Bookkeeping services for businesses are the backbone of financial management. At BFC Tax Accountants, we understand that accurate and timely bookkeeping is essential for making informed decisions and maintaining compliance.

Professional bookkeeping goes beyond simple record-keeping, encompassing a range of services that can streamline your financial processes and save you valuable time. In this post, we’ll explore the key bookkeeping services that can benefit your business and drive its success.

What Is Bookkeeping and Why Does It Matter?

The Foundation of Financial Management

Bookkeeping forms the cornerstone of sound financial management. It involves the systematic recording and organization of financial transactions in a business. This process provides a clear picture of a company’s financial health by tracking the money that flows in and out of the business. Every dollar must be accounted for to ensure accurate financial records.

Key Components of Professional Bookkeeping

Professional bookkeeping encompasses several essential elements:

- Meticulous Recording: All financial transactions, including sales, purchases, receipts, and payments, must be documented.

- Data Organization: The recorded information is categorized and organized in a general ledger.

- Regular Reconciliation: Internal financial records are compared with external statements (such as bank statements) to ensure accuracy and identify discrepancies.

A survey by Wasp Barcode Technologies revealed that 60% of small business owners feel they lack sufficient knowledge about accounting and finance. This statistic underscores the importance of professional bookkeeping services for businesses of all sizes.

Bookkeeping vs. Accounting: Distinct Yet Complementary

While often confused, bookkeeping and accounting serve different functions:

- Bookkeeping focuses on recording and organizing financial data.

- Accounting involves interpreting, classifying, analyzing, reporting, and summarizing this financial data.

Bookkeepers handle day-to-day tasks like recording transactions and maintaining financial records. Accountants use the information compiled by bookkeepers to prepare financial statements, analyze business performance, and provide strategic financial advice.

The Impact of Professional Bookkeeping

Professional bookkeeping services offer numerous benefits to businesses:

- Improved Accuracy: Reduces errors in financial records.

- Time Savings: Allows business owners to focus on core operations.

- Better Decision-Making: Provides accurate financial data for informed choices.

- Compliance: Ensures adherence to financial regulations and tax laws.

As we move forward, we’ll explore the core bookkeeping services that can significantly benefit your business and drive its success.

Essential Bookkeeping Services Every Business Needs

At the heart of every successful business lies a robust financial management system. Professional bookkeeping services form the backbone of this system, offering a range of essential functions that keep your business financially healthy and compliant. Let’s explore the core bookkeeping services that can transform your financial management.

Accurate Transaction Recording

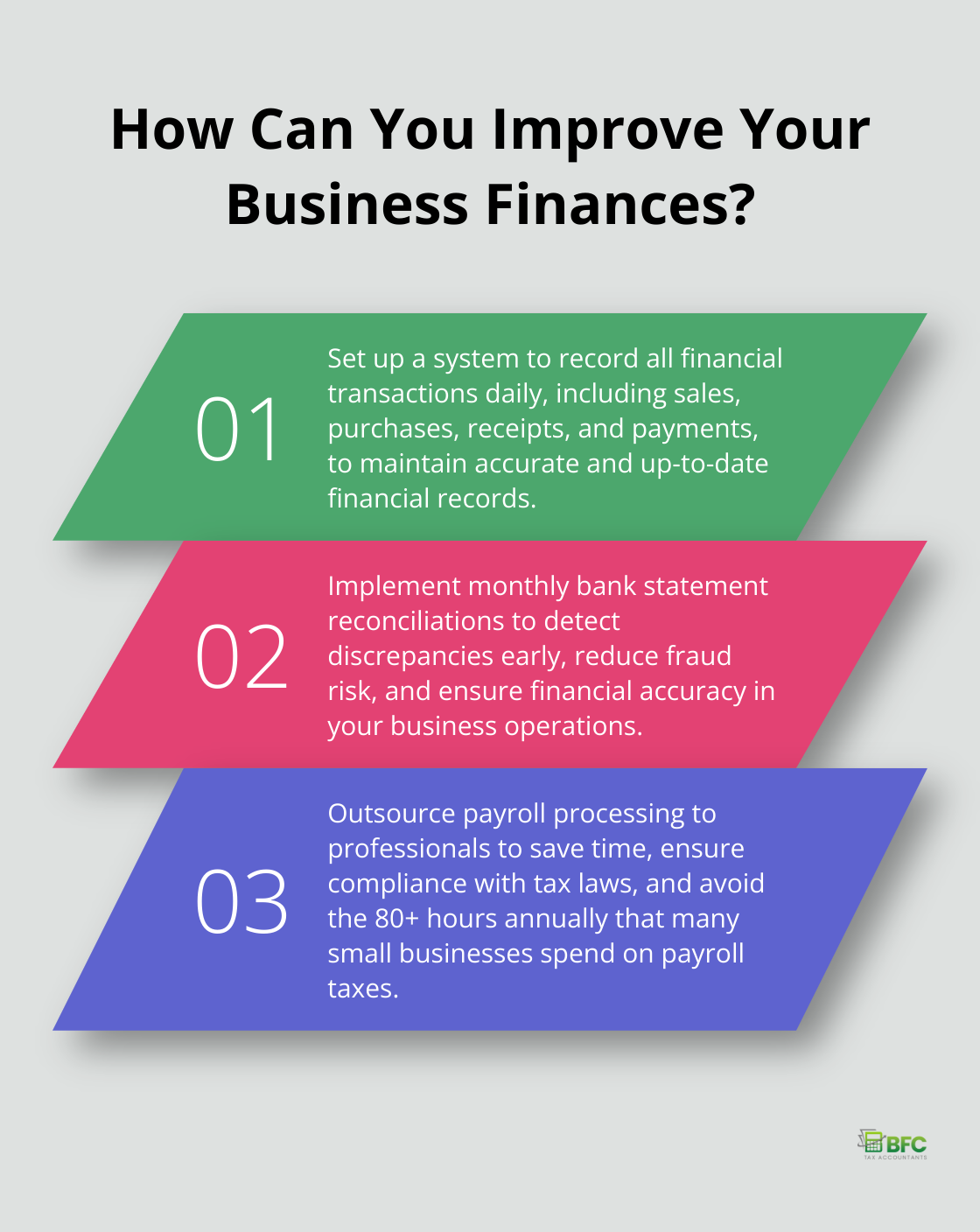

The foundation of sound bookkeeping is meticulous transaction recording. This involves the documentation of every financial activity, from sales and purchases to expenses and payments. A study by the Association of Certified Fraud Examiners, based on 1,921 real cases of occupational fraud from 138 countries and territories, highlights the importance of proper financial controls. Maintaining detailed records not only protects your business but also provides valuable insights into your cash flow patterns.

Bank Statement Reconciliation

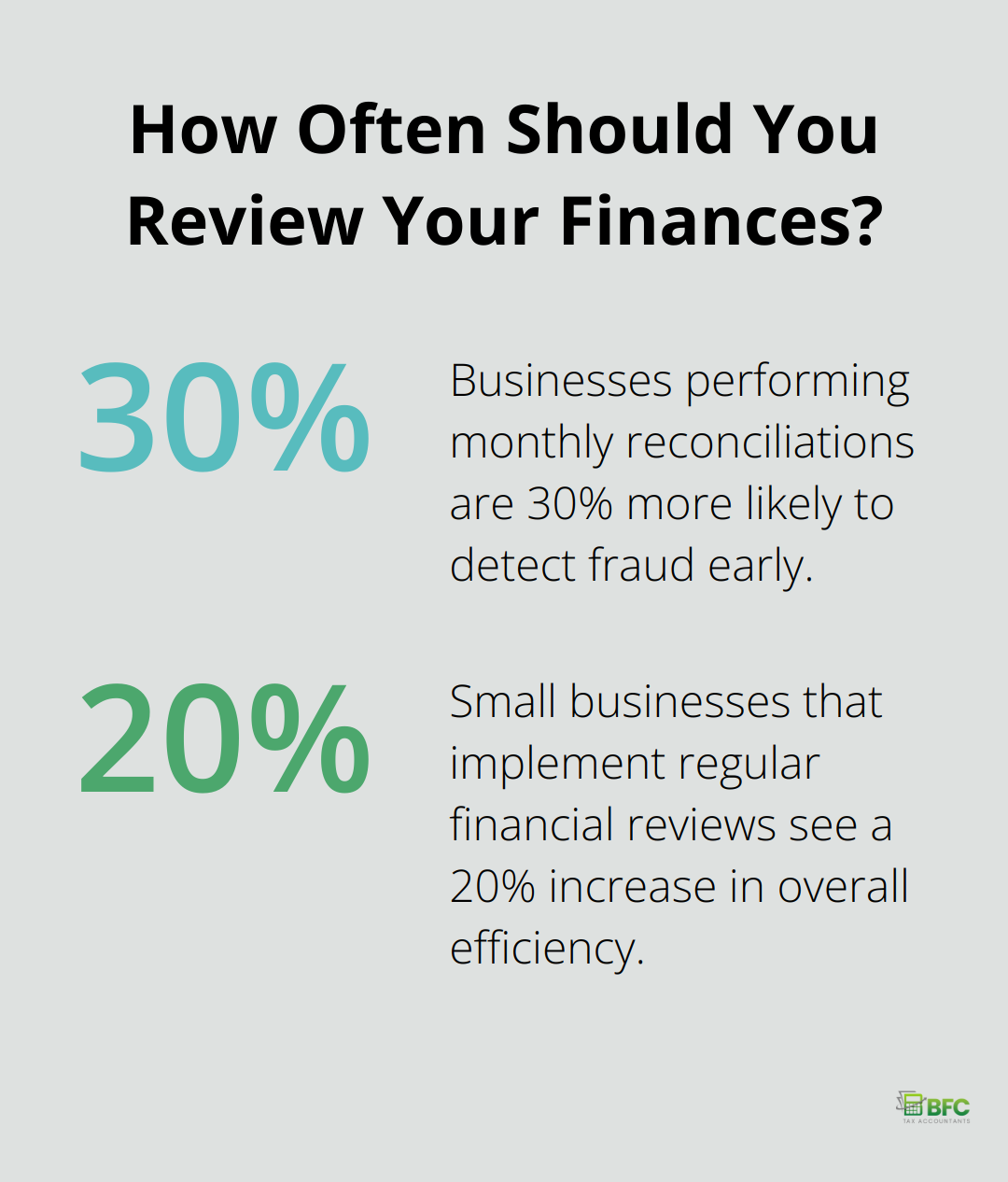

Regular bank reconciliation detects discrepancies and prevents financial mishaps. This process compares your internal financial records with your bank statements to ensure everything matches up. The American Institute of CPAs reports that businesses performing monthly reconciliations are 30% more likely to detect fraud early. This practice maintains financial accuracy and provides peace of mind.

Accounts Payable and Receivable Management

Effective management of accounts payable and receivable maintains healthy cash flow. This service tracks incoming payments from customers and outgoing payments to suppliers. A survey by Sage reveals that businesses with streamlined accounts receivable processes receive payments up to 30% faster. Optimization of these processes improves working capital and strengthens relationships with both customers and suppliers.

Financial Statement Preparation

Comprehensive financial statements provide a clear picture of your business’s financial health. These include balance sheets, income statements, and cash flow statements. According to a 2023 survey by QuickBooks, small businesses that implement regular financial reviews see a 20% increase in overall efficiency. These documents not only help in decision-making but are also crucial for securing loans or attracting investors.

Payroll Processing

Accurate and timely payroll processing ensures employee satisfaction and legal compliance. This service covers wage calculations, tax withholdings, and benefit deductions. A study by the National Small Business Association found that 1 in 3 small businesses spend over 80 hours annually on payroll taxes. Outsourcing this task to professionals can save time and ensure compliance with ever-changing tax laws.

Professional bookkeeping provides more than just number crunching; it offers the financial clarity needed to make informed business decisions. The next section will explore how these services can benefit your business and drive its success.

Why Professional Bookkeeping Matters

Professional bookkeeping services offer a wealth of benefits that extend far beyond basic number-crunching. These services can transform your financial management, providing clarity, efficiency, and strategic advantages that drive business success.

Precision in Financial Reporting

Accuracy in financial reporting is essential for businesses of all sizes. Professional bookkeepers use advanced software and rigorous processes to minimize errors. A study from the American Institute of CPAs reported that accounting software with built-in error-checking reduced mistakes by 40%. This level of accuracy ensures compliance with regulatory standards and provides a solid foundation for financial decision-making.

Time Savings for Business Owners

Time is a precious commodity for business owners. Outsourcing bookkeeping tasks reclaims a significant portion of your schedule. A survey by Sage revealed that small business owners spend an average of 120 working days per year on administrative tasks. Professional bookkeeping services can cut this time by up to 60%, allowing you to focus on core business activities and growth strategies.

Enhanced Decision Making

Access to accurate, up-to-date financial data is vital for informed business decisions. Professional bookkeepers provide regular financial reports and insights that illuminate your business’s financial health. Research shows that teams with instant access to financial data can improve decision-making speed by 30%. This agility can be a game-changer in competitive markets.

Simplified Tax Processes

Tax season can overwhelm businesses without proper financial records. Professional bookkeeping services maintain organized, compliant financial records year-round, which significantly simplifies tax preparation. The National Small Business Association reports that businesses using professional bookkeeping services spend 40% less time on tax preparation (compared to those managing finances in-house). This efficiency saves time and reduces the risk of costly errors or missed deductions.

Scalable Solutions for Growth

As your business grows, so do your financial management needs. Professional bookkeeping services offer scalable solutions that adapt to your evolving requirements. Whether you expand your product line, enter new markets, or increase your workforce, professional bookkeepers adjust their services to support your growth. This flexibility ensures that your financial management remains robust and efficient, regardless of your business size or complexity.

Final Thoughts

Professional bookkeeping services form the cornerstone of successful financial management for businesses of all sizes. These services provide the foundation for informed decision-making and sustainable growth through meticulous transaction recording, bank reconciliation, accounts management, financial statement preparation, and payroll processing. The importance of professional bookkeeping for business success cannot be overstated, as it ensures financial accuracy, saves time for business owners, and enhances decision-making through reliable data.

At BFC Tax Accountants, we understand the critical role that bookkeeping services for businesses play in driving success. Our team of experts offers comprehensive bookkeeping solutions tailored to your specific needs. We provide a full suite of professional accounting and tax services for both individuals and businesses, including personal and corporate tax planning, bookkeeping, and payroll processing.

Our cloud-based solutions ensure accessibility and efficiency for our clients. We specialize in serving the local community in Barrie, Ontario, ensuring compliance with Canadian tax laws while maximizing tax savings and financial organization. Let us handle the complexities of bookkeeping while you concentrate on running and expanding your business.