At BFC Tax Accountants, we understand the complexities of filing corporate taxes online in Canada.

The digital age has transformed how businesses handle their tax obligations, making it easier and more efficient than ever before.

This guide will walk you through the process of filing corporate taxes online in Canada, from preparation to submission.

What Are Your Corporate Tax Obligations in Canada?

Corporate tax filing in Canada requires meticulous attention to detail and a solid grasp of the country’s tax laws. This chapter outlines the key aspects of corporate tax obligations that Canadian businesses must understand and fulfill.

Corporate Tax Return Requirements

Canadian corporations must file a T2 Corporation Income Tax Return annually. This obligation applies to all corporations, even those that are dormant or have no income to report. The T2 return encompasses various schedules and forms that detail the corporation’s financial activities, income, deductions, and credits.

Filing Deadlines and Payment Schedules

The deadline for filing corporate taxes in Canada is six months after the end of the corporation’s fiscal year. For instance, if your fiscal year ends on December 31, your filing deadline falls on June 30 of the following year. However, it’s crucial to note that while you have six months to file, any taxes owed must be paid within two months of the fiscal year-end for most corporations. Canadian-controlled private corporations (CCPCs) with taxable income under $500,000 may have different payment schedules depending on their business’s tax year and whether they pay installments monthly or quarterly.

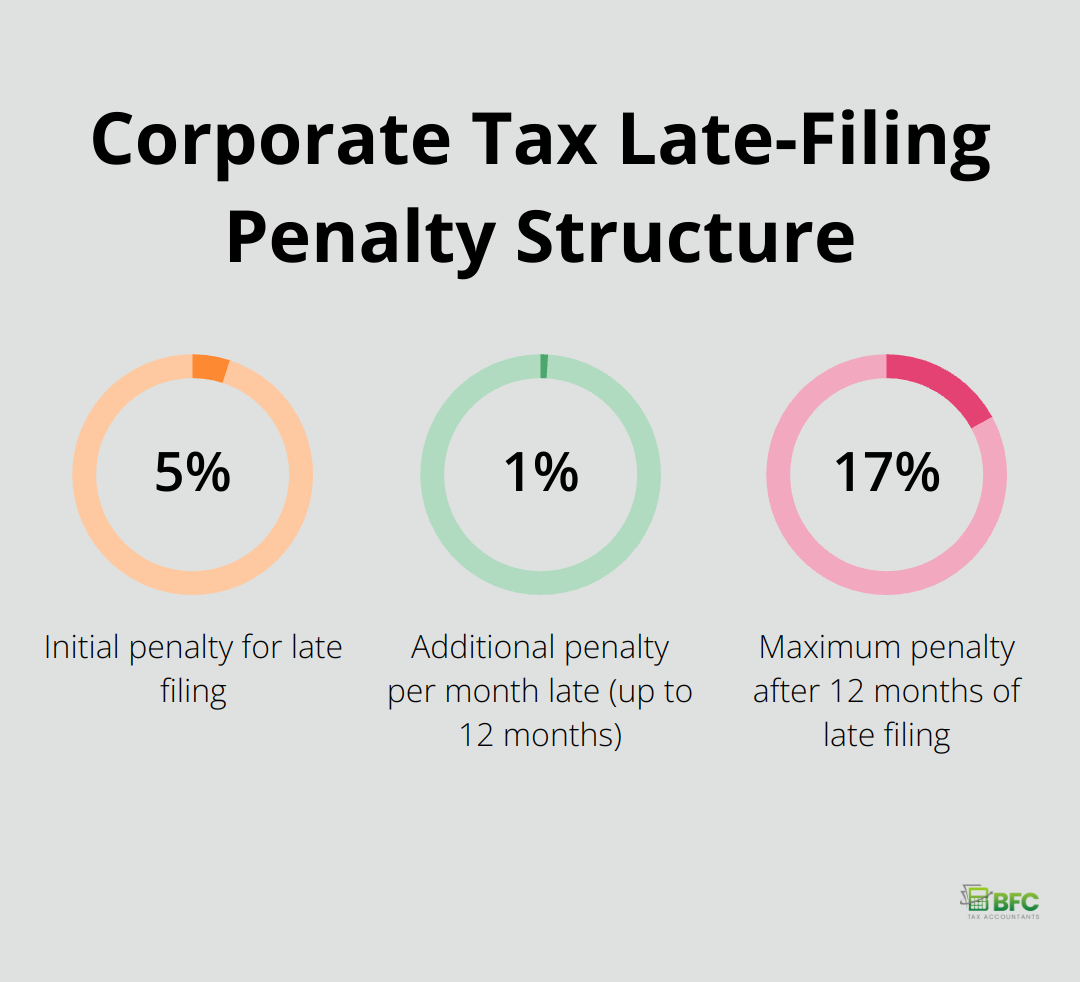

Penalties for Non-Compliance

The Canada Revenue Agency (CRA) enforces strict penalties for late filing or non-compliance. These penalties can significantly impact a company’s finances. The late-filing penalty amounts to 5% of the unpaid tax plus 1% of the unpaid tax for each full month the return is late (up to a maximum of 12 months). Additionally, interest charges apply to any unpaid amounts, compounding daily.

Electronic Filing Mandates

For tax years starting after 2023, all corporations have to file their T2 Corporation Income Tax Return electronically, with some exceptions for insurance corporations. This mandate ensures compliance and accelerates the processing of returns and potential refunds.

Tax Planning and Compliance

Staying on top of your corporate tax obligations goes beyond avoiding penalties. It’s about maintaining good standing with the CRA and having a clear picture of your company’s financial health. Proper tax planning and timely filing can also help identify eligible deductions and credits and ensure you’re maximizing your tax savings.

As we move forward, let’s explore how to prepare effectively for online corporate tax filing, ensuring you have all the necessary documents and information at your fingertips.

How to Prepare for Online Corporate Tax Filing

Organize Your Financial Records

The first step in preparing for online corporate tax filing involves the organization of all relevant financial documents for the tax year. This includes your company’s income statement, balance sheet, and cash flow statement. You’ll need records of all business expenses, receipts, invoices, and bank statements. Don’t forget asset purchase records, loan agreements, and any government correspondence related to taxes.

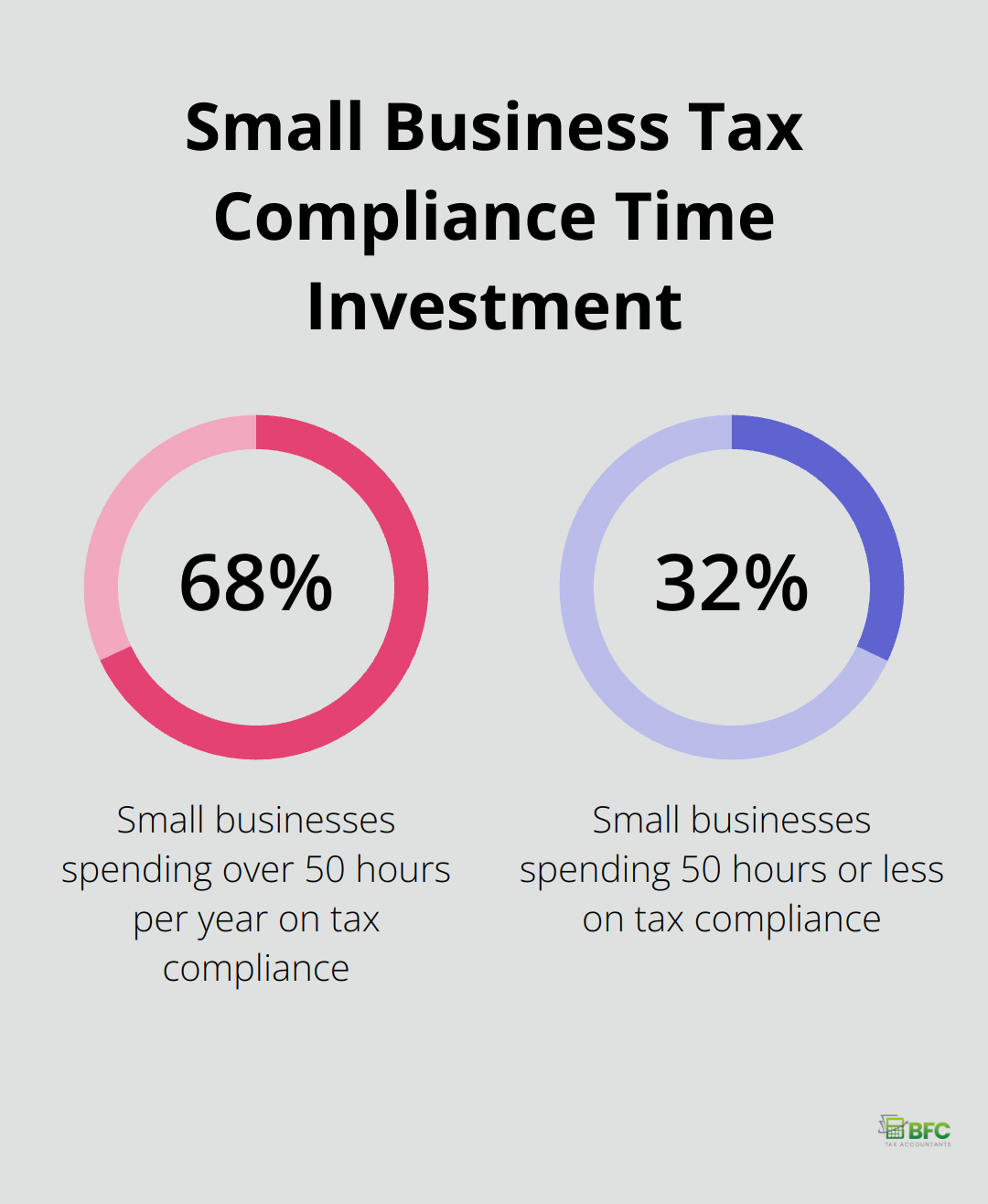

A 2022 survey by the Canadian Federation of Independent Business revealed that 68% of small businesses spend over 50 hours per year on tax compliance. Early organization of documents can reduce this time investment significantly.

Calculate Your Taxable Income

After organizing your financial records, the next step is to calculate your taxable income. This process involves the subtraction of allowable expenses and deductions from your total revenue. Common deductions include operating expenses, capital cost allowance (CCA), and eligible business investment losses.

The Canada Revenue Agency (CRA) provides information about filing corporation income tax, tax rates, and provincial and territorial corporate tax on their website.

Stay Updated on Tax Law Changes

Tax laws and regulations change frequently. For example, in 2022, the CRA introduced new rules for immediate expensing of eligible property for Canadian-controlled private corporations (CCPCs). This allows CCPCs to write off up to $1.5 million in eligible capital property in the year of purchase.

Regular checks of the CRA website or subscription to tax update services can help you stay informed. Many accounting firms monitor these changes continuously to ensure their clients’ tax strategies remain optimized and compliant.

Leverage Tax Software

The use of tax software can simplify the preparation process significantly. These tools often include built-in calculators, error checks, and up-to-date forms. A 2023 report by Statistics Canada showed that 87% of Canadian businesses now use some form of digital tax preparation tool.

Several options are available in the market. Professional accounting firms often offer their clients access to professional-grade tax software as part of their service, ensuring accuracy and efficiency in the tax preparation process.

Review Previous Year’s Returns

A review of your previous year’s tax returns can provide valuable insights into potential deductions or credits you may have overlooked. It also helps identify any recurring issues that need addressing.

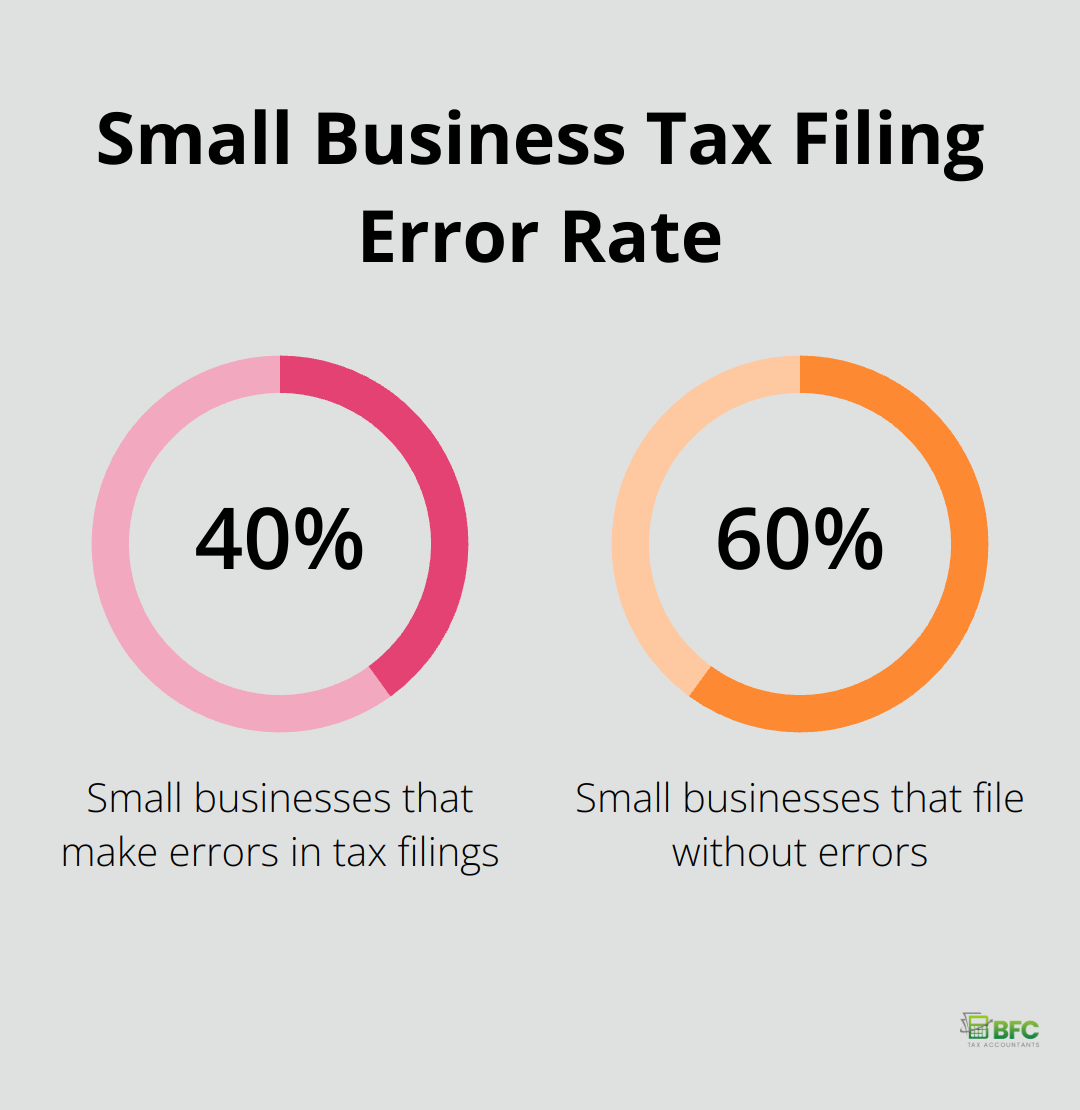

A study by the CRA found that 40% of small businesses made errors in their tax filings, often due to overlooked deductions or misclassified expenses. A careful review of past returns can help avoid these common pitfalls.

As you complete these preparation steps, you’ll find yourself well-equipped to navigate the online corporate tax filing process. The next chapter will guide you through the actual filing procedure, step by step.

How to File Corporate Taxes Online in Canada

Choose Your Online Filing Method

The first step in filing corporate taxes online in Canada involves selecting the right method. The Canada Revenue Agency (CRA) strongly encourages electronic filing through its Corporation Internet Filing service. However, this option can present challenges for those unfamiliar with tax laws.

Many businesses prefer tax preparation software. Popular choices include TurboTax Business, UFile, and H&R Block’s software. These programs often feature built-in error checks, which can significantly reduce the risk of mistakes.

For complex tax situations, professional accounting firms (such as BFC Tax Accountants) provide expert assistance. These firms use advanced tax software and maintain up-to-date knowledge of tax laws to ensure accurate filings.

Set Up Your CRA My Business Account

After choosing your filing method, you must set up or access your CRA My Business Account. This online portal plays a vital role in managing your corporate tax affairs.

The My Business Account is an online portal that lets you interact with the Canada Revenue Agency (CRA) on various business accounts. The registration process requires your business number, corporation name, and other identifying information.

Complete Your T2 Corporation Income Tax Return

The T2 return forms the core of your corporate tax filing. It includes several schedules that detail your company’s income, deductions, and credits.

Key sections to focus on include:

- Schedule 100 (Balance Sheet Information)

- Schedule 125 (Income Statement Information)

- Schedule 141 (Notes Checklist)

These schedules constitute the backbone of your corporate tax return. Accuracy in these sections is paramount.

Submit Your Return

Once you complete all necessary forms and schedules, you can submit your return. If you use tax software or a professional service, this process often involves a simple “submit” button click.

Before submission, double-check all entries.

After submission, you’ll receive a confirmation number. Keep this number for your records – it serves as your proof of filing.

Seek Professional Assistance When Needed

While online filing simplifies the process, complex tax situations may require professional help. Accounting firms offer expertise in navigating intricate tax laws and maximizing potential deductions.

These professionals can help identify often-overlooked deductions, ensure compliance with the latest regulations, and provide peace of mind during the filing process.

Final Thoughts

Filing corporate taxes online in Canada has become an essential practice for businesses of all sizes. The process can be streamlined with proper preparation and the right tools. Online filing offers numerous advantages, including reduced paperwork, minimized errors, and faster processing times.

The complexity of corporate tax laws and the potential for costly mistakes underscore the importance of seeking professional assistance. BFC Tax Accountants specializes in helping businesses file corporate taxes online in Canada. Our expertise in Canadian tax laws, combined with our use of advanced tax software, ensures accurate and timely filings.

Successful corporate tax filing contributes to your business’s overall health and growth. The landscape of corporate taxation continues to evolve, and staying informed and prepared will be key to navigating the process successfully. Businesses can turn the task of filing corporate taxes online in Canada from a challenge into a manageable part of their financial strategy.