At BFC Tax Accountants, we understand the complexities of managing finances and taxes for businesses and individuals. Our Exacta Bookkeeping Tax Services offer a comprehensive suite of solutions to meet your financial needs.

From tax preparation to bookkeeping and business advisory, we provide expert guidance every step of the way. This blog post outlines our key services and how they can benefit you.

What Tax Preparation Services Do We Offer?

At BFC Tax Accountants, we offer a comprehensive range of tax preparation services tailored to meet the diverse needs of our clients. Our expertise covers personal, corporate, self-employed, and estate and trust tax returns, ensuring that every aspect of your financial life receives precise and careful handling.

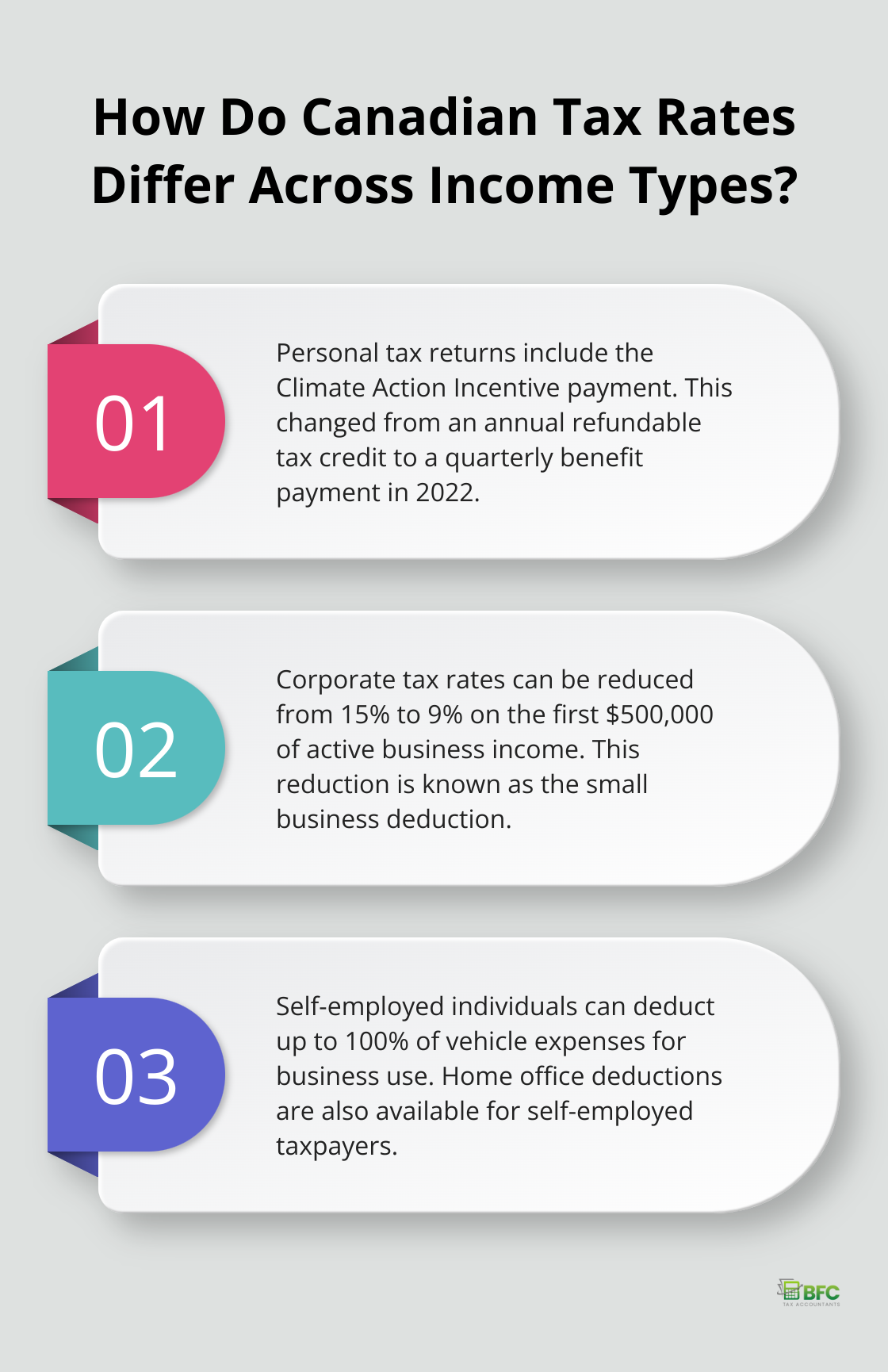

Personal Tax Returns

Our personal tax return service maximizes your refunds while ensuring full compliance with Canadian tax laws. We stay current with the latest tax credits and deductions, such as the Climate Action Incentive payment, which changed from a refundable tax credit claimed annually on personal income tax returns to a quarterly benefit payment in 2022. Our team meticulously reviews your financial situation to identify every opportunity for tax savings.

Corporate Tax Returns

For businesses, we provide comprehensive corporate tax preparation services. We understand the complexities of corporate taxation in Canada, including the small business deduction that can reduce the federal tax rate from 15% to 9% on the first $500,000 of active business income. Our experts work diligently to ensure your corporation benefits from all available deductions and credits while maintaining full compliance with tax regulations.

Self-Employed Tax Returns

Self-employed individuals face unique tax challenges. We specialize in navigating the intricacies of self-employment taxes, including proper categorization of business expenses and maximization of home office deductions. In Canada, you can deduct up to 100% of your vehicle expenses if it’s used solely for business purposes. Our team ensures you take advantage of every allowable deduction to minimize your tax liability.

Estate and Trust Tax Returns

Estate and trust taxation requires specialized knowledge and attention to detail. Our experts handle these complex returns with precision, ensuring compliance with specific regulations while maximizing tax efficiency for beneficiaries. We guide executors and trustees through the intricate process of reporting income and distributing assets in the most tax-effective manner.

Our cloud-based systems allow for secure, real-time collaboration, ensuring you always have access to your financial information. With our expertise, you can focus on growing your business or managing your personal finances, knowing that your tax matters are in capable hands. As we move forward, let’s explore how our bookkeeping and accounting services complement our tax preparation offerings to provide a holistic financial management solution.

How We Streamline Your Financial Operations

At Kyei Baffour, we offer robust bookkeeping and accounting services that form the foundation of any successful business. Our comprehensive suite of services streamlines your financial operations, providing accurate, timely, and insightful financial information.

Precision in Financial Reporting

We prepare detailed monthly financial statements that paint a clear picture of your business’s financial health. These statements include balance sheets, income statements, and cash flow statements. Managers can use these financial statements to track performance, budgets, and other metrics, and as tools to make decisions, motivate teams, and maintain a clear financial picture.

Efficient Payroll Management

Our payroll processing service eliminates the hassle of managing employee compensation. We handle everything from wage and deduction calculations to T4 slip preparation and payroll tax remittance. Small businesses often spend considerable time on payroll. Our service can significantly reduce this time, allowing you to focus on core business activities.

Streamlined Cash Flow

Effective management of accounts payable and receivable is essential for maintaining healthy cash flow. We implement systems to track outstanding invoices, manage vendor payments, and optimize your working capital. Many businesses see noticeable improvements in cash flow after implementing our recommended strategies.

Comprehensive Year-End Reporting

Our year-end financial reporting service ensures you’re fully prepared for tax season and provides valuable insights for strategic planning. We compile comprehensive reports that satisfy regulatory requirements and offer a detailed analysis of your financial performance throughout the year.

Technology-Driven Solutions

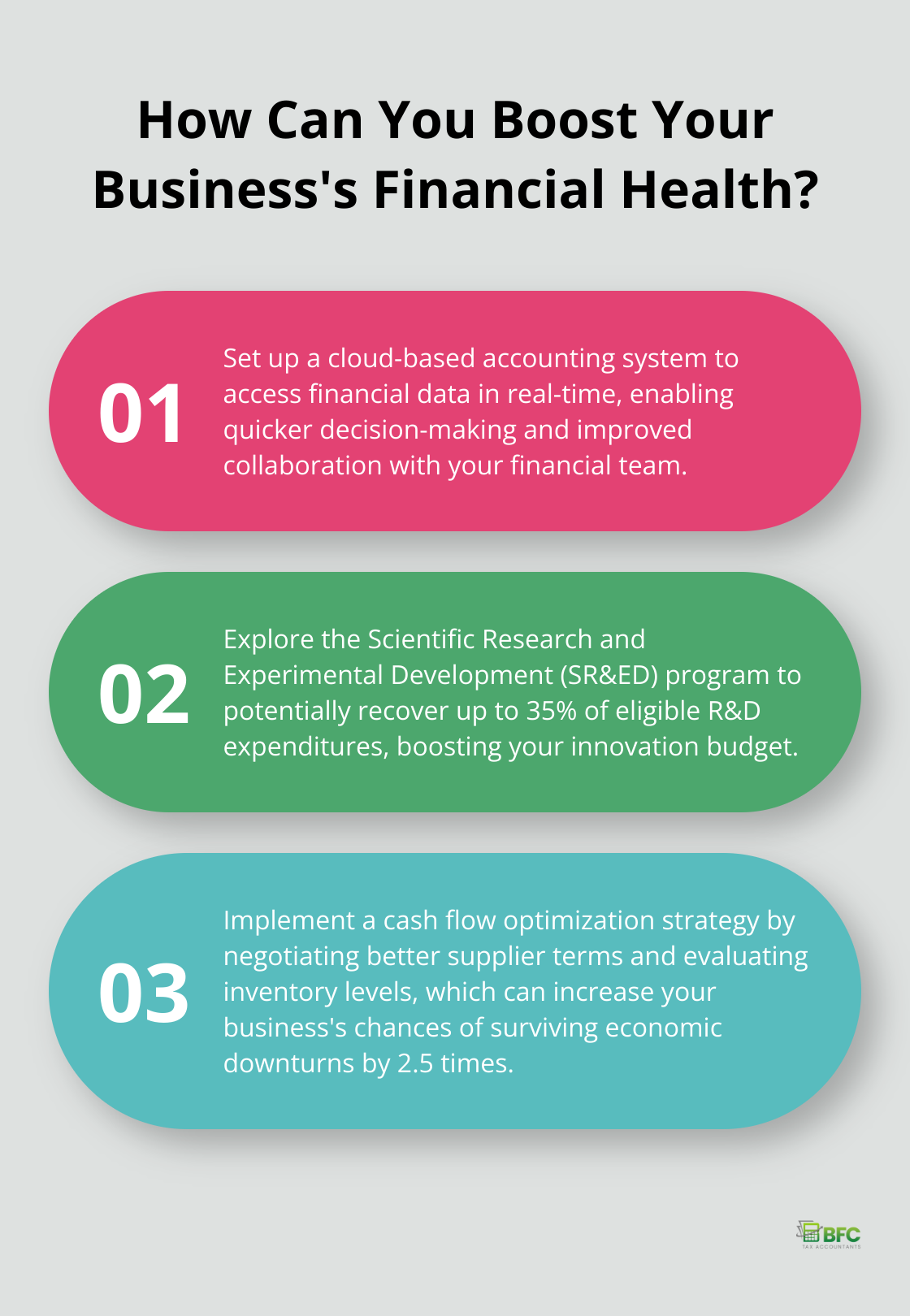

We leverage cloud-based accounting software to provide real-time access to your financial data, enabling more informed decision-making. This technology-driven approach offers advantages including increased security, improved collaboration, enhanced financial clarity, and real-time updates to bookkeeping data.

At Kyei Baffour, we don’t just process numbers; we provide actionable insights that propel your business forward. Our team of experienced professionals delivers tailored solutions that address your unique financial needs and challenges. As we move forward, let’s explore how our business advisory services can further enhance your financial strategy and drive growth.

How We Optimize Your Business Strategy

At Kyei Baffour, we provide comprehensive business advisory services that transform your financial strategy. Our expert team offers tailored solutions to optimize your business structure, enhance cash flow, and develop robust budgets for sustainable growth.

Tax Efficiency Maximization

Tax planning is a year-round activity that impacts your bottom line. We analyze your business operations to identify tax-saving opportunities. For example, the Canada Revenue Agency allows businesses to deduct up to 100% of meal expenses for long-haul truck drivers. Our advisors know these nuanced regulations to maximize your deductions.

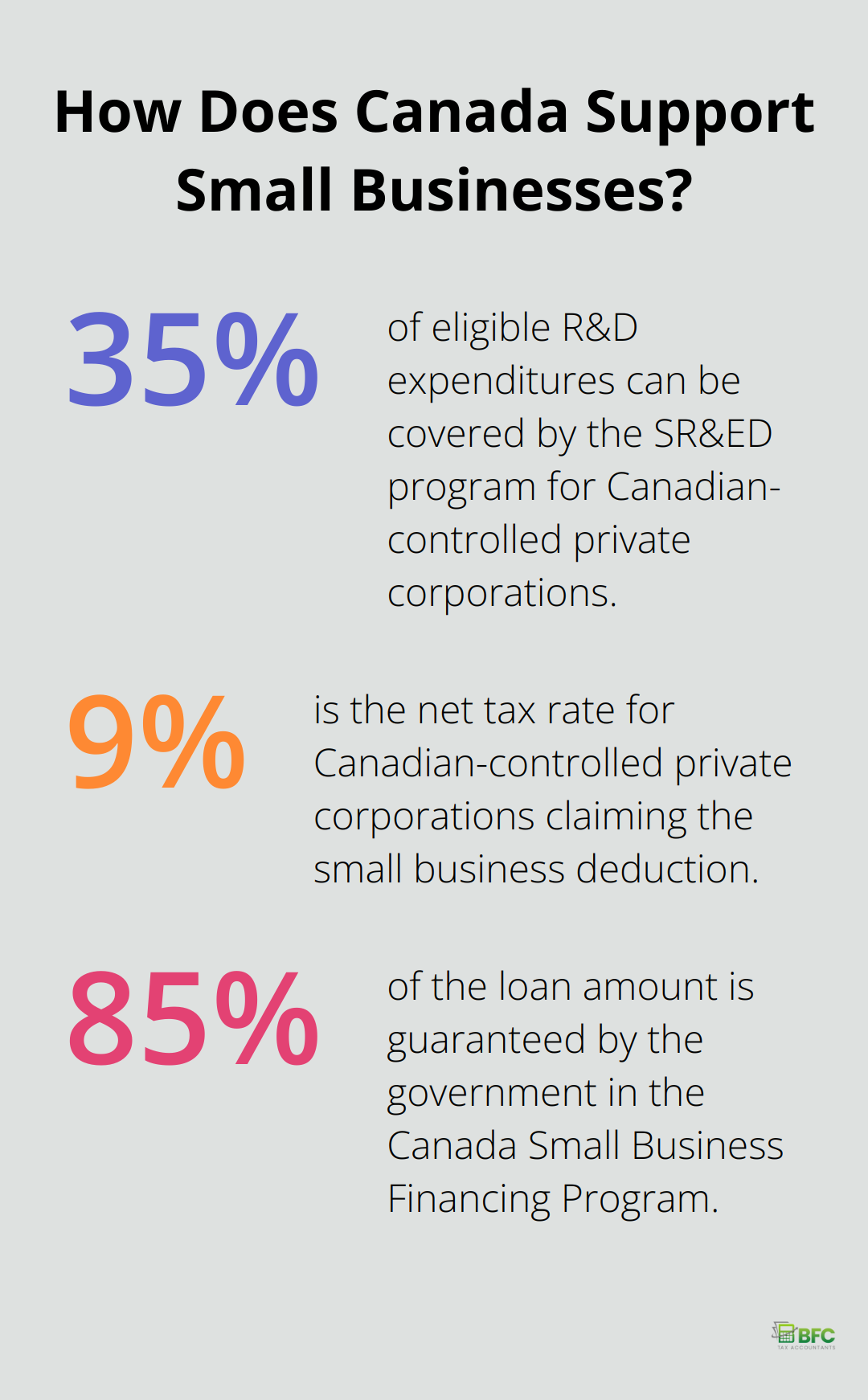

We also help you navigate complex tax credits. The Scientific Research and Experimental Development (SR&ED) program offers tax incentives that can cover up to 35% of eligible R&D expenditures for Canadian-controlled private corporations. Our team assesses your eligibility and guides you through the application process.

Success-Oriented Structuring

The right business structure is crucial for tax efficiency and liability protection. We evaluate your current structure and recommend changes if necessary. Incorporating your business can lead to significant tax advantages. For Canadian-controlled private corporations claiming the small business deduction, the net tax rate is 9%.

Cash Flow Enhancement

Effective cash flow management is vital for any business. We implement strategies to improve your cash position, such as inventory level optimization and supplier term negotiation. Businesses with strong cash flow management are 2.5 times more likely to survive economic downturns.

Our advisors help you explore financing options to support growth. The Canada Small Business Financing Program offers loans up to $1,000,000 for small businesses (with the government guaranteeing 85% of the loan amount to the lender).

Future Forecasting

Accurate budgeting and forecasting are essential for informed business decisions. We use advanced financial modeling techniques to create realistic projections. This allows you to anticipate cash flow needs, plan for capital expenditures, and set achievable growth targets.

Our forecasting methods incorporate market trends and economic indicators. We consider factors like the Bank of Canada’s interest rate projections, which can impact borrowing costs and consumer spending patterns.

Final Thoughts

Exacta Bookkeeping Tax Services at BFC Tax Accountants provide comprehensive financial solutions for individuals and businesses. We offer expert tax preparation, streamlined bookkeeping, and strategic business advisory services to meet diverse financial needs. Our team stays current with tax laws and regulations to optimize your tax position and maximize deductions and credits.

We deliver precise financial statements, efficient payroll processing, and effective accounts management to form the backbone of sound financial management. Our business advisory services help you optimize tax strategies, choose advantageous business structures, and develop accurate forecasts for sustainable growth. We utilize cutting-edge technology to provide real-time access to your financial data (enabling informed decision-making).

To start with Exacta Bookkeeping Tax Services, visit our website to explore our offerings and schedule a consultation. Our team will assess your financial needs and develop a customized plan to help you achieve your goals. Kyei Baffour handles the complexities of your financial management, allowing you to focus on what you do best.