At Kyei Baffour, we understand that every business has unique financial needs. Personalized bookkeeping & tax services offer tailored solutions that go beyond generic approaches.

These customized services can significantly impact your financial health, accuracy, and compliance. In this post, we’ll explore how personalized financial solutions can benefit your business and maximize your financial potential.

What Is Personalized Bookkeeping?

Tailoring Financial Records to Your Business

Personalized bookkeeping adapts financial record-keeping to the unique needs of each business. This customized method transforms financial management for clients. It starts with an in-depth analysis of business operations, revenue streams, expense categories, and industry-specific requirements. This analysis allows the creation of a chart of accounts that accurately reflects the business structure.

Different businesses require different focuses. A restaurant might need detailed inventory tracking for perishables, while a software company would prioritize subscription revenue recognition. Customizing these elements ensures that financial records provide meaningful insights for decision-making.

Improving Accuracy and Efficiency

Personalization significantly enhances the accuracy of financial data. When bookkeeping systems align with a business’s specific needs, it reduces errors in categorization and data entry. This precision proves invaluable during tax season or when seeking financing.

Efficiency gains stand out as another major benefit. AI-powered tools can now automate technical memo writing and answer complex questions for accountants, potentially saving time on financial tasks. This time savings allows more focus on core business activities and growth.

Accessing Real-Time Financial Insights

Personalized bookkeeping provides real-time access to financial data that matters most to a business. Custom dashboards and reports highlight key performance indicators specific to an industry and goals.

For example, a retail business might track daily sales, inventory turnover, and profit margins by product line. This level of detail (often unavailable in generic systems) enables quick adjustments to pricing, purchasing, or marketing strategies based on current data.

Streamlining Financial Processes

A tailored bookkeeping approach streamlines financial processes. It eliminates unnecessary steps and focuses on the most relevant tasks for a specific business. This streamlining can lead to faster month-end closings, more accurate forecasting, and improved cash flow management.

Personalized bookkeeping also adapts to a company’s growth. As a business expands, its financial needs evolve. A personalized system can scale and adjust to accommodate new revenue streams, additional locations, or changes in business structure.

The next chapter will explore how these personalized bookkeeping principles extend to tax services, offering even more benefits for businesses seeking to optimize their financial strategies.

Tailored Tax Strategies for Your Business

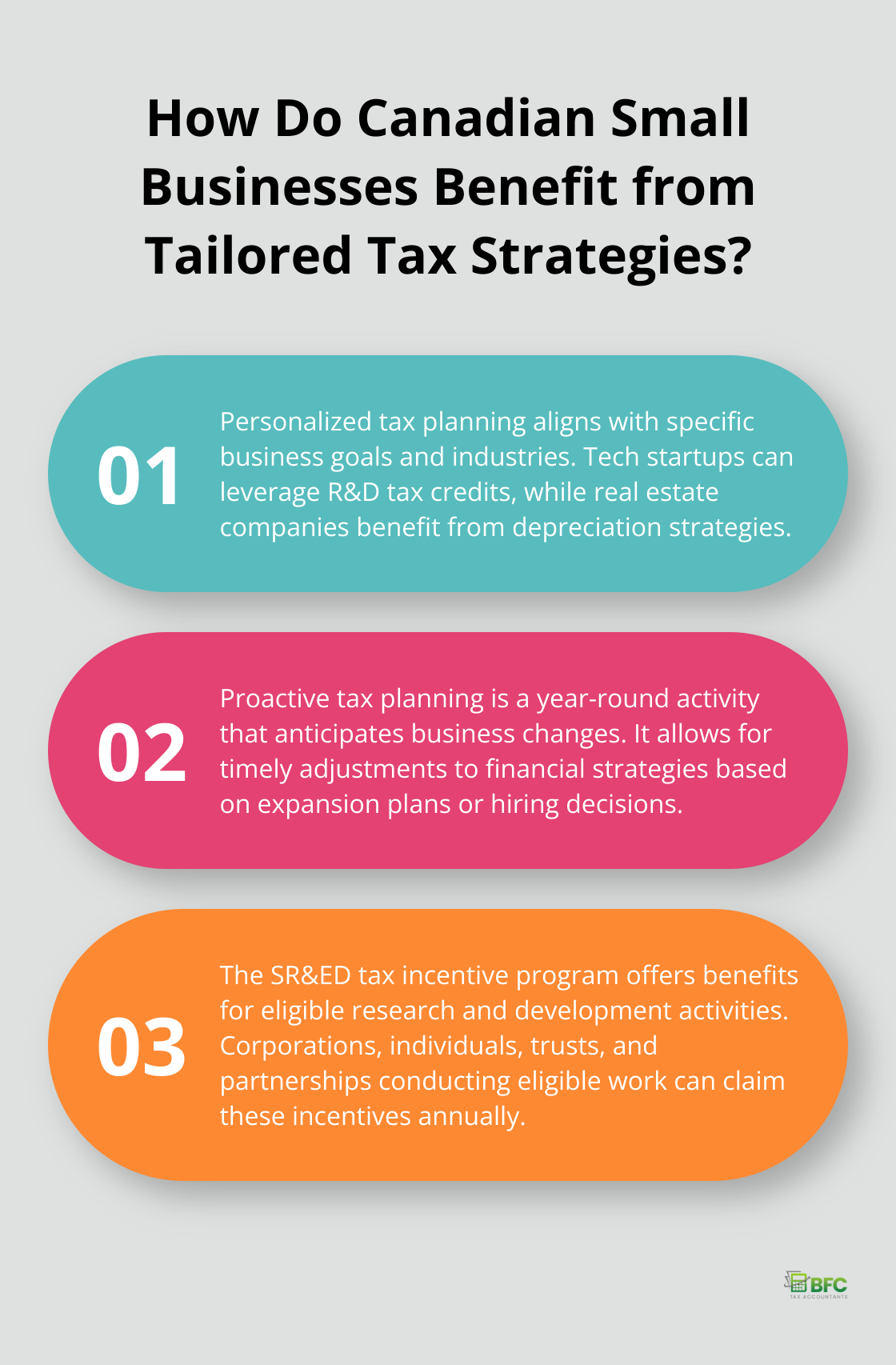

Aligning Tax Strategies with Business Goals

Generic tax advice often fails to address the unique challenges and opportunities your business faces. A tailored tax strategy considers your industry, growth plans, and financial objectives. Tech startups might benefit from R&D tax credits, while real estate companies could leverage depreciation strategies more effectively.

Personalized tax planning simplifies the process, ensuring you’re not just compliant, but strategically positioned for success. This approach delves into the fundamentals of Canadian taxation for small businesses, key tax strategies, record-keeping essentials, and other important considerations.

Proactive Planning for Tax Efficiency

Effective tax planning is a year-round activity, not a last-minute scramble. Proactive tax planning anticipates changes in your business and the tax landscape. This approach allows for timely adjustments to your financial strategies.

If you plan to expand your business, a customized tax plan might include strategies for optimal entity structure or advice on the tax implications of hiring new employees versus contractors.

Maximizing Deductions and Credits

One of the most significant advantages of personalized tax services is the ability to identify and maximize all available deductions and credits. The Canadian tax code offers numerous opportunities for businesses to reduce their tax burden, but these can be easily overlooked without expert guidance.

The Scientific Research and Experimental Development (SR&ED) tax incentive program allows corporations, individuals, trusts, and partnerships that conduct eligible work to claim SR&ED tax incentives for the year. This program can provide significant benefits to businesses engaged in research and development activities.

Strategic Timing of Income and Expenses

Customized tax strategies also consider the timing of income and expenses. Strategic decisions about when to make major purchases or recognize income can significantly impact your tax liability. This level of planning requires a deep understanding of your business’s cash flow and growth projections.

Navigating Complex Tax Laws

Tax laws are constantly evolving, and staying compliant can be challenging. Personalized tax services keep you informed about relevant changes and help you adapt your strategies accordingly. This proactive approach (which includes regular updates and consultations) minimizes the risk of costly mistakes and ensures you’re always prepared for potential audits.

As we move forward, let’s explore how to implement these personalized financial services effectively in your business operations.

How to Implement Personalized Financial Services

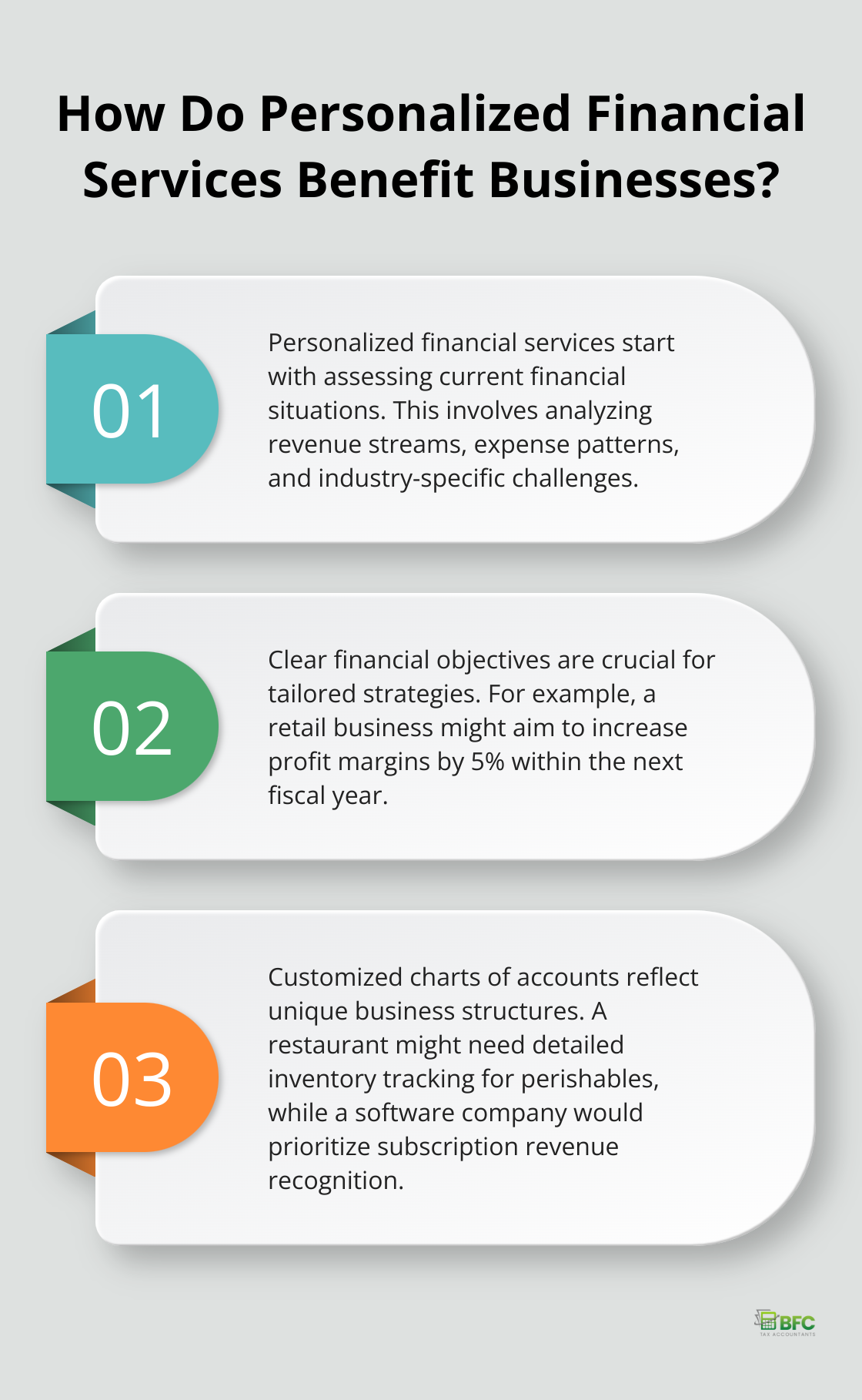

Assess Your Current Financial Situation

The implementation of personalized financial services starts with a thorough assessment of your current financial state. This step involves an analysis of your revenue streams, expense patterns, and industry-specific challenges. A clear understanding of your financial landscape forms the foundation for tailored solutions.

Set Clear Financial Objectives

Establish specific, measurable financial goals for your business. These objectives should align with your overall business strategy. A retail business might aim to increase profit margins by 5% within the next fiscal year. A tech startup could focus on optimizing its tax position to attract investors. Clear goals provide direction for your personalized financial strategy.

Select Appropriate Financial Tools

Choose financial tools that match your business processes and reporting needs. Personalized financial services often include intuitive dashboards and sophisticated forecasting tools, allowing businesses to create accurate financial plans, track progress, and modify strategies as needed. The right tools will streamline your financial processes and improve accuracy.

Customize Your Chart of Accounts

Create a chart of accounts that accurately reflects your business structure. This customization ensures that your financial records provide meaningful insights for decision-making. Different businesses require different focuses. A restaurant might need detailed inventory tracking for perishables, while a software company would prioritize subscription revenue recognition.

Establish Regular Financial Reviews

Schedule monthly or quarterly financial reviews to track progress towards your goals. These reviews should include analysis of key performance indicators (KPIs) specific to your industry and business model. A subscription-based business might focus on customer acquisition cost and lifetime value. A manufacturing company could prioritize inventory turnover and production efficiency metrics.

Adapt to Changes and Opportunities

Personalized financial services should evolve with your business. Regular reviews provide opportunities to address emerging financial challenges or capitalize on new opportunities. If your business experiences seasonal fluctuations, you might need to adjust your cash flow management strategies or explore short-term financing options during slower periods (always consult with a financial professional before making such decisions).

Final Thoughts

Personalized bookkeeping and tax services transform financial management for businesses of all sizes. These tailored solutions provide accuracy, efficiency, and insights that generic approaches cannot match. The benefits extend beyond record-keeping to proactive tax planning, strategic decision-making, and long-term fiscal health.

Businesses that use personalized financial solutions often improve cash flow management and forecasting accuracy. These services adapt to business growth, changing regulations, and market conditions, which aligns financial strategies with goals. Improved compliance and strategic tax planning can lead to significant savings and reduced risk of errors or audits.

BFC Tax Accountants offers personalized bookkeeping and tax services designed to address unique financial challenges. We provide expert guidance and support to navigate complex financial waters (from tax planning to efficient bookkeeping solutions). Take the first step towards optimizing your financial strategy and unlock your business’s full potential with our tailored approach.