At Kyei Baffour, we know how important it is to stay informed about personal tax brackets. As we approach 2025, understanding the upcoming changes in Canada’s tax system is crucial for effective financial planning.

This blog post will break down the federal, provincial, and territorial tax brackets for 2025, helping you navigate the complex world of Canadian taxation. We’ll also provide insights on how these changes might affect your bottom line and offer tips for maximizing your tax savings.

How Tax Brackets Work in Canada

The Foundation of Progressive Taxation

Canada’s progressive tax system forms the basis of how income tax is calculated. These brackets determine the amount of income tax you pay based on your earnings. Each bracket represents an income range taxed at a specific rate, which increases as your income grows.

The Mechanics of Tax Brackets

Canada’s tax system divides your income into portions, each taxed at the rate of its corresponding bracket. This approach ensures that higher earners contribute more in taxes while protecting lower-income individuals from excessive tax burdens. It strikes a balance between social responsibility and economic incentives.

The Importance of Knowing Your Tax Bracket

Understanding your tax bracket is essential for several reasons:

Real-World Applications

Tax bracket awareness can lead to substantial savings. Consider these scenarios:

- A retiree strategically withdraws from their RRSP over several years to remain in a lower tax bracket, resulting in thousands of dollars in tax savings.

- A small business owner adjusts their salary and dividend mix to optimize their overall tax position, tailoring their approach to their specific tax bracket.

These examples illustrate how understanding tax brackets can inform critical financial decisions, whether you’re planning for retirement, considering a career change, or managing a business.

As we move forward, let’s examine the specific federal tax brackets for 2025, which will provide a clearer picture of how these principles apply to your personal financial situation.

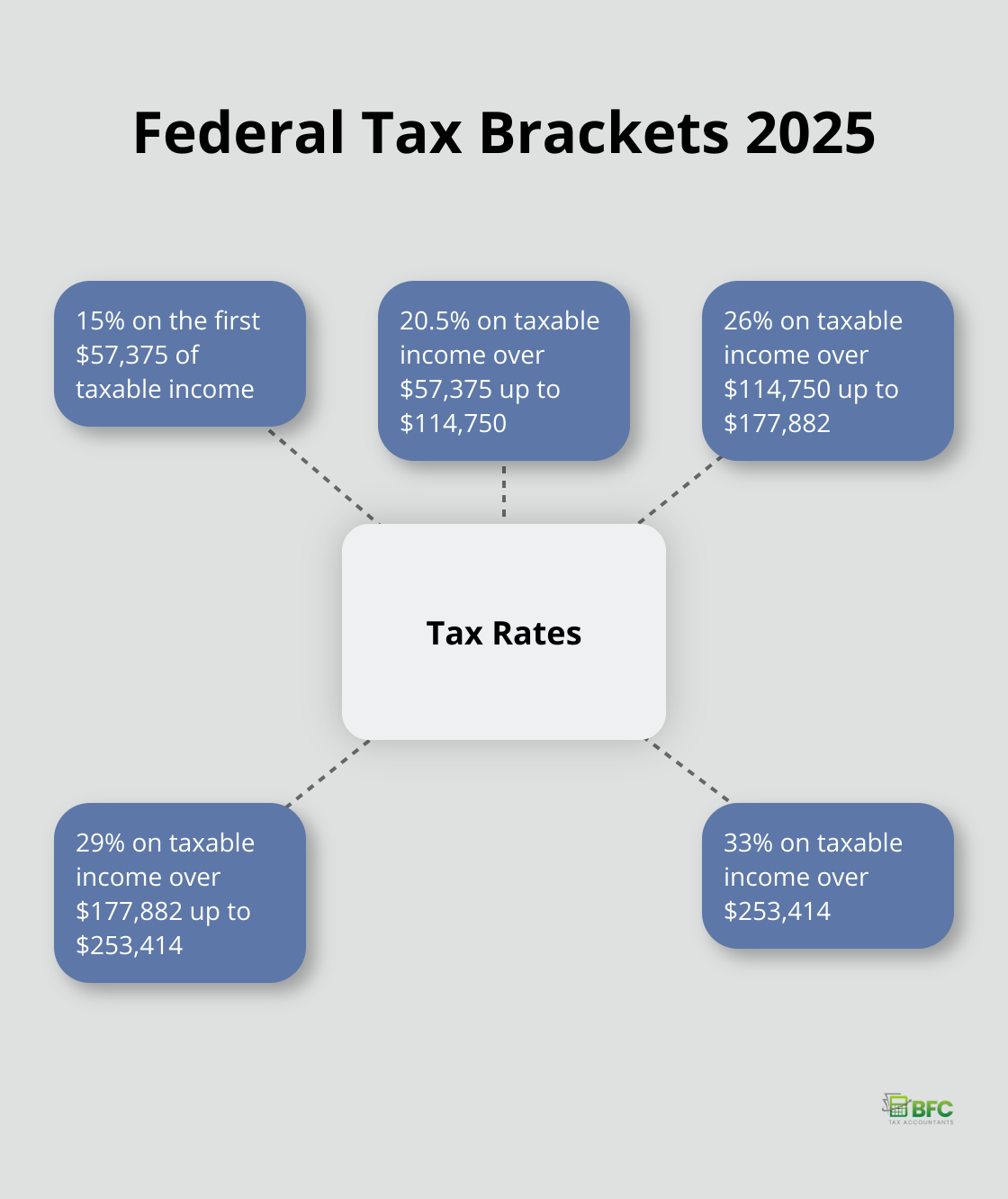

What Are the Federal Tax Brackets for 2025?

Updated Federal Tax Brackets

The federal tax brackets for 2025 have increased by 2.7%. This increase helps offset inflation’s effects on taxpayers’ income. Here’s a breakdown of the new brackets:

A proposal aims to reduce the lowest personal tax rate from 15% to 14%, effective July 1, 2025. This change would create an effective tax rate of 14.5% for the 2025 tax year on the first income bracket.

Key Changes from Previous Years

The basic personal amount has increased to $15,969 for 2025. This increase allows you to earn more before paying federal income tax.

The capital gains inclusion rate remains stable at 50% for 2025. This consistency provides continuity for investors and business owners as they plan their financial strategies.

Determining Your Federal Tax Bracket

To identify your federal tax bracket, you must calculate your taxable income. This includes all your income sources minus eligible deductions. Once you have this figure, you can match it against the brackets listed above.

Canada uses a progressive tax system. This means you don’t pay the highest rate on all your income, only on the portion that falls within each bracket.

For example, if your taxable income is $60,000, you’ll pay:

- 15% on the first $57,375 ($8,606.25)

- 20.5% on the remaining $2,625 ($538.13)

This system ensures a gradual increase in tax rates as income rises.

Impact on Your Tax Planning

Understanding these federal tax brackets forms the foundation of effective tax planning. However, it’s just the first step. Provincial and territorial tax rates, along with various credits and deductions, also play significant roles in determining your final tax bill.

To get a more accurate estimate of your tax liability, try using a tax calculator (many are available online). These tools can help you understand how different income levels and deductions affect your overall tax picture.

As we move forward, let’s examine how provincial and territorial tax brackets interact with these federal rates to create your total tax obligation for 2025.

How Do Provincial Tax Brackets Affect Your Total Tax Bill?

The Dual Nature of Canadian Taxation

Canada’s tax system combines federal and provincial/territorial rates. Federal tax brackets apply uniformly across the country, but each province and territory sets its own rates and brackets. This dual system creates significant variations in the total tax burden based on location.

Provincial Tax Rate Variations

Provincial tax rates differ substantially across Canada. Quebec residents face some of the highest provincial rates, with a top marginal rate of 25.75% on income over $112,655. Alberta, in contrast, maintains a flat tax rate of 10% for all income levels.

Ontario employs a progressive tax system with rates from 5.05% to 13.16%. British Columbia’s rates start at 5.06% and increase to 20.50% for high earners.

These variations mean two individuals with identical incomes could have significantly different tax bills based solely on their province of residence. For example, a person earning $100,000 in Alberta would pay less in provincial taxes than someone with the same income in Ontario or British Columbia.

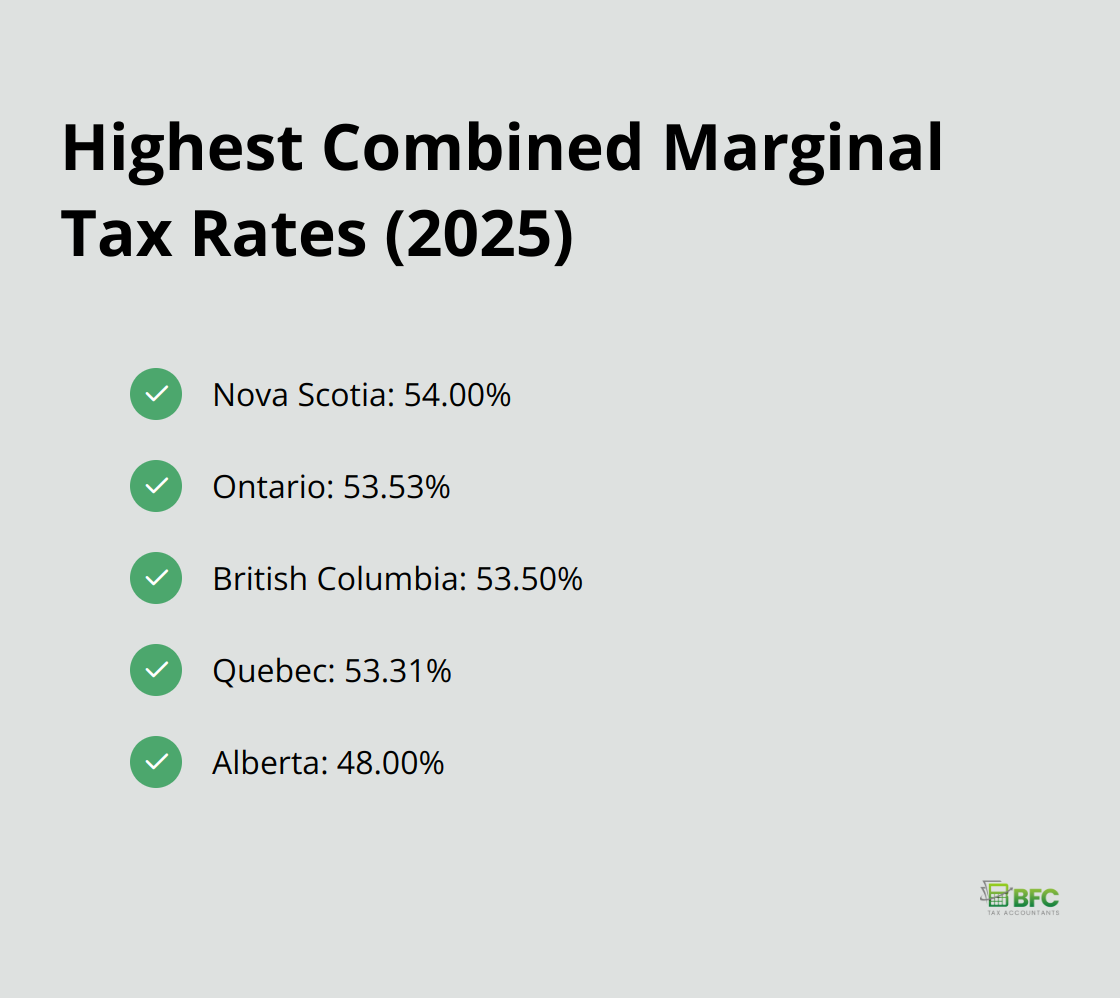

Combined Federal and Provincial Tax Rates

To understand your true tax obligation, you must consider the combined federal and provincial rates. Here’s a snapshot of the highest combined marginal tax rates for some provinces in 2025:

These figures illustrate the substantial impact of provincial tax policies on your overall tax burden. High-income earners in Nova Scotia, for instance, face a notably higher tax rate than their counterparts in Alberta.

Tax Planning Across Provinces

Understanding these provincial differences is essential for effective tax planning, especially if you consider relocating or have income sources in multiple provinces. Here are some key considerations:

- Income Splitting: If you’re part of a couple with significantly different incomes, a move to a province with a flatter tax structure might result in tax savings.

- Retirement Planning: Retirees might benefit from living in provinces with lower tax rates or more generous credits for seniors.

- Business Location: For business owners, the location of your company can impact both corporate and personal tax liabilities.

- Investment Income: Some provinces offer more favourable treatment of certain types of investment income (which could influence your investment strategy).

These provincial tax differences can help you make more informed financial choices and potentially save thousands in taxes over time. However, tax considerations shouldn’t be the sole factor in major life decisions like where to live or work.

Final Thoughts

Personal tax brackets for 2025 reflect Canada’s progressive tax system. The federal brackets have increased by 2.7%, adjusting for inflation and maintaining fairness across income levels. Provincial variations add complexity but also create opportunities for strategic financial planning.

Tax bracket knowledge serves as a practical tool for managing finances and making informed decisions about income, investments, and residence. The interplay between federal and provincial rates can significantly impact your overall tax burden. It involves a comprehensive understanding of credits, deductions, and how various income sources are taxed.

At BFC Tax Accountants, we help individuals and businesses maximize their tax savings while ensuring compliance with Canadian tax laws. Our expertise in personal and corporate tax planning, coupled with our understanding of local tax implications in Barrie, Ontario, allows us to provide tailored solutions for your unique financial situation. We offer the tools and knowledge to help you navigate the 2025 tax brackets and beyond.