At BFC Tax Accountants, we understand the importance of maximizing your tax benefits. The Basic Personal Amount is a crucial tax credit that can significantly reduce your tax burden.

This guide will walk you through the process of claiming the Personal Tax Credit Return Basic Personal Amount on your tax return. We’ll cover eligibility criteria, recent changes, and step-by-step instructions to help you make the most of this valuable tax benefit.

What Is the Basic Personal Amount?

Definition and Purpose

The Basic Personal Amount (BPA) is a non-refundable tax credit that reduces the amount of income tax you owe to the Canadian government. It allows Canadians to earn a minimum level of income before paying federal income tax. The BPA effectively makes a portion of your income tax-free at the federal level.

How the BPA Functions

For the 2024 tax year, the federal BPA is $15,705. This means the first $15,705 of your income is not subject to federal income tax. However, provincial BPAs may differ. It’s important to check current rates for your province of residence.

Recent Changes to the BPA

The federal government has implemented a gradual increase in the BPA. This increase is part of a broader plan to boost the BPA for eligible individuals.

Income-Based Reductions

The BPA is income dependent. It provides a partial reduction to taxpayers with taxable income above the BPA.

Provincial Variations

Each province has its own BPA, which may differ from the federal amount. These provincial amounts can significantly impact your overall tax savings when combined with the federal BPA.

The BPA is a valuable tool for reducing your tax burden, but its application can be complex. As we move into the next section, we’ll explore who is eligible to claim this important tax credit and how income levels affect the amount you can claim.

Who Can Claim the Basic Personal Amount?

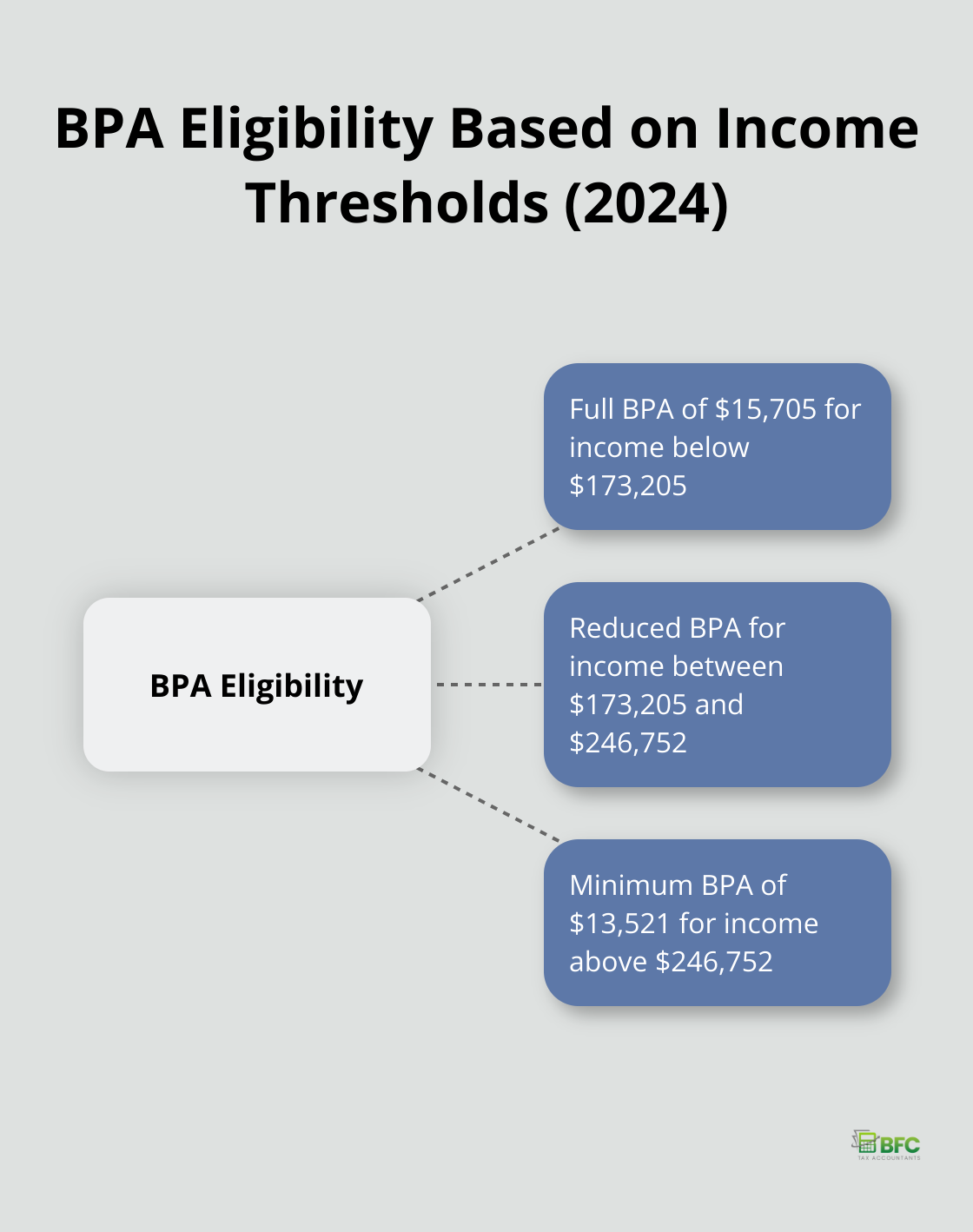

Income Thresholds and BPA Amounts

The Basic Personal Amount (BPA) is a valuable tax credit, but eligibility varies based on income and residency status. For the 2024 tax year, the maximum federal BPA stands at $15,705. However, this full amount applies only to individuals with net income below $173,205.

Income exceeding this threshold results in a gradual decrease of the BPA. For those earning between $173,205 and $246,752, the BPA reduction follows a sliding scale. Once income surpasses $246,752, eligibility drops to the minimum BPA of $13,521.

Residency Requirements

To claim the federal BPA, you must qualify as a Canadian resident for tax purposes. This typically requires significant residential ties to Canada, such as a home, spouse, or dependents in the country.

If your residency status changed during the tax year (either becoming a resident or ceasing to be one), you may qualify for a prorated BPA. The amount correlates to the number of days you held Canadian residency.

Non-Resident Considerations

Different rules apply to non-residents working in Canada. If you earned employment income or operated a business in Canada, you might qualify for a prorated BPA. The amount depends on the ratio of your Canadian-source income to your total world income.

For non-resident tax credits, inclusion of at least 90% of your world income in your Canadian tax return is necessary to qualify for the BPA.

Provincial Variations

Each province sets its own BPA, which may differ from the federal amount. These provincial amounts can significantly impact your overall tax savings when combined with the federal BPA. It’s essential to check the specific requirements for your province of residence to maximize your tax benefits.

Special Cases and Exceptions

Certain situations may affect your BPA claim. For instance, if you’re claiming a spouse or common-law partner amount, your BPA might be adjusted. Similarly, if you’re a non-resident performing duties of an office or employment in Canada, special rules may apply.

The complexity of BPA claims often necessitates professional guidance. In the next section, we’ll outline the steps to claim your Basic Personal Amount on your tax return, ensuring you don’t miss out on this valuable tax credit.

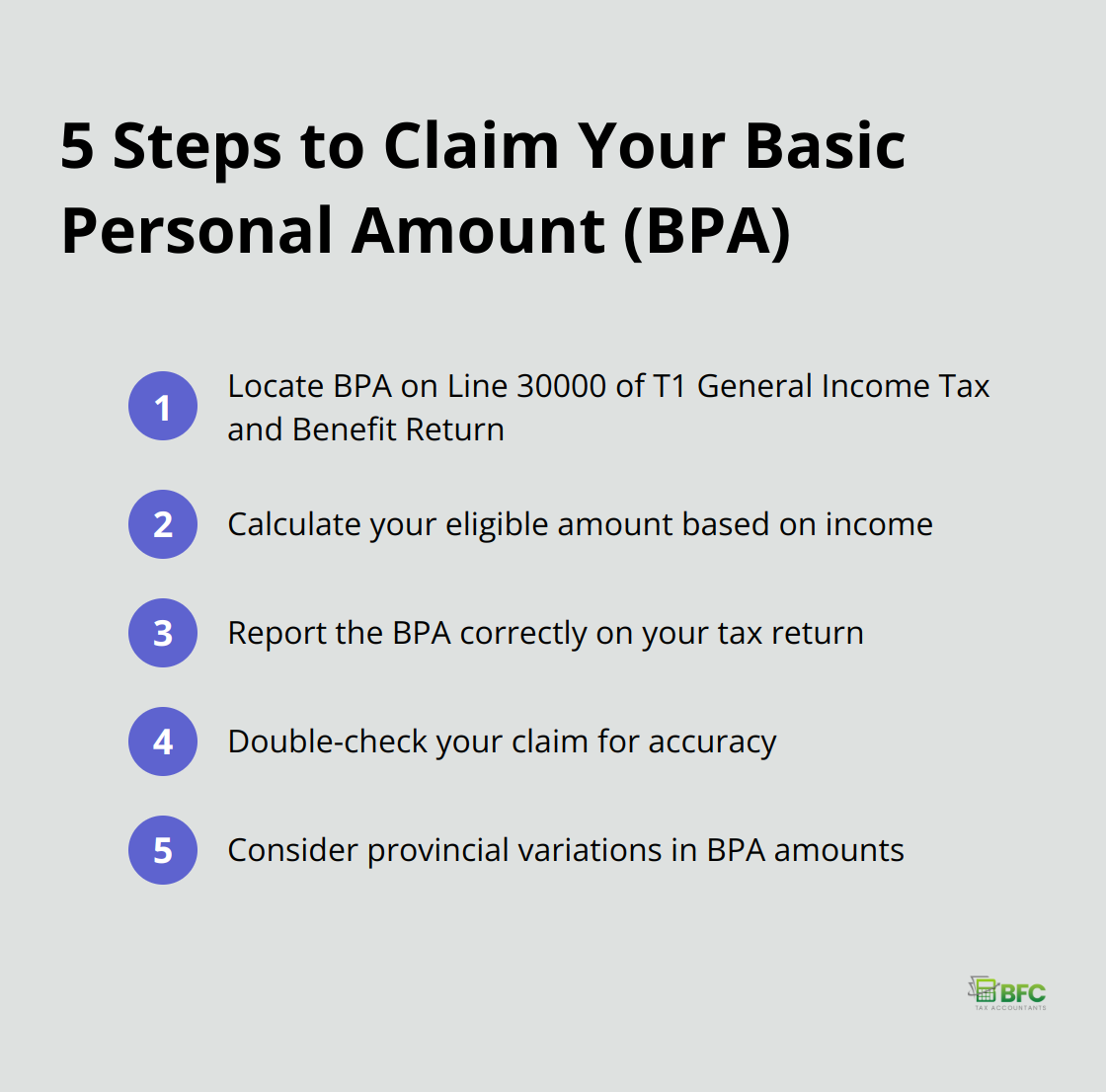

How to Claim Your Basic Personal Amount

Locating the BPA on Your Tax Form

The Basic Personal Amount (BPA) appears on Line 30000 of your T1 General Income Tax and Benefit Return. You’ll find this line in the “Federal Tax” section. Tax software usually calculates and inputs this amount automatically, but it’s wise to verify it yourself.

Calculating Your Eligible Amount

For the 2024 tax year, the maximum federal BPA is $15,705. Your eligible amount depends on your income:

- Income below $173,205: Full BPA of $15,705

- Income between $173,205 and $246,752: Reduced BPA

- Income above $246,752: Minimum BPA of $13,521

To determine your specific amount, use this formula:

BPA = $15,705 – (Net Income – $173,205) x ($2,184 / $73,547)

(This calculation applies only to the federal BPA; provincial amounts may differ.)

Reporting the BPA Correctly

Enter your appropriate BPA on Line 30000 of your tax return. Tax software typically handles this calculation based on your income information. For paper returns, you must input this amount manually.

The BPA is a non-refundable tax credit, which means it can reduce your tax owing to zero but won’t result in a refund if it exceeds your tax liability.

Double-Checking Your Claim

Review your tax return thoroughly before submission. Errors in BPA claims can cause processing delays or trigger audits. If you’re uncertain about any aspect of claiming your BPA, consult a tax professional. They can help you maximize your benefits while ensuring compliance with tax laws.

Considering Provincial Variations

Each province sets its own BPA, which often differs from the federal amount. These provincial amounts can significantly impact your overall tax savings when combined with the federal BPA. Check the specific requirements for your province of residence to optimize your tax benefits.

Final Thoughts

The Personal Tax Credit Return Basic Personal Amount offers substantial savings for Canadian taxpayers across income brackets. You can reduce your tax burden and keep more of your hard-earned money when you understand and claim this credit correctly. Annual changes to BPA thresholds and amounts require your attention, as do accurate records of your income and residency status throughout the year.

Tax situations often present complexities unique to each individual. We recommend consulting with a tax professional for personalized advice tailored to your specific circumstances. They can help you navigate the intricacies of the tax system and ensure you make the most of all available credits and deductions.

At BFC Tax Accountants, we provide expert tax services to individuals and businesses in Barrie, Ontario. Our experienced accountants can guide you through claiming your Basic Personal Amount and other tax credits (ensuring compliance with Canadian tax laws while maximizing your savings). From personal tax planning to business tax solutions, we simplify your financial management and help you focus on growth.