Completing your personal tax return form can be a daunting task, but it doesn’t have to be. At BFC Tax Accountants, we’ve seen countless clients struggle with this annual obligation.

This guide will walk you through the process step-by-step, helping you navigate the complexities of tax filing with confidence and ease.

What Documents Do You Need for Your Tax Return?

Preparing for your tax return requires gathering the right documents. This step is essential for an accurate and efficient filing process. Proper preparation can save time and reduce stress for taxpayers.

Income Statements: The Foundation of Your Return

Income statements form the cornerstone of your tax return. These include:

- T4 slips from your employer

- T4A forms for pension, retirement, annuity, or other income

- T5 slips for investment income

Obtain all these documents before you start. The Canada Revenue Agency (CRA) typically mails these forms by the end of February, but many employers now provide them electronically. Check your online accounts or contact your employer if you haven’t received them by early March.

Investment Income: Report Every Penny

If you have investments, you must report all income earned. This includes:

- Interest from savings accounts

- Dividends from stocks

- Capital gains from selling investments

Look for T3 slips (for income from mutual funds) and T5008 slips (for securities transactions). Some financial institutions provide these forms online, so check your investment accounts.

Receipts for Deductions and Credits: Maximize Your Savings

Deductions and credits can significantly reduce your tax bill. Common deductions include:

- Charitable donations

- Medical expenses

- Child care costs

For 2023, charitable donations can provide a tax credit of up to 49% of the donated amount. Keep all relevant receipts organized throughout the year to streamline this process. Try using a digital filing system or a dedicated folder for tax-related documents.

Previous Year’s Tax Return: Your Reference Point

Your last year’s tax return serves as a valuable guide. It can remind you of credits or deductions you claimed previously and help ensure you don’t overlook anything this year. It also contains important information like your social insurance number and any carry-forward amounts (such as capital losses or unused RRSP contributions).

Organization is key to a smooth tax filing process. Create a system that works for you, whether it’s a physical file folder or a digital storage solution. With all these documents ready, you’ll tackle your tax return efficiently and effectively.

The next chapter will guide you through understanding the tax return form itself, breaking down its key components and helping you navigate its complexities with confidence.

What’s Inside the T1 General Form?

The Structure of the T1 General Form

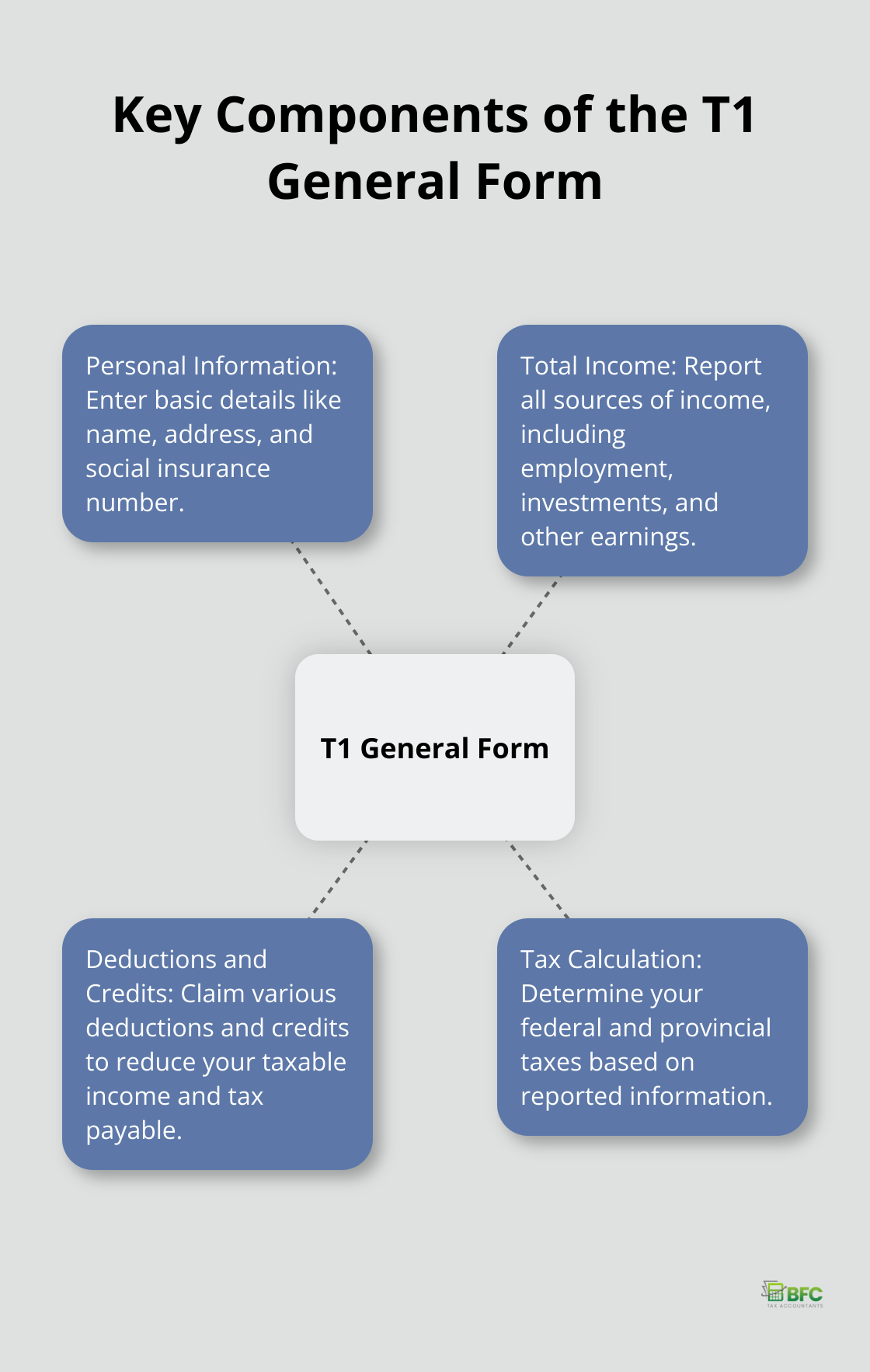

The T1 General form serves as the foundation of your personal tax return in Canada. This comprehensive document, issued by the Canada Revenue Agency (CRA), captures all aspects of your financial life for the tax year.

The form starts with a section for your basic personal information. You’ll need to provide your name, address, and social insurance number. This section also asks about your marital status and residence, which can affect your tax calculations.

Reporting Your Total Income

The next major section focuses on your total income. Here, you’ll report all sources of income, from employment earnings to investment returns. Line 15000 is a key line to watch, as it sums up your total income for the year.

Deductions and Tax Credits

After reporting your income, you’ll encounter the deductions section. This part allows you to reduce your taxable income through various claims. Common deductions include:

- RRSP contributions

- Union dues

- Moving expenses

The tax credits section follows the deductions. Here, you can claim amounts that directly reduce your tax payable. These include:

- The basic personal amount ($13,808)

- Credits for charitable donations

- Credits for medical expenses

Calculating Your Tax

The final sections of the T1 form involve calculating your federal and provincial taxes. This is where all your reported information comes together to determine whether you owe additional tax or are due for a refund.

Understanding the structure of the T1 General form can significantly ease the filing process. However, if you find the form complex, seeking professional help can be beneficial. The next chapter will provide a step-by-step guide to filling out this form, helping you navigate each section with confidence.

How to Fill Out Your Tax Return Form

Start with Personal Information

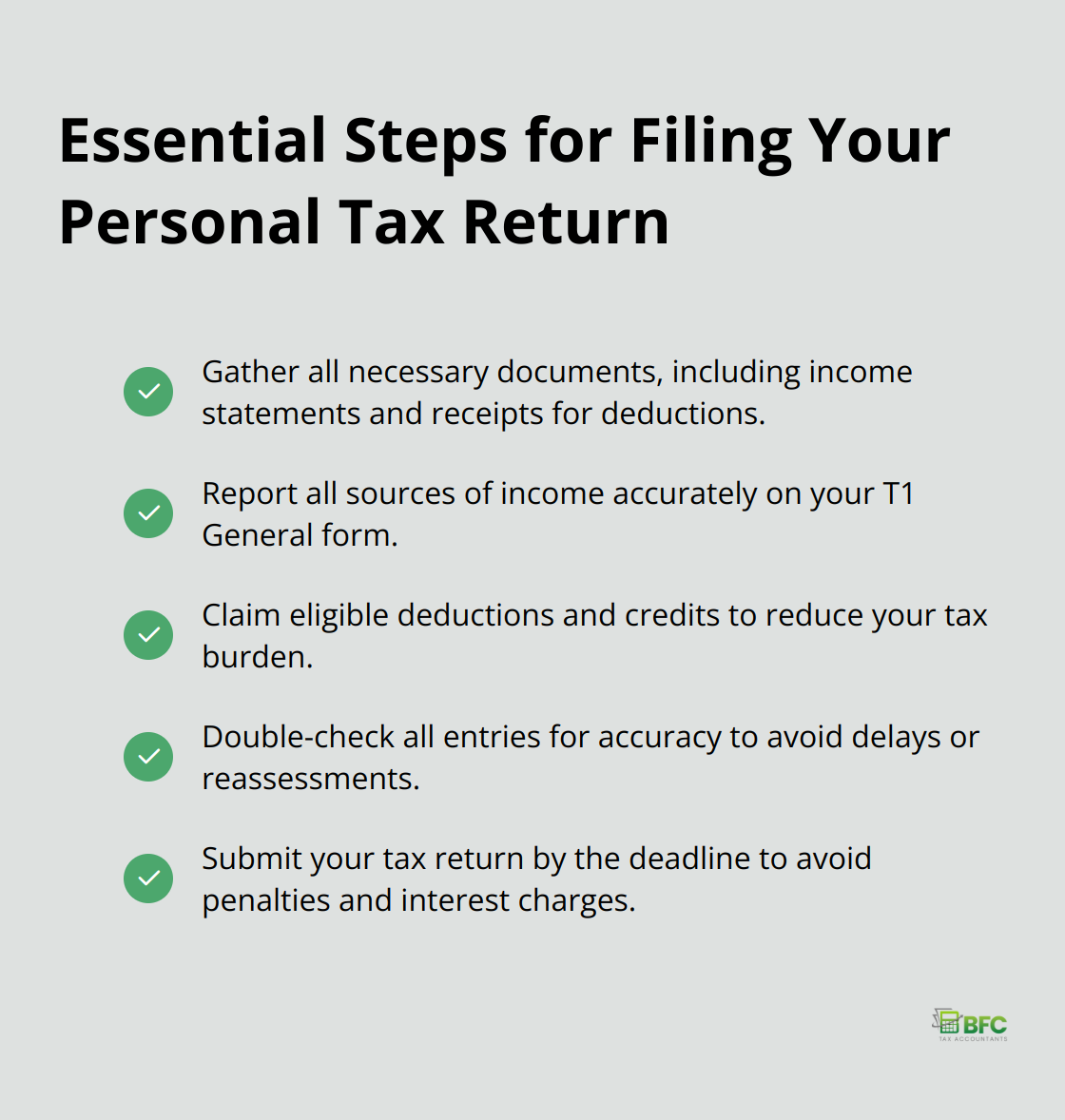

Begin your tax return by completing the identification section at the top of the form. Enter your name, address, social insurance number, and date of birth. Accuracy is essential here – even a small error could delay the processing of your return. Double-check your social insurance number, as this is the primary identifier for your tax file.

Report All Income Sources

Move on to the income section next. Report all money you’ve earned throughout the year. The Canada Revenue Agency (CRA) receives copies of most income slips, so thoroughness is key to avoid reassessments.

Enter your employment income (typically the largest source for most Canadians) from box 14 of your T4 slip on line 10100. If you have multiple T4s, add them together. Include other income sources such as:

- Self-employment earnings (line 13500)

- Investment income (line 12100)

- Capital gains (line 12700)

Claim Deductions and Credits

After reporting income, reduce your tax burden through deductions and credits. Common deductions include RRSP contributions (line 20800) and moving expenses (line 21900). These directly lower your taxable income.

Tax credits reduce the amount of tax you owe. The basic personal amount (line 30000) is available to all taxpayers. Other popular credits include:

- Medical expense tax credit (line 33200)

- Charitable donation tax credit (line 34900)

Try to be strategic with your claims. For example, medical expenses must exceed 3% of your net income or $2,479 (whichever is less) to be eligible. It often makes sense to group these expenses in a single tax year to maximize the benefit.

Calculate Tax Owing or Refund

The final step determines whether you owe additional tax or are due for a refund. The form will guide you through this calculation, factoring in the tax you’ve already paid through payroll deductions.

If you owe a significant amount, consider adjusting your payroll deductions for the coming year. This can help you avoid a large lump sum payment at tax time.

While this guide provides a general overview, tax situations can be complex. If you’re unsure about any aspect of your return, consult with a professional. BFC Tax Accountants specializes in navigating these complexities and ensures clients maximize their tax benefits while staying compliant with Canadian tax laws.

Final Thoughts

Completing your personal tax return form requires attention to detail and a thorough understanding of the process. Accuracy and timeliness are essential when filing your taxes to avoid delays, potential audits, or missed opportunities for deductions and credits. Submitting your return by the deadline helps you avoid late filing penalties and interest charges.

Many Canadians file their taxes independently, but the complexities of tax law make professional assistance valuable. BFC Tax Accountants specializes in personal tax return preparation, offering expert guidance to maximize your tax benefits while ensuring compliance with Canadian tax regulations. Our team of experienced professionals can help you navigate complex tax situations and identify often-overlooked deductions.

We stay up-to-date with the latest tax laws and regulations (allowing us to offer tailored advice for your unique circumstances). Our comprehensive approach to tax planning and preparation goes beyond simply filling out forms. Your tax return is an opportunity to take control of your financial future, and approaching it with diligence will set you up for financial success in the years to come.