Understanding CRA personal tax rates is essential for every Canadian taxpayer. At BFC Tax Accountants, we know how complex the tax system can be.

This blog post will break down the current federal and provincial tax rates, explain how they affect your personal finances, and provide insights on optimizing your tax situation.

How Canada’s Tax System Works

Canada’s progressive tax system funds essential public services while promoting economic growth and social equity. This system requires higher earners to contribute a larger percentage of their income in taxes.

Progressive Taxation Explained

The Canadian tax system taxes different portions of income at different rates. The marginal tax rate changes depending on your tax bracket, so whether you earn $20,000 or $1 million, the tax rate applies differently to various portions of your income.

Federal and Provincial Tax Interaction

A unique aspect of the Canadian tax system is the combination of federal and provincial taxes. Federal tax rates remain consistent nationwide, but provincial rates vary. Each level of government has its own tax brackets and corresponding marginal tax rates. This dual system allows provinces to tailor their tax policies to local needs while maintaining a national framework.

Leveraging Tax Credits and Deductions

The Canadian tax system offers numerous credits and deductions that can significantly reduce your final tax bill. These range from the basic personal amount to specific credits for charitable donations or medical expenses. Proper utilization of these credits and deductions can lead to substantial tax savings.

For example, maximizing RRSP contributions can reduce your taxable income and bolster your retirement savings. It’s these types of strategies (when applied correctly) that can make a real difference in your financial future.

As we move forward, let’s examine the specific tax rates you’ll encounter in 2025 and how they might affect your personal finances.

What Are the 2025 CRA Personal Tax Rates?

The 2025 tax year introduces changes to personal tax rates that will affect Canadians’ financial planning. Understanding these rates is essential for effective tax management and financial decision-making.

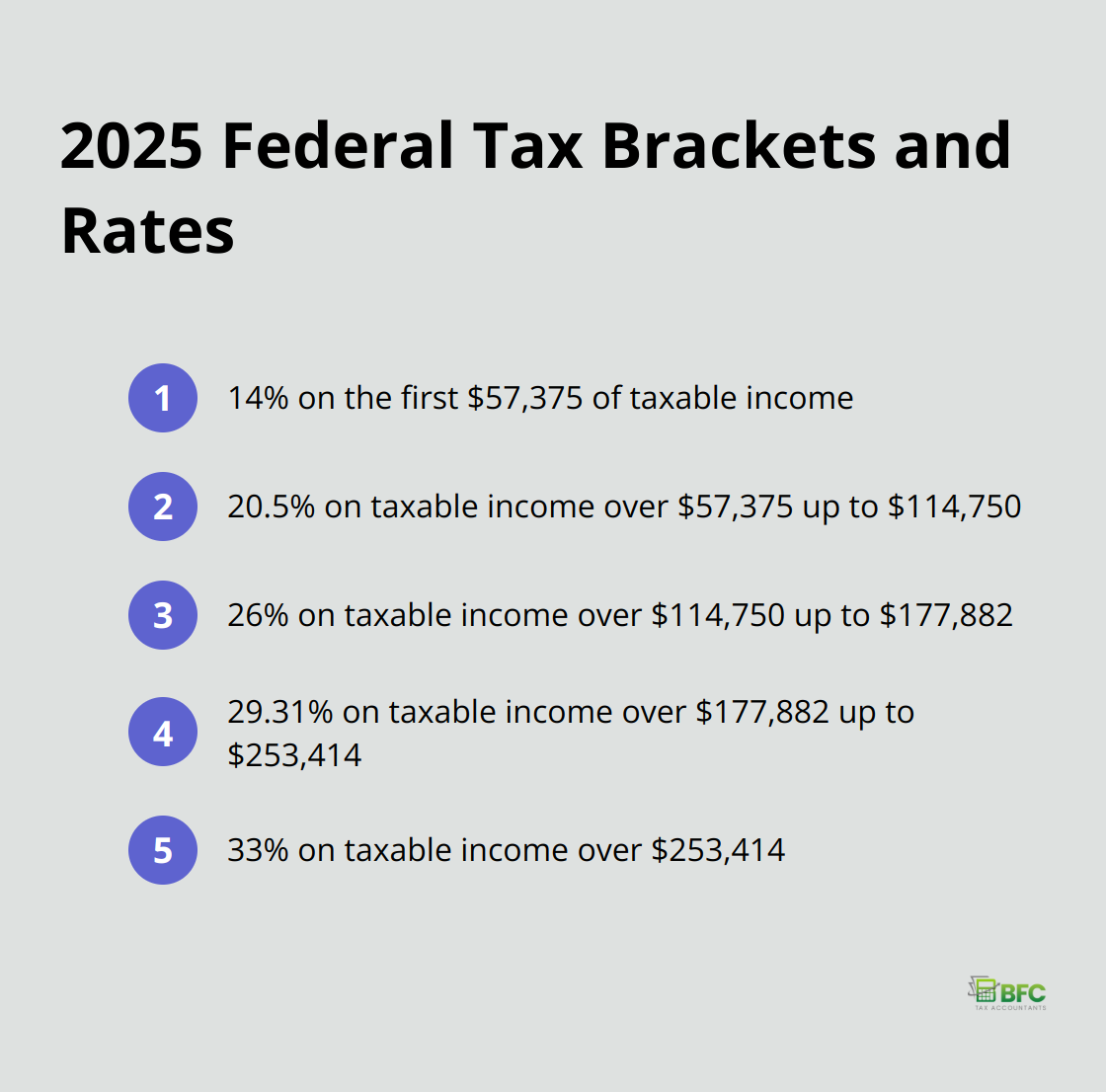

Federal Tax Rates for 2025

The federal government has announced a decrease in the lowest tax bracket rate from 15% to 14%, effective July 1, 2025. This change will result in an effective rate of 14% for the entire 2025 tax year. Here’s a breakdown of the federal tax brackets and rates:

These rates reflect the government’s effort to provide tax relief for lower-income earners while maintaining higher rates for top earners.

Ontario Provincial Tax Rates

Ontario residents pay provincial income tax in addition to federal taxes. The Ontario tax rates for 2025 are:

- 5.05% on the first $49,231 of taxable income

- 9.15% on taxable income over $49,231 up to $98,463

- 11.16% on taxable income over $98,463 up to $150,000

- 12.16% on taxable income over $150,000 up to $220,000

- 13.16% on taxable income over $220,000

Combined Federal and Provincial Tax Rates

The total marginal tax rates for Ontario residents in 2025 (combining federal and provincial rates) are:

- 19.05% on the first $49,231

- 23.15% on income between $49,231 and $57,375

- 29.15% on income between $57,375 and $98,463

- 31.16% on income between $98,463 and $114,750

- 37.16% on income between $114,750 and $150,000

- 38.16% on income between $150,000 and $177,882

- 41.47% on income between $177,882 and $220,000

- 42.47% on income between $220,000 and $253,414

- 46.16% on income over $253,414

These combined rates demonstrate the progressive nature of our tax system, with higher earners paying a larger percentage of their income in taxes.

Impact on Your Tax Planning

The changes in tax rates for 2025 will affect your take-home pay and overall tax liability. For most Canadians, the reduction in the lowest federal tax bracket will result in modest savings. However, the impact will vary depending on your income level and personal circumstances.

We recommend reviewing your tax situation in light of these changes. Strategies such as income splitting, maximizing RRSP contributions (which can reduce your taxable income), or timing the realization of capital gains can help optimize your tax position under the new rates.

The next section will explore how different types of income and various deductions can influence your personal tax rate, providing a more comprehensive understanding of your tax obligations.

What Impacts Your Personal Tax Rate?

Income Sources and Their Tax Treatment

Your personal tax rate depends on the types of income you receive. Employment income faces full taxation at your marginal rate. Capital gains receive preferential treatment, with only 50% subject to tax. Canadian dividends benefit from the dividend tax credit, which reduces the effective tax rate. Self-employment income allows for more deductions compared to employment income, potentially lowering your overall tax burden.

The Power of Tax Credits and Deductions

Tax credits and deductions can significantly reduce your tax liability. Deductions lower your taxable income, while credits directly reduce your tax payable. Common deductions include RRSP contributions, childcare expenses, and moving expenses for work. These can lower your taxable income and potentially place you in a lower tax bracket. The basic personal amount (a non-refundable tax credit) will increase to $14,538 for 2025, providing tax relief for all Canadians. Other valuable credits include the Canada Workers Benefit, medical expenses, and charitable donations.

Maximizing RRSP Benefits

RRSP contributions offer dual advantages. They reduce your taxable income for the contribution year and allow for tax-deferred growth. However, consider your expected retirement income. If you anticipate a higher tax bracket when withdrawing funds, a Tax-Free Savings Account (TFSA) might prove more beneficial for some of your savings.

Strategic Management of Capital Gains and Dividends

The tax treatment of capital gains and dividends can impact your overall tax rate. You can manage your tax liability through strategic planning of when to realize capital gains or losses. Offsetting capital gains with capital losses can reduce your taxable income. For dividend income, the type matters. Eligible dividends from large Canadian corporations receive more favourable tax treatment than non-eligible dividends from small businesses. In some cases (particularly for lower-income individuals), it’s possible to receive eligible dividends almost tax-free due to the dividend tax credit.

The Impact of Tax Planning

Effective tax planning can lead to substantial savings. This involves carefully structuring income sources and timing investment decisions. For example, a small business owner nearing retirement might save thousands in taxes by balancing salary and dividends from their corporation and strategically timing RRSP contributions. Professional guidance can help you navigate these complex decisions and optimize your tax situation.

Final Thoughts

Understanding CRA personal tax rates empowers individuals to manage their wealth and plan for the future effectively. The complex interplay of federal and provincial rates, income types, and available deductions creates a unique tax landscape for each person. This knowledge equips you to make informed decisions about your finances, investments, and career choices.

Professional tax planning offers significant benefits beyond simple compliance. A skilled tax professional can help you navigate the intricacies of the tax system, identify savings opportunities, and structure your finances in the most tax-efficient manner. This expertise can lead to substantial reductions in your tax burden, freeing up resources for other financial goals.

BFC Tax Accountants specializes in optimizing tax situations for individuals and businesses in Barrie, Ontario and beyond. Our comprehensive services cover personal and corporate tax planning, preparation for self-employed individuals, estate planning, and business tax solutions. We offer tailored accounting packages designed to meet the unique needs of your business, ensuring compliance with Canadian tax laws while maximizing your tax savings.