Falling behind on bookkeeping can be a nightmare for professional service businesses. At BFC Tax Accountants, we understand the challenges of maintaining accurate financial records while juggling client demands.

Catch up bookkeeping services offer a lifeline to businesses drowning in paperwork and financial disorganization. This guide will walk you through the steps to get your books back on track and explore how professional services can streamline your financial management.

Why Up-to-Date Books Matter

Clear Financial Picture for Smart Decisions

Accurate and current bookkeeping forms the backbone of any successful professional service business. Up-to-date books provide a real-time snapshot of your business’s financial health. This clarity allows you to make informed decisions about resource allocation, pricing strategies, and growth opportunities. For example, a law firm with current books can quickly assess which practice areas are most profitable, enabling them to focus their marketing efforts effectively.

Stay Audit-Ready and Tax Compliant

The Canada Revenue Agency (CRA) can initiate an audit at any time. Businesses with organized, up-to-date financial records can face these audits with confidence. Moreover, accurate bookkeeping ensures you claim all eligible deductions and credits, potentially saving thousands in taxes. A study by Intuit found that small businesses overpay their taxes by an average of $11,000 due to poor record-keeping.

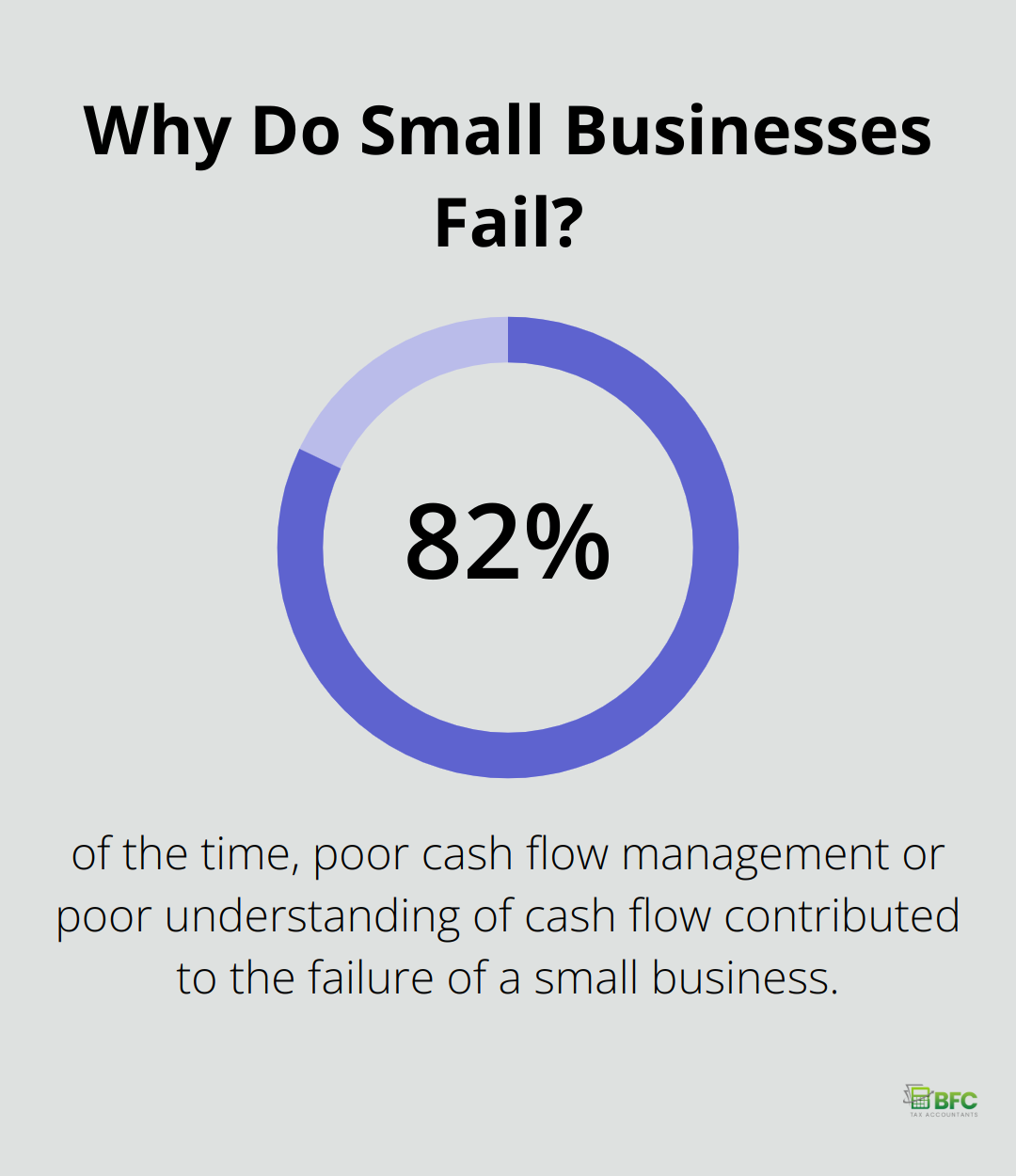

Master Your Cash Flow

Cash flow is the lifeblood of any business. Current books allow you to forecast cash flow accurately, helping you avoid cash crunches and plan for future expenses. A survey by U.S. Bank found that 82% of business failures occur due to poor cash flow management. With up-to-date books, you can spot trends, anticipate slow periods, and make proactive decisions to keep your cash flow healthy.

Leverage Technology for Efficiency

Modern bookkeeping software (like QuickBooks or Xero) can automate many aspects of financial record-keeping. These tools can sync with your bank accounts, categorize transactions, and generate reports with a few clicks. This automation not only saves time but also reduces the risk of human error in data entry.

Facilitate Strategic Planning

Up-to-date books provide the foundation for strategic planning. They allow you to set realistic financial goals, track progress, and adjust your strategies as needed. For instance, if your books show that a particular service line is underperforming, you can decide whether to invest more resources or pivot to more profitable areas.

Now that we’ve established the importance of current bookkeeping, let’s explore the practical steps you can take to catch up on your financial records and maintain them moving forward.

How to Catch Up on Your Bookkeeping

Organize Your Financial Documents

Start by collecting all your financial documents. This includes bank statements, credit card statements, receipts, invoices, and any other relevant financial records. Create a filing system (either physical or digital) to sort these documents by date and type. The National Association of Professional Organizers reports that the average person wastes 4.3 hours per week searching for papers. An organized system will save you time and reduce stress in the long run.

Reconcile Your Accounts

Next, match your bank and credit card statements with your records. This process involves comparing each transaction in your statements to your internal records. Use your accounting software to streamline this process. Many modern accounting platforms (such as QuickBooks) can automatically import bank transactions, which makes reconciliation faster and more accurate. Pay close attention to any discrepancies or unexplained transactions, as these could indicate errors or potential fraud.

Update Your Books

Now it’s time to refresh your books. Start with your accounts payable and receivable. Review all outstanding invoices and bills, and update their status in your accounting system. This step is essential for effective cash flow management. A study found that 82% of the time, poor cash flow management or poor understanding of cash flow contributed to the failure of a small business. Keeping your accounts current will provide a clear picture of your financial obligations and expected income.

Record all transactions in your accounting software, including cash transactions that you might have overlooked. Categorize each transaction correctly for accurate financial reporting. If you’re uncertain about specific transactions or categories, consider consulting with a professional bookkeeper or accountant.

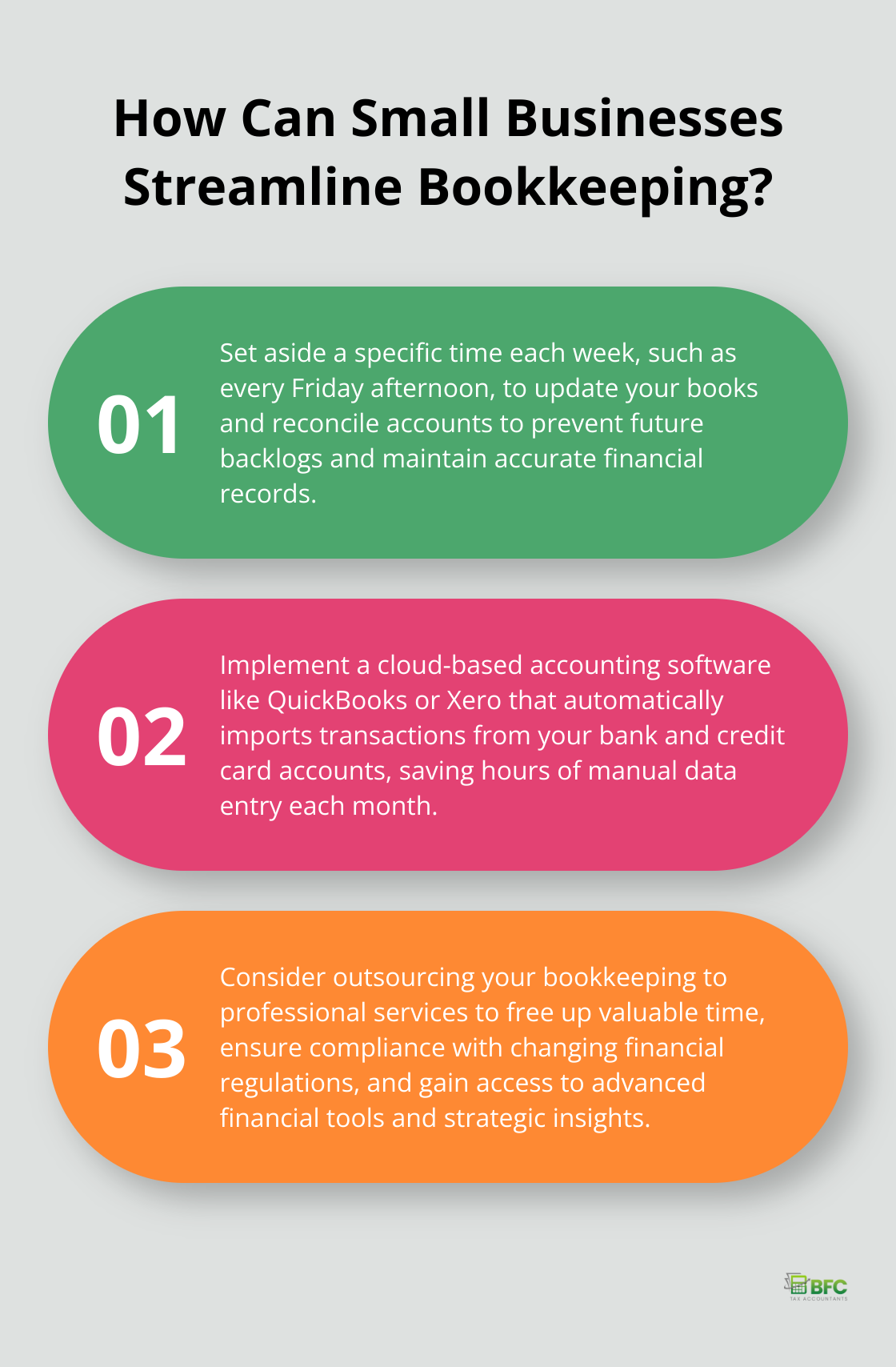

Implement Ongoing Bookkeeping Practices

To prevent future backlogs, establish regular bookkeeping routines. Allocate time each week to update your books and reconcile accounts. Consider using cloud-based accounting software that can automatically import transactions from your bank and credit card accounts. This can save you hours of manual data entry each month.

Receipt-scanning apps can capture and categorize expenses on the go. This practice can significantly reduce the time spent on bookkeeping and improve the accuracy of your records.

While these steps can help you catch up on your bookkeeping, maintaining accurate books is an ongoing process. If you find yourself consistently falling behind or struggling with complex financial situations, it might be time to explore professional bookkeeping services. Let’s examine how these services can benefit your business and streamline your financial management.

Why Professional Bookkeeping Services Transform Financial Management

Time Reclamation for Core Business Focus

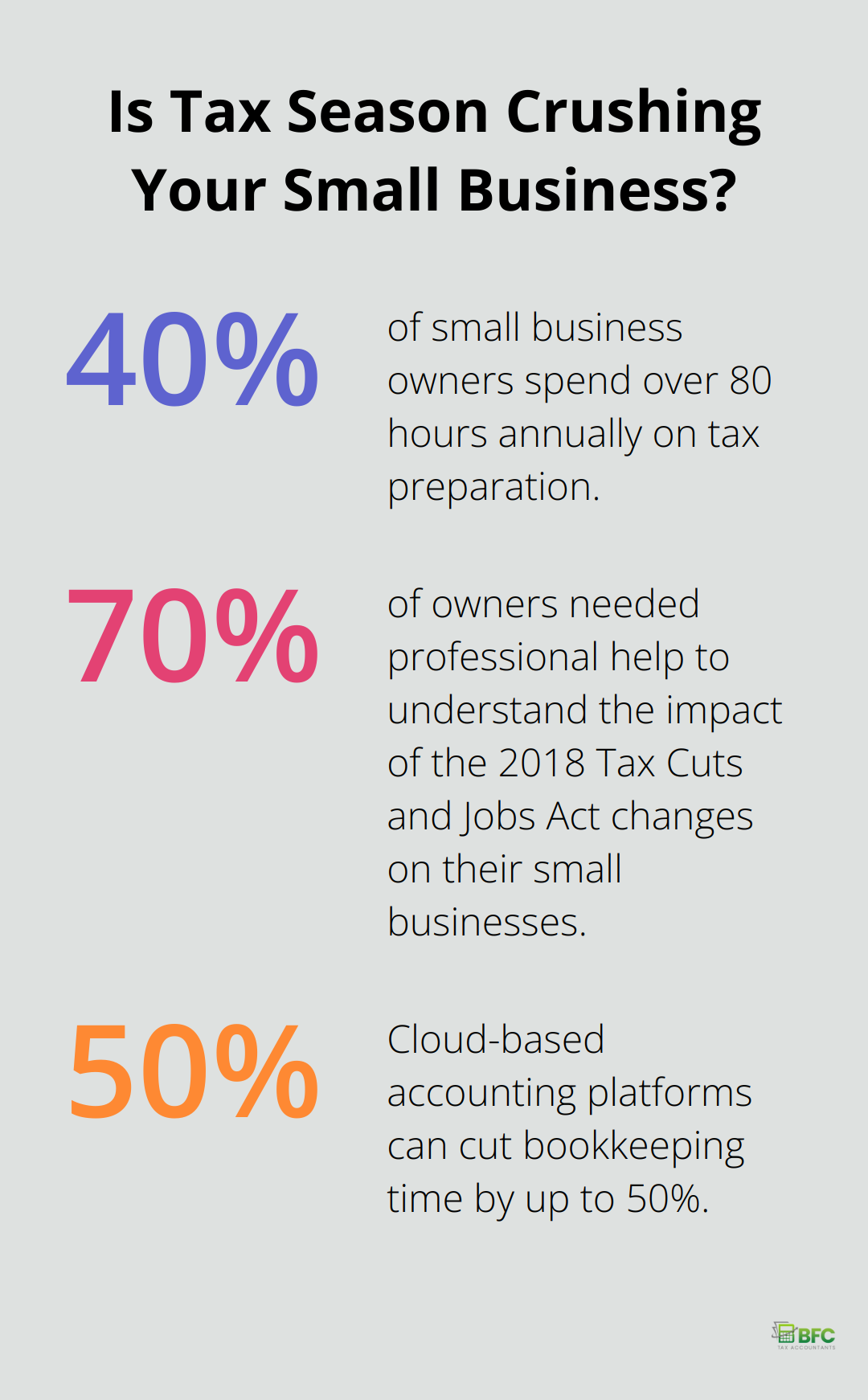

Professional bookkeeping services free up valuable time for business owners. The National Small Business Association reports that 40% of small business owners spend over 80 hours annually on tax preparation. Outsourcing these tasks to experts allows you to redirect this time to growing your business and serving clients.

Expert Navigation of Complex Financial Regulations

Financial regulations and tax laws change frequently. Professional bookkeepers stay current with these changes, ensuring your business remains compliant. A survey by Clutch revealed that 70% of owners needed professional help to understand the impact of the 2018 Tax Cuts and Jobs Act changes on their small businesses.

Access to Advanced Financial Tools

Professional bookkeeping services often provide access to cutting-edge accounting software and tools. These technologies offer real-time financial insights, automate repetitive tasks, and generate comprehensive reports. Cloud-based accounting platforms can cut bookkeeping time by up to 50% (according to a Xero study).

Customized Services for Your Business Needs

Professional bookkeepers tailor their services to your specific business requirements. This customization ensures you receive comprehensive financial support without paying for unnecessary services. Whether you need basic bookkeeping or complex financial analysis, a professional service adapts to your needs.

Strategic Financial Insights

Professional bookkeeping services do more than just balance the books. They provide strategic insights, identify cost-saving opportunities, and support data-driven decision-making. This financial expertise can propel your business forward, turning your bookkeeper into a valuable financial ally.

Final Thoughts

Up-to-date books provide a strategic advantage for professional service businesses. Accurate financial records enable informed decision-making, ensure tax compliance, and improve cash flow management. Professional bookkeeping services offer a solution for businesses overwhelmed by catch-up bookkeeping tasks. These experts save time, provide access to advanced tools, and offer strategic financial insights.

Professional bookkeepers adapt to your business needs and stay current with changing regulations. They transform from number crunchers to valuable allies in your business journey. Prioritizing bookkeeping becomes an investment in your company’s future, regardless of whether you manage it in-house or partner with professionals.

For expert financial guidance in Barrie, Ontario and surrounding areas, Kyei Baffour at BFC Tax Accountants offers comprehensive accounting and tax services. Their expertise in Canadian tax laws (and commitment to personalized service) allows you to focus on business growth. Take action today to organize your financial records and set your business on a path to success.