Filing corporate taxes in Canada can be a complex process for businesses of all sizes. At BFC Tax Accountants, we understand the challenges companies face when navigating the intricacies of corporate tax obligations.

This guide will walk you through the essential steps of filing corporate taxes in Canada, from understanding your tax responsibilities to submitting your return accurately and on time. We’ll provide practical tips and insights to help streamline your tax filing process and maximize your potential deductions.

Understanding Corporate Tax Obligations in Canada

Who Pays Corporate Taxes?

Corporate tax obligations in Canada apply to all incorporated businesses, regardless of size or industry. This includes small businesses, large corporations, and Canadian-controlled private corporations (CCPCs). Sole proprietorships and partnerships follow different tax rules.

Corporate Tax Filing Deadlines

The deadline for filing corporate taxes in Canada falls six months after your fiscal year-end. For businesses with a fiscal year aligned with the calendar year, this typically means June thirty. However, the Canada Revenue Agency (CRA) requires corporations to pay any taxes owed within two months after the fiscal year-end (three months for CCPCs).

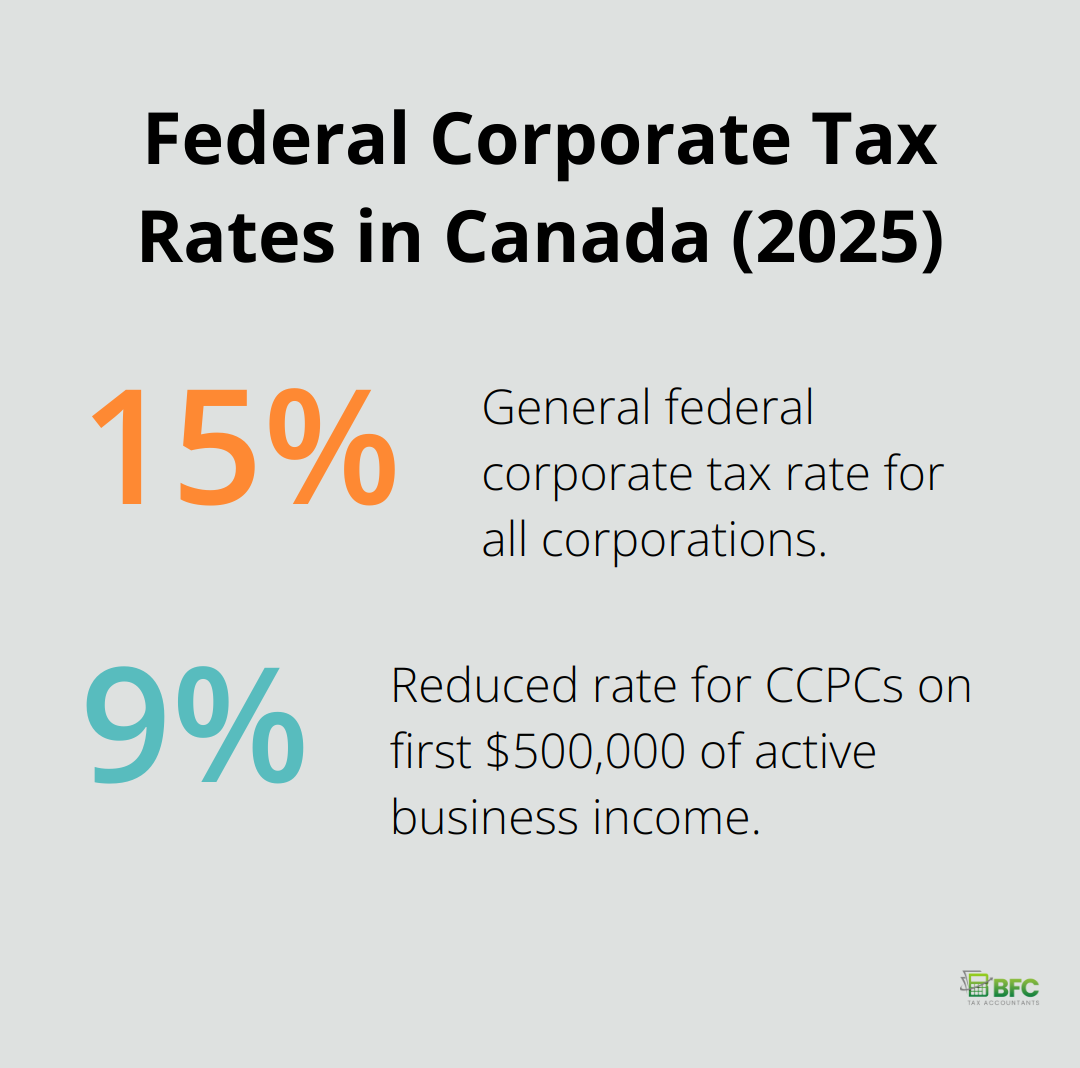

Corporate Tax Rates

As of twenty twenty-five, the federal corporate tax rate in Canada stands at 15%. CCPCs benefit from a reduced rate of 9% on the first $500,000 of active business income. Provincial rates vary significantly. For example, Ontario’s general corporate tax rate is 11.5%, while Alberta’s is 8%.

Calculating Corporate Tax

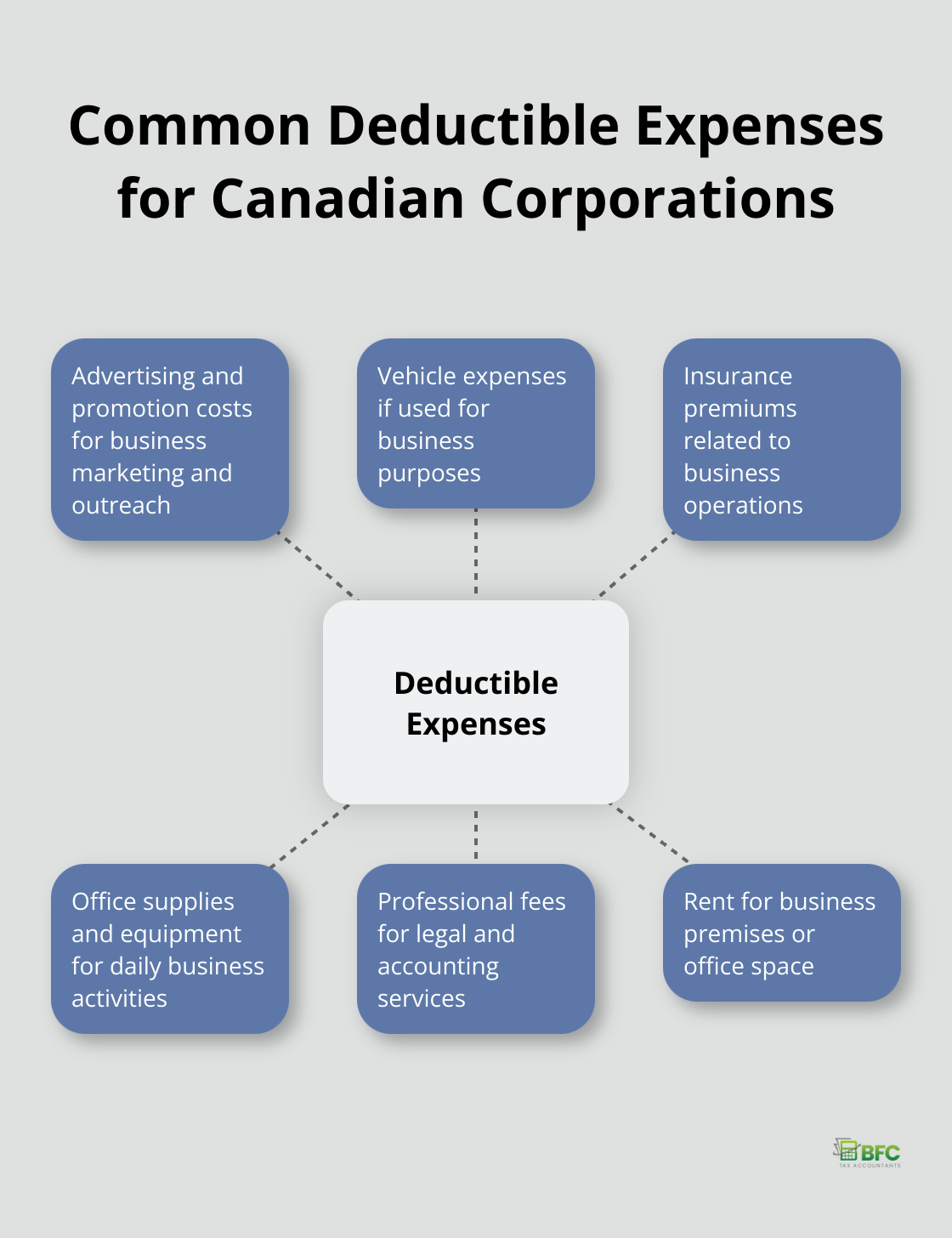

To calculate your corporate tax, you need to determine your taxable income and apply the appropriate tax rates. Taxable income equals your net income after deducting eligible expenses. Common deductions include salaries, office rent, equipment purchases, and marketing costs.

Many businesses overlook potential deductions. The Scientific Research and Experimental Development (SR&ED) tax credit can significantly lower tax liability for qualifying businesses. Corporations, individuals, trusts, and partnerships that conduct eligible work may be able to claim SR&ED tax incentives for the year.

Importance of Accurate Bookkeeping

Accurate bookkeeping throughout the year is essential for smooth tax filing. Consider using accounting software (like QuickBooks or Xero) to keep your finances organized. This practice not only simplifies tax preparation but also provides valuable insights into your business’s financial health.

Understanding these key aspects of corporate tax obligations equips you to manage your business finances effectively. However, tax laws can be complex and change frequently. Many businesses in Barrie (and beyond) trust BFC Tax Accountants to handle their corporate tax needs, ensuring compliance and maximizing potential savings.

As we move forward, let’s explore how to prepare for corporate tax filing, including the essential documents you’ll need and the steps to calculate your taxable income accurately.

How to Prepare for Corporate Tax Filing

Gather Your Financial Documents

The first step in corporate tax preparation involves collecting all relevant financial records. These include:

- Income statements and balance sheets

- Bank statements and credit card records

- Receipts for business expenses

- Payroll records

- Previous year’s tax return

Organize these documents chronologically and by category. This organization will save time and reduce stress when you file.

Calculate Your Taxable Income

Your taxable income equals your total revenue minus allowable deductions. Common deductions include:

The Canada Revenue Agency (CRA) provides detailed guidelines on eligible deductions. Review these carefully to ensure you claim all applicable deductions.

Choose Your Filing Method

The CRA offers two primary filing methods: electronic and paper. Electronic filing (NETFILE) provides an easy-to-use, convenient, secure, and confidential option for filing your corporation income tax return.

Paper filing remains an option, but it’s slower and more prone to errors. Corporations with annual revenue exceeding $1 million must file electronically.

Consider Professional Assistance

While it’s possible to file corporate taxes independently, many businesses opt for professional help. The tax code changes frequently, and a professional can ensure compliance with all regulations while maximizing deductions.

If you decide to file independently, tax preparation software can guide you through the process and help catch common errors.

Review and Double-Check

Before submission, review all entries carefully. Common mistakes include:

- Incorrect business number or fiscal period

- Math errors in calculations

- Missing signatures or schedules

Take time to double-check everything. A small error can lead to processing delays or even trigger an audit (which no one wants).

Corporate tax preparation doesn’t have to overwhelm you. With careful organization and attention to detail, you can navigate the process successfully. Now that you’ve prepared your documents and calculated your taxable income, let’s move on to the actual filing process in the next chapter.

How to File Your Corporate Tax Return

Completing Form T2

Completing Form T2 is a crucial step in reporting corporate income in Canada. Whether you file electronically or use the traditional CRA-issued return, you have different options for filing your T2 return. Begin by entering your corporation’s name, business number, and tax year. Then, proceed through each section methodically, referring to your financial statements and records.

Focus on Schedule 100 (Balance Sheet Information) and Schedule 125 (Income Statement Information). These schedules form the foundation of your financial reporting. Accuracy in these sections is essential, as discrepancies can prompt CRA inquiries.

Reporting Income and Expenses

When you report your business income, include all revenue streams. This encompasses your primary business activities, investment income, capital gains, and any other sources of corporate income.

For expenses, consult the CRA’s guidelines on eligible deductions. Common deductible expenses include:

The CRA scrutinizes expense claims closely. Maintain detailed records and receipts for all claimed expenses. This documentation proves invaluable if the CRA requests additional information or conducts an audit.

Claiming Tax Credits and Deductions

Canadian corporations can benefit from various tax credits and deductions. The Small Business Deduction (SBD) is available to eligible corporations. The SBD for a taxation year is generally calculated by multiplying the SBD rate by the lesser of the corporation’s income for the year from an active business carried on in Canada and other specified amounts.

Research and development activities may qualify for the Scientific Research and Experimental Development (SR&ED) tax credit. This program can provide substantial tax savings for innovative companies.

Provincial tax credits vary, so check the specific credits available in your province. For example, Ontario offers tax credits for businesses in sectors like digital media and film production.

Submitting Your Return

After you complete Form T2 and all relevant schedules, submit your return. Electronic filing through the CRA’s Corporation Internet Filing service is mandatory for most corporations. This system provides immediate confirmation of receipt and faster processing times.

If you’re eligible for paper filing, sign all necessary areas and include all required schedules. Mail your return to the appropriate tax centre based on your corporation’s location.

Your corporate tax return is due six months after your fiscal year-end. However, you must pay any taxes owed within two months of your year-end (three months for certain small businesses).

Filing corporate taxes can be complex, and mistakes can be costly. Many businesses in Barrie (and across Canada) trust BFC Tax Accountants to handle their corporate tax filings. Our expertise ensures accuracy, compliance, and maximizes potential tax savings.

Final Thoughts

Filing corporate taxes in Canada requires careful planning and attention to detail. Accurate record-keeping throughout the year forms the foundation of successful tax filing. Businesses must organize financial documents, calculate taxable income correctly, and take advantage of all eligible deductions and credits.

Timeliness and accuracy are paramount when filing corporate taxes in Canada. Late submissions can result in fines and interest charges, while errors or inconsistencies may trigger audits. Many businesses find value in professional assistance for complex tax situations and changing regulations.

BFC Tax Accountants specializes in corporate tax planning and preparation for businesses in Barrie and beyond. Our team stays up-to-date with the latest tax laws (and can help you maximize deductions while ensuring full compliance). Effective tax management optimizes your financial position for long-term success.