Personal tax planning is a powerful tool for financial success. At Kyei Baffour, we’ve seen how effective strategies can significantly reduce tax burdens and increase wealth.

This guide will walk you through key techniques to optimize your tax situation, from maximizing deductions to timing income and expenses. We’ll also debunk common myths and highlight often-overlooked opportunities to keep more money in your pocket.

What Is Personal Tax Planning?

Personal tax planning involves the strategic management of finances to minimize tax liability and maximize wealth. It requires an understanding of the tax system and the application of legal methods to reduce tax obligations.

The Impact of Proactive Planning

Effective tax planning demands continuous attention and regular adjustments. Statistics Canada reports that Canadians paid an average of $35,000 in taxes in 2022. Many could have reduced this amount through proper planning.

Key Elements of a Solid Tax Strategy

A comprehensive tax plan typically includes:

- Income Management: This element focuses on the strategic timing of income receipt to minimize the impact on tax brackets.

- Deduction Optimization: Knowledge of deductible expenses and meticulous record-keeping can lead to substantial savings.

- Investment Planning: The selection of tax-efficient investment vehicles (such as TFSAs) can protect gains from taxes.

- Retirement Planning: The use of RRSPs not only saves for the future but also reduces current taxable income.

Dispelling Tax Planning Myths

Many Canadians believe tax planning only benefits the wealthy. This misconception can prove costly. Even modest incomes can benefit from strategic planning. For example, a family earning $75,000 annually could save up to $3,000 in taxes by properly claiming all eligible credits and deductions.

Another prevalent myth suggests that tax planning is illegal. In reality, it’s not only legal but encouraged. The Canada Revenue Agency (CRA) provides numerous incentives designed for taxpayer use.

Some individuals think DIY tax software suffices for tax planning. While these tools help with filing, they can’t replace the personalized strategies a professional provides. The paramount benefit of hiring a professional tax service is the accuracy it brings to your tax filings and credits.

The Value of Professional Guidance

While self-education about tax planning proves beneficial, the complexities of the tax code often necessitate professional assistance. A qualified tax professional can provide tailored advice, identify overlooked opportunities, and ensure compliance with ever-changing tax laws. Professional guidance is valuable because tax professionals typically know tax laws better than other financial professionals and are recognized by the Internal Revenue Service.

The next chapter will explore specific strategies to maximize tax deductions and credits, providing you with practical tools to optimize your personal tax planning approach.

How to Maximize Tax Deductions and Credits

Understanding Available Deductions and Credits

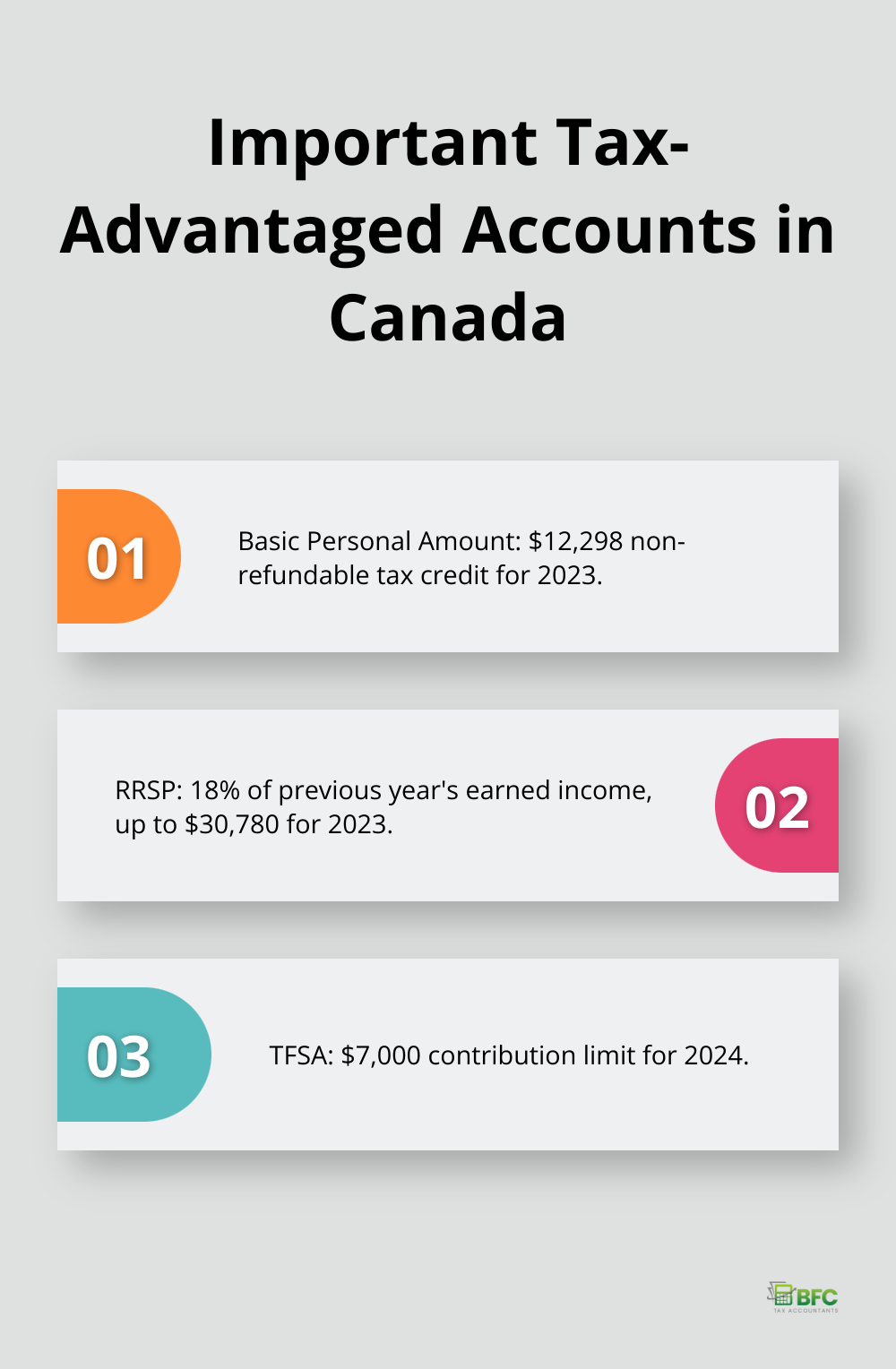

The Canadian tax system offers numerous deductions and credits to reduce your tax burden. The Basic Personal Amount, a non-refundable tax credit, stood at $12,298 for the 2023 tax year. This credit can potentially save taxpayers thousands by reducing their taxable income.

Employees can benefit from the Canada Employment Amount. In 2024, this credit allows claims up to the lesser of your employment income or the maximum amount set for that year on line 31260 of your tax return.

Medical expenses often go unclaimed. You can claim eligible medical expenses that exceed the lesser of $2,635 or 3% of your net income. This includes prescription medications, dental work, and even travel expenses for medical treatment.

Effective Strategies for Deduction Maximization

Group deductible expenses to optimize your claims. If you have flexibility in timing medical procedures or charitable donations, concentrate them in a single tax year to surpass thresholds and maximize your claims.

Maintain meticulous records. The Canada Revenue Agency (CRA) requires documentation for claimed expenses. Organize receipts, invoices, and relevant paperwork throughout the year. This practice ensures you don’t miss out on deductions and prepares you for potential audits.

Leveraging Tax-Advantaged Accounts

Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs) serve as powerful tools for tax optimization.

RRSP contributions reduce your taxable income. For 2023, the RRSP contribution limit was 18% of your previous year’s earned income (up to a maximum of $30,780). Maximizing your RRSP contributions can significantly reduce your current tax liability while saving for retirement.

TFSAs offer tax-free growth and withdrawals. The TFSA contribution limit for 2024 is $7,000. Over time, this tax-free growth can result in substantial savings, especially for high-income earners who may face higher tax rates in retirement.

The Tax Benefits of Charitable Giving

Charitable donations support causes you care about and provide tax benefits. In Canada, donations over $200 are eligible for a federal tax credit of 29%, with an additional provincial credit that varies by province.

Consider donating appreciated securities instead of cash. When you donate stocks or mutual funds that have increased in value, you receive a tax receipt for the full market value and avoid capital gains tax on the appreciation.

Professional Guidance for Optimal Results

Maximizing tax deductions and credits requires a comprehensive understanding of the tax code and careful planning. While these strategies can significantly reduce your tax burden, working with a professional ensures you leverage all available opportunities while remaining compliant with tax laws.

BFC Tax Accountants in Barrie, Ontario, offers expert guidance on personal tax planning and preparation. Our team specializes in identifying often-overlooked deductions and credits, tailoring strategies to your unique financial situation.

The next chapter will explore the critical aspect of timing your income and expenses to further optimize your tax planning strategy.

When Should You Time Your Income and Expenses?

Income Splitting Strategies

Income splitting distributes income among family members to reduce the overall tax burden. In Canada, you and your spouse or partner must make a joint election on your income tax returns using Form T1032 to split pension income. This strategy often leads to substantial tax savings, especially if one partner falls into a lower tax bracket.

Business owners can pay reasonable salaries to family members who work in the business. The Canada Revenue Agency (CRA) scrutinizes these arrangements, so ensure the compensation aligns with market rates and actual work performed.

Deferring Income and Accelerating Expenses

Timing your income and expenses can lower your tax bill. If you expect to be in a lower tax bracket next year, consider deferring income to that year. Self-employed individuals might delay invoicing clients until January.

Accelerating expenses into the current tax year can reduce your taxable income. This strategy works well for business owners who can purchase necessary equipment or supplies before year-end.

Managing Capital Gains and Losses

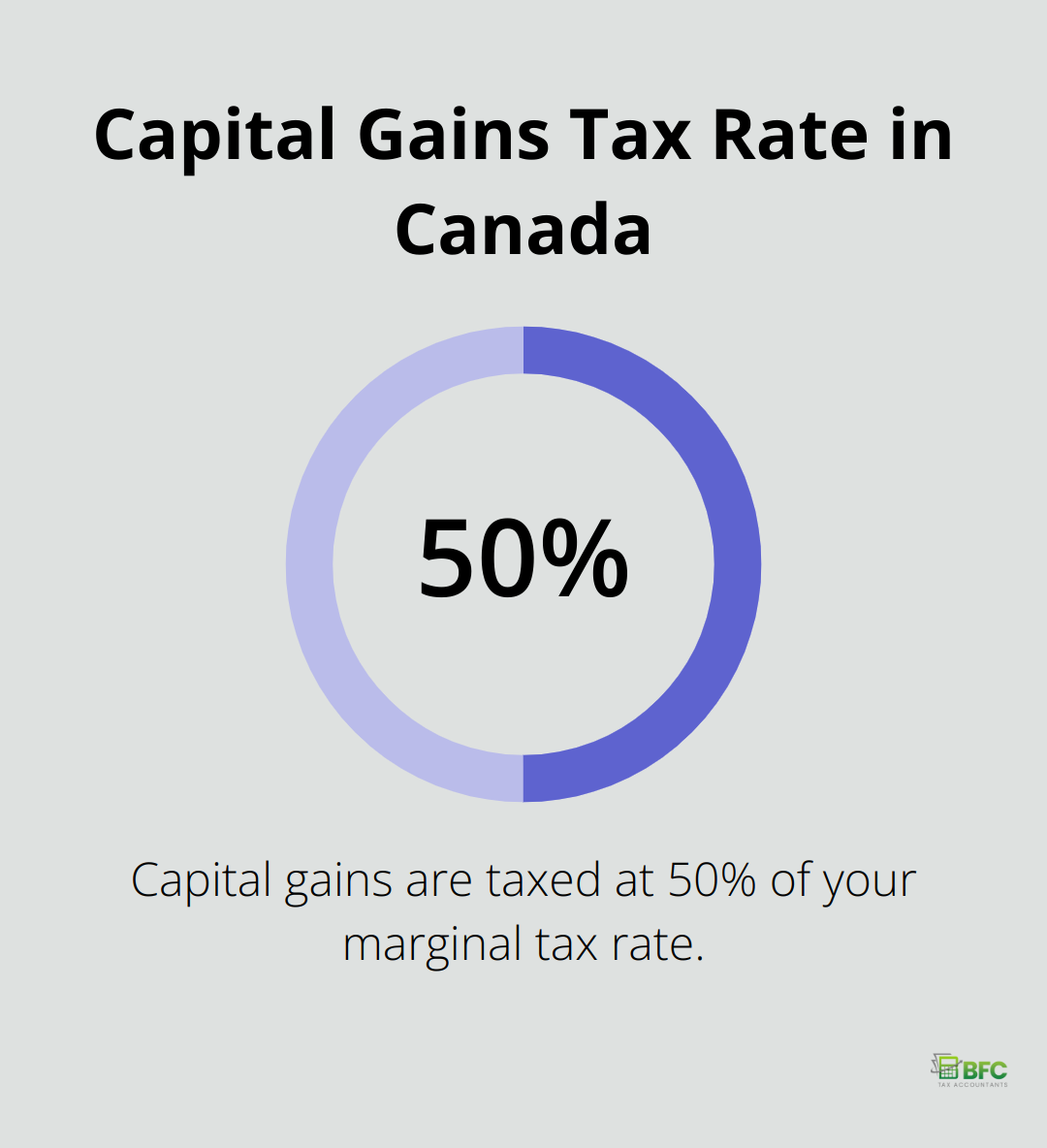

Capital gains are taxed at 50% of your marginal tax rate. To minimize the tax impact, consider selling investments with unrealized losses to offset gains. This strategy (known as tax-loss harvesting) can significantly reduce your tax liability.

Be aware of the superficial loss rule. If you repurchase the same or similar security within 30 days before or after the sale, the CRA may disallow the loss.

Retirement Income Planning

Effective retirement income planning can lead to substantial tax savings. Try converting a portion of your RRSP to a RRIF before age 71. This strategy allows you to take advantage of the pension income tax credit and potentially split income with your spouse.

Strategically withdraw from your TFSA and RRSP to help manage your tax bracket. TFSA withdrawals have no impact on income-tested benefits like OAS, nor do they limit entitlement to other government plans like the guaranteed income.

Professional Guidance

Timing your income and expenses requires a nuanced approach. A team of experts can help you navigate these strategies, ensuring you maximize your tax savings while remaining compliant with CRA regulations.

Final Thoughts

Personal tax planning empowers individuals to reduce their tax burden and increase wealth. The Canadian tax landscape changes frequently, which requires regular review and adjustment of tax strategies. Professional assistance often proves invaluable due to the complexities of the tax code.

A qualified tax accountant can provide tailored advice, identify overlooked opportunities, and ensure compliance with tax laws. Their expertise can lead to substantial savings and peace of mind. Effective tax planning integrates into your overall financial plan and continues throughout the year.

At BFC Tax Accountants, we offer personal tax planning strategies tailored to your unique financial situation. Our team in Barrie, Ontario, provides comprehensive tax services for individuals and businesses. We help you maximize tax savings while maintaining compliance with Canadian tax laws.