At Kyei Baffour, we know that navigating personal tax credits can be complex, especially for couples.

Understanding how to claim the personal tax credit basic and spouse amounts can significantly reduce your tax burden.

This guide will walk you through the process of maximizing your tax credits as a couple, helping you keep more money in your pocket.

What Are Personal Tax Credits?

Personal tax credits are powerful tools in the Canadian tax system that can significantly reduce your tax bill. Many taxpayers underutilize these credits, leaving money on the table.

How Personal Tax Credits Work

Personal tax credits directly reduce the amount of tax you owe, dollar for dollar. If you have $1,000 in tax credits and owe $5,000 in taxes, your tax bill drops to $4,000. This makes tax credits more valuable than deductions, which only reduce your taxable income.

Types of Personal Tax Credits

Canada offers a wide array of personal tax credits. Some common ones include:

Basic Personal Amount

Every Canadian resident can claim this non-refundable credit, which is increasing gradually to reach $15,000 by 2023 for most taxpayers.

Age Amount

If you’re 65 or older, you may qualify for an additional credit of up to $7,898 (2023), depending on your income.

Disability Tax Credit

This can provide substantial tax relief for those with severe and prolonged physical or mental impairments.

Medical Expenses

You can claim a credit for eligible medical expenses that exceed the lesser of $2,635 or 3% of your net income.

Maximizing Your Tax Credits

To get the most out of personal tax credits, keep detailed records of all potentially eligible expenses throughout the year. Many Canadians miss out on credits simply because they don’t track their expenses properly.

Tax professionals specialize in identifying all the tax credits you’re eligible for, ensuring you don’t miss any opportunities to reduce your tax burden. Their expertise in Canadian tax law allows them to maximize your benefits while maintaining full compliance.

The next chapter will explore specific strategies for couples to optimize their tax credits and potentially increase their combined tax savings.

Which Tax Credits Can Couples Claim Together?

The Basic Personal Amount: A Universal Credit

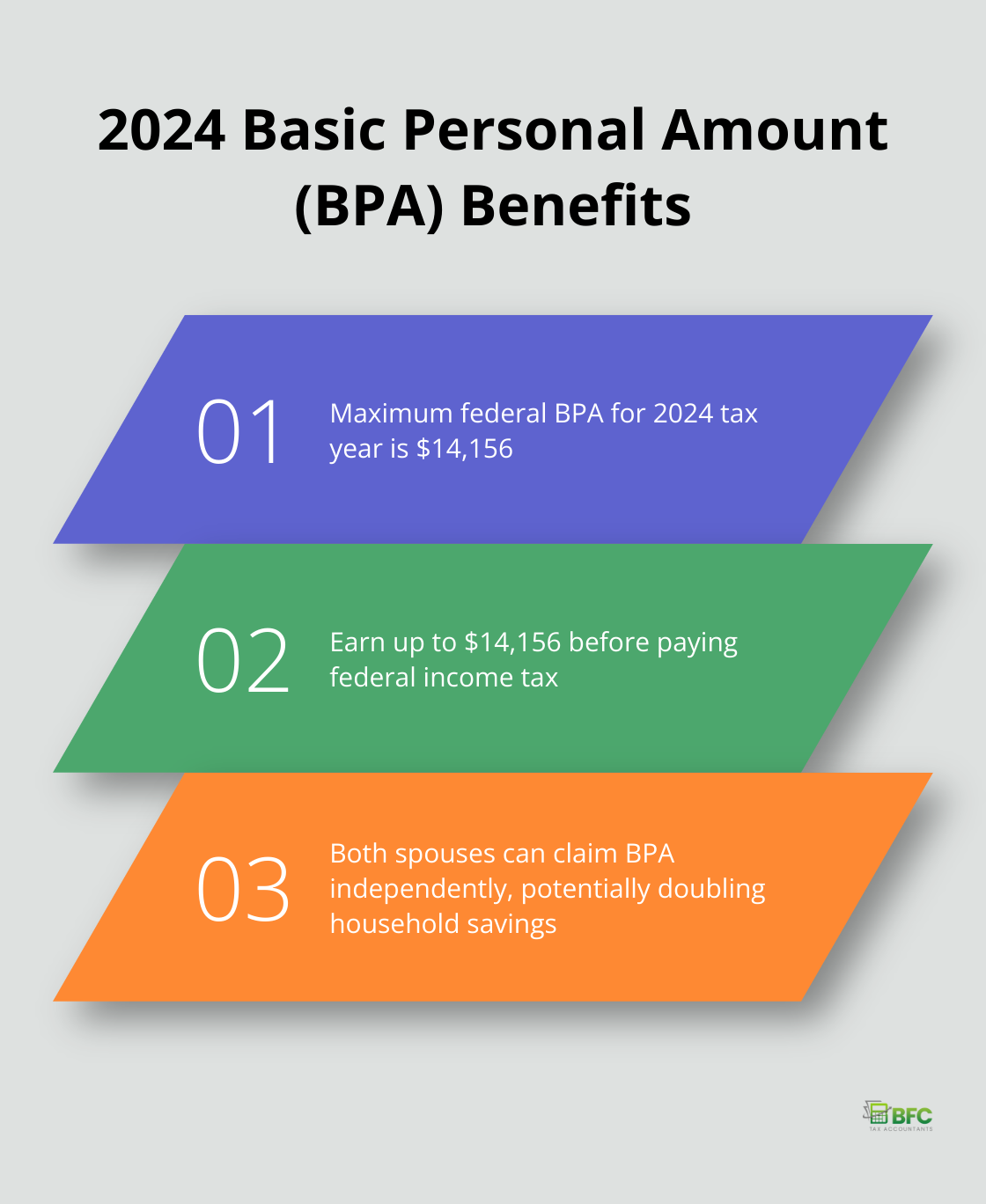

The Basic Personal Amount (BPA) stands as a non-refundable tax credit available to all Canadian residents. For the 2024 tax year, the maximum federal BPA reaches $14,156 for most taxpayers. This allows you to earn up to $14,156 before paying federal income tax. Both you and your spouse can claim this credit independently, which potentially doubles your household savings.

Maximizing the Spouse or Common-Law Partner Amount

If your spouse or common-law partner earns less than the BPA threshold, you might qualify to claim an additional credit. The maximum claim equals the BPA, but it reduces dollar-for-dollar based on your partner’s net income. This credit proves particularly beneficial if one partner has a significantly lower income or stays home to care for children.

Age Amount: A Boost for Seniors

For couples where one or both partners are 65 or older, the Age Amount provides substantial tax relief. However, this amount starts to decrease when individual net income exceeds a certain threshold and phases out completely at a higher income level. Couples should strategize to optimize this credit, especially if one partner’s income approaches the threshold.

Leveraging the Disability Tax Credit

The Disability Tax Credit (DTC) serves as a powerful tool for eligible individuals and their supporting family members. Approved applicants who are 18 years and older may claim the base disability amount. If you or your spouse has a severe and prolonged physical or mental impairment, this credit deserves your attention. The application process requires certification by a medical practitioner, so start early to ensure you don’t miss out.

Optimizing Medical Expense Claims

Medical expenses can accumulate quickly, but they also offer significant tax-saving opportunities. You can claim a credit for eligible expenses that exceed a certain percentage of the lower-income spouse’s net income. A smart strategy involves having the lower-income spouse claim all family medical expenses to maximize the credit. Keep meticulous records of all health-related costs, including prescriptions, dental work, and even travel expenses for medical treatments.

These credits can significantly reduce your tax burden as a couple. However, the key to maximizing your tax savings lies in understanding how these credits interact and planning your claims strategically. While online resources provide general guidance, the nuances of your specific situation often require professional insight to fully optimize your tax position. The next section will explore advanced strategies for couples to further enhance their tax savings through credit transfers and income splitting.

To apply for these tax credits and benefits, you need to file your tax return online or by paper. Understanding the income tax brackets and rates is crucial for effective tax planning.

How Couples Can Maximize Their Tax Credits

Transfer Credits Between Spouses

Couples often miss out on significant tax savings by not fully leveraging their combined tax credits. One of the most effective strategies involves transferring unused tax credits. If one spouse has a lower income and can’t use all their non-refundable tax credits, they can transfer the unused portion to their partner. This proves particularly useful for credits like the age amount, pension income amount, and disability amount.

For instance, if your spouse has $1,000 in unused disability tax credits, transferring this to you could result in substantial tax savings (especially if you’re in a higher tax bracket).

Split Pension Income

Retired couples can achieve significant tax savings through pension income splitting. You can allocate up to 50% of your eligible pension income to your spouse. This strategy works best when there’s a considerable income disparity between partners.

Couples who split their pension income saved an average of $1,000 in taxes in 2022 (according to Statistics Canada). However, the exact savings depend on your specific situation, so it’s important to calculate the numbers or consult with a tax professional.

Optimize Charitable Donations

Charitable donations offer excellent tax benefits, but how you claim them as a couple matters. In Canada, you receive a 15% credit on the first $200 of donations and a 29% credit on amounts over $200.

To maximize this benefit, pool your donations on one tax return. For example, if you and your spouse each donated $200, claiming $400 on one return would result in a higher credit than claiming $200 on each return separately.

Claim Eligible Dependents Strategically

If you have children or other eligible dependents, plan who claims them. The spouse with the higher income should typically claim the eligible dependent credit, as it’s a non-refundable credit that reduces taxes payable.

For children under 18, the Canada Child Benefit (CCB) provides tax-free monthly payments. While this isn’t a tax credit per se, it’s important to ensure both partners report their income accurately, as the CCB is income-tested.

Leverage Home Buyers’ Plan Together

For couples planning to buy their first home, the Home Buyers’ Plan (HBP) allows each of you to withdraw up to $60,000 from your RRSPs tax-free. That’s a combined $120,000 you can put towards your home purchase without immediate tax implications.

Final Thoughts

Personal tax credits in Canada offer substantial opportunities to reduce your tax burden. The personal tax credit basic and spouse amounts form the foundation of many Canadians’ tax strategies. Proper documentation ensures you don’t miss out on valuable deductions, simplifies the tax filing process, and provides crucial evidence in case of an audit.

Online resources offer general guidance, but individual tax situations often require professional expertise to fully optimize. Working with a professional tax accountant can unlock hidden savings and ensure compliance with ever-changing tax laws. BFC Tax Accountants specializes in identifying eligible tax credits and developing strategies to maximize your benefits.

Tax planning should occur throughout the year, not just during tax season. Regular consultations with tax professionals help you adapt to changes in your personal circumstances and evolving tax legislation. This proactive approach allows you to make the most of available tax credits, keeping more money in your pocket and securing a stronger financial future for you and your spouse.