses. These range from materials and labor to equipment rentals and subcontractor fees. Each cost must be meticulously tracked and allocated to the correct project.

A single residential construction project can encompass over 20 different cost categories. When you multiply that by the number of active projects, you’re faced with hundreds of cost items to track daily. This level of detail is essential for accurate job costing but can quickly become overwhelming without a robust system in place.

The Complexity of Progress Billings

Progress billings add another layer of intricacy to construction bookkeeping. Unlike businesses that invoice upon completion, construction companies bill clients at various stages of a project. This requires careful tracking of completed work against the total contract value.

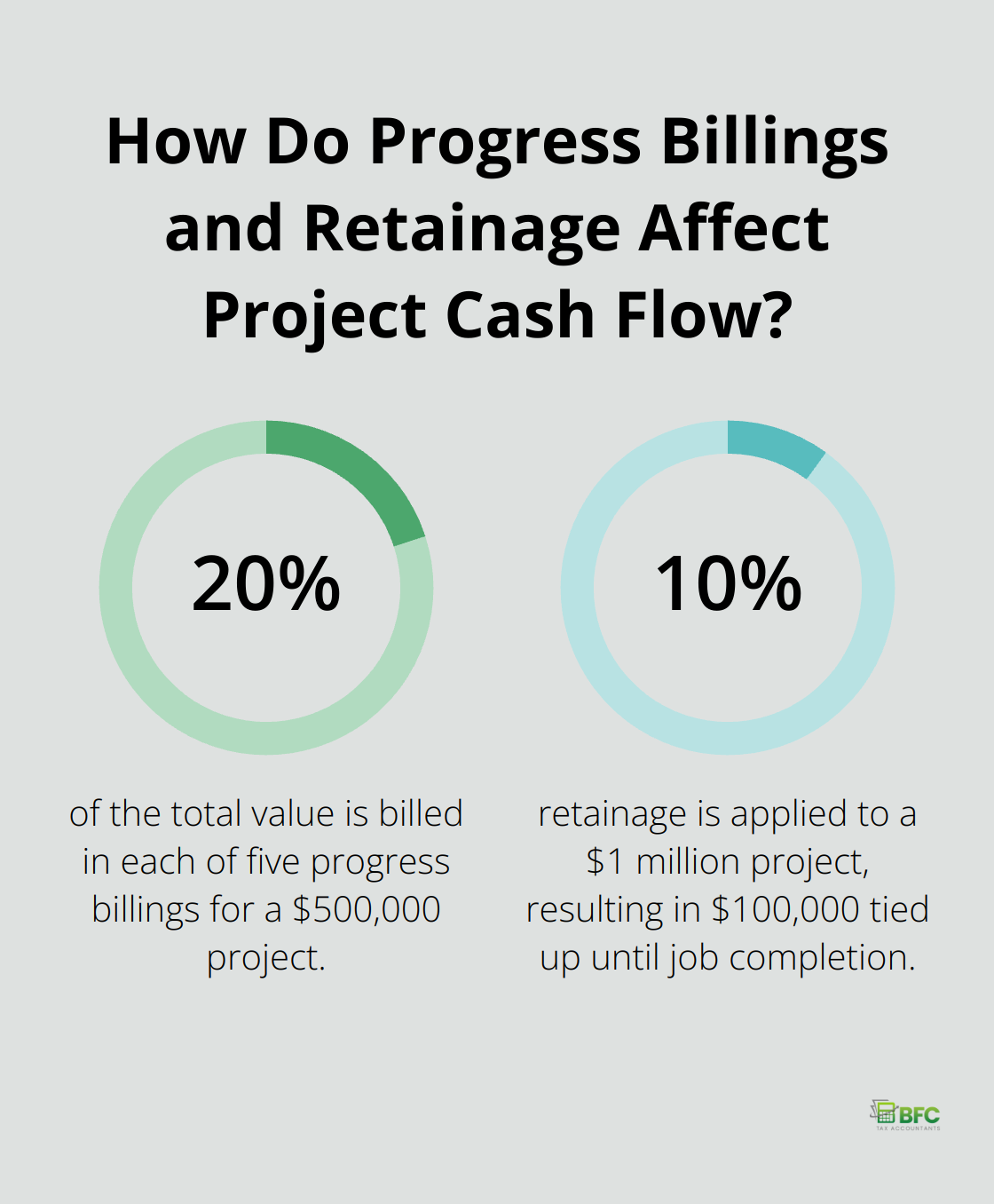

For instance, a $500,000 project might involve five progress billings of $100,000 each (20% of the total value). Each billing must accurately reflect the work completed to that point, which requires precise tracking and documentation.

The Challenge of Retainage

Retainage (the practice of withholding a percentage of payment until project completion) further complicates cash flow management. Best practices for managing retention payments include proper documentation, negotiating workable contracts, and streamlining cash flow.

Consider a $1 million project with 10% retainage. That’s $100,000 tied up until the job is complete. When you multiply this across multiple projects, it becomes clear why cash flow management in construction is so challenging.

The Need for Specialized Bookkeeping Services

The complexities of construction bookkeeping underscore the need for specialized services. At BFC Tax Accountants, we understand these unique challenges. Our construction bookkeeping services are designed to address these intricacies head-on, providing clarity and control over financial operations.

We use industry-specific software and techniques to ensure every dollar is accounted for, every project remains profitable, and businesses maintain healthy cash flow. This specialized approach allows construction companies to focus on what they do best – building – while we handle the financial intricacies behind the scenes.

As we move forward, let’s explore the key components that make up effective construction bookkeeping and how they contribute to a company’s success.

What Makes Construction Bookkeeping Effective?

Construction bookkeeping forms the foundation of financial success in the industry. It requires precision, timeliness, and industry-specific knowledge. Let’s explore the key elements that make construction bookkeeping truly effective.

Master Job Costing

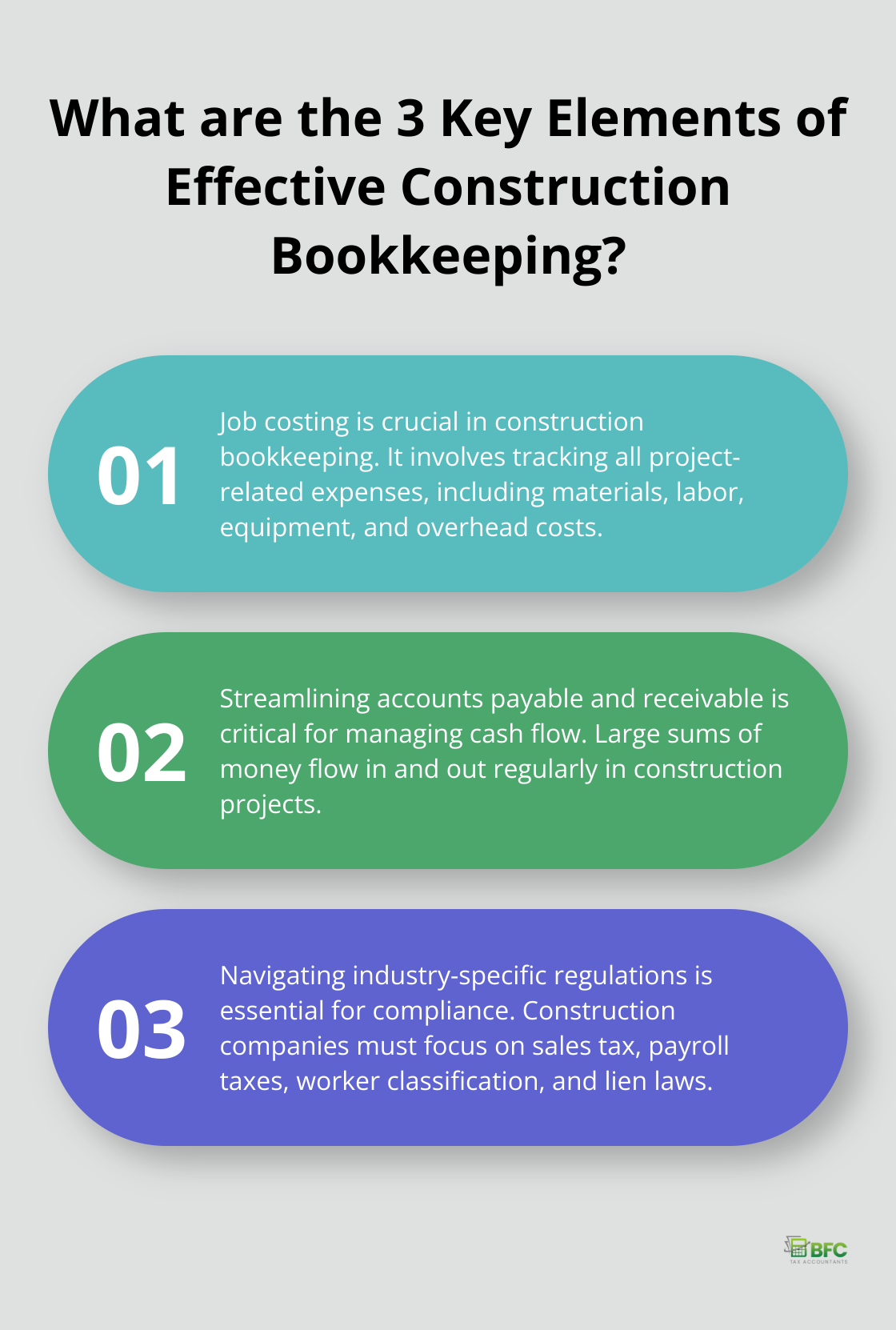

Job costing is the heartbeat of construction bookkeeping. It involves meticulous tracking of all expenses related to each project. This includes materials, labor, equipment, and overhead costs. Accurate job costing allows construction companies to track construction costs and price projects competitively while ensuring profitability.

To implement effective job costing, construction firms should:

- Use specialized software designed for construction accounting

- Train staff on proper cost allocation techniques

- Review and update cost codes regularly to reflect current project needs

Streamline Accounts Payable and Receivable

Managing cash flow is critical in construction, where large sums of money flow in and out regularly. Effective bookkeeping involves streamlining both accounts payable (AP) and accounts receivable (AR) processes.

For AP, this means:

- Negotiate favorable payment terms with suppliers

- Take advantage of early payment discounts when cash flow allows

- Implement a system to track and approve invoices efficiently

On the AR side, construction companies should:

- Invoice promptly and accurately

- Follow up on overdue payments consistently

- Consider offering incentives for early payment

In construction, it’s common for a contractor to have active accounts payable due to suppliers, subcontractors and vendors on a constant rotation.

Navigate Industry-Specific Regulations

Construction bookkeeping isn’t just about numbers; it’s also about compliance. The construction industry is subject to various regulations and tax laws that can significantly impact financial reporting and tax obligations.

Key areas of focus include:

- Sales tax on materials and services

- Payroll taxes and worker classification

- Lien laws and retainage requirements

To stay compliant, construction companies should:

- Stay informed about changes in tax laws and regulations

- Work with bookkeeping professionals who specialize in construction

- Implement systems to track and report on compliance-related data

Effective bookkeeping provides the insights and data needed to make informed business decisions and drive growth in a competitive industry. As we move forward, we’ll explore how professional construction bookkeeping services can benefit your company and contribute to its success.

How Professional Bookkeeping Boosts Construction Success

Professional construction bookkeeping services offer a game-changing advantage for builders and contractors. These specialized services provide strategic insights that can significantly impact a company’s bottom line.

Precision in Financial Reporting

Professional bookkeeping improves financial reporting accuracy dramatically. Construction companies often manage multiple projects simultaneously, each with its own set of expenses and revenue streams. Professional bookkeepers use industry-specific software to track these complex financial flows with precision.

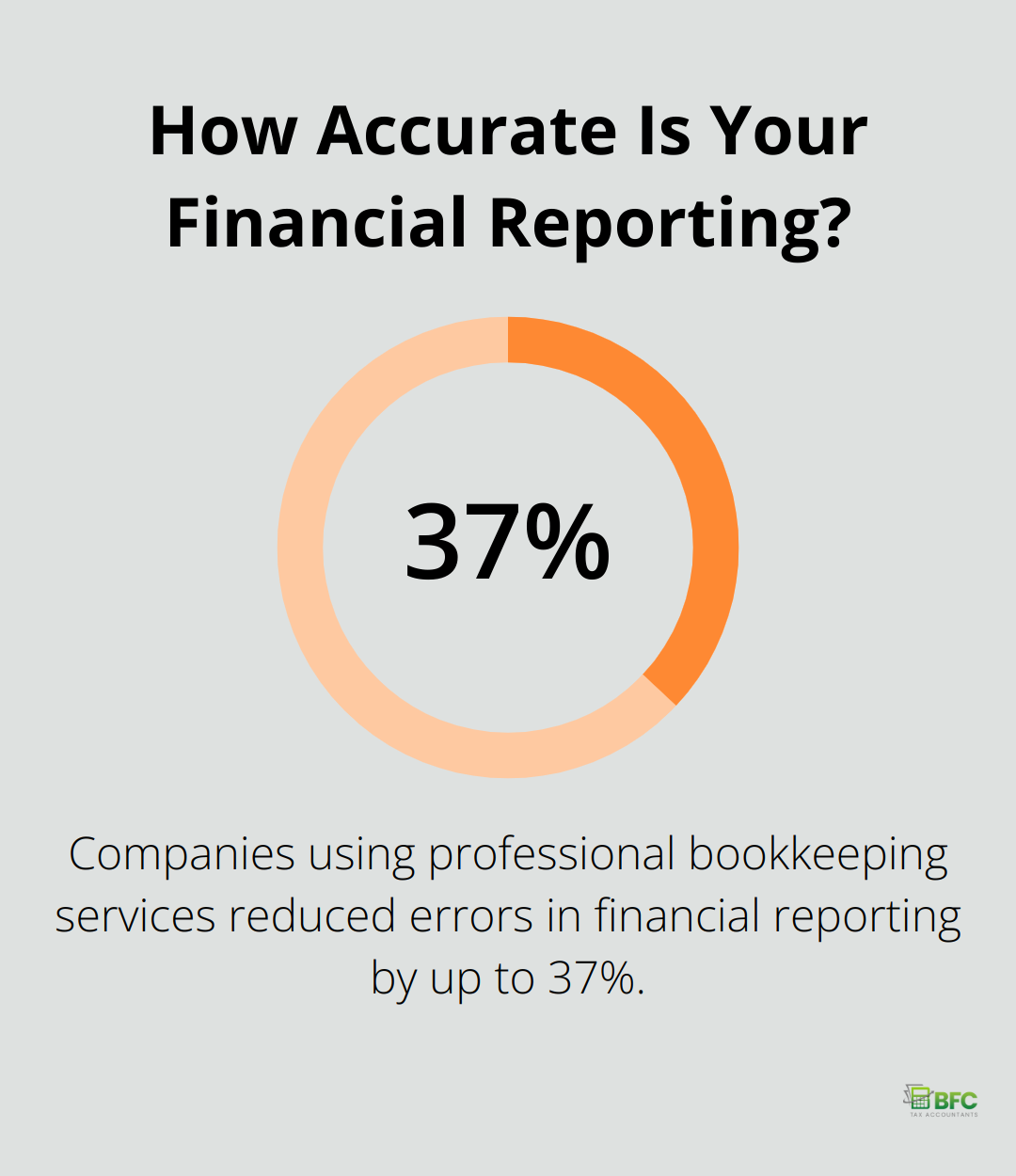

A study by the Construction Financial Management Association found that companies using professional bookkeeping services reduced errors in financial reporting by up to 37%. This level of accuracy allows for better-informed decision-making and can prevent costly mistakes in project bidding and resource allocation.

Streamlined Cash Flow Management

Cash flow is the lifeblood of any construction business, and professional bookkeeping services excel at optimizing it. These services help construction companies maintain a healthy cash position through robust systems for invoicing, payment tracking, and expense management.

A professional bookkeeper ensures timely tracking of accounts receivable and payable, preventing cash shortages and delays. With better cash flow visibility, construction firms can make more informed decisions about project financing and resource allocation.

Focus on Core Competencies

Professional bookkeeping frees up time and mental energy for construction business owners and managers. Instead of getting bogged down in financial minutiae, they can focus on managing projects and growing their business.

The National Association of Home Builders reports that construction company owners who outsource their bookkeeping save an average of 16 hours per week (equivalent to two full workdays). This time can be redirected towards client relationships, project management, or business development.

Enhanced Compliance and Risk Management

Professional bookkeepers stay up to date with industry-specific regulations and tax laws. This knowledge helps construction companies maintain compliance and reduce the risk of penalties or legal issues.

Professional bookkeeping services can:

- Ensure accurate tax filings

- Manage payroll taxes and worker classification

- Handle lien laws and retainage requirements

Data-Driven Decision Making

Professional bookkeepers provide detailed financial reports and analyses. These insights enable construction company owners to make informed decisions about:

- Project pricing and bidding

- Resource allocation

- Business expansion opportunities

With accurate, real-time financial data, construction companies can identify trends, spot potential issues early, and capitalize on growth opportunities.

Final Thoughts

Construction bookkeeping services are essential for modern construction businesses. The complexities of project-based accounting and industry-specific regulations demand specialized expertise. Professional bookkeeping empowers construction firms to make data-driven decisions, optimize project bids, and manage cash flow effectively.

Companies that prioritize robust bookkeeping practices position themselves for long-term success and growth. They navigate complex regulations, manage risks effectively, and seize new opportunities with confidence. Construction leaders who embrace professional bookkeeping can focus on building and growing their businesses.

At BFC Tax Accountants, we understand the unique challenges faced by construction businesses in Barrie, Ontario and beyond. Our specialized construction bookkeeping services provide the financial clarity and strategic insights needed to thrive in this competitive industry. Don’t let financial complexities hold your construction business back.