Personal income tax deductions can significantly reduce your tax bill. However, many Canadians miss out on valuable deductions simply because they’re unaware of them.

At BFC Tax Accountants, we’ve seen firsthand how proper tax planning can lead to substantial savings. This guide will walk you through common deductions, strategies to maximize them, and often-overlooked opportunities to keep more money in your pocket.

Top 5 Personal Income Tax Deductions

Charitable Donations: A Win-Win for You and Society

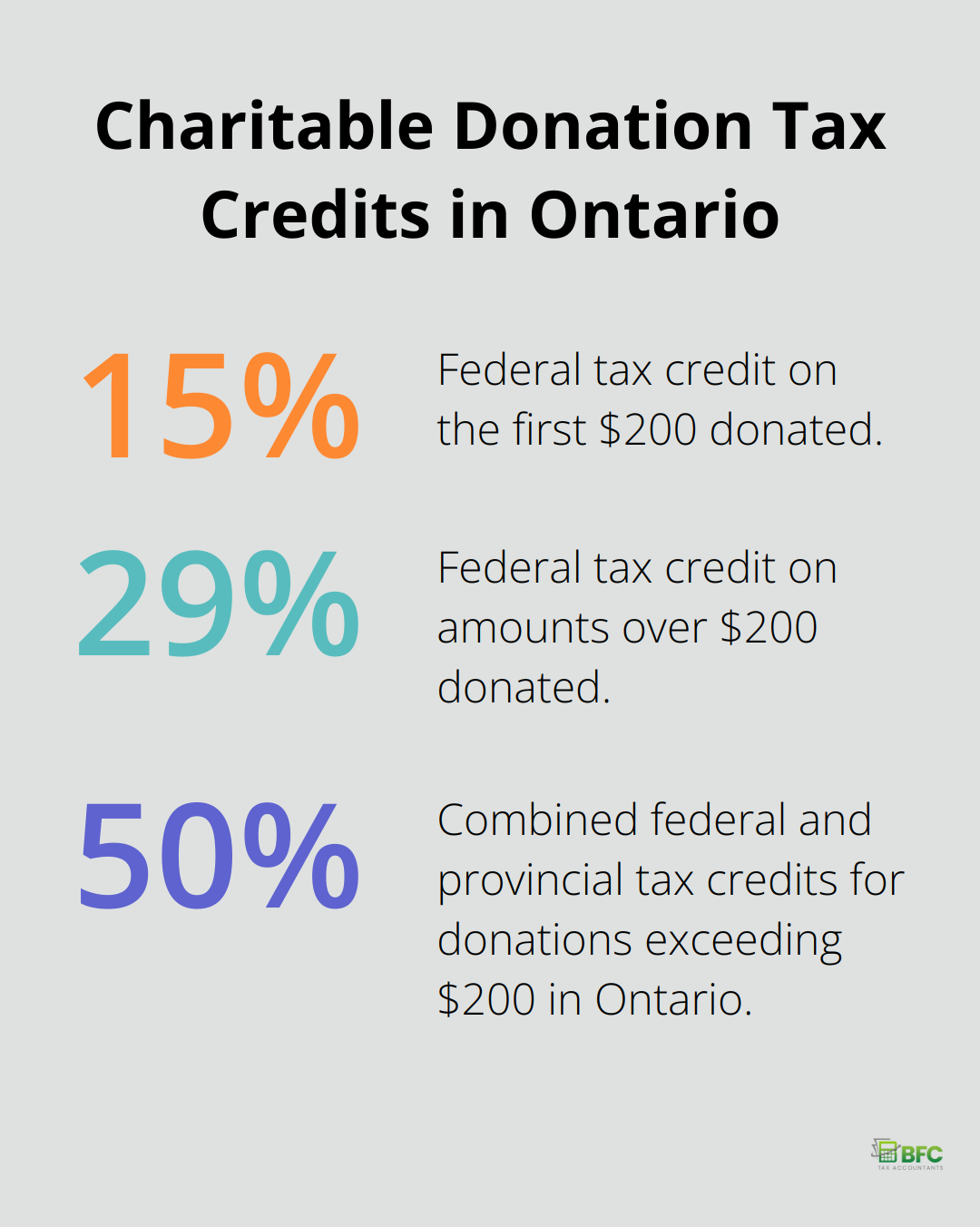

Donating to registered charities supports important causes and provides substantial tax benefits. The federal government offers a tax credit of 15% on the first $200 donated and 29% on amounts over $200. Some provinces offer additional credits. In Ontario, you can receive up to 50% in combined federal and provincial tax credits for donations exceeding $200.

Medical Expenses: Beyond Doctor Visits

Many Canadians underestimate the range of medical expenses they can claim. Besides typical costs like prescriptions and dental care, you can claim expenses for gluten-free products (with a doctor’s note), travel expenses for medical treatment, and even air conditioning units if medically necessary. To maximize this deduction, aggregate family medical expenses under one spouse’s name (typically the lower-income earner).

RRSP Contributions: Your Path to Tax-Deferred Growth

Contributing to a Registered Retirement Savings Plan (RRSP) reduces your taxable income effectively. In 2024, you can contribute up to 18% of your previous year’s earned income, to a maximum of $31,560. This lowers your current tax bill and allows your investments to grow tax-free until withdrawal.

Childcare Expenses: Support for Working Parents

Working parents can claim up to $8,000 per child under 7 and $5,000 for children aged 7 to 16. This includes costs for daycare, after-school programs, and summer camps. In two-parent households, the lower-income spouse must claim these expenses.

Home Office Expenses: Adapting to the New Normal

Home office expense deductions are available for employees required to work from home. You can claim a portion of your rent, utilities, and internet costs based on the percentage of your home used for work. Self-employed individuals can also deduct a portion of their property taxes and home insurance.

Tax laws change frequently and can be complex. Consult with a professional to ensure you maximize your deductions while complying with Canadian tax laws. Now, let’s explore strategies to make the most of these deductions and uncover often-overlooked opportunities to reduce your tax burden.

Smart Strategies for Tax Savings

Meticulous Record-Keeping

Accurate and detailed records form the foundation of successful tax planning. Use digital tools or business expense tracking apps to track expenses throughout the year. Categorize receipts immediately and store them securely. This practice saves time during tax season and ensures you don’t miss any potential deductions.

Strategic Expense Timing

In terms of timing, the only restriction is that expenses incurred in a business’s fiscal year must be claimed against income earned in that year. This flexibility allows you to optimize your tax situation within the fiscal year.

Mastering Carry-Forward Options

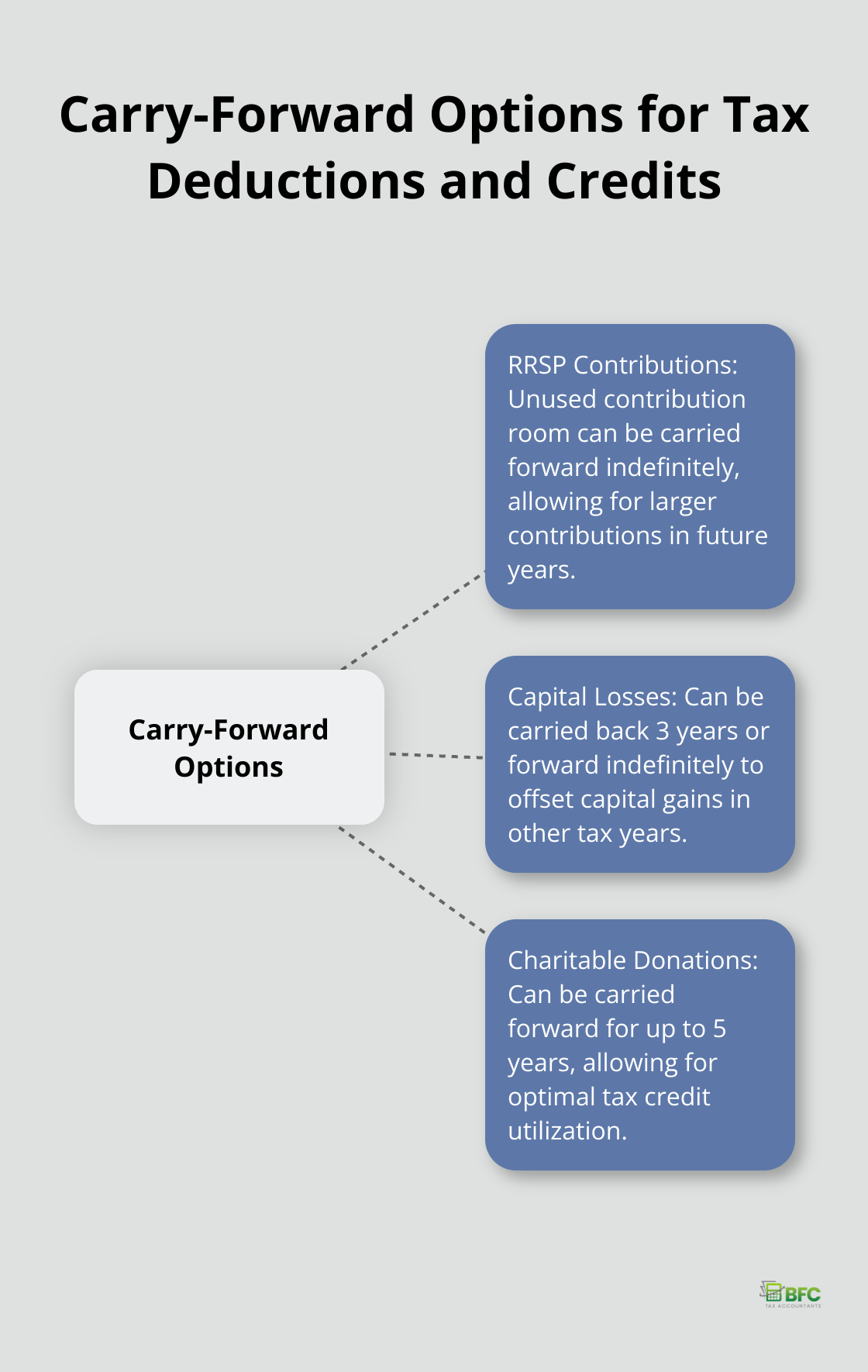

Many tax deductions and credits in Canada offer carry-forward options. RRSP contributions, capital losses, and charitable donations can often be carried forward to future years. This flexibility allows you to optimize your tax situation over multiple years. You might choose to carry forward charitable donations to a year when you expect to be in a higher tax bracket, maximizing the value of your tax credit.

Income Splitting Opportunities

Income splitting can be an effective way to reduce your family’s overall tax burden. This strategy involves shifting income from a higher-earning family member to a lower-earning one (within legal limits). Common methods include spousal RRSPs, pension income splitting for retirees, and employing family members in a business (if legitimate work is performed).

Leveraging Tax Credits

Tax credits directly reduce the amount of tax you owe. Find deductions, credits, and expenses you can claim on your tax return to help reduce the amount of tax you have to pay. Research available credits thoroughly (or consult with a tax professional) to ensure you’re not leaving money on the table.

Tax laws are complex and change frequently. These strategies can be powerful tools for reducing your tax burden, but it’s important to consult with a professional tax advisor to ensure you’re making the most of your unique financial situation. In the next section, we’ll explore often-overlooked deductions that could lead to significant savings on your tax return.

Hidden Tax Deductions You Might Be Missing

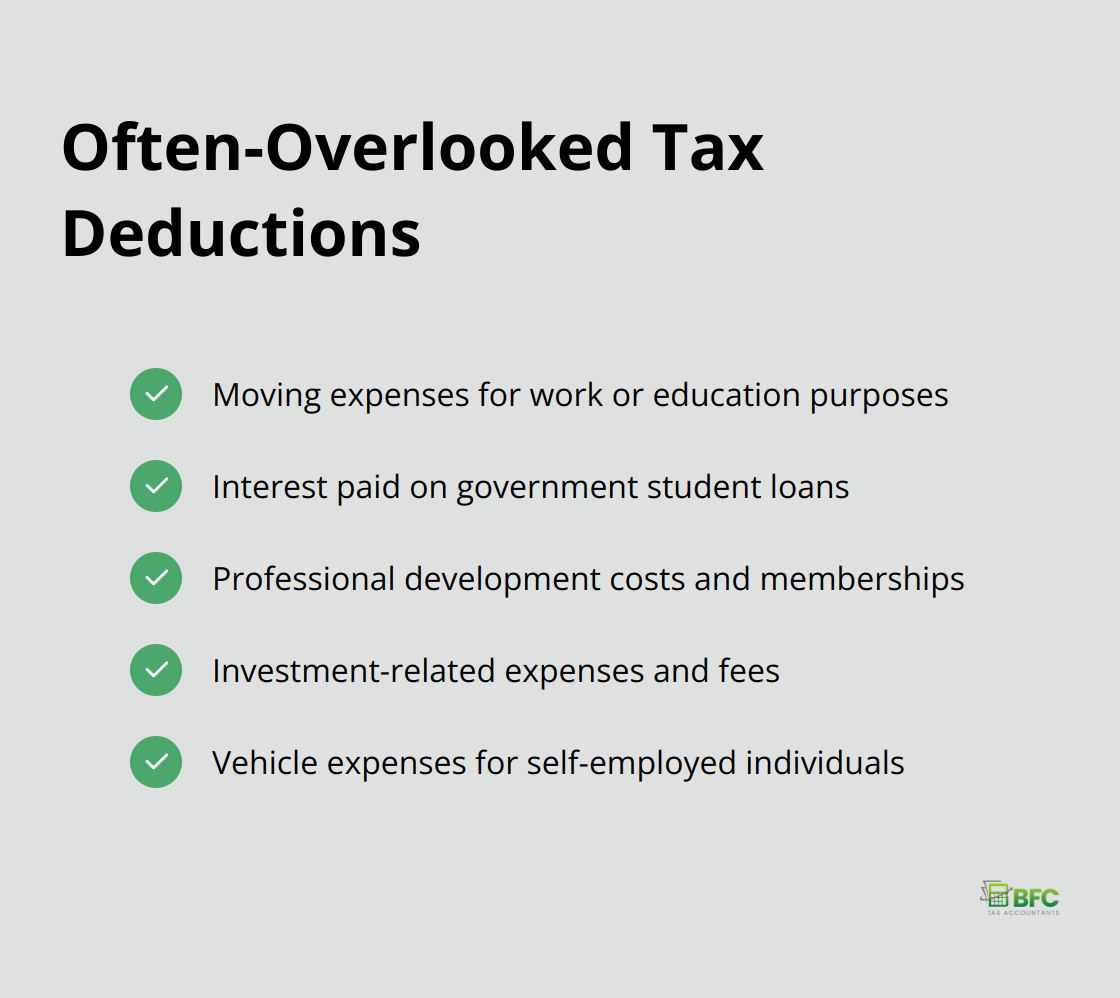

Many Canadians overlook valuable tax deductions that could significantly reduce their tax burden. We’ve identified several often-missed opportunities for tax savings. Let’s explore these hidden gems and how you can take advantage of them.

Moving for Work or Education

If you’ve relocated for work or education purposes, you might qualify for tax deductions. The Canada Revenue Agency provides general information about tax measures related to moving expenses. To maximize this deduction, keep all receipts related to your move and use the detailed method for calculating your claim.

Student Loan Interest

Recent graduates often forget they can claim interest paid on government student loans. This deduction applies to federal and provincial student loans (but not to private loans or lines of credit). According to the 2023 Canadian budget, a low-income student in Manitoba could receive more than $5,600 in additional support in 2023 thanks to proposed enhancements to Canada Student Loans. You can carry forward unclaimed interest for up to five years, allowing you to optimize your tax situation over time.

Professional Development Costs

Union dues, professional memberships, and certain educational expenses can reduce your taxable income. For instance, if you’re a teacher who paid for additional qualifications or a lawyer maintaining your bar membership, these costs may qualify. Keep detailed records of all work-related expenses, as they may qualify for deduction.

Investment-Related Expenses

Fees paid for investment advice, safety deposit boxes for storing investment documents, and interest on money borrowed for investment purposes can all qualify as tax-deductible. To maximize this benefit, try consolidating your investments with one advisor to potentially reduce overall fees.

Vehicle Expenses for Self-Employed Individuals

Self-employed individuals who use their vehicle for business purposes can deduct a portion of their vehicle expenses. This includes fuel, maintenance, insurance, and even depreciation. The Canada Revenue Agency allows you to claim these expenses based on the percentage of business use of your vehicle. Maintain a detailed log of your business-related mileage to support your claim.

These often-overlooked deductions can add up to significant tax savings. However, tax laws are complex and change frequently. While we’ve provided general guidance, it’s important to consult with a professional tax advisor to ensure you maximize your deductions while complying with Canadian tax laws.

Final Thoughts

Personal income tax deductions offer numerous opportunities to reduce your tax burden. From charitable donations to home office expenses, you can save money through careful planning and record-keeping. Smart strategies include timing your expenses strategically and leveraging carry-forward options to optimize your tax situation over multiple years.

Don’t overlook often-missed deductions such as moving expenses, student loan interest, and investment-related costs. These hidden gems can lead to significant savings on your tax return. Tax laws change frequently, so it’s important to stay informed and seek professional guidance.

We at BFC Tax Accountants specialize in helping individuals and businesses navigate Canadian tax laws. Our expert team offers comprehensive tax planning and preparation services (including personal and corporate tax solutions). You can potentially save thousands of dollars on your taxes by taking advantage of all available deductions and working with experienced professionals.