At BFC Tax Accountants, we understand the challenges businesses face in managing their finances effectively. Outsourced bookkeeping services can be a game-changer for companies looking to streamline their financial operations.

However, choosing the right provider is crucial for success. This guide will help you navigate the selection process and find the best outsourced bookkeeping service for your business needs.

What Are Outsourced Bookkeeping Services?

Definition and Scope

Outsourced bookkeeping services are financial management solutions provided by external professionals or firms. These services handle a company’s day-to-day financial transactions, record-keeping, and reporting. The scope of outsourced bookkeeping typically covers a wide range of financial tasks, including recording transactions, reconciling bank statements, managing accounts payable and receivable, and preparing financial reports. Many providers also offer payroll processing, tax preparation, and strategic financial advice.

Benefits of Outsourcing

Companies choose to outsource bookkeeping for several compelling reasons:

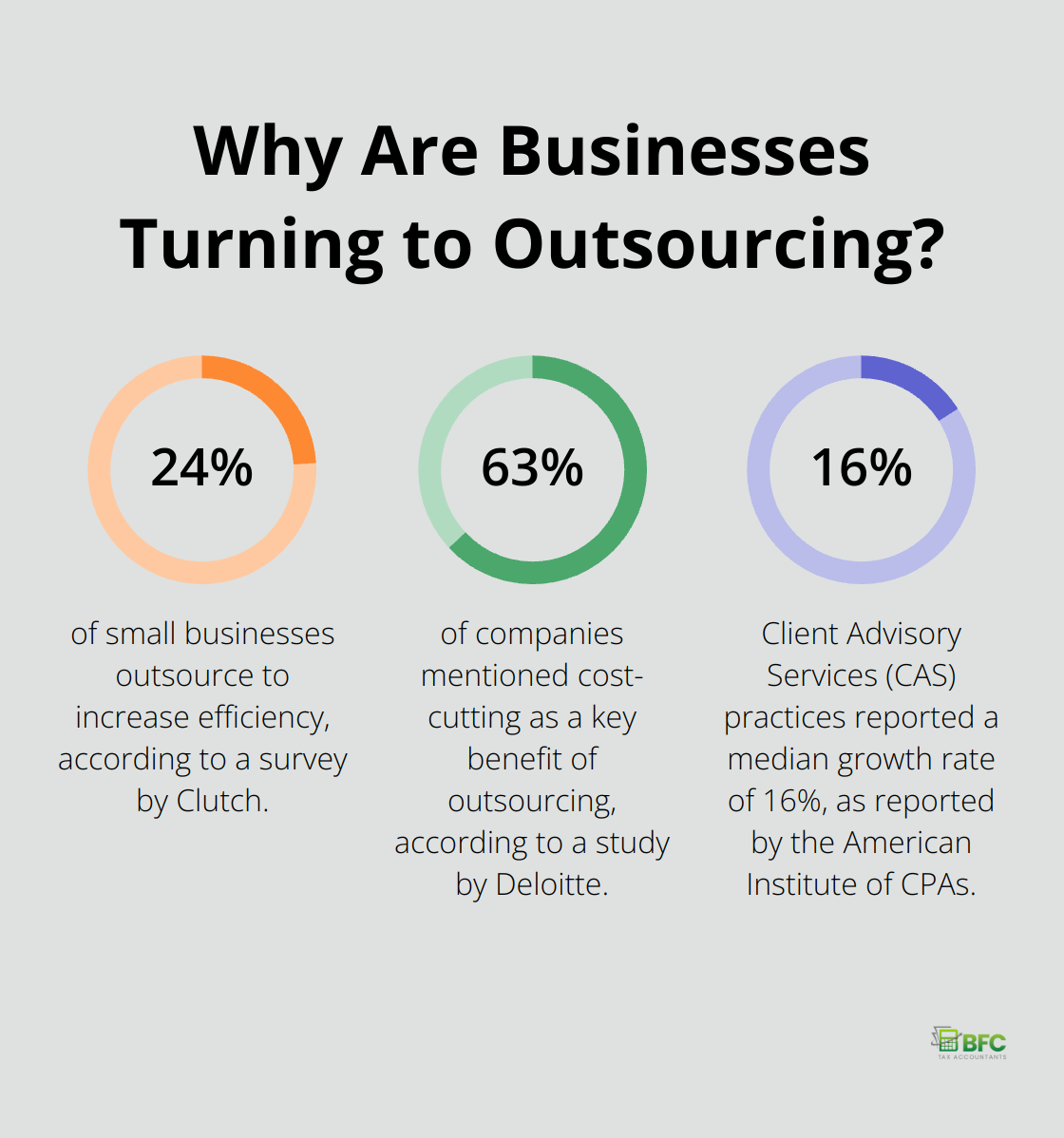

- Cost-effectiveness: A study by Deloitte found that 63% of companies mentioned cost-cutting as a key benefit of outsourcing. Outsourcing eliminates the need for full-time in-house staff, reducing overhead costs.

- Timesaving: Business owners can focus on core operations while experts handle their finances. This leads to increased productivity and efficiency. A survey by Clutch revealed that 24% of small businesses outsource to increase efficiency.

- Access to expertise: Outsourced bookkeepers stay updated with the latest accounting standards and tax regulations. This ensures compliance and reduces the risk of costly errors. The American Institute of CPAs reports that Client Advisory Services (CAS) practices reported a median growth rate of 16%.

Common Tasks Handled

Outsourced bookkeepers manage a variety of financial tasks, including:

- Transaction categorization and data entry

- Bank and credit card reconciliations

- Accounts payable and receivable management

- Financial statement preparation

- Payroll processing

- Tax document preparation

Many providers also offer additional services like cash flow forecasting, budgeting assistance, and financial analysis. These value-added services can provide insights for business growth and decision-making.

Technology in Outsourced Bookkeeping

Modern outsourced bookkeeping services leverage advanced technology. Cloud-based accounting software (like QuickBooks Online and Xero) allows real-time collaboration between businesses and their outsourced bookkeepers. These platforms provide secure data storage and easy access to financial information.

Automation plays an increasing role in outsourced bookkeeping. AI-powered tools can categorize transactions, reconcile accounts, and even generate basic reports. This automation reduces human error and increases efficiency. A report by Sage found that 58% of accountants expect AI to significantly impact their profession in the coming years.

As we explore the world of outsourced bookkeeping services, it’s important to consider the key factors that will help you choose the right provider for your business. Let’s examine these factors in the next section.

What Makes a Great Bookkeeping Service?

Industry-Specific Expertise

The best bookkeeping services possess deep knowledge of your industry. For instance, real estate businesses require bookkeepers who understand property management accounting. 42% of SMEs turn to business contacts within their industry for information and assistance in identifying trade opportunities.

Comprehensive Service Offerings

Top-tier bookkeeping services extend beyond basic transaction recording. They provide a full range of financial management services, including cash flow forecasting, financial analysis, and strategic advice. A Sage survey reveals that accountants are navigating a changing world where clients expect more than traditional accounting services.

Cutting-Edge Technology

Modern bookkeeping hinges on advanced technology. Your provider should utilize current accounting software that integrates seamlessly with your existing systems. Cloud-based solutions offer particular advantages, enabling real-time access to financial data.

Ask potential providers about their tech stack and methods for staying current with technological advancements. Avoid outdated practices that could hinder your financial management efficiency.

Ironclad Security Measures

Financial data protection should rank as a top priority. Inquire about a provider’s security protocols, including data encryption, access controls, and backup procedures. The Canadian Centre for Cyber Security recommends multi-factor authentication and regular security audits as best practices for financial service providers.

Transparent Pricing

Clear pricing structures prevent unexpected costs from eroding the benefits of outsourcing. Seek providers who offer upfront pricing details. Some charge hourly rates, while others provide fixed monthly fees based on transaction volume or service complexity.

Responsive Communication

Effective communication plays a vital role in financial management. Your bookkeeping service should remain readily available to answer questions and provide updates. Look for providers who offer multiple communication channels and clearly defined response times.

When evaluating potential bookkeeping services, ask probing questions. Request case studies or references from clients in similar industries. Schedule a consultation to assess their communication style and expertise firsthand.

The right bookkeeping service acts as more than just a vendor – they become a partner in your business’s financial success. The next section will guide you through the steps to evaluate and select the ideal bookkeeping services for small business needs.

How to Select Your Ideal Bookkeeping Partner

Assess Your Financial Management Needs

Start with a comprehensive evaluation of your financial management requirements. Create a detailed list of tasks you need assistance with, from basic transaction recording to complex financial analysis. This list will help you identify providers that offer the specific services your business requires.

Set a Realistic Budget

Establish a budget that aligns with your financial needs and potential return on investment. The average cost of an accountant in 2025 can vary based on factors like location and specialization. Your budget should reflect the complexity of your financial requirements and the anticipated benefits of improved financial management.

Research Potential Providers

Look for bookkeeping services with experience in your industry. For instance, if you operate in the real estate sector, search for providers who understand property management accounting. Don’t hesitate to ask peers for referrals, as many small and medium-sized enterprises rely on industry contacts for business recommendations.

Request and Compare Proposals

After identifying potential providers, ask for detailed proposals. These should outline their service offerings, pricing structure, and additional features (such as financial reporting or tax preparation assistance). Compare these proposals carefully to determine which provider best matches your specific needs.

Vet Your Options

Don’t base your decision solely on written proposals. Check references and online reviews to gauge the experiences of current and past clients. Look for patterns in feedback, particularly regarding reliability, accuracy, and communication.

Schedule consultations or demos with your top choices. This allows you to assess their communication style and technical capabilities firsthand. Ask about their onboarding process, typical response times, and how they handle financial emergencies.

Make Your Final Decision

Consider factors beyond price when making your final choice. The cheapest option isn’t always the best value. Weigh the potential long-term benefits of working with a more experienced or comprehensive provider against short-term cost savings.

Try to negotiate terms that work for your business. Many providers offer flexible contracts or trial periods. This can prove particularly beneficial if you’re new to outsourced bookkeeping.

The right bookkeeping partner can significantly impact your business’s financial health and growth potential. Take the time to make an informed decision that aligns with your long-term goals.

Final Thoughts

Selecting the right outsourced bookkeeping services impacts your business’s financial health and growth. You must evaluate potential providers based on industry expertise, service offerings, technology, security measures, pricing transparency, and communication. This evaluation sets the foundation for a successful partnership and supports your long-term business goals.

Outsourced bookkeeping services offer numerous advantages, including cost savings, increased efficiency, and access to expert knowledge. These benefits can significantly improve your financial management and decision-making processes. Advanced technology and real-time financial insights further enhance the value of these services.

At BFC Tax Accountants, we provide outsourced bookkeeping services tailored to meet the unique needs of businesses in Barrie, Ontario and beyond. We offer comprehensive accounting and tax services (leveraging cloud-based technology). Take the first step towards streamlined operations by exploring outsourced bookkeeping options today.