Personal tax credits are a powerful tool for reducing your tax burden in Canada. As we approach 2025, understanding and maximizing these credits becomes even more important.

At BFC Tax Accountants, we’ve seen firsthand how proper utilization of personal tax credits can lead to significant savings for our clients. This guide will walk you through the key personal tax credits for 2025 and provide strategies to make the most of them.

Understanding Personal Tax Credits in Canada

What Are Personal Tax Credits?

Personal tax credits form the foundation of Canada’s tax system. These credits reduce the amount of tax you owe directly. Unlike deductions that lower your taxable income, tax credits decrease your tax payable. This makes them particularly valuable, especially for individuals in lower income brackets.

Types of Personal Tax Credits in 2025

In 2025, Canadians can benefit from several personal tax credits:

- Basic Personal Amount (BPA): The most common credit, available to all taxpayers. For 2025, the BPA is expected to be $15,000, allowing Canadians to earn more tax-free income.

- Canada Workers Benefit: This credit has expanded eligibility criteria for low-income earners. In 2025, single workers can receive up to $1,633 if their adjusted net income is below $26,855, while families can receive up to $2,813.

- Disability Tax Credit: Provides substantial savings for individuals with disabilities.

Refundable vs. Non-Refundable Credits

It’s important to understand the distinction between refundable and non-refundable tax credits:

- Refundable credits (such as the GST/HST credit) can result in a tax refund even if you don’t owe any tax.

- Non-refundable credits (like the medical expenses tax credit) can only reduce your tax owing to zero.

Maximizing Your Credits

To optimize your personal tax credits, maintain meticulous records throughout the year. This includes keeping receipts for medical expenses, charitable donations, and tuition fees. Many Canadians miss out on potential savings by failing to claim all eligible expenses.

Tax laws change frequently. The Canada Revenue Agency (CRA) updates credit amounts and eligibility criteria annually. Staying informed about these changes is essential to maximize your tax savings. You should consider consulting with a tax professional to ensure you’re not missing out on potential savings.

As we move forward, let’s explore the key personal tax credits for 2025 and strategies to make the most of them.

Key Personal Tax Credits for 2025

Basic Personal Amount (BPA)

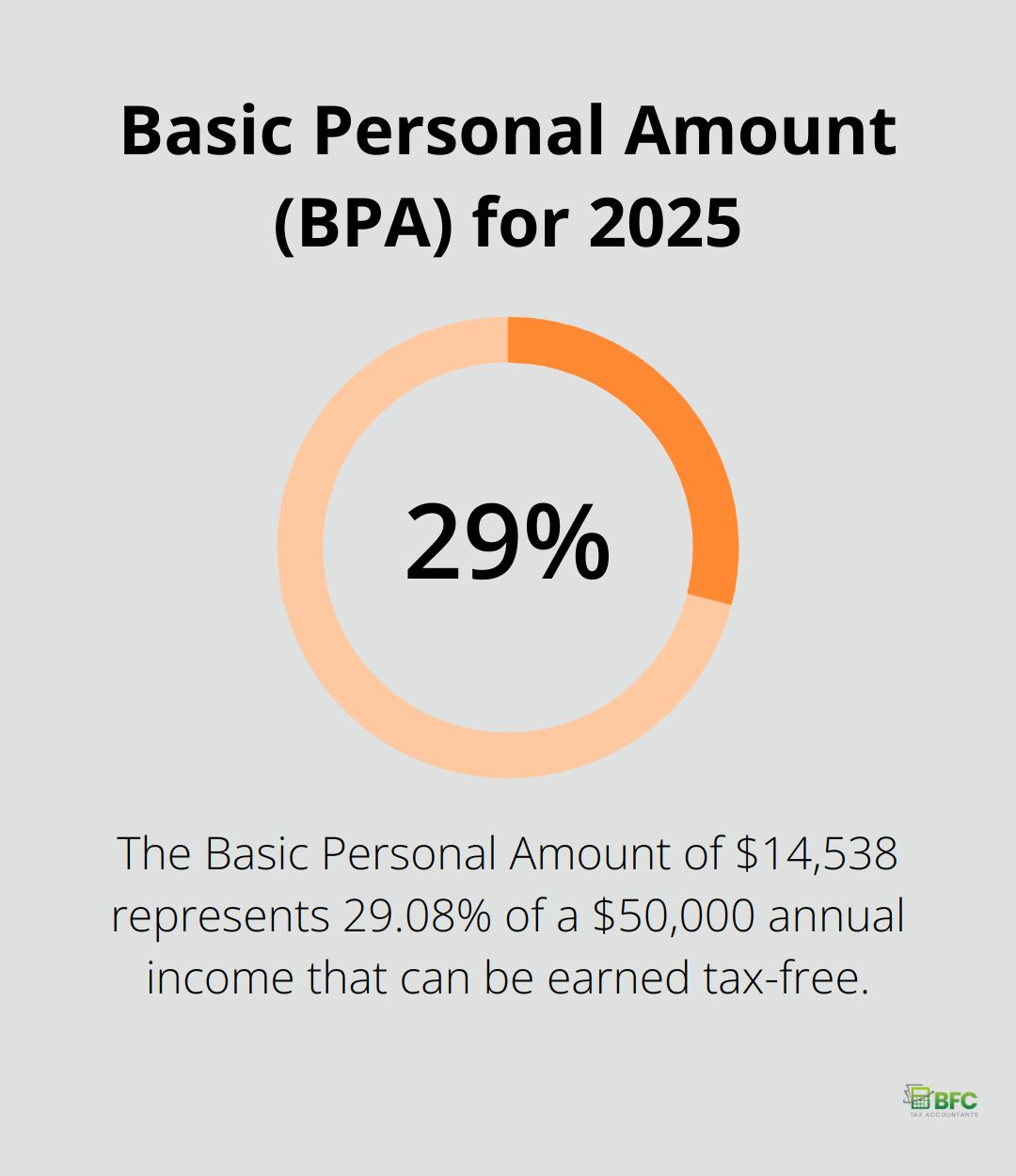

The Basic Personal Amount will increase to 14,538 for 2025. This allows you to earn up to $14,538 before paying any federal income tax. High-income earners may face a reduced BPA, so check your eligibility. This increase offers substantial tax savings across all income brackets.

Medical Expenses Tax Credit

You can claim eligible medical expenses that exceed the lesser of 3% of your net income or $2,635 for 2025. Save all receipts for medical expenses (including prescription medications, dental work, and travel expenses for medical treatment). Don’t overlook less common eligible expenses (such as gluten-free products for celiac disease or air purifiers for severe allergies).

Charitable Donations Credit

Donations to registered charities can result in significant tax savings. The first $200 of donations receives a 15% federal credit, with amounts over $200 eligible for a 29% credit. Some provinces offer additional credits. To maximize this benefit, consider bundling multiple years of donations into a single tax year to exceed the $200 threshold.

Disability Tax Credit

The Disability Tax Credit provides substantial tax relief for individuals with prolonged physical or mental impairments. Eligibility requirements include being able to apply after you turn 17.5 if you’re under 18. Your application won’t be processed until your 18th birthday.

Age Amount Credit

If you’re 65 or older by the end of the tax year, you may qualify for the Age Amount Credit. For 2023, the maximum credit is $1,259 federally and $293 for Ontario. This credit can significantly reduce the tax burden for seniors, especially when combined with pension income splitting strategies.

Tuition Tax Credit

While the federal education and textbook credits were eliminated in 2017, the tuition tax credit remains. Students can claim eligible tuition fees paid to qualifying educational institutions. You can carry forward unused credits or transfer them to a spouse, parent, or grandparent, up to a maximum of $5,000.

These credits can make a substantial difference in your tax return. The key to maximizing these benefits lies in careful planning and record-keeping throughout the year. Each taxpayer’s situation is unique, and professional advice can help ensure you take full advantage of all available credits. In the next section, we’ll explore strategies to optimize your personal tax credits and maximize your savings.

How to Optimize Your Personal Tax Credits

Keep Detailed Records

Effective tax credit optimization starts with thorough record-keeping. Create a system to organize receipts, invoices, and documentation related to potential tax credits. This includes medical expenses, charitable donations, and educational costs. Use digital tools or applications to scan and categorize receipts throughout the year. This approach will make tax time less stressful and reduce the risk of overlooking eligible expenses.

Time Your Expenses and Donations Strategically

Timing plays a crucial role in maximizing tax credits. For medical expenses, try to group them into a 12-month period within the tax year to potentially exceed the minimum threshold more easily. For charitable donations, you might benefit from bundling multiple years’ worth of contributions into a single tax year to surpass the $200 threshold for higher credit rates. Always ensure these strategies align with your financial situation and don’t cause undue hardship.

Use Family Tax Planning

Family tax planning can optimize personal tax credits effectively. Explore opportunities to transfer credits between family members. A lower-income spouse might benefit more from claiming medical expenses. Students can transfer unused tuition credits to parents or grandparents.

Investigate Lesser-Known Eligible Expenses

Many taxpayers miss potential savings by overlooking less common eligible expenses. For the medical expense tax credit, items like gluten-free products for those with celiac disease, air purifiers for severe allergies, and certain home renovations for mobility purposes may qualify. The disability tax credit can apply to a wide range of conditions (including mental health disorders and learning disabilities).

Consult with Tax Professionals

Tax laws are complex and constantly evolving. Consulting with a professional can ensure you leverage all available credits and avoid costly mistakes. Tax experts stay up-to-date with the latest regulations and can provide tailored advice to maximize your tax savings. If you’re in Barrie, Ontario, BFC Tax Accountants specializes in personalized tax planning for individuals and businesses.

Final Thoughts

Personal tax credits in 2025 offer significant opportunities to reduce your tax burden and increase your financial well-being. You can maximize these benefits through strategic planning, meticulous record-keeping, and a thorough understanding of available credits. Professional guidance proves invaluable in navigating the complexities of the tax system and ensuring you capitalize on every opportunity for savings.

BFC Tax Accountants specializes in personal tax planning and preparation, offering expert advice tailored to your unique situation. Our team stays current with the latest tax regulations to help you optimize your tax credits and overall financial position. We assist individuals and businesses in navigating the intricacies of the Canadian tax system.

Don’t miss out on potential savings. Take time to review your tax situation and explore all available credits (including those for 2025). Consider seeking professional advice to make the most of every opportunity to reduce your tax burden and strengthen your financial future.