At BFC Tax Accountants, we understand that managing finances is a critical aspect of running a successful business. Many entrepreneurs wonder, “How much do bookkeeping services cost?” The answer isn’t straightforward, as several factors influence pricing.

In this post, we’ll break down the key elements that affect bookkeeping costs and provide insights to help you make an informed decision for your business.

What Impacts Bookkeeping Costs?

Bookkeeping costs vary widely based on several key factors. These elements can significantly influence pricing for businesses in Barrie, Ontario and beyond.

Business Size and Complexity

The size and complexity of your business play a major role in determining bookkeeping costs. A small startup with straightforward finances might pay as little as $200 per month for basic services. In contrast, a medium-sized company with multiple revenue streams could see costs upwards of $2,000 monthly. Larger enterprises with complex financial structures often require full-time, in-house bookkeeping teams, which pushes costs even higher.

Transaction Volume

The number of financial transactions your business processes directly impacts bookkeeping fees. A study by the Association of Chartered Certified Accountants (ACCA) found that 30% of businesses in the UK use Modified Accrual accounting. This occurs because higher transaction volumes require more time and resources to manage accurately.

Service Frequency and Scope

How often you need bookkeeping services, and the level of detail required also affect costs. Monthly reconciliations and reports generally cost more than quarterly or annual services but provide more timely financial insights. Basic bookkeeping (covering data entry and bank reconciliations) might cost $300-$500 per month for a small business. The average cost for online bookkeeping services ranges from $300-$800 per month, depending on the level of service and support needed.

Industry-Specific Requirements

Certain industries have unique bookkeeping needs that can impact costs. For example, construction companies often require job costing, while e-commerce businesses need inventory tracking. These specialized services can increase bookkeeping expenses by 20-30%. Nonprofit organizations face additional compliance requirements, potentially adding another layer of complexity (and cost) to their bookkeeping needs.

Understanding these factors helps you anticipate and budget for bookkeeping expenses. Whether you’re a small business owner in Barrie or a growing enterprise, finding a cost-effective bookkeeping solution that scales with your business is essential. The next section will explore the average costs of bookkeeping services to give you a clearer picture of what to expect.

What Are the Average Costs for Bookkeeping Services?

Bookkeeping costs vary widely based on service providers and business needs. This section breaks down common pricing models to help you understand what to expect.

Hourly Rates and Monthly Retainers

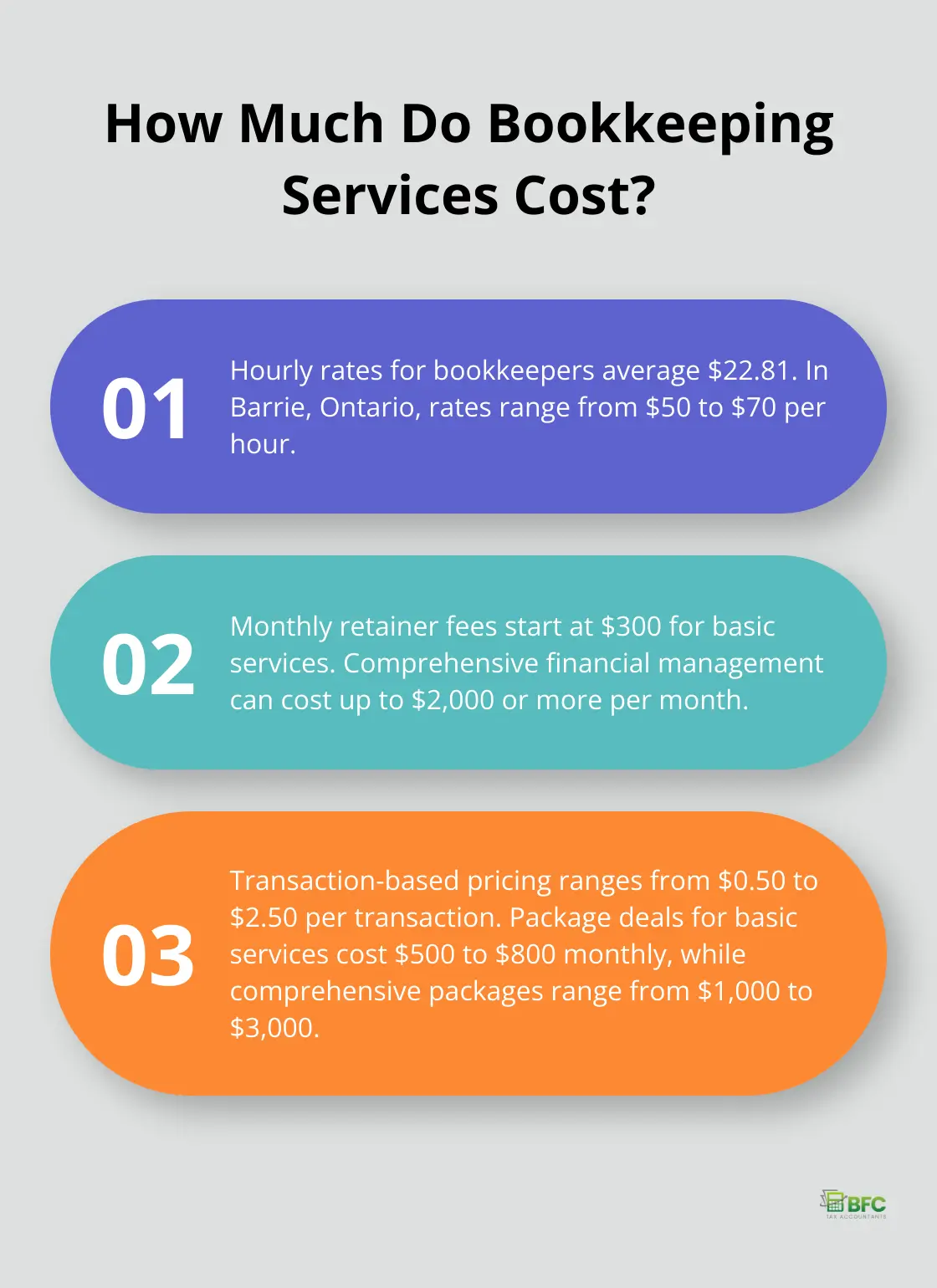

Many bookkeepers charge by the hour, with rates typically around $22.81. Small businesses in Barrie, Ontario might pay around $50 to $70 per hour for professional bookkeeping services. However, hourly rates can accumulate quickly, especially for businesses with complex financial needs.

Monthly retainer fees offer another pricing option. These fees usually start at about $300 per month for basic services and can reach $2,000 or more for comprehensive financial management. Retainers provide predictable costs and often include a set number of hours or specific services each month.

Transaction-Based and Package Pricing

Some bookkeepers offer per-transaction pricing, which benefits businesses with low transaction volumes. Rates typically range from $0.50 to $2.50 per transaction (depending on complexity). This model works well for businesses with straightforward finances but can become expensive as transaction volumes increase.

Package deals have gained popularity, offering a set of services for a fixed monthly fee. A basic package might include monthly reconciliations, financial statement preparation, and basic reporting for $500 to $800 per month. More comprehensive packages (including services like payroll processing, accounts payable management, and advanced reporting) can range from $1,000 to $3,000 monthly.

In-House vs. Outsourced Bookkeeping

The choice between in-house and outsourced bookkeeping significantly impacts costs. An in-house bookkeeper’s salary in Canada averages around $45,000 to $55,000 annually, plus benefits. This option provides dedicated support but comes with additional overhead costs.

Outsourcing often proves more cost-effective, especially for small to medium-sized businesses. Outsourced services typically range from $500 to $2,500 per month, depending on the complexity and volume of work. This option offers flexibility and access to a team of experts without the commitment of a full-time employee.

When evaluating costs, consider the value of accurate financial records and expert insights. Investing in quality bookkeeping services can prevent costly errors and maximize tax benefits in the long run. The next section will explore strategies to optimize your bookkeeping expenses while maintaining high-quality financial management.

How to Cut Bookkeeping Costs

Embrace Cloud-Based Accounting Software

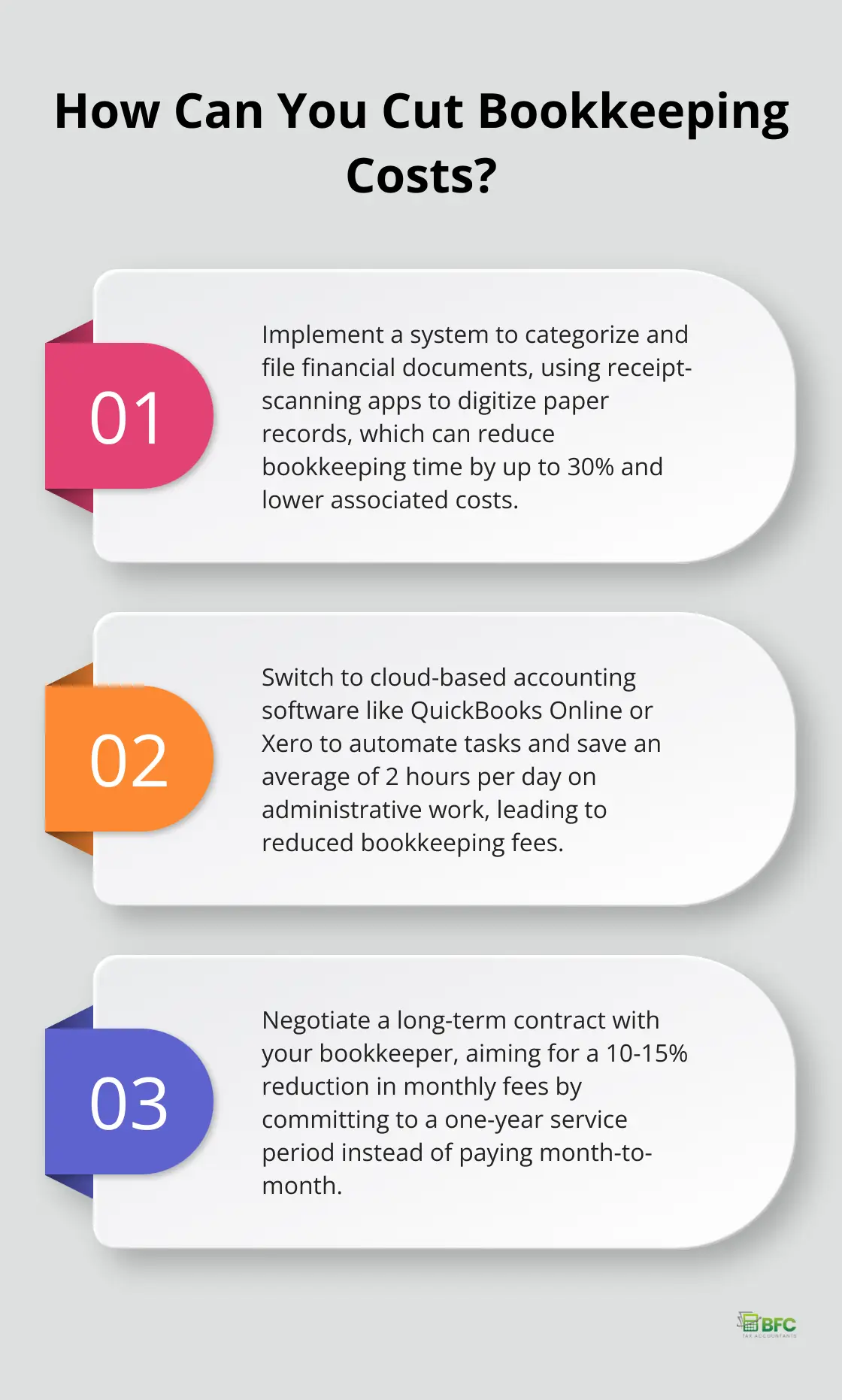

Cloud-based accounting software like QuickBooks Online or Xero can reduce bookkeeping costs. These platforms automate many tasks, which cuts the time needed for manual data entry. A study by Sage found that businesses using cloud accounting software save an average of 2 hours per day on administrative tasks. This efficiency translates to lower bookkeeping fees, especially for firms that charge hourly rates.

Streamline Your Record-Keeping

Organized financial records lead to more efficient bookkeeping. You should implement a system to categorize and file receipts, invoices, and other financial documents. This organization can cut bookkeeping time by up to 30% (according to a survey by the American Institute of Professional Bookkeepers). Consider using receipt-scanning apps to digitize paper documents, which further streamlines the process.

Opt for Bundled Services

Many accounting firms offer package deals that combine bookkeeping with tax preparation services. These bundles often come at a discount compared to purchasing services separately. For instance, some firms offer up to 20% off when you combine monthly bookkeeping with annual tax preparation. This approach not only saves money but also ensures consistency in your financial reporting.

Explore Virtual Bookkeeping Options

Virtual bookkeeping services can cost significantly less than traditional in-person options. Modern bookkeeping tends to be highly efficient compared to traditional bookkeeping, which means that the savings and efficiencies get passed on to clients. Plus, you’re not limited to local providers, which allows you to shop around for the best rates nationwide.

Negotiate Long-Term Contracts

If you’re satisfied with your current bookkeeper, you should consider negotiating a long-term contract. Many firms offer discounts for clients who commit to extended service periods. You might secure a 10-15% reduction in monthly fees by signing a one-year contract instead of paying month-to-month. This approach provides cost savings and budget predictability for your business.

Final Thoughts

Bookkeeping costs vary based on business size, transaction volume, service frequency, and industry requirements. These factors help businesses budget for their financial management needs. Accurate records, timely reporting, and expert insights often outweigh the initial costs of professional bookkeeping services.

Cost-cutting strategies can reduce expenses, but quality financial management remains essential. Investing in reliable bookkeeping services prevents costly errors and ensures tax compliance. The right bookkeeping service acts as a strategic partner in your business’s financial health.

BFC Tax Accountants offers tailored bookkeeping solutions for businesses in Barrie, Ontario and surrounding areas. We provide personalized quotes based on specific requirements, ensuring competitive pricing. Our expertise in Canadian tax laws allows us to deliver value-driven services that support business growth.