At BFC Tax Accountants, we’ve witnessed a revolution in financial management practices. Modern bookkeeping services have transformed how businesses handle their finances, offering unprecedented efficiency and accuracy.

From cloud-based solutions to artificial intelligence, these advancements are reshaping the landscape of financial record-keeping. In this post, we’ll explore the latest innovations that are making bookkeeping more streamlined and insightful than ever before.

How Cloud Solutions Transform Bookkeeping

Cloud-based bookkeeping solutions have revolutionized financial management for businesses of all sizes. These platforms offer unprecedented accessibility and efficiency, transforming how companies handle their finances.

Real-Time Financial Insights

Cloud-based systems provide businesses with access to up-to-the-minute financial data from any location with an internet connection. This instant visibility enables quicker decision-making and more agile financial management.

Automation Streamlines Processes

Modern cloud solutions automate numerous tedious bookkeeping tasks. Bank feeds import transactions automatically, while machine learning algorithms categorize expenses with increasing accuracy over time. This automation significantly reduces manual data entry errors and saves time.

Enhanced Collaboration and Expertise

Cloud platforms facilitate seamless collaboration between businesses and their accountants or bookkeepers. This real-time sharing of financial data allows for more proactive financial advice and quicker problem-solving. Many businesses (including those served by Kyei Baffour) experience improved financial outcomes due to this enhanced collaboration.

Robust Security Measures

While some businesses may have initial concerns about cloud security, reputable cloud accounting platforms often provide stronger security measures than traditional on-premises solutions. These include encryption, multi-factor authentication, and regular backups.

Scalability and Flexibility

Cloud-based bookkeeping solutions offer unparalleled scalability and flexibility. As businesses grow, these systems can easily accommodate increased data volumes and more complex financial operations. This scalability (combined with the ability to access financial information from anywhere) makes cloud solutions particularly attractive for businesses with multiple locations or remote teams.

The transformative power of cloud-based bookkeeping extends beyond mere convenience. These solutions pave the way for more sophisticated financial management practices, setting the stage for the integration of artificial intelligence in bookkeeping processes.

AI Revolutionizes Bookkeeping

Artificial Intelligence (AI) transforms bookkeeping, making it smarter, faster, and more accurate. This technology reshapes financial management for businesses of all sizes, offering unprecedented efficiency and insights.

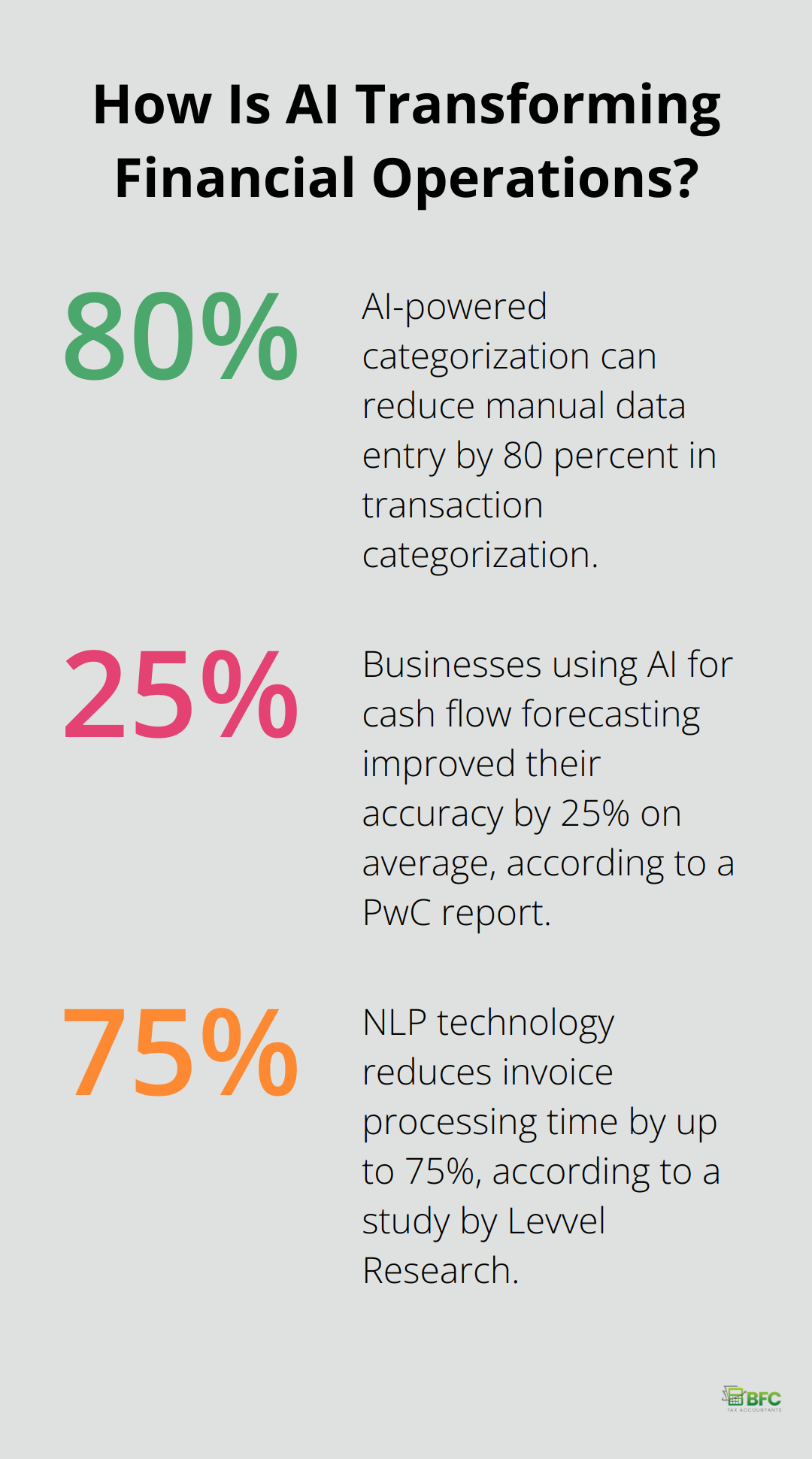

Smart Transaction Categorization

AI algorithms now categorize transactions with remarkable accuracy. This technology learns from historical data and user behavior, which reduces manual input and errors. A study found that AI-powered categorization can reduce manual data entry by 80 percent, while simplifying data amendments, streamlining checks and reducing the burden of risk and penalties by customs.

Predictive Cash Flow Management

AI’s ability to analyze vast amounts of data enables more accurate cash flow forecasting. By examining historical trends, seasonal patterns, and external factors, AI tools predict future cash positions with unprecedented precision. A report by PwC indicates that businesses using AI for cash flow forecasting improved their accuracy by 25% on average.

Fraud Detection and Prevention

AI excels at identifying unusual patterns that might indicate fraudulent activity. Machine learning algorithms analyze transactions in real-time, flagging suspicious activities for immediate review. The Association of Certified Fraud Examiners provides insights on the structure, priorities and performances of in-house fraud investigation teams, helping to assess operational effectiveness.

Streamlined Invoice Processing

Natural Language Processing (NLP), a branch of AI, revolutionizes invoice processing. NLP extracts key information from invoices, regardless of format or layout, and automatically inputs it into accounting systems. This technology reduces processing time by up to 75%, according to a study by Level Research.

As AI continues to evolve, its impact on bookkeeping will only grow. Businesses that embrace these technologies now will position themselves to thrive in an increasingly competitive landscape. The integration of AI with other business systems marks the next frontier in modern bookkeeping, promising even greater efficiencies and insights.

How Integration Boosts Bookkeeping Efficiency

Modern bookkeeping services no longer operate in isolation. They now integrate seamlessly with various business tools, creating a cohesive ecosystem that enhances efficiency and provides deeper insights. This integration transforms how businesses manage their finances and operations.

Streamlined Sales Data Management

Cloud-based POS systems integrate effortlessly with cloud-based accounting software, enabling real-time data sharing. This real-time data flow allows for more accurate and timely financial reporting.

Enhanced Customer Insights

The synergy between Customer Relationship Management (CRM) software and bookkeeping systems offers a holistic view of customer interactions and financial transactions. This integration enables businesses to track the profitability of individual customers or projects (a feature that many find invaluable for decision-making and targeted marketing strategies).

Optimized Inventory Control

Inventory management tools linked with bookkeeping software provide real-time updates on stock levels, costs, and sales trends. Integrated systems can improve cash flow management in the process.

Automated Payroll and Compliance

Payroll processing and reporting have become more streamlined through integration. Many software providers automate payroll entries, tax calculations, and compliance reporting. This integration reduces payroll processing time and minimizes compliance risks associated with manual errors.

Unified Data Ecosystem

The power of integrated systems extends beyond individual benefits. Businesses gain a more comprehensive understanding of their financial health and operational efficiency through a unified data ecosystem. This holistic view enables more strategic decision-making and positions companies for sustainable growth in an increasingly competitive landscape.

By leveraging these integrated bookkeeping services, businesses can significantly boost their efficiency and gain valuable insights for growth.

Final Thoughts

Modern bookkeeping services have transformed financial management for businesses of all sizes. Cloud-based solutions, AI-driven processes, and integrated systems now offer real-time access, automation, and enhanced collaboration. These advancements provide increased accuracy, improved efficiency, and valuable time savings, enabling quicker decision-making and freeing up resources for strategic tasks.

Businesses that adopt these innovative technologies gain a competitive edge in today’s fast-paced environment. They can adapt more quickly to market changes, make data-driven decisions, and focus on core activities rather than administrative tasks. The scalability of modern solutions supports business growth while enhanced security measures protect sensitive financial information.

BFC Tax Accountants offers comprehensive accounting and tax services tailored to individuals and businesses in Barrie, Ontario. We utilize cutting-edge technology to provide efficient, accurate, and insightful financial management solutions. Our team of experts can help you navigate the complexities of modern bookkeeping with confidence, ensuring your business remains compliant, efficient, and poised for growth.