At BFC Tax Accountants, we understand that managing finances is a top concern for businesses of all sizes. Many wonder, “How much does it cost for bookkeeping services?” The answer isn’t one-size-fits-all.

In this post, we’ll break down the factors that influence bookkeeping costs and provide insights into what you can expect to pay for these essential services.

What Drives Bookkeeping Costs?

Various factors impact the cost of bookkeeping services. Understanding these elements can help you budget more effectively and choose the right level of service for your business.

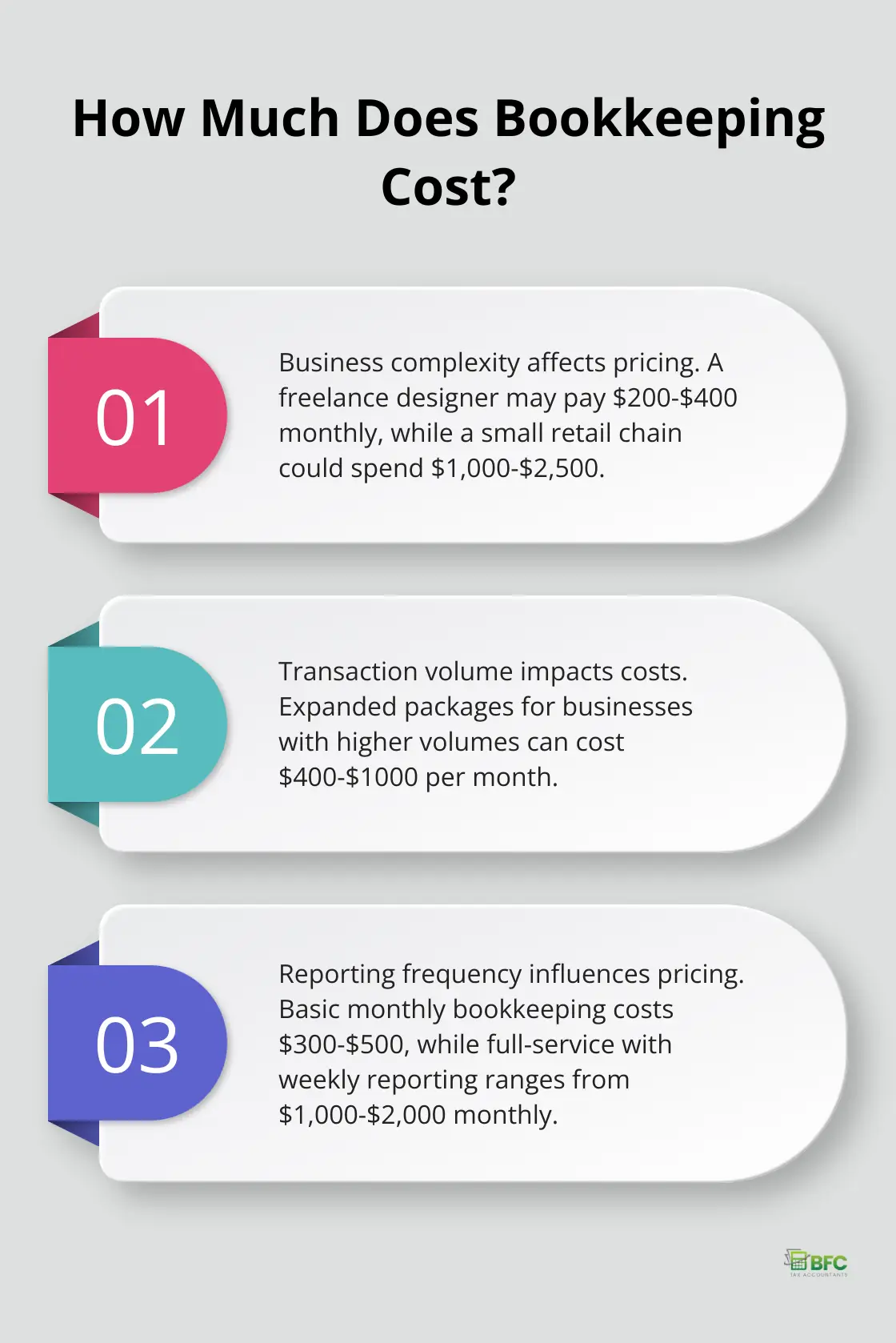

Business Complexity Matters

The complexity of your business operations significantly affects bookkeeping costs. A sole proprietorship with a single income stream will typically require less bookkeeping work than a multi-location retail business with inventory management and multiple revenue channels. For example, a freelance graphic designer might pay around $200-$400 per month for basic bookkeeping, while a small retail chain could expect costs upwards of $1,000-$2,500 monthly.

Transaction Volume Impacts Pricing

The number of financial transactions your business processes each month is a key cost driver. More transactions mean more data entry, reconciliation, and potential for errors that need review. Expanded packages for larger businesses with higher transaction volumes can run $400-$1000 monthly.

Industry-Specific Needs Affect Costs

Certain industries require specialized bookkeeping knowledge, which can impact service costs. It’s important to note that pricing strategies should not be based solely on cost but also consider various factors specific to your industry and business model.

Reporting Frequency and Service Level

The frequency of financial reporting and the level of service you need also play important roles in determining costs. Monthly reconciliations and reports are standard, but some businesses require weekly or even daily updates. Full-service bookkeeping (which might include accounts payable, accounts receivable, and payroll processing) naturally costs more than basic transaction recording.

Basic monthly bookkeeping might cost $300-$500, while full-service bookkeeping with weekly reporting could range from $1,000-$2,000 per month. Consider your business needs carefully – while more frequent reporting provides better financial visibility, it may not be necessary for all businesses.

Understanding these factors will help you make an informed decision about your bookkeeping needs. Quality bookkeeping services can save money in the long run by avoiding costly errors and providing valuable insights for business growth. Now, let’s explore the common pricing models used by bookkeeping service providers.

How Bookkeepers Price Their Services

Bookkeeping service providers use various pricing models to accommodate different business needs and budgets. Understanding these models will help you select the most suitable option for your company.

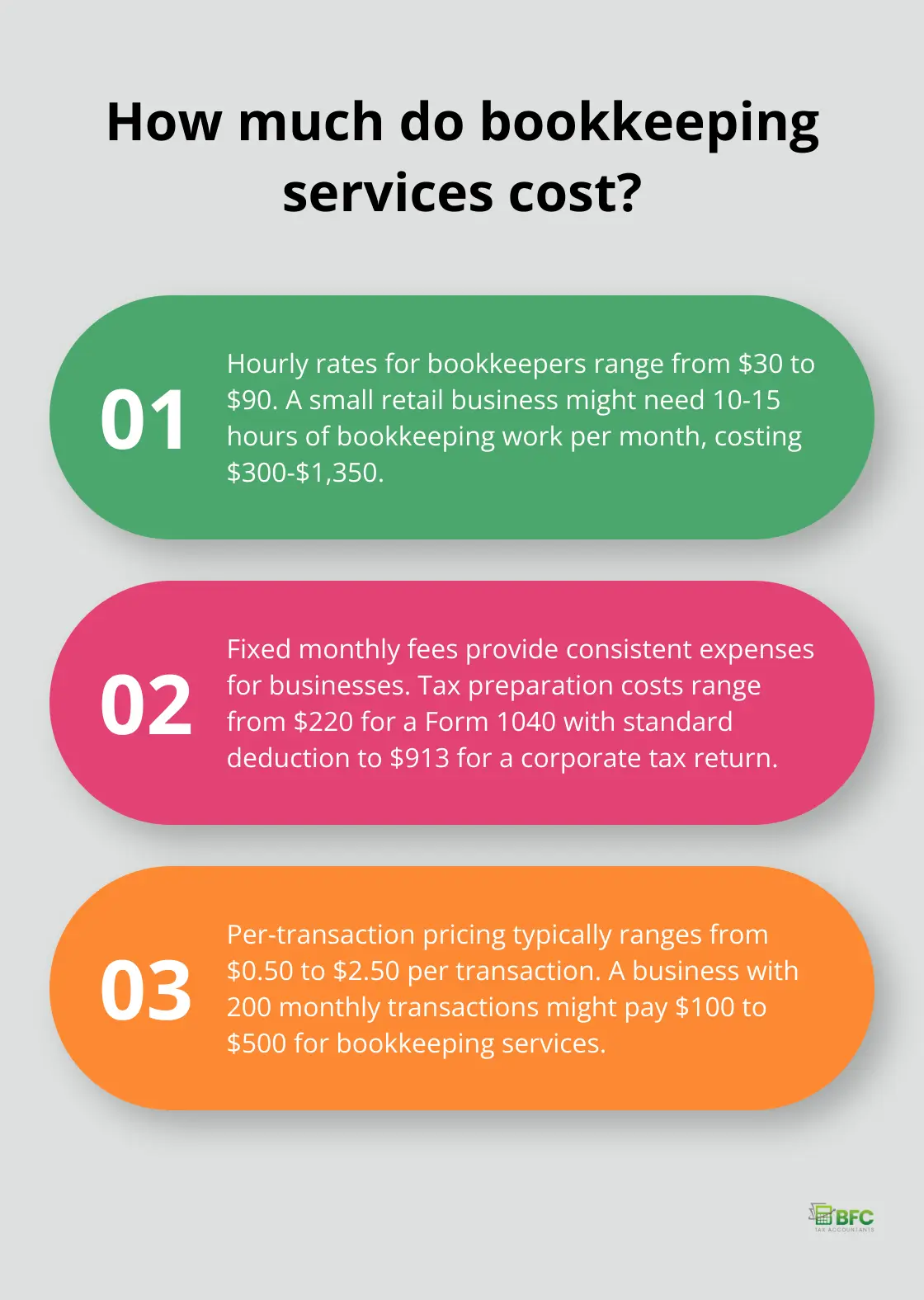

Hourly Rates: Flexibility with a Caveat

Many bookkeepers charge by the hour, with rates typically ranging from $30 to $90. This model suits businesses with fluctuating needs. However, it requires a clear estimate of expected hours to prevent budget overruns. A small retail business might need 10-15 hours of bookkeeping work per month, resulting in a monthly cost of $300-$1,350.

Fixed Monthly Fees: Predictable Expenses

Fixed monthly fees appeal to businesses seeking consistent expenses. These packages often include a set number of transactions or services. The average cost of tax preparation can range from $220 for a Form 1040 claiming the standard deduction to $913 for a corporate tax return.

Per-Transaction Pricing: Pay-As-You-Go

Some bookkeepers base their charges on the number of transactions processed. This model proves cost-effective for businesses with low transaction volumes. Prices typically range from $0.50 to $2.50 per transaction. A business with 200 monthly transactions might pay $100 to $500 for bookkeeping services under this model.

Tiered Pricing: Scalable Solutions

Tiered pricing offers different service levels at varying price points. This model allows businesses to choose a package that aligns with their needs and budget. For example, a basic tier might include monthly reconciliations and financial statements ($200-$400), while a premium tier could offer additional services like cash flow forecasting and budget preparation ($600-$1,000).

Value-Based Pricing: Focus on Outcomes

Some bookkeepers adopt a value-based pricing model, which considers the perceived value of their services to the client. This approach supports the shift towards an advisory services business model as it fortifies client relationships. Value-based pricing requires a thorough understanding of the client’s business and financial goals.

The choice of pricing model significantly impacts your bookkeeping costs. Consider your business’s specific needs, transaction volume, and growth plans when selecting a service provider. In the next section, we’ll explore how these pricing models translate into average costs for different types of businesses.

What Do Bookkeeping Services Cost for Different Businesses?

Bookkeeping costs vary significantly across different business types and sizes. This chapter explores these variations to help you budget effectively for your financial management needs.

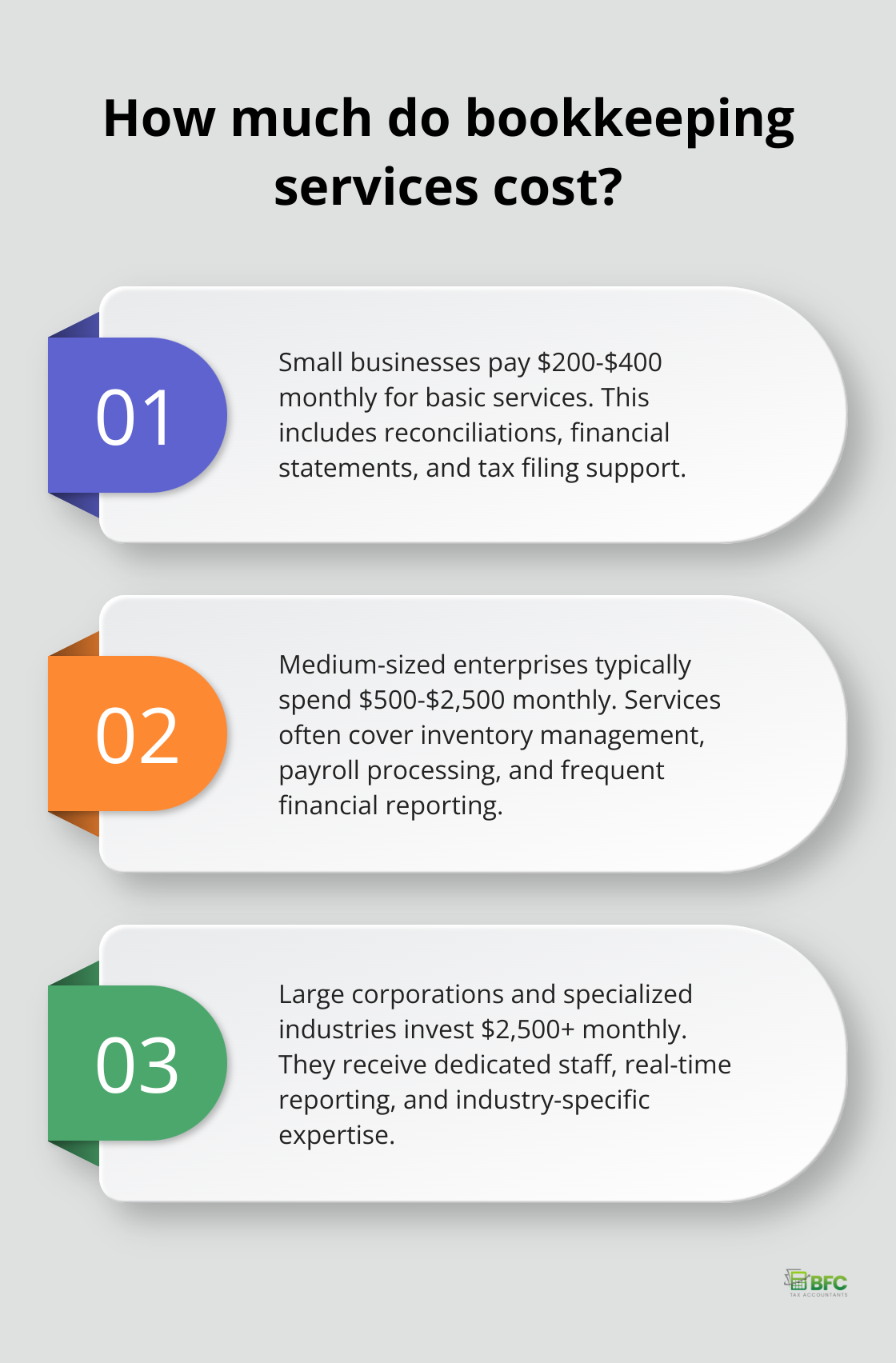

Small Businesses and Startups

Learn how much you should budget for bookkeeping and accounting services at different stages of your business. Basic bookkeeping packages for startups often include monthly reconciliations, financial statement preparation, and basic tax filing support.

Medium-Sized Enterprises

Medium-sized businesses face more complex financial needs, resulting in higher bookkeeping costs.

Comprehensive bookkeeping packages for medium-sized enterprises often include inventory management, payroll processing, and more frequent financial reporting.

Large Corporations and Specialized Industries

Large corporations and businesses in specialized industries (such as healthcare or finance) often require the most extensive bookkeeping services.

Tailored solutions for complex need often include dedicated bookkeeping staff, real-time financial reporting, and specialized industry knowledge. While costs are higher, the value provided through accurate financial management and compliance is substantial.

Impact of Professional Bookkeeping

Investing in quality bookkeeping services pays off.

Professional bookkeeping services (like those offered by Kyei Baffour) provide scalable solutions to match your needs and budget, regardless of your business size or industry. Expert bookkeeping ensures you receive accurate financial information to drive informed financial decisions and maintain compliance.

Final Thoughts

The cost for bookkeeping services depends on various factors unique to your business. Size, complexity, transaction volume, and industry-specific requirements shape the pricing structure that best fits your needs. Professional bookkeeping services offer benefits beyond basic record-keeping, ensuring compliance with tax regulations and providing valuable insights for strategic planning.

At BFC Tax Accountants, we understand the importance of tailored bookkeeping solutions. Our team offers a range of services designed to meet the diverse needs of businesses in Barrie, Ontario and beyond. We provide the financial expertise you need to thrive.

Investing in professional bookkeeping services leads to long-term financial stability and success. You free up valuable time to focus on growing your business while ensuring your financial foundation remains solid. The true value of bookkeeping services extends far beyond their cost-it’s an essential component of your business’s financial health and future prosperity.