At BFC Tax Accountants, we understand that managing personal income tax can be a challenge for many Canadians. Reducing your tax burden is not just about saving money; it’s about making your hard-earned income work harder for you.

In this guide, we’ll explore effective strategies on how to reduce personal income tax in Canada. From maximizing RRSP contributions to optimizing your investment strategy, we’ll cover practical steps you can take to minimize your tax liability and keep more of your money.

How RRSP Contributions Can Lower Your Tax Bill

Understanding Your RRSP Contribution Limit

Registered Retirement Savings Plans (RRSPs) serve as powerful tools for reducing personal income tax in Canada. Your RRSP contribution limit typically equals 18% of your previous year’s earned income, up to a maximum of $31,560 for 2024. This limit appears on your most recent Notice of Assessment from the Canada Revenue Agency (CRA). Knowing this number helps you avoid over-contributing and incurring penalties.

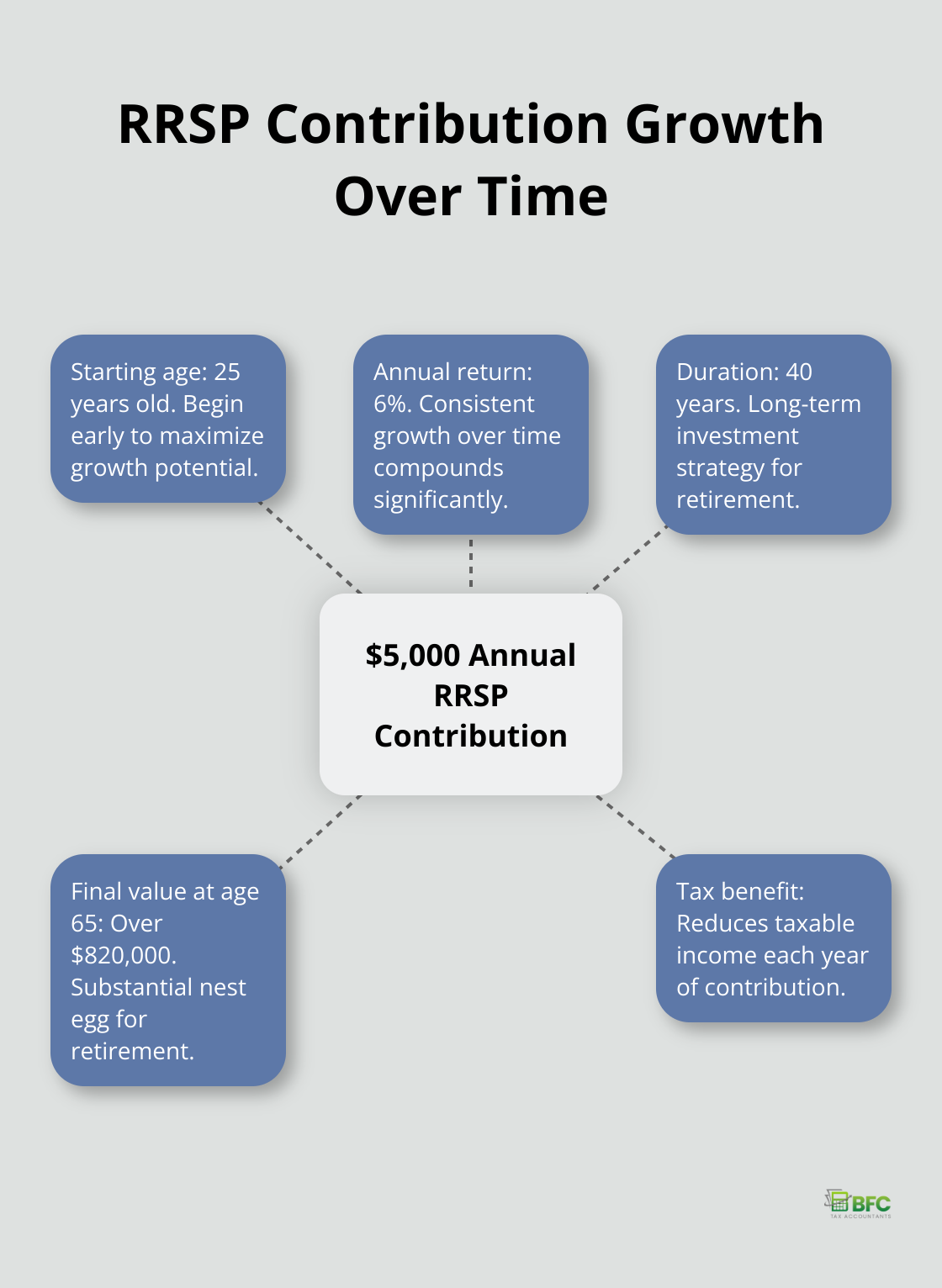

The Impact of Early and Regular Contributions

Starting RRSP contributions early in your career can significantly impact your tax savings and retirement nest egg. For instance, a $5,000 annual contribution starting at age 25 (assuming a 6% annual return) could grow to over $820,000 by age 65. This approach not only builds your retirement savings but also reduces your taxable income each year.

Strategies for Unused Contribution Room

If you haven’t maximized your RRSP contributions in previous years, you have unused contribution room that carries forward. This presents an opportunity for catch-up contributions. You can use tax refunds, bonuses, or set up automatic monthly contributions to take advantage of this unused room.

How RRSP Contributions Reduce Taxable Income

RRSP contributions are deducted from your income before taxes are calculated. For example, if you earn $80,000 and contribute $10,000 to your RRSP, you’ll only be taxed on $70,000. For someone in a 35% tax bracket, this could result in $3,500 in tax savings.

While RRSPs offer immediate tax benefits, you’ll pay taxes on withdrawals in retirement. However, most people fall into a lower tax bracket during retirement, resulting in overall tax savings.

Maximizing Your RRSP Benefits

To maximize your RRSP benefits, try to contribute the full amount allowed each year. If you can’t contribute the maximum, even small regular contributions can add up over time. Consider setting up automatic monthly transfers to your RRSP to make saving easier.

You should also review your RRSP investment strategy regularly. Diversifying your investments within your RRSP can help manage risk and potentially increase returns. As you approach retirement, you may want to shift to more conservative investments to protect your savings.

Now that we’ve covered how RRSP contributions can lower your current tax bill, let’s explore other tax credits and deductions that can further lower your personal income tax in Canada.

How to Maximize Tax Credits and Deductions in Canada

Leverage Common Tax Credits

The Canada Workers Benefit (CWB) offers substantial tax relief for low-income workers. In 2024, eligible individuals can receive up to $1,428, while families may qualify for up to $2,461. This refundable tax credit can reduce your tax liability or result in a refund.

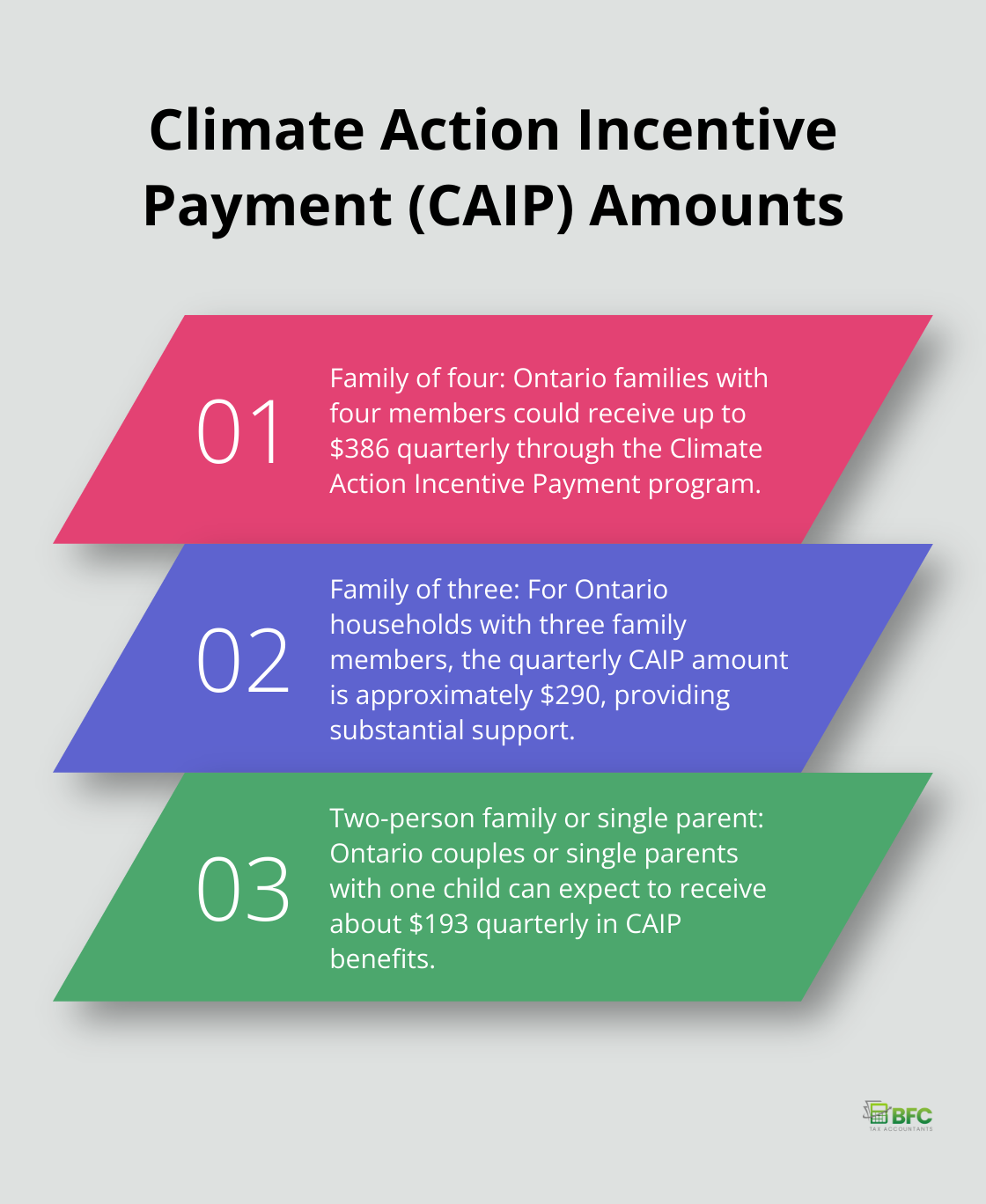

The Climate Action Incentive Payment (CAIP) is another valuable credit. For 2023-24, a family of four in Ontario could receive up to $386 quarterly. The amount varies by province and family size, so check your eligibility.

Uncover Often-Overlooked Deductions

Moving expenses often slip through the cracks. If you relocated at least 40 kilometres closer to work or school, you can deduct eligible moving expenses from your income earned at the new location. This includes transportation costs, temporary living expenses, and fees for selling your old home.

Home office expenses present another opportunity for tax savings. If you work from home, you may deduct a portion of your rent, utilities, and internet costs. For 2024, the simplified method allows a deduction of $2 per day worked from home (up to a maximum of $500).

Optimize Medical Expenses and Charitable Donations

Medical expenses can lead to significant tax reductions. You can claim eligible medical expenses that exceed the lesser of $2,635 or 3% of your net income for 2024. This encompasses prescription medications, dental procedures, and even travel expenses for medical treatment.

Charitable donations not only support causes you care about but also offer tax benefits. Donations over $200 provide a federal tax credit, with additional provincial credits. Consider bundling multiple years of donations into a single tax year to maximize this benefit.

Utilize Education-Related Credits

Students (or those supporting them) should not overlook education-related credits. The Tuition Tax Credit allows students to claim eligible tuition fees paid to qualifying educational institutions. While textbook and education amounts no longer exist at the federal level, some provinces still offer these credits.

For those repaying student loans, the Student Loan Interest Credit provides a non-refundable tax credit on the interest paid on qualifying student loans.

Tax laws change frequently, so it’s important to stay informed about the latest regulations. While these strategies can help reduce your tax burden, personalized advice proves invaluable for optimal results. Let’s explore how to optimize your investment strategy to further minimize your tax liability.

How to Invest Smarter and Pay Less Tax

Choose Tax-Efficient Investment Vehicles

Tax-Free Savings Accounts (TFSAs) offer powerful tax-free growth opportunities. In 2024, you can contribute up to $7,000 to your TFSA. Any investment gains within a TFSA remain completely tax-free, even upon withdrawal. This makes TFSAs ideal for high-growth investments.

For long-term savings, consider a Registered Education Savings Plan (RESP) if you’re saving for a child’s education. The government matches 20% of your contributions (up to $500 per year), and the investment grows tax-free until withdrawal.

Understand Tax Implications of Different Income Types

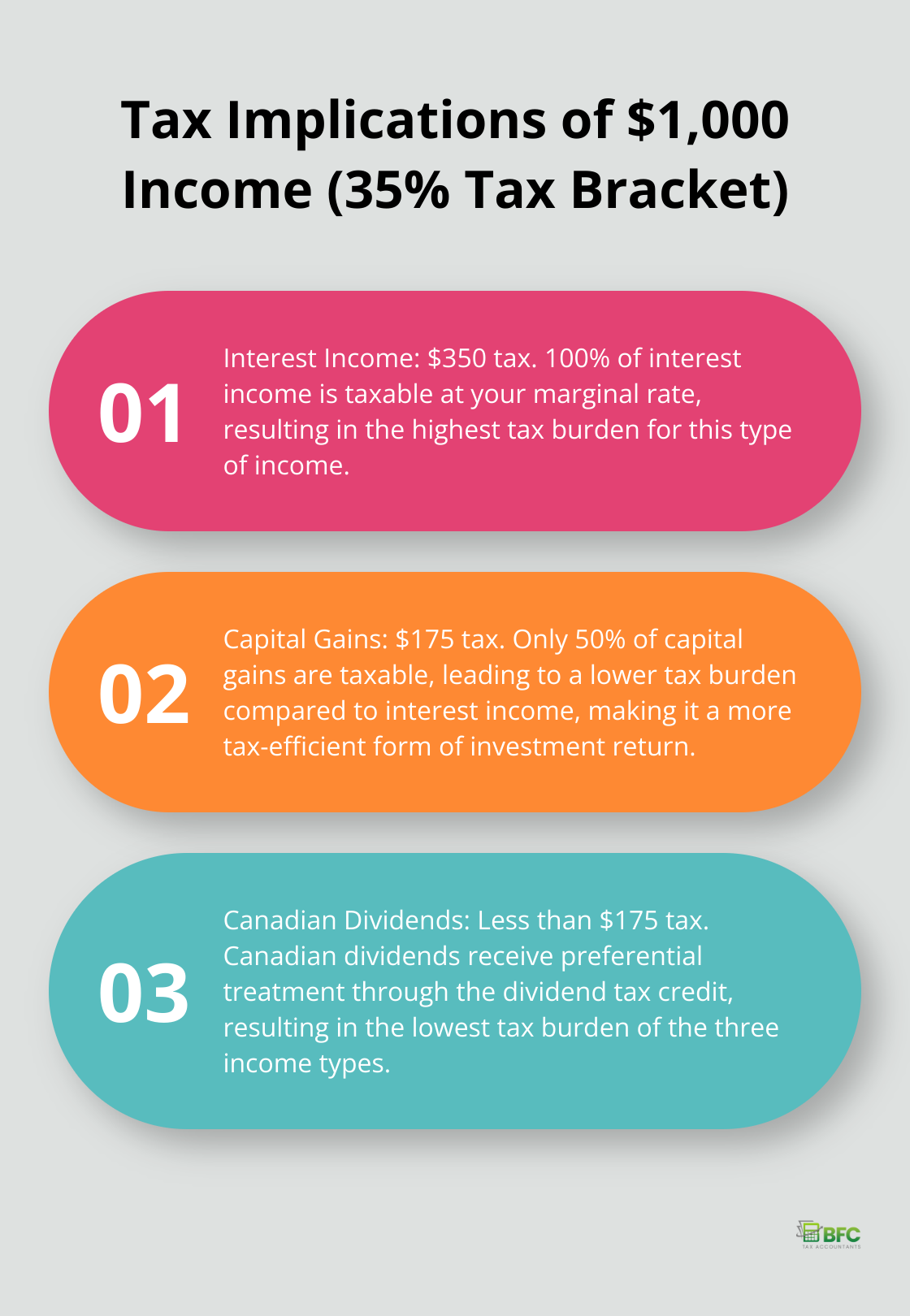

Canada taxes various investment incomes differently. Only 50% of capital gains are taxable, while 100% of interest income faces taxation at your marginal rate. Dividends from Canadian corporations receive preferential treatment through the dividend tax credit.

For example, if you’re in the 35% tax bracket, $1,000 of interest income results in $350 of tax. The same $1,000 in capital gains leads to only $175 in tax. Canadian dividends result in even less tax due to the dividend tax credit.

Leverage Tax-Loss Harvesting

Tax-loss harvesting involves selling investments that have decreased in value to offset capital gains elsewhere in your portfolio. This strategy can reduce your overall tax bill. Capital losses can be used to reduce capital gains in the current year, the three preceding years, or in any future year.

For instance, if you have $5,000 in capital gains and sell underperforming stocks for a $3,000 loss, you’ll only pay tax on $2,000 of gains. Be aware of the “superficial loss” rule, which prevents you from claiming a capital loss if you repurchase the same (or similar) security within 30 days.

Place Your Investments Strategically

The location of your investment’s matters. Try to keep high-growth investments in your TFSA where gains are tax-free. Hold interest-bearing investments in your RRSP where the income is tax deferred.

For non-registered accounts, consider holding Canadian dividend-paying stocks to take advantage of the dividend tax credit. Also, investments with a high turnover rate (frequently bought and sold) suit registered accounts better to avoid frequent taxable events.

Consult with a Professional

While these strategies can help reduce your tax burden, every investor’s situation is unique. A professional tax accountant (like those at BFC Tax Accountants) can provide personalized advice tailored to your specific financial situation and goals. They can help you navigate complex tax laws and maximize your tax savings through strategic investment planning.

Final Thoughts

Reducing personal income tax in Canada requires a comprehensive strategy. You can lower your taxable income by maximizing RRSP contributions and taking advantage of available tax credits and deductions. Smart investment strategies, including the use of TFSAs and strategic asset allocation, also play a key role in minimizing tax liabilities on your investment income.

Tax regulations change frequently, so you must stay informed about new opportunities for savings. Regular reviews of your financial situation and adjustments to your strategies can lead to significant tax savings over time. Working with a professional tax accountant can yield even greater benefits in your quest to reduce personal income tax in Canada.

BFC Tax Accountants specializes in personalized tax planning and preparation for individuals and businesses in Barrie, Ontario. Our expertise in Canadian tax laws allows us to provide tailored solutions that maximize your tax savings. Contact BFC Tax Accountants today for a personalized consultation and start optimizing your tax strategy.