Tax season is approaching, and it’s time to mark your calendars. The personal tax due date for 2025 is a crucial deadline for all taxpayers.

At BFC Tax Accountants, we’re here to guide you through the filing process and help you avoid costly penalties. This post will cover key dates, preparation tips, and the consequences of missing the deadline.

When Are Personal Tax Returns Due in 2025?

General Deadline for Personal Tax Returns

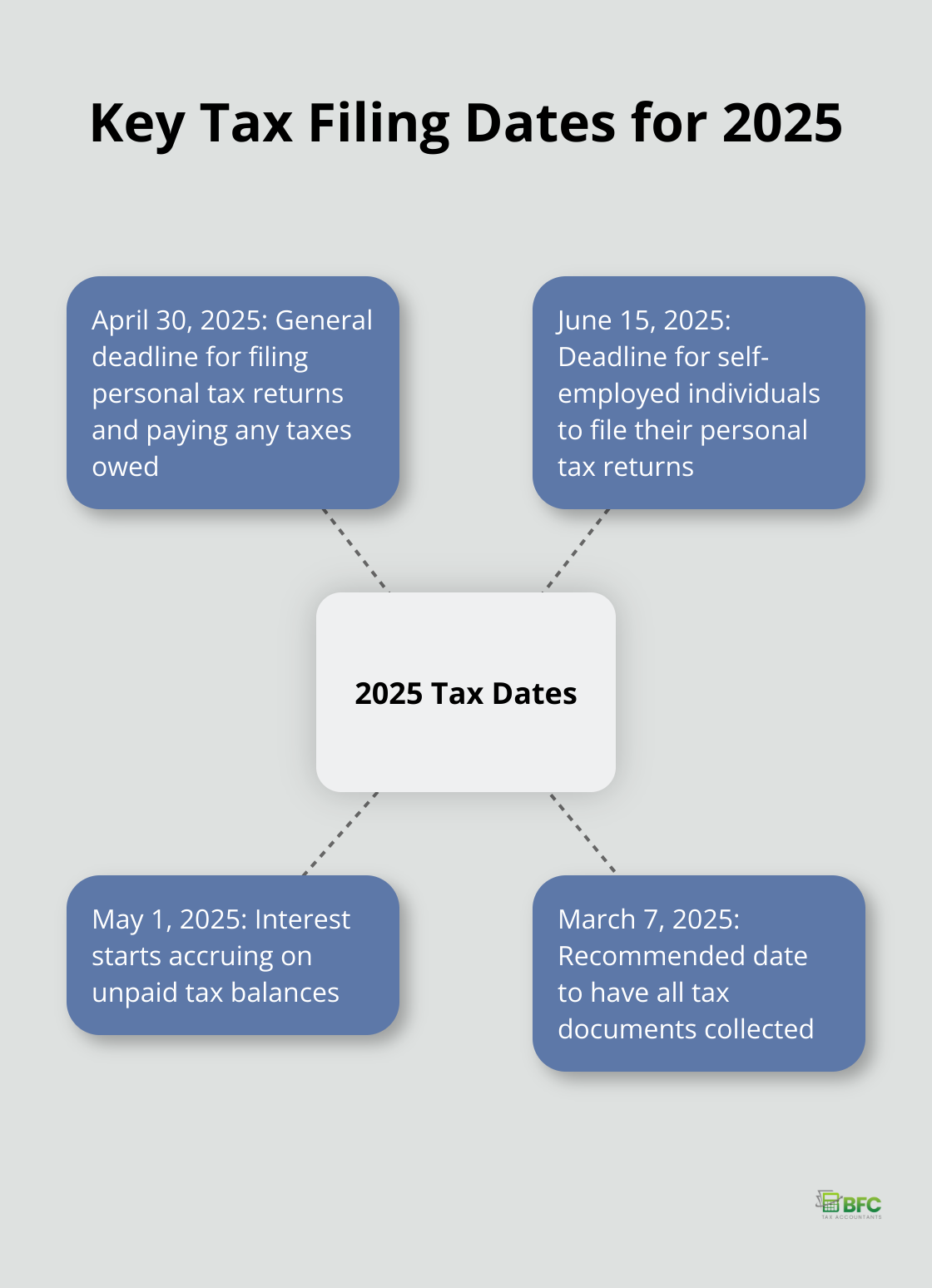

The 2025 tax season approaches, and Canadian taxpayers must mark April 30, 2025, on their calendars. This date serves as the deadline for most individuals to file their 2024 personal income tax returns. Employees, retirees, and those with investment income fall under this category. It’s important to note that any taxes owed must also be paid by this date to avoid interest charges.

Deadline for Self-Employed Individuals

Self-employed individuals (or those with a self-employed spouse or common-law partner) have until June 15, 2025, to file their personal tax returns. However, this extended filing deadline doesn’t apply to tax payments. Any taxes owed are still due by April 30, 2025. Failure to pay by this date will result in interest charges on the unpaid amount.

Extension Options and Considerations

The Canada Revenue Agency (CRA) doesn’t offer automatic extensions for personal tax returns. However, they may grant extensions in exceptional circumstances (such as natural disasters or serious illness). If you believe you qualify for an extension, contact the CRA directly or seek assistance from a professional tax service.

An important point to remember: even if you receive an extension to file, it doesn’t extend the deadline to pay any taxes owed. Interest will accrue on unpaid balances starting May 1, 2025.

Benefits of Early Filing

Filing early can be advantageous, especially for those expecting a refund. The CRA typically processes electronic returns within two weeks, allowing you to receive your refund sooner. If you have complex financial circumstances, consulting with a tax professional well before the deadline can help ensure accurate and timely filing.

Preparing for the Next Steps

As you plan for these important tax deadlines, it’s essential to start gathering necessary documents and understanding any new tax laws that may affect your 2024 return. The next section will guide you through the preparation process, helping you organize your financial records and stay ahead of the game for the 2025 tax season.

How to Prepare for the 2025 Tax Season

Collect Your Documents Early

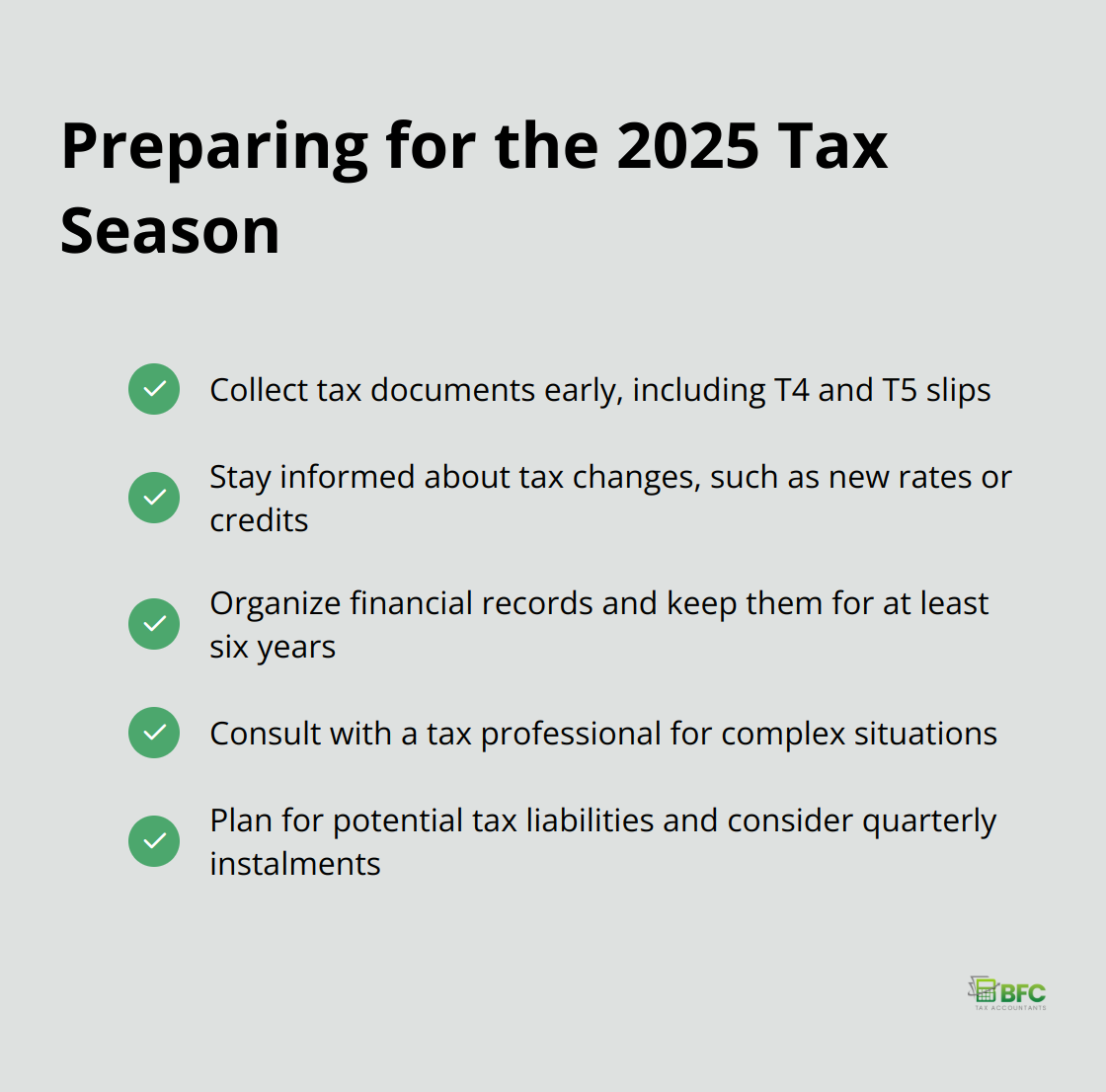

Start gathering your tax documents as soon as they arrive. This includes T4 slips from employers, T5 slips for investment income, and receipts for deductible expenses. Create a dedicated folder (or digital space) for these documents. The Canada Revenue Agency will grant relief in respect of late-filing penalties for information returns filed on or before March 7, 2025, so try to have everything collected by early March.

Stay Informed About Tax Changes

Tax laws can change from year to year. The 2025 tax year may see adjustments to tax brackets, deduction limits, or new credits. The Department of Finance Canada announced that the lowest marginal personal income tax rate will be reduced from 15 per cent to 14 per cent, effective July 1, 2025. Review these updates or consult with a tax professional to understand how they might affect your return.

Organize Your Financial Records

Maintain organized financial records throughout the year to save time and reduce stress during tax season. Consider using accounting software or apps to track expenses and income. The CRA recommends keeping records for at least six years (especially for self-employed individuals). Regular monthly or quarterly reviews of your finances can help identify potential deductions and ensure accuracy when it’s time to file.

Consult with a Professional

Tax situations can be complex. If you’re unsure about any aspect of your taxes, it’s always best to consult with a professional. BFC Tax Accountants offers expert guidance to help you navigate the intricacies of tax preparation and ensure you’re fully prepared for the 2025 tax season.

Plan for Potential Tax Liabilities

Estimate your potential tax liability early in the year. This allows you to set aside funds or adjust your withholdings if necessary. For self-employed individuals or those with significant investment income, consider making quarterly tax instalments to avoid a large lump sum payment at tax time.

As you prepare for the upcoming tax season, it’s important to understand the consequences of missing the filing deadline. Let’s explore what happens if you fail to file on time and how it can impact your financial situation.

What Happens If You Miss the Tax Deadline?

Late Filing Penalties

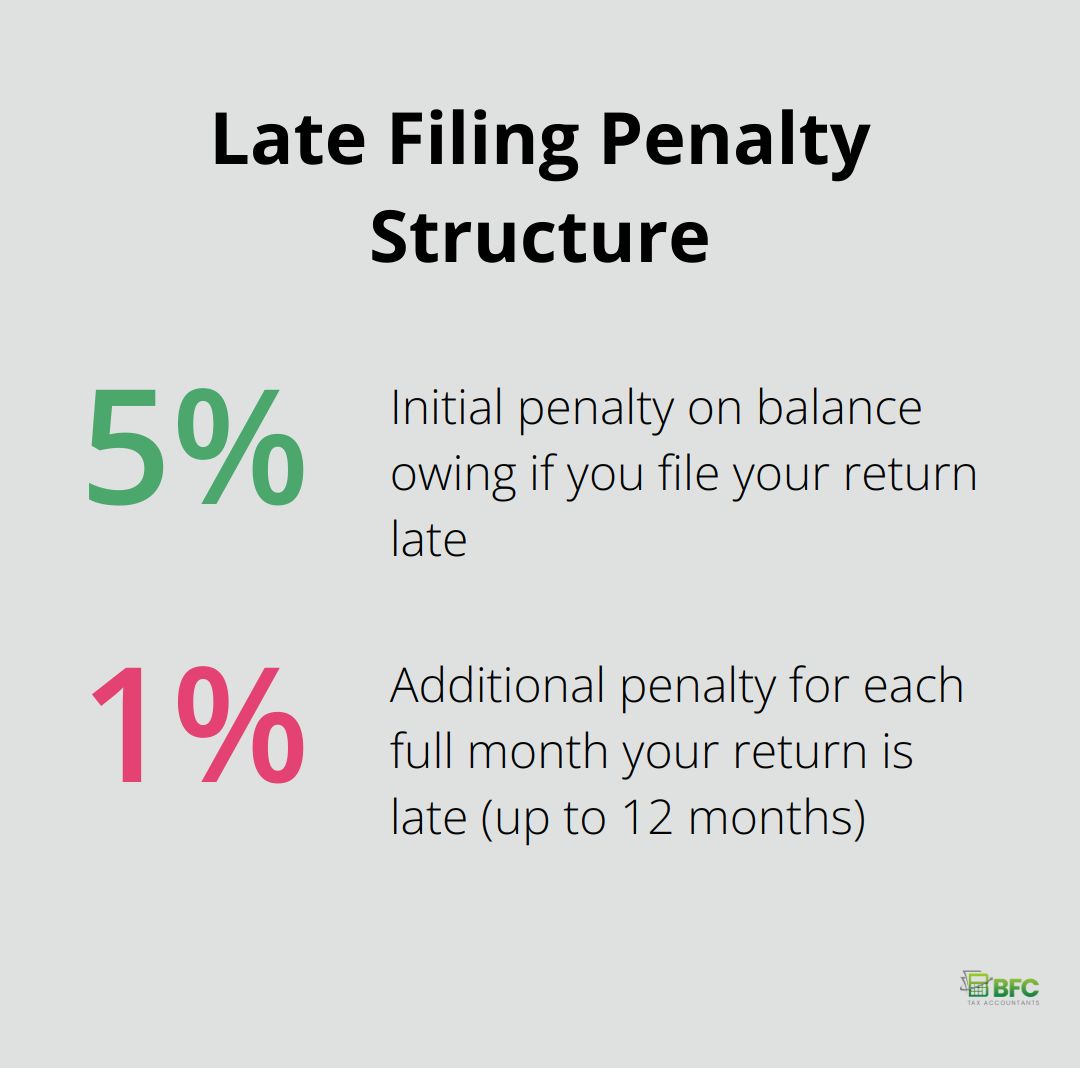

The Canada Revenue Agency (CRA) imposes strict penalties for late tax filings. If you owe taxes and file your return late, the CRA will charge a penalty of 5% of your 2024 balance owing, plus an additional 1% for each full month your return is late (up to a maximum of 12 months).

Interest Charges on Unpaid Taxes

The CRA doesn’t stop at penalties; they also charge compound daily interest on any unpaid tax amounts starting from May 1, 2025. The interest rate, set quarterly, can fluctuate. As of April 1, 2023, the prescribed interest rate stood at 8%. To illustrate, a $5,000 tax debt could accumulate over $400 in interest charges in just one year.

Impact on Government Benefits and Credits

Late filing can jeopardize your eligibility for various government benefits and credits. Many programs (such as the Canada Child Benefit and the Goods and Services Tax/Harmonized Sales Tax credit) rely on your tax return information to determine your eligibility and payment amounts. A late tax return could result in delays or interruptions in these payments.

For instance, the Canada Child Benefit can provide up to $6,997 per year for each child under six and up to $5,903 per year for each child aged 6 to 17. A late tax return could lead to a temporary suspension of these essential payments, causing significant financial stress for families.

Real-World Consequences

The impact of missing tax deadlines extends beyond mere numbers. Real people face real consequences. Some individuals have faced over $2,000 in penalties and interest after failing to file for two consecutive years. Others have lost months of crucial benefit payments due to late returns, leading to severe financial strain.

Mitigating the Impact

To avoid these costly repercussions, file your taxes on time, even if you can’t pay the full amount owed immediately. The CRA offers payment arrangements for those who need them. Filing on time will at least help you avoid the late-filing penalties. If you find tax preparation overwhelming, consider seeking professional help. BFC Tax Accountants offers expert guidance to ensure timely and accurate filing, helping you avoid penalties and maximize your benefits.

Final Thoughts

The personal tax due date for 2025 will arrive quickly. April 30, 2025, marks the deadline for most Canadians to file their personal tax returns and pay any taxes owed. Self-employed individuals must file by June 15, 2025, but should pay taxes by April 30 to avoid interest charges.

Timely filing prevents penalties, maintains access to government benefits, and ensures financial health. Late filing can result in significant penalties, compound interest on unpaid taxes, and potential disruptions to essential benefits (such as the Canada Child Benefit). Start early by gathering necessary documents, staying informed about tax law changes, and maintaining organized financial records throughout the year.

BFC Tax Accountants provides comprehensive tax services tailored to your unique needs. Our team of experts in Barrie, Ontario, offers personal and corporate tax planning and preparation. We stay up-to-date with Canadian tax laws to help you navigate the 2025 tax season with confidence and peace of mind.