At Kyei Baffour, we understand that knowing when personal income taxes are due is crucial for every Canadian taxpayer. The deadline for filing taxes can vary depending on your circumstances and missing it can lead to penalties and interest charges.

In this post, we’ll break down the standard tax filing deadlines, explore exceptions, and discuss the consequences of late filing. We’ll also share how our team can help you navigate the tax season with ease.

When Is Tax Day in Canada?

Standard Filing Deadline: April 30th

In Canada, the standard tax filing deadline is April 30th. This date marks the end of the tax season for most Canadian taxpayers. The Canada Revenue Agency (CRA) sets this deadline to ensure a uniform and organized process for collecting and processing tax returns across the country.

Rationale Behind April 30th

The CRA chose April 30th as the tax filing deadline for several reasons:

- It aligns with the end of the fiscal year for many businesses.

- It provides sufficient time for taxpayers to gather necessary documents.

- It allows a buffer after the RRSP contribution deadline (March 1st), giving Canadians time to factor in these contributions.

Weekend Adjustments

When April 30th falls on a weekend, the CRA typically extends the deadline to the next business day. For example, if April 30th is a Saturday or Sunday, the filing deadline moves to the following Monday. This extension ensures taxpayers have access to banking services and postal facilities to complete their filings and payments.

Early Preparation Benefits

Starting tax preparation well before the deadline offers several advantages:

- Reduced stress and rushed decisions

- More time to gather necessary documents (T4 slips, investment income statements, receipts for deductions)

- Opportunity to seek professional advice if needed

Many taxpayers find that organizing tax information throughout the year makes the April rush more manageable.

Electronic Filing Advantages

The CRA encourages electronic filing, which often results in faster processing times and quicker refunds. E-filed returns are typically processed within two weeks, compared to up to eight weeks for paper returns. This efficiency can be particularly beneficial for those expecting a refund.

While April 30th is the general deadline, specific circumstances may alter your filing date. Self-employed individuals (and their spouses) have until June 15th to file their returns. However, any taxes owed are still due by April 30th to avoid interest charges. These exceptions lead us to our next topic: the various scenarios that might affect your personal tax filing deadline.

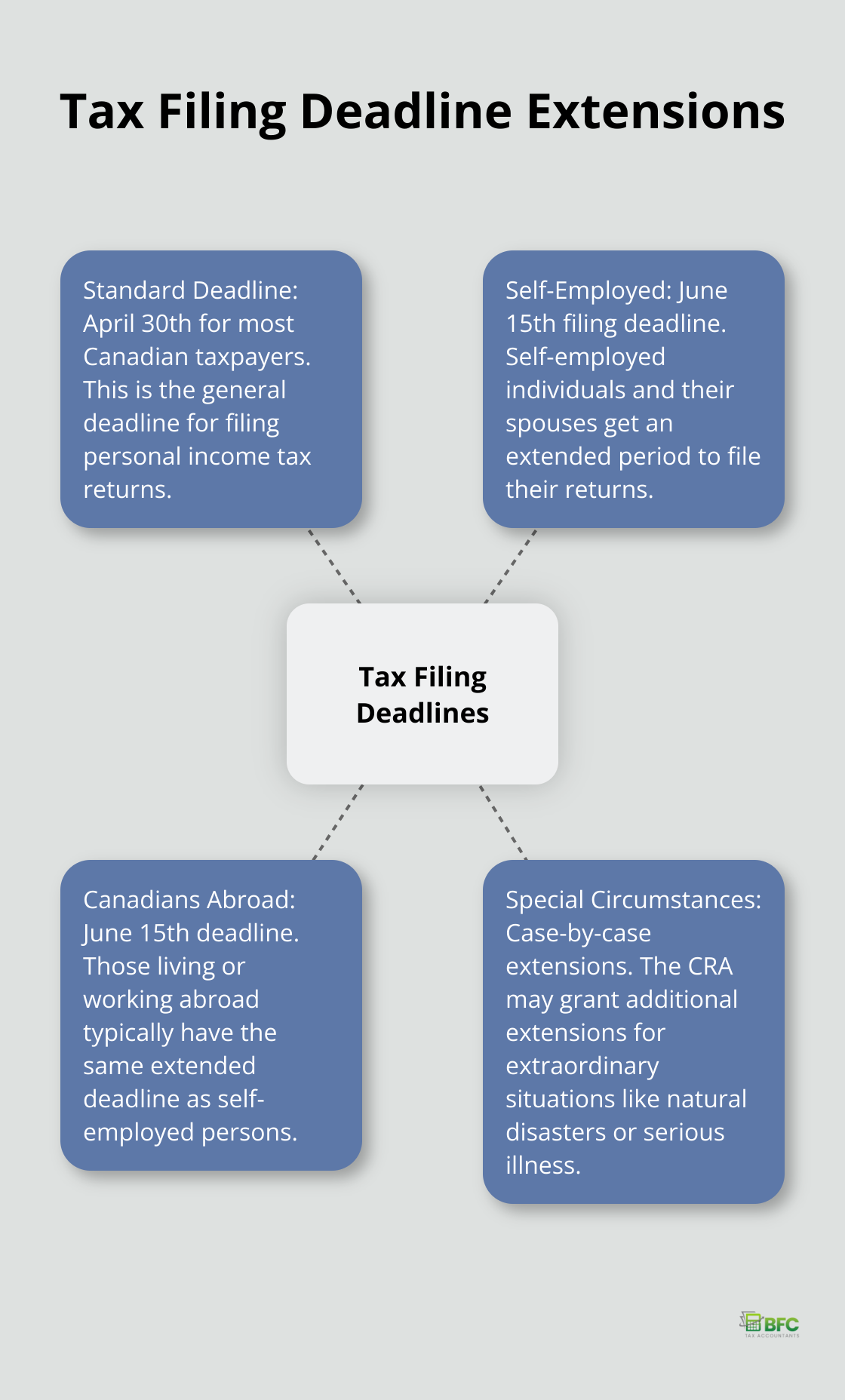

Who Gets Extra Time to File Taxes?

Self-Employed Individuals

Self-employed Canadians receive an extended filing deadline of June 15th. This extension acknowledges the complexity of calculating income and expenses for self-employed individuals. However, any taxes owed must still be paid by April 30th to avoid interest charges.

Canadians Living Abroad

Canadians who live or work abroad may still have to pay Canadian and provincial or territorial income taxes if they maintain residential ties to Canada. The Canada Revenue Agency (CRA) typically grants these individuals the same June 15th deadline as self-employed persons. Specific rules apply based on the taxpayer’s status and country of residence.

Special Circumstances

The CRA may grant additional extensions due to extraordinary circumstances. These situations include:

- Natural disasters

- Serious illness

- Significant life events that prevent timely filing

Taxpayers who believe they qualify for such an extension should contact the CRA as soon as possible.

Late Filing Penalties

Despite these extensions, it’s important to note that late filing penalties still apply if taxes owed are not paid by April 30th. The CRA imposes a penalty of 5% of the balance owing, plus 1% for each full month the return is late (up to a maximum of 12 months).

Professional Assistance

Tax professionals can help navigate these deadlines and extensions. They ensure clients receive fair treatment and avoid unnecessary penalties. Their expertise is particularly valuable for those with complex tax situations or those facing extraordinary circumstances.

The next chapter will explore the consequences of missing tax filing deadlines in more detail, including the impact on government benefits and credits.

What Happens If You Miss the Tax Filing Deadline?

Late-Filing Penalties

The Canada Revenue Agency (CRA) imposes strict penalties on late filers who owe taxes. These penalties start at 5% of your 2024 balance owing, plus an additional 1% for each full month that you file after the due date, to a maximum of 12 months. Repeat offenders face even harsher consequences. If the CRA has charged you a late-filing penalty in any of the three previous tax years, your penalties for the current year might double.

Interest Charges on Unpaid Taxes

The CRA doesn’t stop at penalties. They also charge compound daily interest on any unpaid tax amounts starting from May 1st. The interest rate, which the CRA sets quarterly, can fluctuate. As of 2025, individuals face an interest rate of 8% on overdue taxes. This means that even a small tax debt can balloon significantly over time if left unpaid.

Impact on Government Benefits and Credits

Late filing can jeopardize your eligibility for various government benefits and credits. Many programs (such as the Canada Child Benefit, the GST/HST credit, and certain provincial benefits) use your tax return information to determine your eligibility and payment amounts. Filing late might result in delays or interruptions in receiving these benefits.

For instance, if you qualify for the Canada Child Benefit, late filing could lead to a temporary suspension of your payments until the CRA processes your return. This can cause significant financial stress, especially for families who depend on these benefits for everyday expenses.

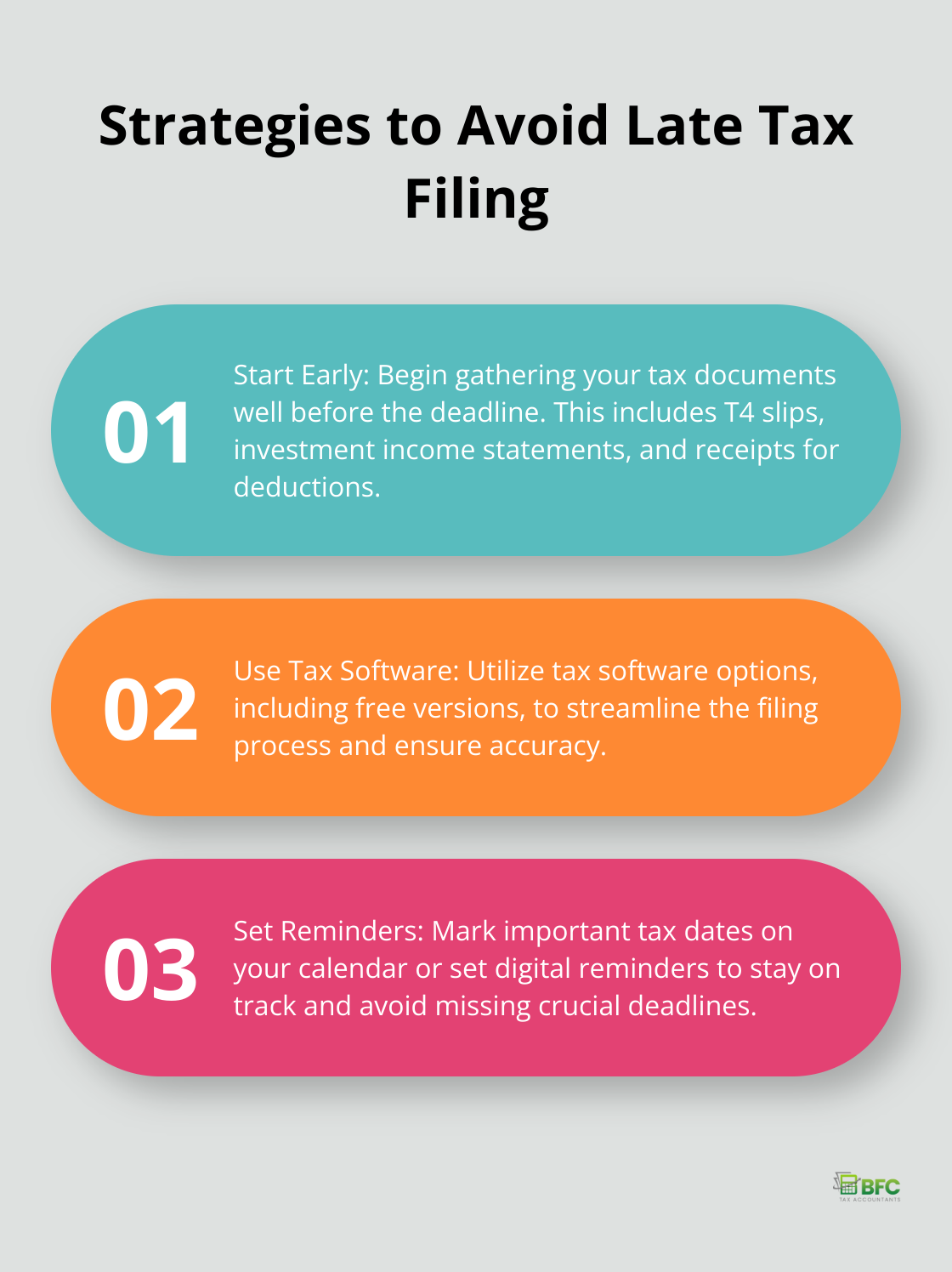

Strategies to Avoid Late Filing

- Start Early: Begin gathering your tax documents (T4 slips, investment income statements, receipts for deductions) well before the deadline.

- Use Tax Software: Many tax software options (including some free versions) can streamline the filing process.

- Set Reminders: Mark important tax dates on your calendar or set digital reminders to stay on track.

- File Even If You Can’t Pay: If you can’t pay the full amount owed, file your return on time anyway. This will help you avoid late-filing penalties (though interest may still accrue on the unpaid balance).

- Seek Professional Help: If your tax situation is complex, consider hiring a professional accountant. They can ensure accurate filing and help you maximize your deductions and credits.

Final Thoughts

Understanding when personal income taxes are due helps Canadian taxpayers avoid penalties and maintain financial health. The standard deadline of April 30th applies to most individuals, while self-employed Canadians must file by June 15th. Taxes owed must be paid by April 30th to avoid interest charges, regardless of filing deadline.

Timely filing prevents costly penalties and ensures uninterrupted access to government benefits. Early preparation allows taxpayers to take advantage of all available deductions and credits, potentially reducing their tax burden. At Kyei Baffour, we understand the complexities of the Canadian tax system and the importance of meeting these deadlines.

Our team of expert accountants at BFC Tax Accountants can help you navigate tax season with ease. We offer comprehensive tax preparation and filing services, ensuring accuracy and maximizing your returns. Don’t let the question of when personal income taxes are due cause you stress; with BFC Tax Accountants, you can approach tax season with confidence.