E-commerce has revolutionized the way businesses operate, but it’s also introduced new financial complexities. At BFC Tax Accountants, we understand that managing the books for an online store requires specialized knowledge and tools.

E-commerce bookkeeping services are designed to tackle the unique challenges of digital retail. From multi-channel sales to international transactions, these services help online businesses maintain accurate financial records and stay compliant with tax regulations.

What Is E-commerce Bookkeeping?

The Digital Ledger

E-commerce bookkeeping records, organizes, and analyzes financial transactions for online businesses. It tracks every dollar that flows in and out of a digital store. This process serves as a critical tool for making informed business decisions in the fast-paced world of online retail.

The Virtual Marketplace Difference

Unlike traditional retail, e-commerce operates in a 24/7 global marketplace. This reality creates unique challenges:

- Multiple Sales Channels: An online store might sell products through its website, Amazon, and Etsy simultaneously.

- Various Payment Processors: Each platform has its own fees and payout schedules.

- International Currencies: Dealing with global customers often involves currency conversions.

E-commerce bookkeeping must account for these complexities to provide an accurate financial picture.

Navigating E-commerce Financial Hurdles

Online businesses face distinct financial challenges that require specialized bookkeeping approaches:

Sales Tax Complexity

Sales tax collection and remittance prove particularly tricky for e-commerce. The increase in e-commerce creates challenges for assessing and collecting the goods and services tax (GST) and the harmonized sales tax (HST). With customers potentially located in different states or countries (each with its own tax rules), staying compliant becomes a significant challenge.

Inventory Management Intricacies

Online stores often use dropshipping or fulfillment centers, which complicates tracking of cost of goods sold (COGS). Accurate inventory valuation plays a vital role in financial reporting and tax purposes. This process ensures that your financial statements are accurate and can help to maximize profitability for your business. E-commerce bookkeeping must adapt to these unique inventory models.

The Impact of Financial Precision

Maintaining precise financial records is non-negotiable for online businesses. Accurate bookkeeping provides insights into profitability by product, channel, or marketing campaign. This data proves invaluable for strategic decision-making.

Clean financial records also simplify tax preparation, potentially saving money on accounting fees and reducing the risk of costly audits. Additionally, well-organized books demonstrate your business’s financial health and growth potential to potential investors or lenders.

As we explore the core services included in e-commerce bookkeeping, you’ll see how these specialized practices address the unique needs of online businesses.

Essential E-commerce Bookkeeping Services

E-commerce bookkeeping addresses unique challenges of online retail through several critical components. These services form the backbone of financial management for digital businesses, ensuring accuracy, compliance, and strategic insights.

Transaction Recording and Categorization

Accurate transaction recording forms the foundation of e-commerce bookkeeping. This process captures every sale, refund, and expense across multiple platforms. An online store selling on both Shopify and Amazon must consolidate transactions from both channels into a single financial system.

Categorization assigns each transaction to the appropriate account in your chart of accounts. This step enables detailed financial analysis and simplifies tax preparation. Separating shipping costs from product costs allows for precise profit margin calculations per item.

Inventory and Cost of Goods Sold (COGS) Tracking

E-commerce businesses often face complex inventory scenarios, including dropshipping and multi-warehouse fulfillment. Accurate inventory tracking proves essential for financial reporting and operational efficiency.

COGS tracking calculates the direct costs associated with the goods you sell, including product cost, shipping, and handling. This information supports pricing strategies and profitability analysis.

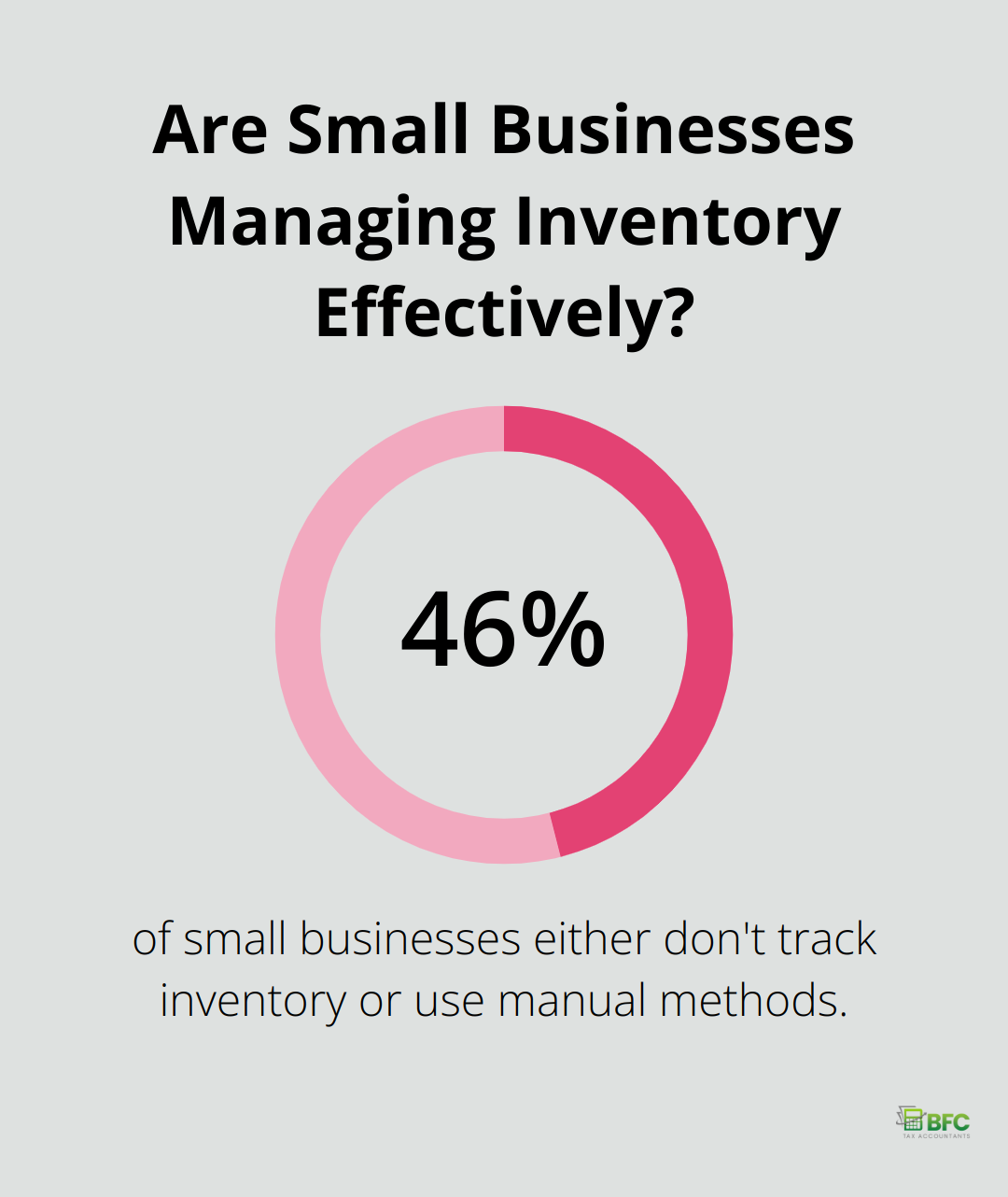

A study by Wasp Barcode Technologies found that 46% of small businesses either don’t track inventory or use manual methods. Implementing automated inventory tracking can significantly improve accuracy and save time.

Sales Tax Management

Sales tax compliance presents one of the most challenging aspects of e-commerce bookkeeping. Varying tax rates and rules across jurisdictions make manual calculation and reporting prone to errors.

Automated sales tax solutions integrate with e-commerce platforms to calculate, collect, and report sales tax accurately. These tools update tax rates in real-time and generate reports for easy filing.

Payment Processor Reconciliation

E-commerce businesses typically use multiple payment processors, each with its own fee structure and payout schedule. Reconciling these accounts involves matching sales records with deposits in your bank account, accounting for fees and timing differences.

Regular reconciliation ensures that all revenue is accounted for and helps identify discrepancies or potential fraud. Perform this task at least monthly, if not weekly for high-volume stores.

Financial Statement Preparation

Comprehensive financial statements result from effective e-commerce bookkeeping. These include:

- Income Statement: Shows revenue, expenses, and profit over a specific period.

- Balance Sheet: Provides a snapshot of assets, liabilities, and equity at a point in time.

- Cash Flow Statement: Tracks the flow of cash in and out of the business.

These statements offer valuable insights into business performance and financial health. They prove essential for making informed decisions about inventory purchases, marketing spend, and growth strategies.

As e-commerce continues to evolve, so do the tools and techniques for managing online business finances. The next section explores advanced features that take e-commerce bookkeeping to new heights of efficiency and insight.

Advanced E-commerce Bookkeeping Features

Multi-Channel Sales Integration

Modern e-commerce often spans multiple platforms. A report by Stitch Labs found that retailers selling on two marketplaces see 190% more in revenue than those selling on just one. This multi-channel approach complicates bookkeeping.

Advanced e-commerce bookkeeping solutions consolidate data from various platforms into a single dashboard. This integration eliminates manual data entry and reduces errors. A clothing retailer selling on their website, Amazon, and Etsy can view combined sales data, inventory levels, and profitability metrics in one place.

International Transaction Management

Global e-commerce sales will cross $6 trillion for the first time in 2024 and reach $8 trillion by 2028. This international growth brings currency conversion challenges. Advanced bookkeeping tools automatically convert foreign currencies to your base currency, ensuring accurate financial reporting.

These systems also track exchange rate fluctuations, helping you understand how currency changes impact your bottom line. This feature proves invaluable for businesses expanding into new markets or sourcing products internationally.

Complex Fulfillment Model Accounting

Dropshipping and third-party fulfillment have revolutionized e-commerce logistics. However, these models introduce accounting complexities. Advanced bookkeeping systems handle these nuances.

For dropshipping, the software tracks supplier invoices, customer payments, and profit margins on each sale. With third-party fulfillment, it manages inventory across multiple warehouses and calculates storage fees and fulfillment costs.

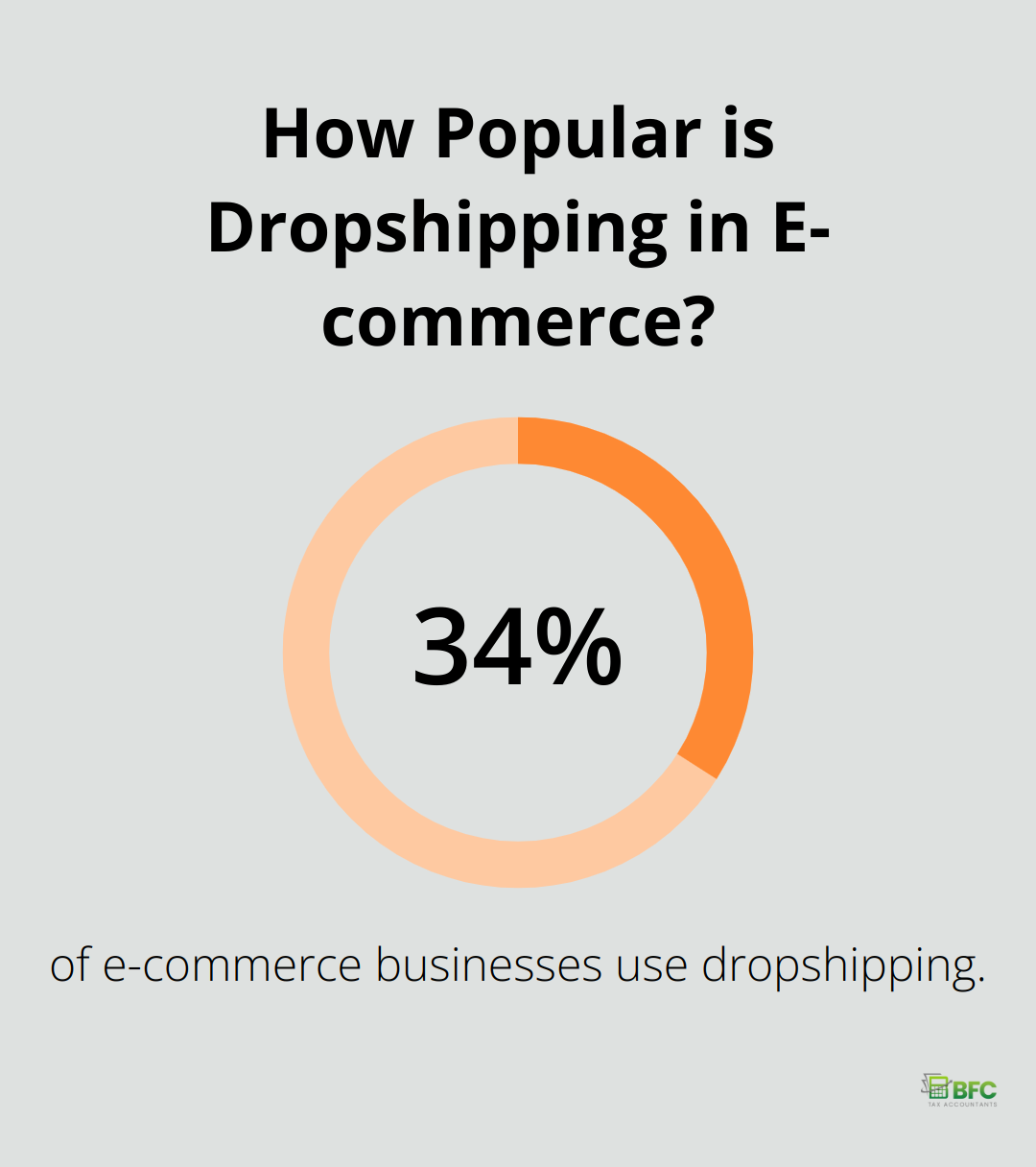

A survey by Statista revealed that 34% of e-commerce businesses use dropshipping. Proper accounting for these transactions ensures accurate profit calculations and tax compliance.

Data-Driven Business Insights

Data-driven decision-making separates successful e-commerce businesses from the rest. Advanced bookkeeping platforms offer robust analytics and reporting features. These tools transform raw financial data into actionable insights.

Key performance indicators (KPIs) such as gross profit margin, customer acquisition cost, and inventory turnover are automatically calculated and presented in easy-to-understand dashboards. This information empowers you to make informed decisions about pricing, marketing spend, and inventory management.

E-commerce Platform Integration

The average e-commerce business uses 5-6 different tools for operations (according to a report by Capterra). Advanced bookkeeping solutions integrate with popular e-commerce platforms, payment gateways, and business tools.

This integration creates a seamless flow of data between systems. For example, when a sale occurs on your Shopify store, it’s automatically recorded in your bookkeeping software, updates your inventory, and triggers a shipping label creation in your fulfillment system.

Final Thoughts

E-commerce bookkeeping services have become essential for online businesses to navigate the complex financial landscape of digital retail. These specialized services address unique challenges faced by e-commerce entrepreneurs, from transaction recording and inventory management to sales tax compliance and multi-channel integration. Advanced features like international transaction management and data-driven analytics further enhance the capabilities of modern e-commerce bookkeeping solutions.

Accurate and timely financial data allows business owners to make informed decisions, optimize operations, and drive growth. Clean books simplify tax preparation, demonstrate financial health to potential investors, and provide valuable insights into business performance across various channels and markets. The ideal bookkeeping system should integrate seamlessly with existing e-commerce platforms, offer robust reporting capabilities, and scale with business growth.

At BFC Tax Accountants, we understand the unique needs of e-commerce businesses. Our e-commerce bookkeeping services help online retailers in Barrie, Ontario and beyond streamline their financial management and ensure compliance with Canadian tax laws. With our expert guidance and cloud-based solutions, you can manage your e-commerce finances confidently and position your business for long-term success in the digital marketplace.