Personal tax credits in Ontario can significantly reduce your tax burden. At BFC Tax Accountants, we understand the importance of maximizing these credits to keep more money in your pocket.

This guide will walk you through the process of claiming personal tax credits in Ontario, helping you navigate both federal and provincial options available to residents.

What Are Personal Tax Credits?

The Basics of Personal Tax Credits

Personal tax credits are powerful tools that reduce your tax bill in Ontario. These credits directly lower the amount of tax you owe, dollar for dollar. Unlike deductions (which lower your taxable income), tax credits subtract from your tax liability after it’s calculated. This makes them particularly valuable for taxpayers.

For example, if you owe $5,000 in taxes and qualify for a $1,000 tax credit, your tax bill drops to $4,000. It’s a straightforward way to keep more money in your pocket.

Federal vs. Provincial Tax Credits

In Ontario, you can benefit from both federal and provincial tax credits. Federal credits apply to your federal tax bill, while provincial credits reduce your Ontario tax liability.

Some common federal credits include:

- The Basic Personal Amount

- The Canada Employment Amount (for those with employment income)

On the provincial side, Ontario offers credits like the Ontario Energy and Property Tax Credit for eligible residents.

Non-Refundable vs. Refundable Credits

It’s important to understand the difference between non-refundable and refundable tax credits:

- Non-refundable credits: These can only reduce your tax liability to zero. Any excess credit amount is lost.

- Refundable credits: These can result in a tax refund even if you don’t owe any taxes.

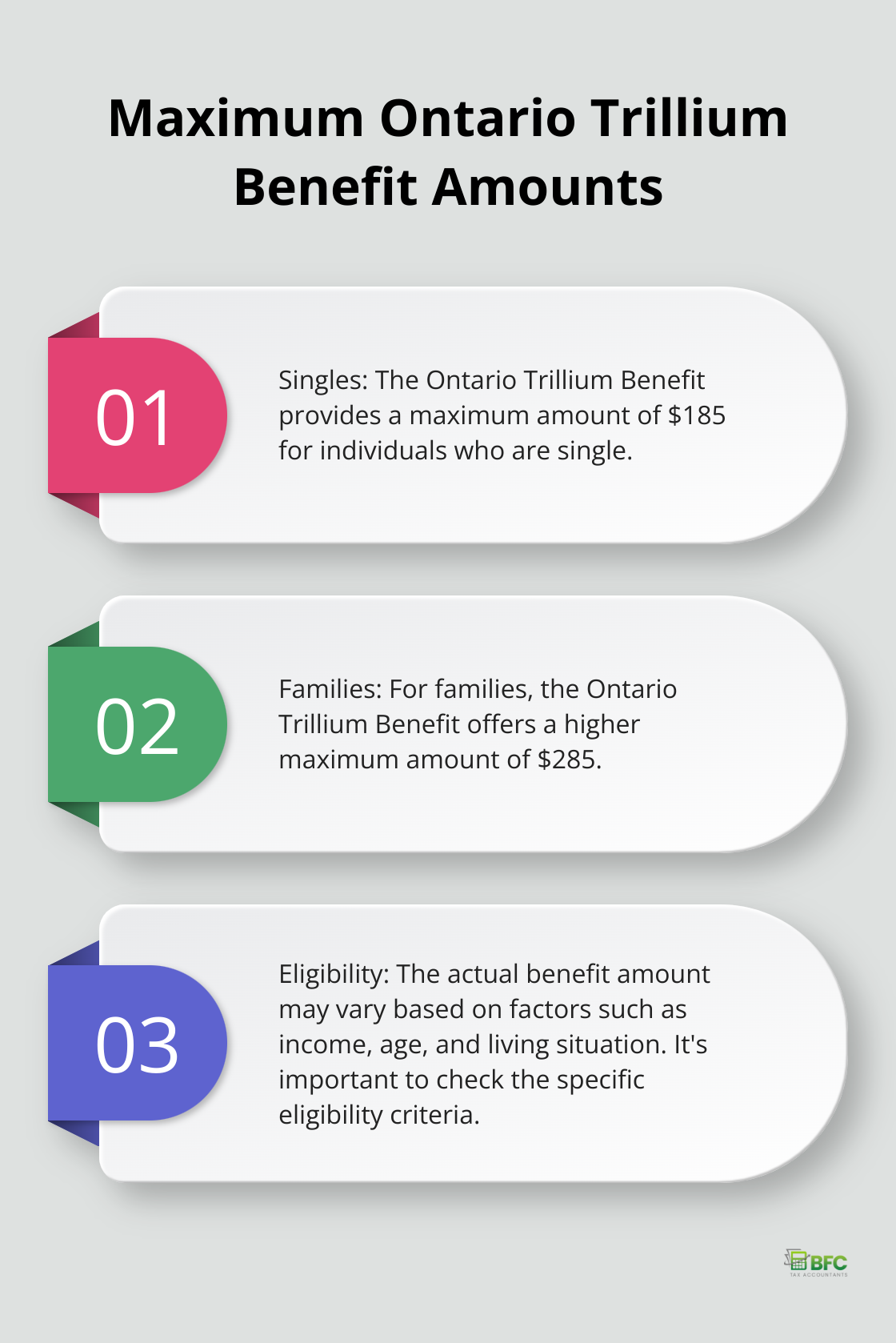

The Ontario Trillium Benefit is an example of a refundable credit that can put money back in your pocket, even if you have no tax liability. If you’re single, you could receive a maximum of $185. Families could receive a maximum of $285.

Maximizing Your Tax Credits

Understanding these distinctions can help you maximize your tax savings and potentially increase your refund. Tax professionals specialize in identifying all applicable credits to ensure their clients in Barrie and across Ontario optimize their tax returns.

To make the most of your tax credits, try to:

- Stay informed about changes in tax laws

- Keep detailed records of expenses that might qualify for credits

- Consult with a tax professional to ensure you don’t miss any opportunities

Now that we’ve covered the basics of personal tax credits, let’s explore some of the most common credits available to Ontario residents.

Which Tax Credits Can You Claim in Ontario?

Ontario residents have access to several valuable tax credits that can significantly reduce their tax burden. Let’s explore some of the most impactful credits available to you.

The Basic Personal Amount: Your First Line of Defence

The Basic Personal Amount (BPA) is a non-refundable tax credit that every taxpayer can claim. For Ontario residents, the amount you can claim is the lesser of the amount on line 31400 of your return or $1,714.

Offsetting Work-Related Expenses

If you’re employed, you can claim the Canada Employment Amount. This non-refundable credit helps cover work-related expenses. For the 2024 tax year, you can claim up to $1,368. While this might seem small, it’s an easy way to reduce your tax bill without keeping receipts.

Medical Expenses: Don’t Leave Money on the Table

The Medical Expenses Tax Credit can provide significant relief if you’ve had substantial health-related costs. You can claim eligible medical expenses paid in any 12-month period ending in 2024 and not claimed by you or anyone else in 2023. This includes a wide range of expenses (from prescription medications to dental work). Keep all your receipts and don’t forget about often-overlooked items like travel expenses for medical treatment.

Charitable Donations: A Win-Win Situation

The Charitable Donations Tax Credit rewards your generosity. For donations up to $200, you’ll receive a 15% federal credit. For amounts over $200, the credit jumps to 29% (or 33% for high-income earners). Ontario adds its own credit on top of this. To maximize this credit, consider bundling several years of donations into a single tax year.

Age Amount: A Bonus for Seniors

If you’re 65 or older, you might qualify for the Age Amount. This non-refundable credit can be up to $7,898 for 2024, but it’s income-tested. The credit starts to reduce when your net income exceeds $42,335 and is completely phased out at $98,309. If you don’t need the full amount, you can transfer the unused portion to your spouse.

Now that we’ve covered some of the most common tax credits, let’s move on to how you can claim these credits effectively and maximize your tax savings.

How to Claim Your Tax Credits

Gather Your Documentation

Start by collecting all necessary documents. This includes T4 slips from employers, T5 slips for investment income, and receipts for medical expenses, charitable donations, and other eligible expenses. The Canada Revenue Agency (CRA) recommends keeping these records for at least six years.

Track all eligible medical costs throughout the year. This includes prescription medications, dental work, and travel expenses for medical treatment. Don’t overlook less obvious expenses (like gluten-free food for celiac disease patients or air purifiers for severe allergies).

Choose Your Filing Method

You have several options for filing your tax return. While paper filing is still available, electronic filing is faster and more efficient. The CRA’s NETFILE service allows you to file directly from your computer using certified tax software.

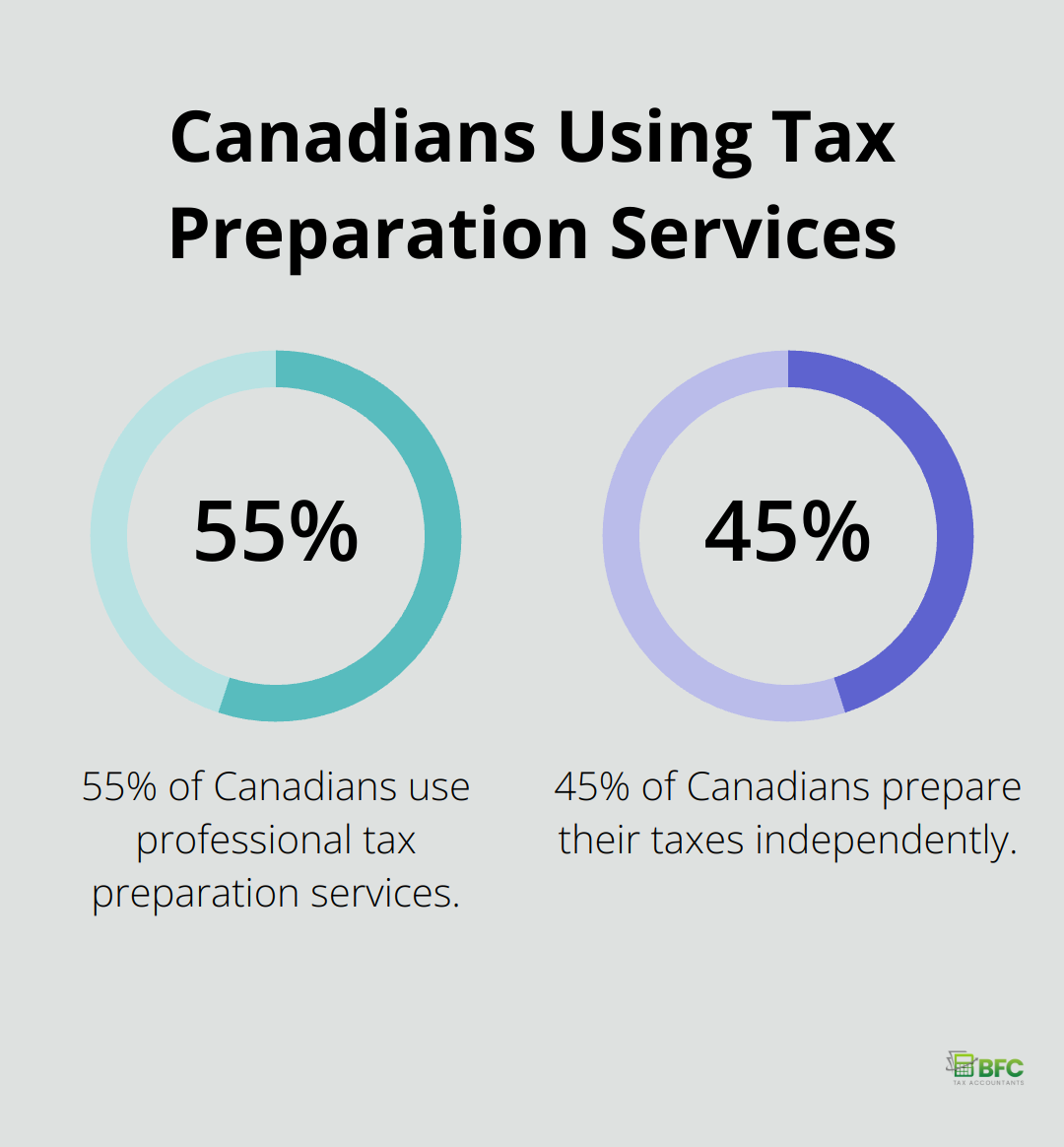

If your tax situation is complex, consider using a professional tax service. According to Statistics Canada, about 55% of Canadians use tax preparation services. These professionals stay up-to-date with the latest tax laws and can identify credits you might miss on your own.

File Accurately and On Time

Accuracy is essential when claiming tax credits. Double-check all entries on your tax return before submitting. Common errors include incorrect social insurance numbers, math mistakes, and forgetting to sign forms.

File your return by the deadline (typically April 30th for most individuals). Late filing can result in penalties and interest charges. If you owe taxes, pay by the deadline even if you can’t file on time to avoid additional charges.

Prepare for Potential Audits

The CRA conducts random audits to ensure compliance. While only about 1% of personal tax returns are audited each year, it’s important to be prepared. Keep detailed records of all claimed expenses and credits. Organize receipts by category and year for easy access if needed.

If you claim home office expenses, maintain a clear separation between personal and business use of your space. Take photos of your home office setup as additional documentation.

Understanding and properly claiming your eligible credits is a significant step towards financial stability and growth. It’s not just about reducing your tax bill this year, but about long-term financial planning.

Final Thoughts

Personal tax credits in Ontario offer substantial opportunities to reduce your tax burden. These credits range from the Basic Personal Amount to the Charitable Donations Tax Credit, each providing a chance to keep more money in your pocket. Tax laws and credits change frequently, so you must stay informed to identify new savings opportunities and avoid potential pitfalls.

BFC Tax Accountants specializes in maximizing tax savings for individuals and businesses in Barrie and across Ontario. Our team of experts stays current with the latest tax legislation changes, ensuring you claim all credits you’re entitled to. We offer personalized tax planning strategies, meticulous return preparation, and year-round support to help you navigate the tax system’s complexities.

Claiming personal tax credits in Ontario isn’t just about reducing your tax bill for one year. It’s about long-term financial planning and making the most of every opportunity to improve your financial situation. Professional guidance can make a significant difference, whether you’re dealing with basic credits or more complex situations involving medical expenses or charitable donations.