Tax season can be overwhelming, but understanding personal tax deductions is key to maximizing your refund. At BFC Tax Accountants, we’ve compiled a comprehensive guide to help you navigate the world of tax deductions.

From common write-offs to often-overlooked opportunities, this post will shed light on the deductions you shouldn’t miss. We’ll also share practical tips to help you make the most of your eligible expenses and potentially reduce your tax burden.

Common Tax Deductions for Individuals

Personal tax deductions can significantly reduce your taxable income, potentially leading to a lower tax bill or a larger refund. Let’s explore some of the most common deductions that individuals often qualify for but may overlook.

Charitable Donations: Support Causes and Save on Taxes

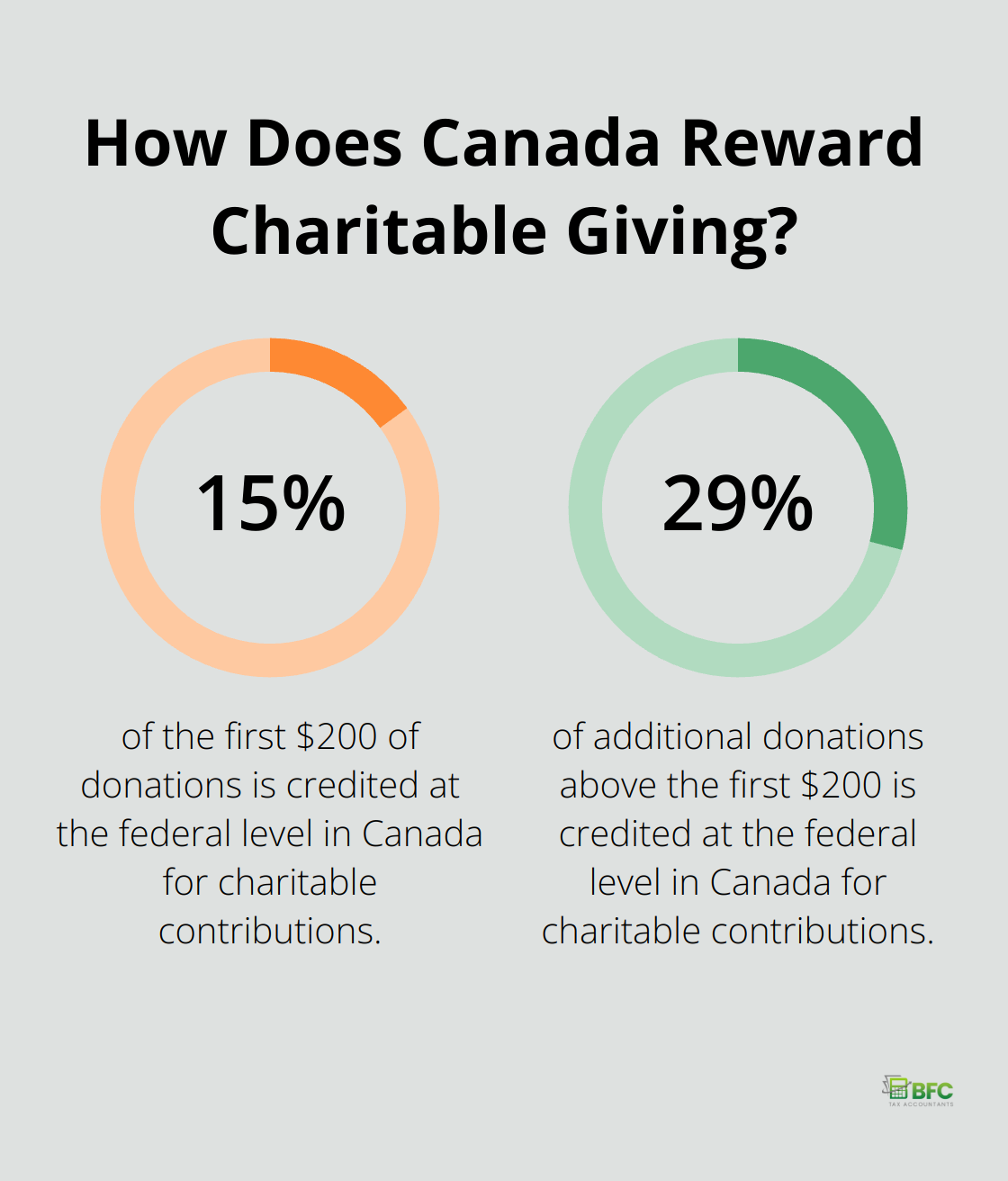

Donating to registered charities supports important causes and provides tax benefits. In Canada, generally, at the federal level, you are credited 15% of the first $200 of donations and 29% of additional donations above the first $200. The Canada Revenue Agency (CRA) requires documentation for claims, so keep all donation receipts.

Medical Expenses: Beyond Doctor Visits

Many Canadians underestimate the range of medical expenses they can claim. Eligible expenses include prescription medications, dental treatments, eyeglasses, and even travel expenses for medical care. You can claim medical expenses that exceed the lesser of 3% of your net income or $2,635 (for the 2023 tax year). Include expenses for your spouse and dependent children to maximize your claim.

RRSP Contributions: Future Savings, Present Tax Relief

Contributing to a Registered Retirement Savings Plan (RRSP) effectively reduces your taxable income. For 2024, the annual RRSP limit is $31,560. RRSP contributions lower your current tax bill and allow your investments to grow tax-free until withdrawal.

Home Office Expenses: Deductions for Remote Work

With remote work becoming more common, home office expenses have gained significance. If you’re self-employed or your employer requires you to work from home, you may qualify to deduct a portion of your home expenses. This can include rent, utilities, and maintenance costs proportional to your workspace. For employees, the CRA offers a simplified method allowing a claim of $2 per day worked from home (up to a maximum of $500).

Moving Expenses: Relocating for Work or Education

If you’ve moved at least 40 kilometers closer to a new work location or educational institution, you might qualify to deduct your moving expenses. Eligible costs include transportation, storage, temporary living expenses, and fees for selling your old home. These deductions can add up to substantial savings, especially for long-distance moves.

Proper documentation proves essential for all claims, so maintain detailed records throughout the year. As we transition to often overlooked deductions, you’ll discover even more opportunities to optimize your tax situation and potentially increase your refund.

Hidden Tax Deductions That Could Save You Money

Many Canadians miss out on valuable tax deductions simply because they don’t know about them. We’ve identified several often-overlooked deductions that could significantly reduce your tax bill. Let’s explore these hidden opportunities to keep more money in your pocket.

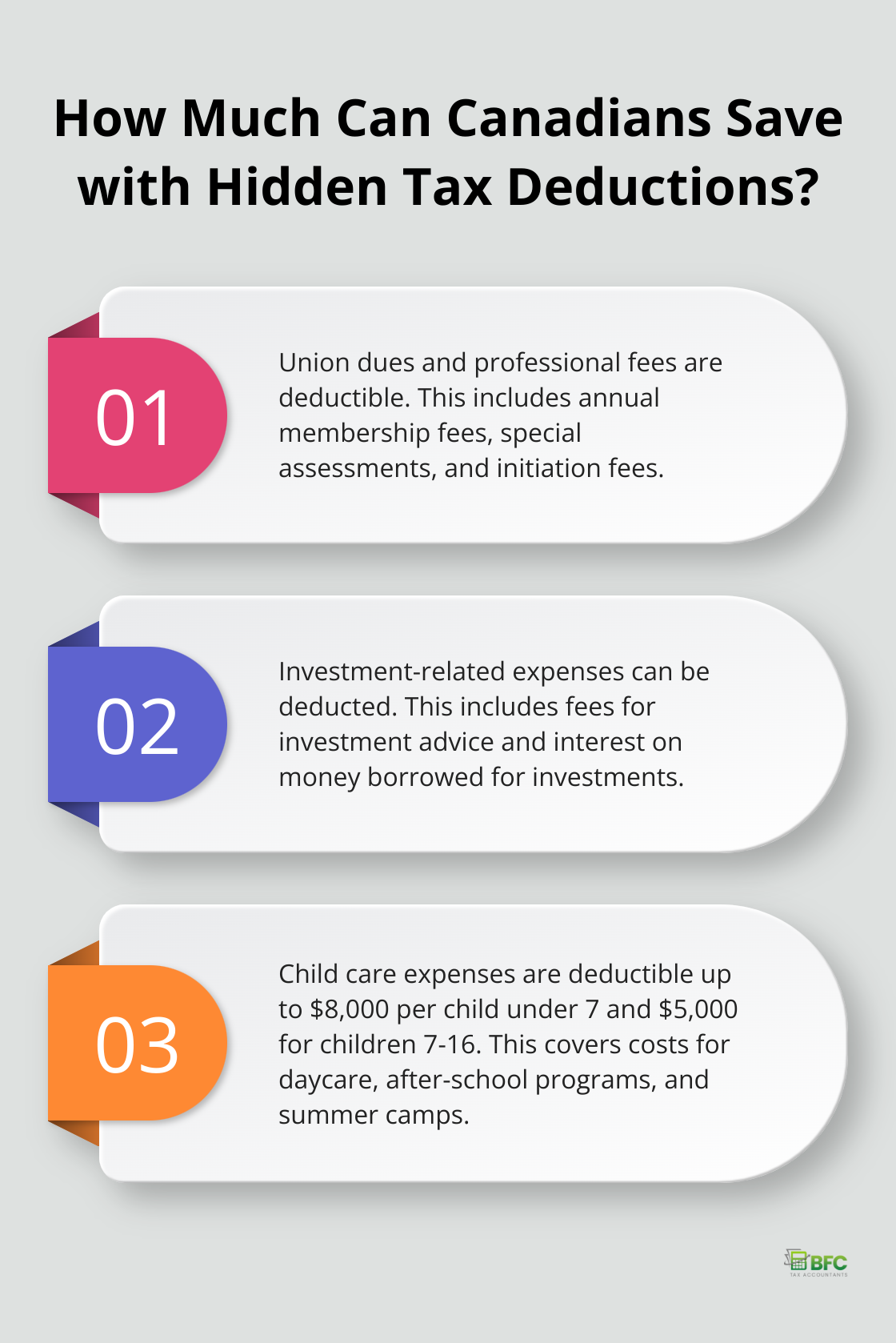

Union Dues and Professional Fees

Members of unions or professional organizations might qualify for a tax deduction. The Canada Revenue Agency allows claims for union dues and professional fees on tax returns. This includes annual membership fees, special assessments, and initiation fees. Some examples of business taxes that may be deductible are municipal taxes, land transfer taxes, gross receipt tax, health and education tax, and hospital tax. Keep your receipts or year-end statements as proof of payment.

Investment-Related Expenses

Investors often overlook deductions related to portfolio management. You can deduct interest and carrying charges incurred to earn income from securities, bonds and other Canadian or foreign investments, if they are earning income. This includes fees paid for investment advice, safety deposit box rentals (for storing investment-related documents), and interest paid on money borrowed for investment purposes.

Child Care Expenses

Working parents can claim significant deductions for childcare expenses. The maximum claim is $8,000 per child under 7 years old and $5,000 for children aged 7 to 16. This includes costs for daycare, after-school programs, and summer camps. Parents who claim these expenses could potentially save thousands on their tax bill.

Student Loan Interest

Repayment of government student loans allows for a tax credit on the interest paid. This applies to federal and provincial student loans (not to private loans or lines of credit). Claiming the interest on these loans can provide significant tax relief for recent graduates.

Public Transit Passes for Seniors

While the general public transit tax credit ended in 2017, seniors aged 65 and older can still claim a tax credit for public transit passes in some provinces. Ontario, for instance, offers a tax credit of up to $3,000 for seniors’ public transit expenses. This can result in substantial savings for seniors who rely on public transportation.

Navigating these lesser-known deductions can be challenging. That’s why professional tax planning services (like those offered by BFC Tax Accountants) can help ensure you take advantage of every eligible deduction. Tax experts stay up to date with the latest laws and regulations to maximize your savings. As we move forward, let’s explore how to make the most of these deductions and optimize your tax strategy.

How to Maximize Your Tax Deductions

Keep Detailed Records

Successful tax planning starts with thorough record-keeping. Create a system to track all potential deductible expenses throughout the year. Save receipts, bank statements, and documentation related to charitable donations, medical expenses, or business-related costs. Digital tools (like expense tracking apps) can simplify this process, making it easier to categorize and total your deductions when tax season arrives.

Time Your Expenses Strategically

The timing of expenses can impact your tax savings significantly. If you’re close to the threshold for medical expense deductions, schedule and pay for eligible procedures before year-end to exceed the limit. Make charitable donations or RRSP contributions just before the deadline for immediate tax benefits. However, don’t incur unnecessary expenses solely for tax purposes – optimize legitimate expenses you would incur anyway.

Use Technology for Precision

Tax software can enhance accuracy and efficiency in preparing your return. These programs often include built-in error checks and can highlight potential deductions you might have overlooked. They also update automatically with the latest tax laws, ensuring you work with current information. Remember that software is a tool, not a substitute for professional judgment, especially for complex tax situations.

Understand Eligibility Criteria

Familiarize yourself with the specific requirements for each deduction you plan to claim. Tax laws change frequently, and what qualified last year might not apply this year. Stay informed about new deductions or credits that may benefit your situation. This knowledge will help you make informed decisions throughout the year and avoid surprises when filing your taxes.

Seek Professional Advice

While self-preparation is possible, consulting with a tax professional can uncover additional savings opportunities. Tax experts stay current with the latest laws and regulations to maximize your deductions. They can provide personalized strategies based on your unique financial situation and help you navigate complex tax scenarios. Professional advice is particularly valuable if you’ve experienced significant life changes or have a complicated tax situation.

Final Thoughts

Personal tax deductions offer numerous opportunities to reduce your tax burden. You can maximize your savings through detailed record-keeping, strategic expense timing, and a thorough understanding of eligibility criteria. Tax regulations change frequently, so you must stay informed about new deductions or credits that may benefit your situation.

Self-preparation is possible, but working with a tax professional provides significant advantages. At BFC Tax Accountants, we offer expert guidance to help you navigate complex tax scenarios and uncover additional savings opportunities. Our team stays current with the latest laws to maximize your deductions and ensure compliance with Canadian tax laws.

Effective tax planning requires an ongoing, proactive approach throughout the year. You can optimize your financial situation and potentially increase your refund through organization and informed decision-making. Our personalized services can help you achieve your financial goals while taking advantage of all eligible personal tax deductions.