Setting the right price for bookkeeping services can be a challenge for many accounting professionals. At Kyei Baffour, we understand the importance of striking a balance between competitive rates and profitability.

This guide will walk you through the key factors influencing pricing and introduce you to various pricing models. We’ll also provide practical steps to help you calculate your rates, including using a bookkeeping services pricing calculator for more accurate estimates.

What Drives Bookkeeping Service Prices?

Business Complexity and Size

The complexity and size of a business significantly impact bookkeeping costs. Small businesses typically pay between $100 to $500 per month for basic bookkeeping and tax filing services. Medium-sized businesses often pay more due to their increased complexity and transaction volume.

Transaction Volume

Transaction volume plays a crucial role in determining bookkeeping costs. More transactions equate to more work for the bookkeeper. A retail store with hundreds of daily transactions requires more time and resources than a consulting firm with a few monthly invoices.

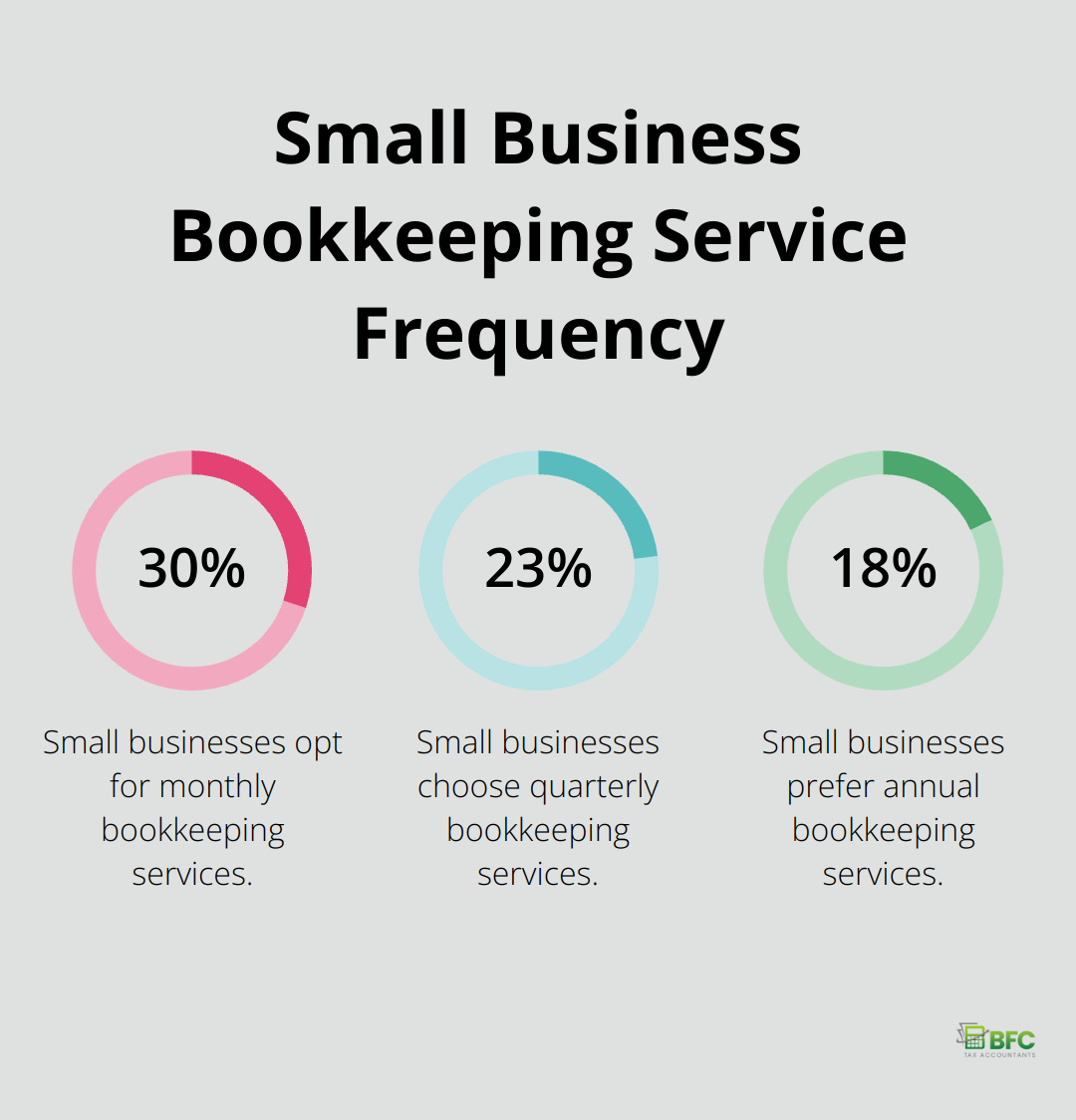

Service Frequency

The frequency of bookkeeping services affects pricing. Monthly bookkeeping costs more than quarterly or annual services but provides more up-to-date financial information. Clutch.co reports that 30% of small businesses choose monthly bookkeeping services, 23% opt for quarterly, and 18% prefer annual services.

Additional Services

Bookkeeping often extends beyond basic transaction recording. Additional services like payroll processing, tax preparation, or financial forecasting can significantly increase the overall cost. Tax preparation fees vary widely, depending on the complexity of the business and its financial situation.

Industry-Specific Requirements

Certain industries have unique bookkeeping needs that affect pricing. Non-profit organizations require specialized bookkeeping to maintain their tax-exempt status. Businesses in highly regulated industries (such as healthcare or finance) may need more complex financial tracking and reporting, which can increase costs.

Understanding these pricing factors helps businesses make informed decisions about their bookkeeping needs and budget accordingly. The next section will explore common pricing models used by bookkeeping service providers to address these various factors.

How Do Bookkeepers Price Their Services?

Bookkeepers use various pricing models to accommodate different client needs and business structures. Each model offers unique advantages and potential drawbacks. Let’s explore the most common pricing strategies in the bookkeeping industry.

Hourly Rates: The Traditional Approach

Many bookkeepers still use hourly rates, especially when dealing with unpredictable workloads or new clients. The average hourly rate for a bookkeeper is approximately $21 based on Salary.com data as of February 2024. Hourly rates typically range between different values depending on various factors.

A bookkeeper in New York City might charge $50-$100 per hour, while one in a smaller town might set rates at $25-$50. This model provides transparency but can sometimes lead to inefficiency if not managed properly.

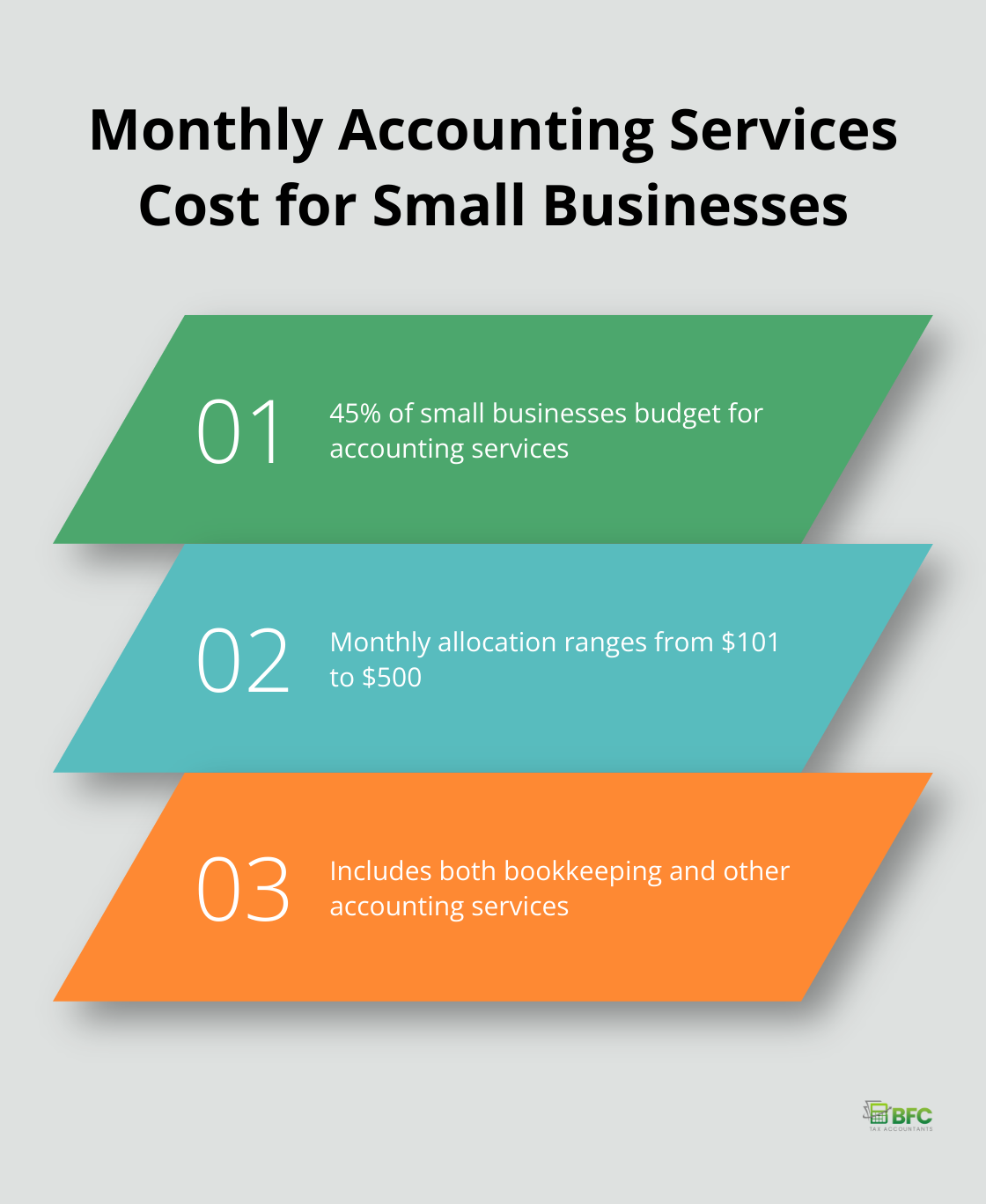

Fixed Monthly Fees: Predictability for Both Parties

Fixed monthly fees offer stability for bookkeepers and predictable costs for clients. A Clutch survey found that 45% of small businesses allocate $101-$500 per month for accounting services (which often includes bookkeeping).

This model works well for clients with consistent monthly transaction volumes. For example, a small retail business with about 500 monthly transactions might pay a fixed fee of $300-$500 per month for basic bookkeeping services.

Per-Transaction Pricing: Scaling with Business Activity

Some bookkeepers opt for per-transaction pricing, which directly ties fees to workload. This model appeals to businesses with fluctuating activity levels. Prices typically range from $0.50 to $2.50 per transaction, depending on complexity.

A restaurant processing 1,000 monthly transactions might pay $1,000-$2,500 under this model (assuming a per-transaction fee of $1-$2.50). This approach ensures fair compensation for busier periods but can result in unpredictable costs for clients.

Tiered Pricing Packages: Catering to Diverse Needs

Many bookkeeping firms offer tiered pricing packages to accommodate various business sizes and needs. This model allows clients to choose a package that best fits their requirements and budget, while bookkeepers can streamline their service offerings.

The choice of pricing model depends on factors like business size, industry, and specific client needs. The next section will guide you through the process of calculating your own bookkeeping service prices, taking into account these various models and factors.

How to Set Your Bookkeeping Prices

Analyze Your Operational Costs

The first step in calculating your bookkeeping service prices is to thoroughly assess your operational costs. This includes software subscriptions, labor expenses, and overhead costs such as office rent and utilities. Generally, small to medium-sized businesses expect to pay between $500-$2,500 USD monthly for their outsourced bookkeeping. Factor in the time spent on each client, considering that experienced bookkeepers often charge $30 to $50 per hour.

Conduct Market Research

Research competitor pricing in your area. In Barrie, Ontario, bookkeeping services for small businesses typically range from $200 to $400 per month. However, prices can vary significantly based on the complexity of the business and the services offered. Use tools like local business directories or professional networks to gather this information.

Set Your Profit Margin

After understanding your costs and the local market rates, determine your target profit margin. A healthy profit margin for bookkeeping services usually falls between 20% to 30%. For instance, if your total costs for servicing a client are $300 per month, and you aim for a 25% profit margin, your price should be at least $375 per month.

Highlight Your Unique Value

Consider what sets your services apart from competitors. If you have specialized industry knowledge or advanced certifications, these can justify higher rates. For example, a Certified QuickBooks ProAdvisor can often command higher fees than non-certified bookkeepers. Those who are not certified reported an overall average hourly rate of $68, while those who are QuickBooks Online-certified reported higher rates.

Implement and Adjust

Start with your calculated prices and monitor client responses. If you win every bid, your prices might be too low. Conversely, if you lose most potential clients, you may need to adjust downward or better communicate your value proposition. Try to achieve a win rate of about 60% to 70% of your proposals.

Pricing is not a one-time task. Review and adjust your rates regularly based on changes in your costs, market conditions, and the value you provide to clients. These steps will position you to set competitive and profitable prices for your bookkeeping services.

Final Thoughts

Pricing bookkeeping services requires careful consideration of multiple factors. Business complexity, transaction volume, service frequency, and industry-specific requirements all influence the right price point. Bookkeepers must develop a pricing strategy that reflects their services’ value through various models like hourly rates, fixed monthly fees, or tiered packages.

Successful pricing balances competitiveness with profitability. Undercutting competitors might attract clients but can lead to unsustainable practices. Instead, communicate your unique value and justify rates through expertise and quality service. Market conditions and operational costs change, so review and adjust your pricing strategy regularly (a bookkeeping services pricing calculator can help streamline this process).

At BFC Tax Accountants, we offer tailored bookkeeping solutions for businesses in Barrie, Ontario. Our team provides cloud-based accessibility and expertise in Canadian tax laws. We support your financial success through personal tax planning, corporate tax preparation, and comprehensive bookkeeping services.