The Canada Tax Basic Personal Amount is a crucial tax credit that can significantly reduce your taxable income. At BFC Tax Accountants, we often see clients missing out on this valuable deduction.

Understanding how to claim this credit correctly can lead to substantial savings on your tax bill. This guide will walk you through the process, ensuring you maximize your benefits and avoid common pitfalls.

What Is the Basic Personal Amount?

Definition and Purpose

The Basic Personal Amount (BPA) is a non-refundable tax credit that reduces the amount of income tax you owe to the Canadian government. The purpose of the BPA is to provide a full reduction from federal income tax to all individuals with taxable income below the BPA. It also provides essential tax relief on basic income.

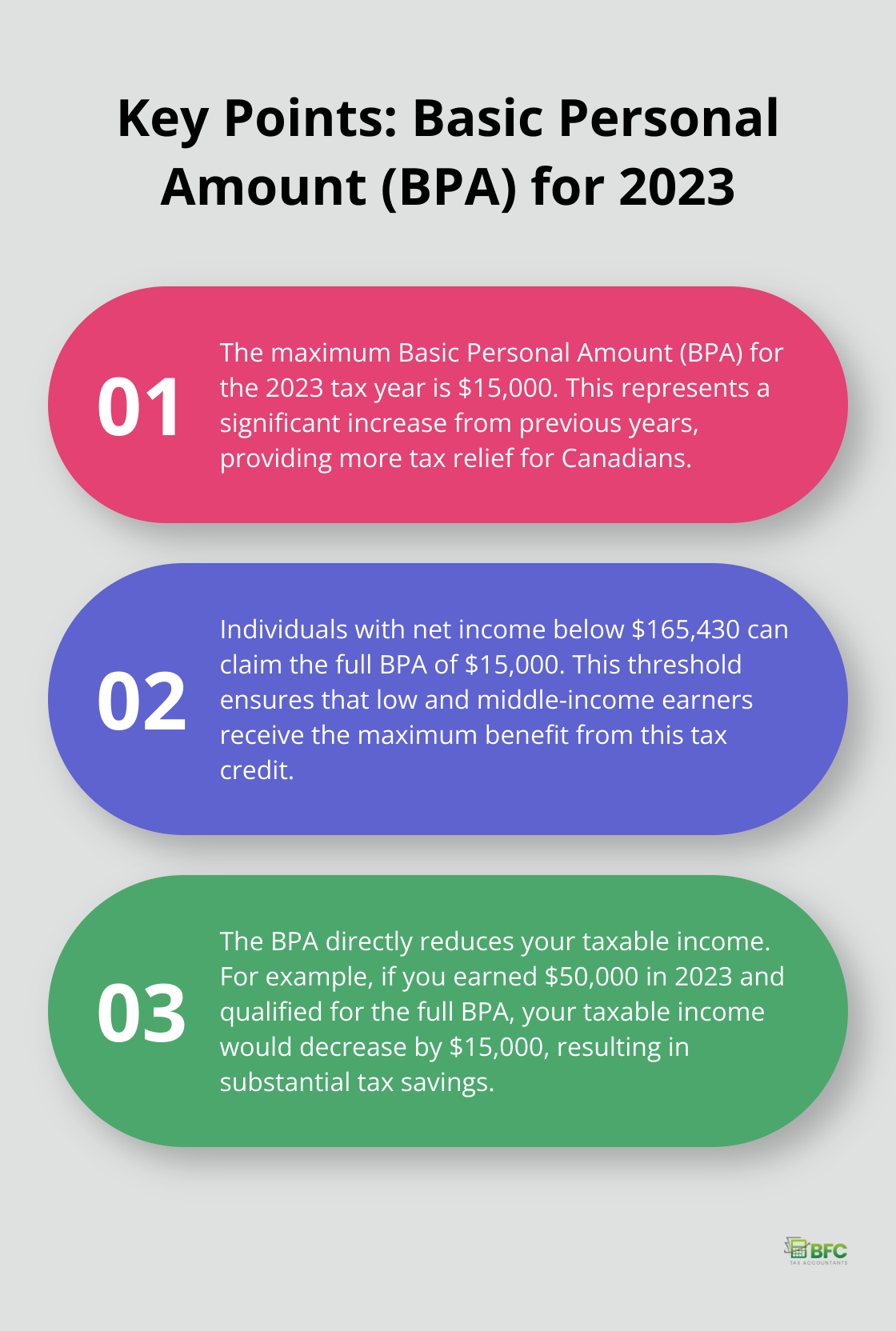

Recent Changes to the BPA

The Canadian government introduced significant changes to the BPA in 2020. The amount has increased gradually and will reach $15,000 by 2023. This increase translates to more money in your pocket, particularly for low and middle-income earners.

Impact on Your Taxes

The BPA directly reduces your taxable income. For instance, if you earned $50,000 in a given year and qualified for the full BPA, your taxable income would decrease accordingly. This reduction can result in substantial tax savings.

It’s important to note that the BPA is income-tested. High-income earners may face a reduction in their BPA.

Maximizing Your BPA Benefit

To optimize your BPA, you must accurately report your income and understand how it affects your eligibility. If your income approaches the threshold where the BPA starts to decrease, strategic tax planning can help you maximize your benefit.

Consider this example: contributing to an RRSP could lower your taxable income enough to qualify for a higher BPA. This strategy not only reduces your current year’s taxes but also builds your retirement savings.

The next section will explore who can claim the BPA and the specific eligibility criteria you need to meet. Understanding these details will help you make the most of this valuable tax credit and potentially increase your tax savings.

Who Qualifies for the Basic Personal Amount?

Canadian Residents and the BPA

Most Canadian residents qualify for the Basic Personal Amount (BPA). For the 2023 tax year, the maximum BPA stands at $15,000. Individuals with net income below $165,430 can claim this full amount. As income increases beyond this threshold, the BPA decreases.

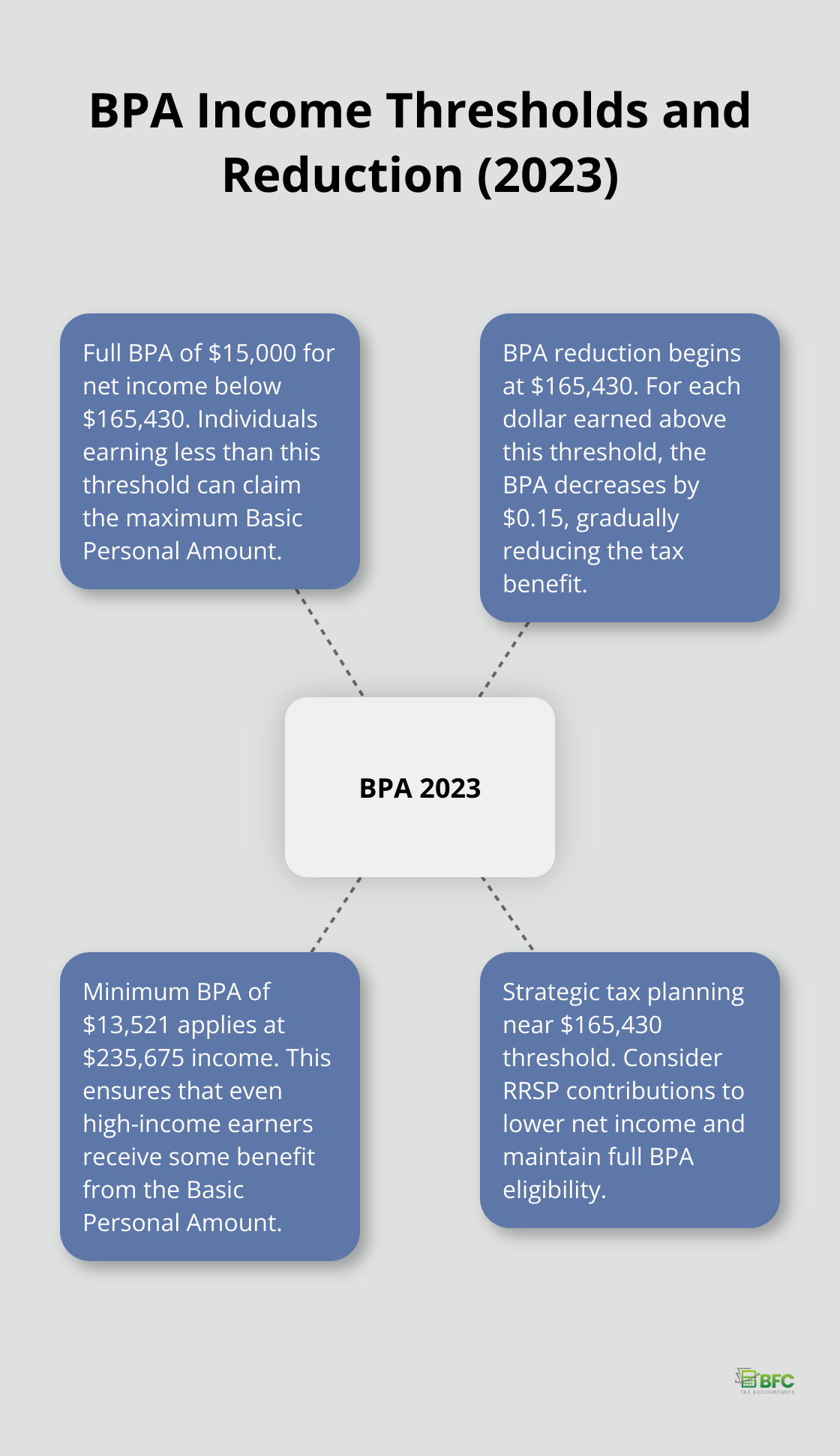

Income Thresholds and BPA Reduction

The BPA reduction begins when net income exceeds $165,430. For each dollar earned above this threshold, the BPA decreases by $0.15. This reduction continues until income reaches $235,675, at which point the minimum BPA of $13,521 applies.

Strategic Tax Planning

Tax planning becomes essential for those near the $165,430 threshold. Contributing to an RRSP could lower net income enough to maintain the full BPA. This strategy not only reduces current year taxes but also builds retirement savings.

Non-Resident Considerations

Non-residents face additional requirements when claiming the BPA. They must earn 90% or more of their world income in Canada to qualify. This rule ensures the BPA primarily benefits those who contribute to the Canadian economy.

Part-Year Residents

For part-year residents, the BPA is prorated based on the number of days of Canadian residency during the tax year. This calculation can prove complex and often requires professional assistance.

Understanding these nuances proves vital for maximizing tax benefits. The next section will provide a step-by-step guide on how to claim the BPA on your tax return, ensuring you don’t miss out on this valuable tax credit.

How to Claim Your Basic Personal Amount

Preparing Your Tax Return

To claim your Basic Personal Amount (BPA), you must first gather all relevant income documents. These include T4 slips from employers, T5 slips for investment income, and any other income statements. These documents help determine your total income, which affects your BPA eligibility.

Calculate your net income next. This figure determines whether you qualify for the full BPA or a reduced amount. For the 2023 tax year, the income threshold starts at $165,430.

Claiming the BPA on Your Return

The BPA is automatically calculated and applied when you file your taxes using tax software or through a professional service. If you file a paper return, enter the appropriate amount on line 30000 of your T1 General form.

Most Canadians earning under $165,430 claim the full BPA of $15,705 for the 2023 tax year. If your income exceeds this threshold, calculate your reduced BPA using the formula provided by the Canada Revenue Agency (CRA).

Avoiding Common Mistakes

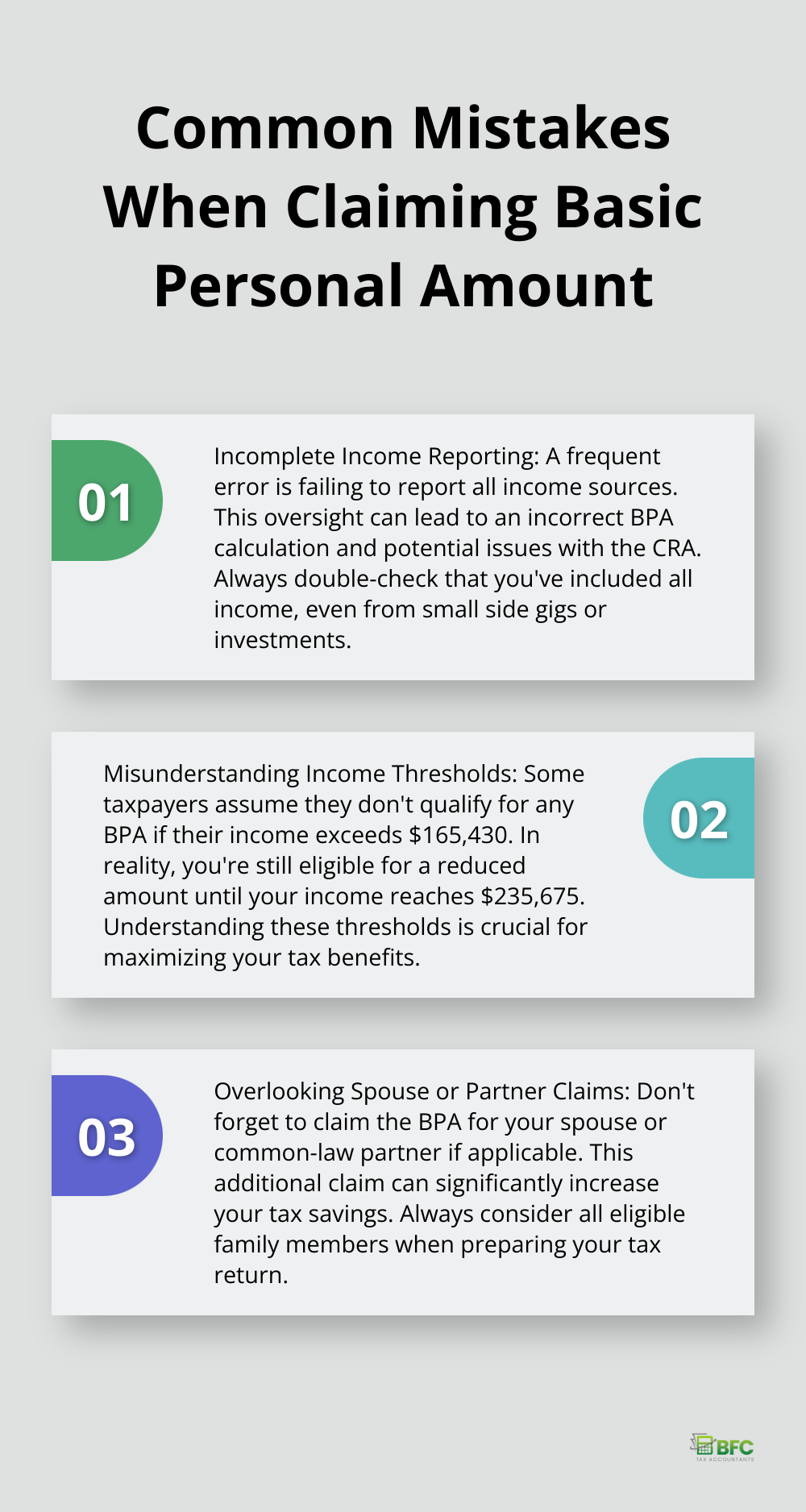

Incomplete Income Reporting

A frequent error is the failure to report all income sources. This oversight can lead to an incorrect BPA calculation and potential issues with the CRA. Double-check that you’ve included all income (even from small side gigs or investments).

Misunderstanding Income Thresholds

Some taxpayers assume they don’t qualify for any BPA if their income exceeds $165,430. In reality, you’re still eligible for a reduced amount until your income reaches $235,675.

Overlooking Spouse or Partner Claims

Don’t forget to claim the BPA for your spouse or common-law partner if applicable. This additional claim can significantly increase your tax savings.

Seeking Professional Assistance

If you’re unsure about any aspect of claiming your BPA, consult with a tax professional. They can help you navigate the complexities of the Canadian tax system and optimize your returns.

Final Thoughts

The Canada Tax Basic Personal Amount provides significant tax savings for Canadian residents. This non-refundable tax credit reduces taxable income, allowing you to keep more of your hard-earned money. You must stay informed about current thresholds and amounts to maximize your benefit.

Accurate record-keeping of all income sources ensures proper calculation of your Basic Personal Amount. Strategic tax planning, such as RRSP contributions, can help you qualify for a higher amount. Don’t forget to claim the Basic Personal Amount for your spouse or common-law partner if applicable.

Professional assistance can simplify the complexities of tax laws and maximize your benefits. BFC Tax Accountants specializes in personal and business tax planning and preparation (including the Canada Tax Basic Personal Amount). Our team in Barrie, Ontario, offers comprehensive accounting services tailored to your unique needs.