The personal tax filing deadline is approaching fast. At BFC Tax Accountants, we know how stressful this time can be for many Canadians.

Missing this crucial date can lead to penalties and interest charges. In this post, we’ll guide you through the essentials of meeting the deadline and what to do if you’re running late.

When Is the Tax Filing Deadline?

The Crucial Date for Canadian Taxpayers

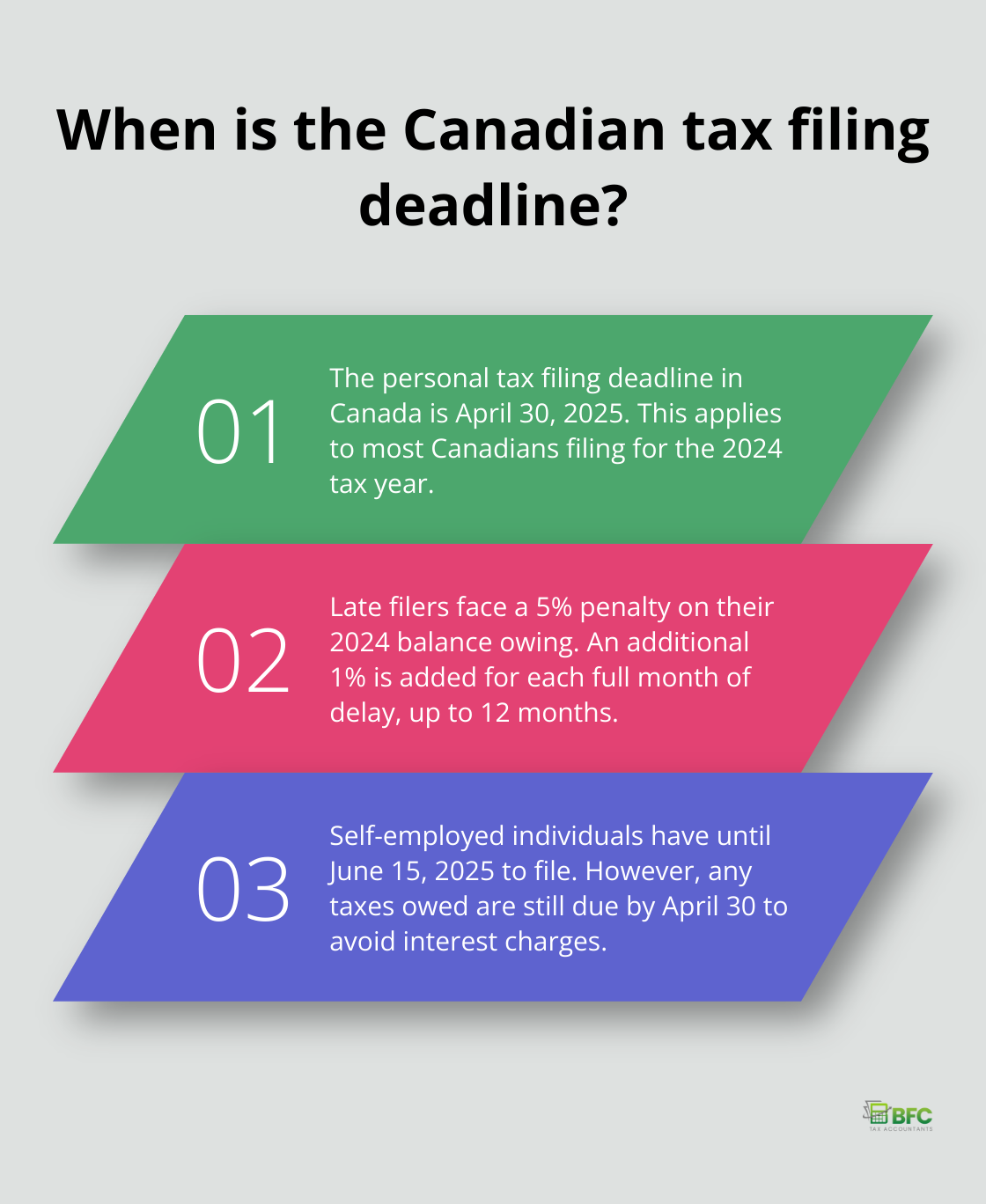

In Canada, the personal tax filing deadline stands as a significant date for every taxpayer. Most individuals must file their income tax return by April 30, 2025. This deadline applies to the majority of Canadians who need to file a tax return for the 2024 tax year.

Financial Repercussions of Late Filing

The Canada Revenue Agency (CRA) imposes strict penalties for missing the deadline. Late filers face a penalty of 5% of their 2024 balance owing, plus an additional 1% for each full month that they file after the due date, to a maximum of 12 months. The CRA also charges compound daily interest on both the unpaid tax amount and the penalties, starting from May 1, 2025.

Who Must File a Tax Return?

While not everyone needs to file a tax return, most Canadian residents do. You must file if you:

- Owe taxes

- Receive a request from the CRA to file

- Want to claim certain benefits or credits

Self-employed individuals and their spouses have until June 15, 2025, to file. However, any taxes owed are still due by April 30 to avoid interest charges.

Key Changes for the 2024 Tax Year

Several changes may affect your 2024 tax filing:

- The basic personal amount has increased to $15,705 (reducing the amount of income tax you pay)

- The maximum pensionable earnings under the Canada Pension Plan (CPP) have risen to $68,500

These changes could significantly impact your tax situation, making it essential to stay informed and prepare accordingly.

Early Preparation: The Key to Smooth Filing

At BFC Tax Accountants, we recommend starting your tax preparation early. This approach helps avoid the last-minute rush and potential errors that could delay your filing or result in an audit. Our team in Barrie, Ontario, stays current with all tax law changes to provide accurate and beneficial tax preparation services.

As we move forward, let’s explore some practical tips to help you meet the tax filing deadline and navigate the process with confidence.

How to Beat the Tax Filing Deadline

Start Early for a Stress-Free Process

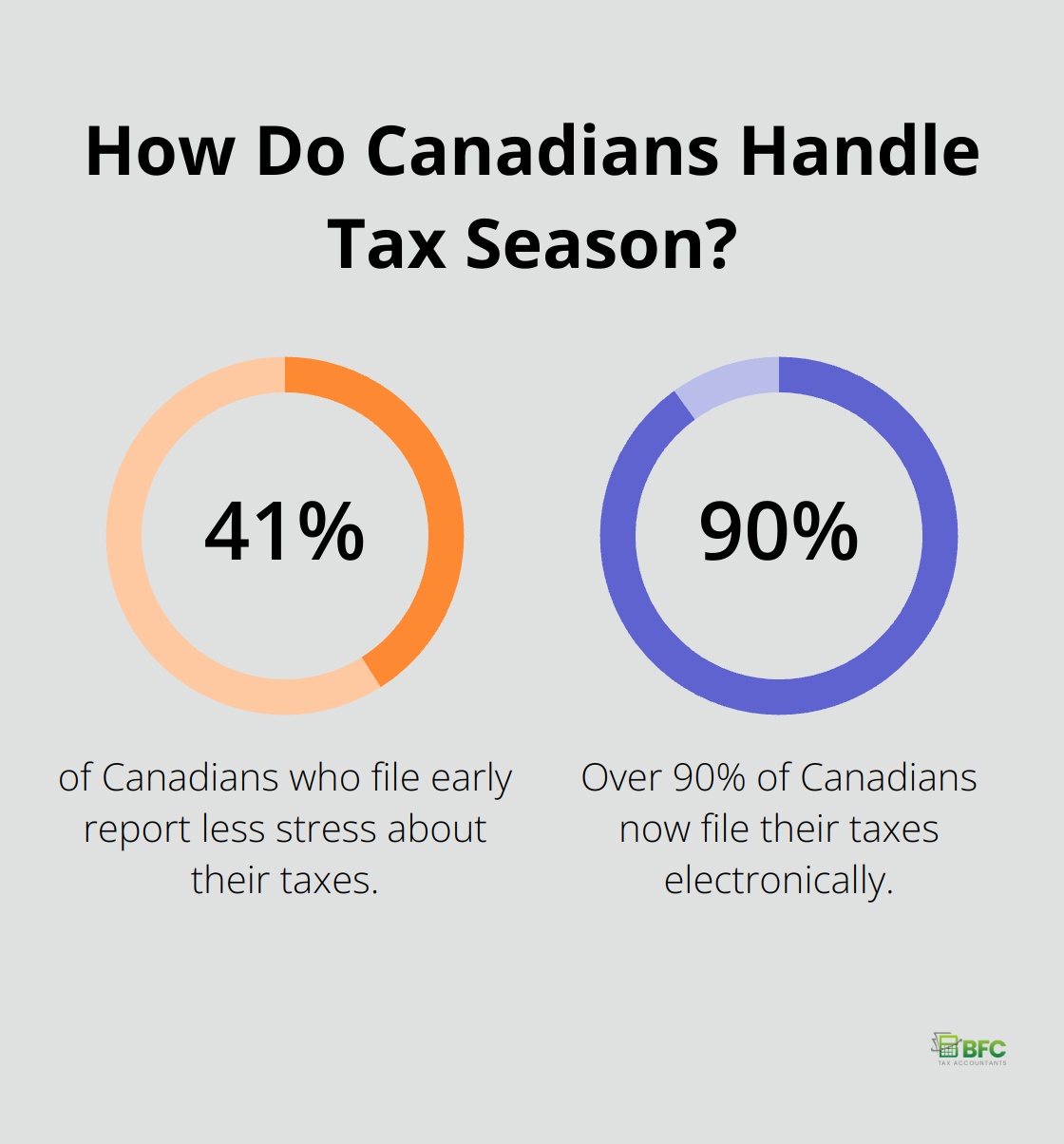

The key to a smooth tax filing process is early preparation. As soon as you receive your T4 slips and other tax documents, organize them. Create a dedicated folder for all tax-related paperwork, including receipts for charitable donations, medical expenses, and any other deductible items. A survey by H&R Block found that 41% of Canadians who file early report less stress about their taxes.

Use Technology to Your Advantage

Tax preparation software has transformed the filing process. These tools guide you through each step, which helps you avoid missing important deductions or credits. Many software options update automatically with the latest tax laws, which reduces the risk of errors. The Canada Revenue Agency reports that over 90% of Canadians now file their taxes electronically, which leads to faster processing times and quicker refunds.

Know When to Seek Professional Help

While software is helpful, complex tax situations may require professional assistance. If you’re self-employed, have multiple income sources, or have undergone significant life changes (like buying a home or starting a business), consider consulting a tax professional. At BFC Tax Accountants, we offer personalized tax planning services that can potentially save you money and prevent costly mistakes.

Opt for Electronic Filing

Electronic filing (NETFILE) is not only faster but also more secure than paper filing. If you file after March 21, 2025, generally, you can expect to get your CCR payment 6-8 weeks after your tax return has been assessed. Plus, you’ll receive immediate confirmation that your return has been received, which gives you peace of mind.

Stay Informed About Tax Law Changes

Tax laws and regulations change frequently. Stay up to date with the latest changes that might affect your filing. For example, the basic personal amount increased to $15,705 for the 2024 tax year, which reduces the amount of income tax you pay. Being aware of these changes can help you maximize your deductions and credits.

These strategies will position you well to meet the tax filing deadline with confidence. But what if, despite your best efforts, you find yourself unable to file on time? Let’s explore your options in such a scenario.

Missed the Deadline? Here’s What to Do

File Your Return Immediately

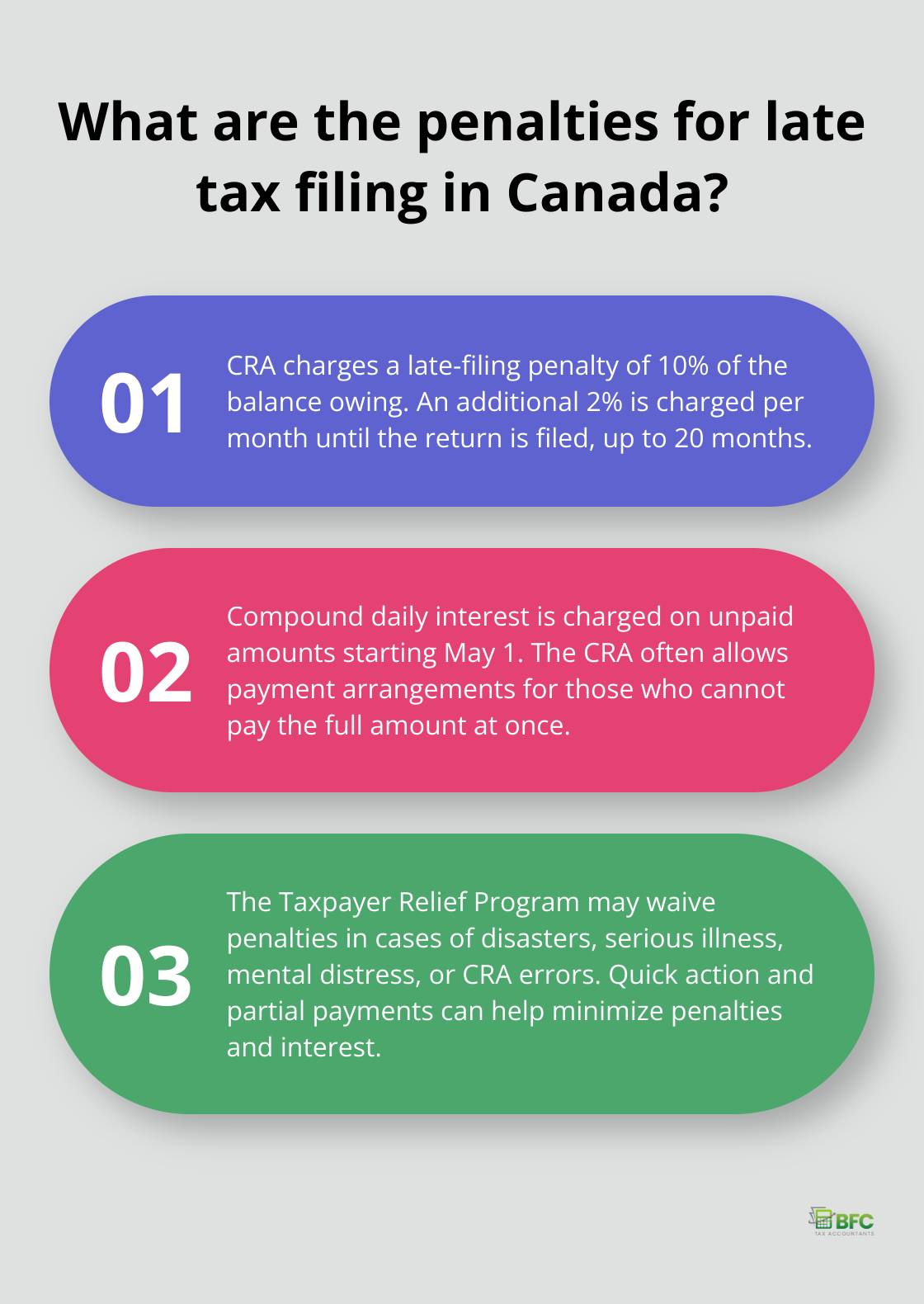

If you missed the previous year’s tax filing deadline, act quickly to minimize penalties. The Canada Revenue Agency (CRA) charges a subsequent late-filing penalty of 10% of your balance owing, plus 2% per month until the return is filed-to a maximum of 20 months. Quick action will stop these penalties from increasing.

Pay What You Can Now

Pay as much as you can, even if you can’t cover the full amount you owe. The CRA charges compound daily interest on any unpaid amounts starting May 1. Paying what you can now reduce the amount of interest that accumulates on your balance.

Request a Payment Arrangement

Contact the CRA to set up a payment arrangement if you can’t pay your entire tax bill at once. The CRA often works with taxpayers who show good faith. You might spread your payments over several months. Interest will continue to accrue on any unpaid balance, but you’ll avoid additional collection actions.

Check Your Eligibility for Penalty Relief

The CRA’s Taxpayer Relief Program may waive or cancel penalties and interest in certain circumstances, such as:

- Natural or human-made disasters

- Serious illness or accident

- Serious emotional or mental distress

- CRA errors or delays

Consider submitting a request for taxpayer relief if any of these apply to you. The process can be complex (professional guidance can be valuable here).

Prepare for Next Year

Start preparing for next year’s taxes early to avoid this situation in the future. Organize your financial documents throughout the year, set reminders for important tax dates, and consider using tax preparation software or professional services to ensure timely and accurate filing.

Final Thoughts

The personal tax filing deadline on April 30, 2025, marks a critical point for Canadian taxpayers. Timely and accurate filing prevents penalties and interest on unpaid balances. Early preparation, organization, and use of available resources will help you navigate tax season confidently.

Filing taxes offers more than meeting a deadline; it provides a chance to review your finances and claim valuable credits. Understanding the process and staying informed about tax law changes will optimize your tax situation. At BFC Tax Accountants, we offer comprehensive tax preparation services tailored to your individual needs.

Our team of experts in Barrie, Ontario, can help you meet the personal tax filing deadline and improve your financial outlook. We provide the expertise and support necessary to navigate the complexities of the Canadian tax system (from personal tax planning to corporate tax solutions). Don’t let tax season overwhelm you; let us transform it into an opportunity for financial growth and peace of mind.