Tax season can be stressful, especially when you’re running behind schedule. At BFC Tax Accountants, we understand the importance of knowing key deadlines to avoid penalties and unnecessary stress.

The personal tax extension deadline for 2024 is a critical date for those who need extra time to file their returns. This blog post will guide you through the extension process, highlighting important dates and steps to ensure you stay compliant with CRA regulations.

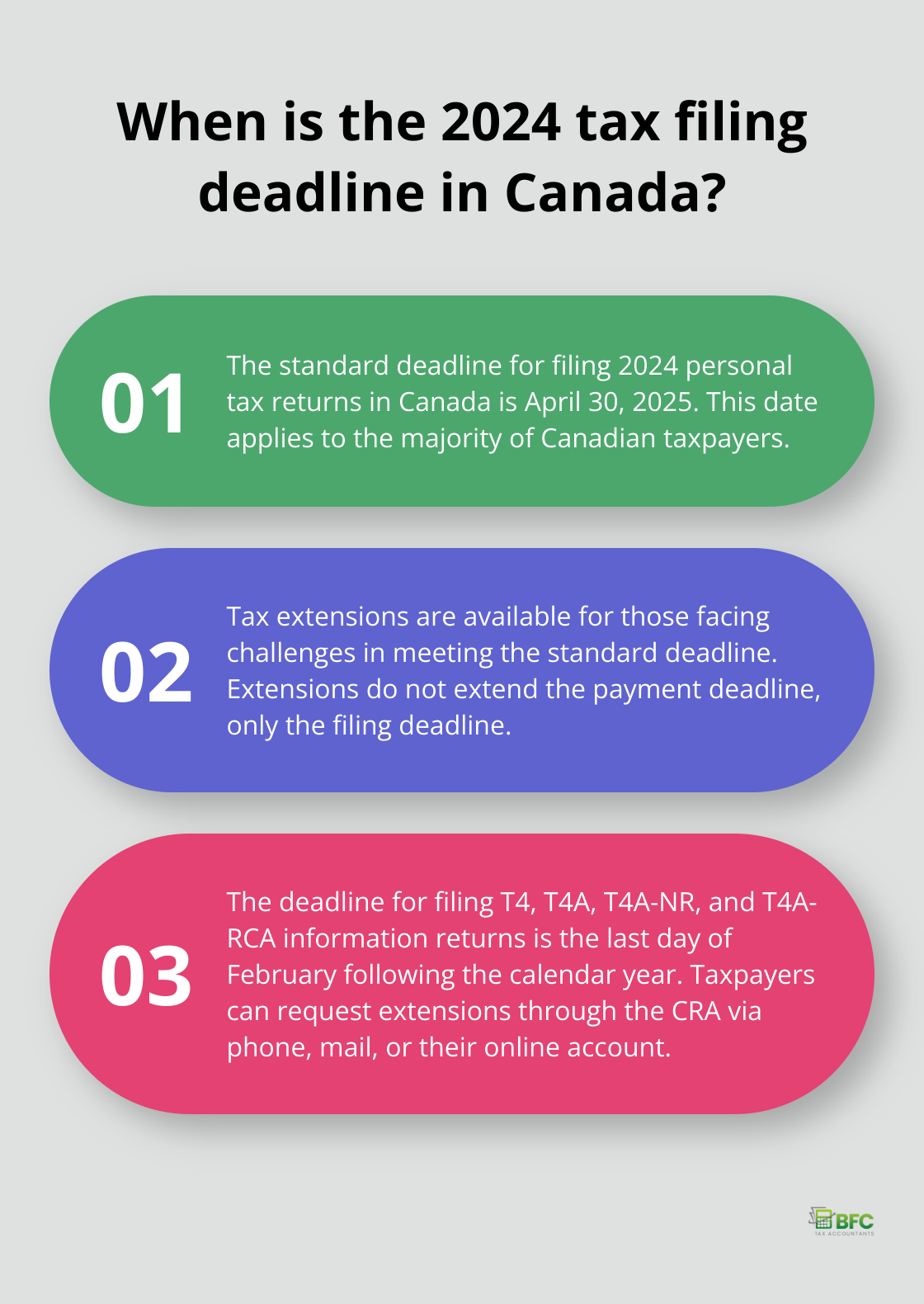

What Is the Standard Tax Filing Deadline for 2024?

The Regular Deadline

For the 2024 tax year, most Canadian taxpayers must file their personal tax returns by April 30, 2025. This date marks the standard deadline for the majority of filers.

The Purpose of Tax Extensions

Tax extensions play an important role in the Canadian tax system. They offer additional time to taxpayers who face challenges in meeting the standard deadline. Common reasons for extensions include:

- Pending tax documents

- Complex financial situations

- Personal emergencies

The Canada Revenue Agency (CRA) offers these extensions to help taxpayers comply without excessive stress.

Eligibility for Tax Extensions

All Canadian taxpayers can request a tax extension. However, an extension to file does not equal an extension to pay. If you owe taxes, you must still pay by the original deadline to avoid interest charges.

Filing deadline: File your T4, T4A, T4A-NR and T4A-RCA information returns by the last day of February after the preceding calendar year.

How to Request an Extension

To request an extension, contact the CRA before the filing deadline. You can do this via phone, mail, or through your My Account on the CRA website. When you make your request, explain why you need the extension and provide an estimate of when you’ll file.

Professional Assistance with Extensions

At BFC Tax Accountants, we often help clients with extension requests. Our experience shows that clear communication with the CRA and a realistic filing timeline can improve the chances of approval. While extensions are often granted, they’re not guaranteed, so it’s best to try for the standard deadline when possible.

The next chapter will explore the specific deadlines for personal tax extensions in 2024, including important distinctions between filing and payment extensions.

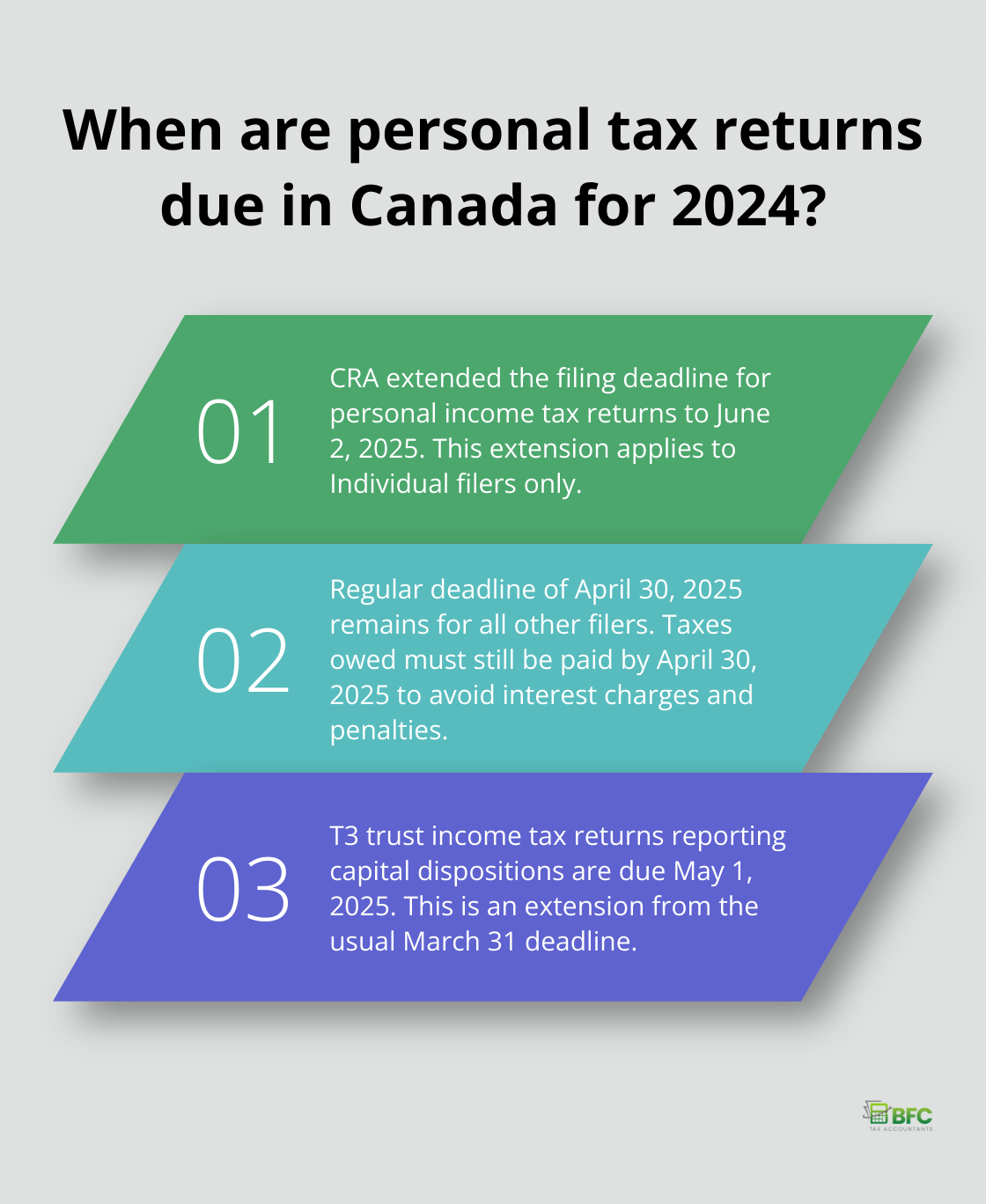

When Is the Extended Tax Deadline?

Extended Deadline for Personal Tax Returns

The Canada Revenue Agency (CRA) has announced significant changes to the tax filing deadlines for 2024. These extensions accommodate taxpayers who face challenges due to recent tax law changes, particularly those related to capital gains.

For the 2024 tax year, the CRA has extended the filing deadline for personal income tax returns (T1) to June 2, 2025. This extension applies to Individual filers. For all other filers, the regular deadline of April 30, 2025, remains in effect.

Filing vs. Payment Extensions

A filing extension does not automatically grant a payment extension. Even if you qualify for the extended filing deadline, you must pay any taxes owed by April 30, 2025, to avoid interest charges and penalties. The CRA calculates interest on unpaid amounts starting from May 1, 2025 (regardless of your filing date).

Consequences of Missing the Extended Deadline

Failure to file your tax return by the extended deadline can result in severe consequences. The CRA imposes a late-filing penalty if you file or pay your taxes late. If you have a history of late filing, these penalties can increase.

Trust Income Tax Returns

For those filing T3 trust income tax returns that report capital dispositions, the deadline has moved to May 1, 2025, from the usual March 31 date. This extension aligns with the changes made for personal tax returns and provides additional time for accurate reporting of capital gains.

Professional Assistance with Extended Deadlines

Navigating these new deadlines can prove challenging. At BFC Tax Accountants, we recommend filing as early as possible, even with these extensions in place. Early filing helps you avoid last-minute stress and potential errors. If you’re unsure about your specific filing requirements or need assistance with these new deadlines, our team of experts stands ready to help you stay compliant and maximize your tax efficiency.

The next section will guide you through the process of filing for a personal tax extension, including the necessary forms and common pitfalls to avoid.

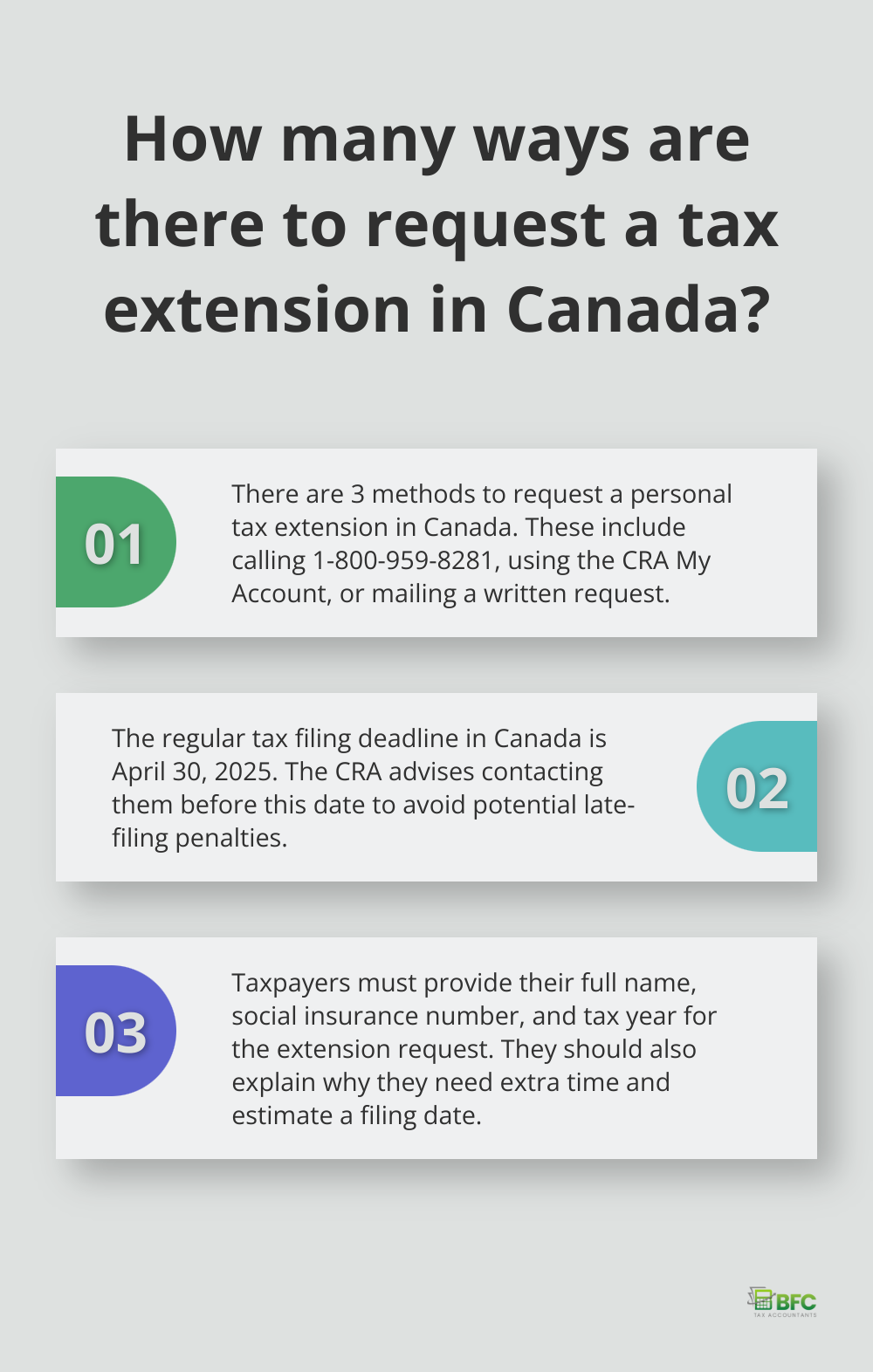

How to Request a Personal Tax Extension

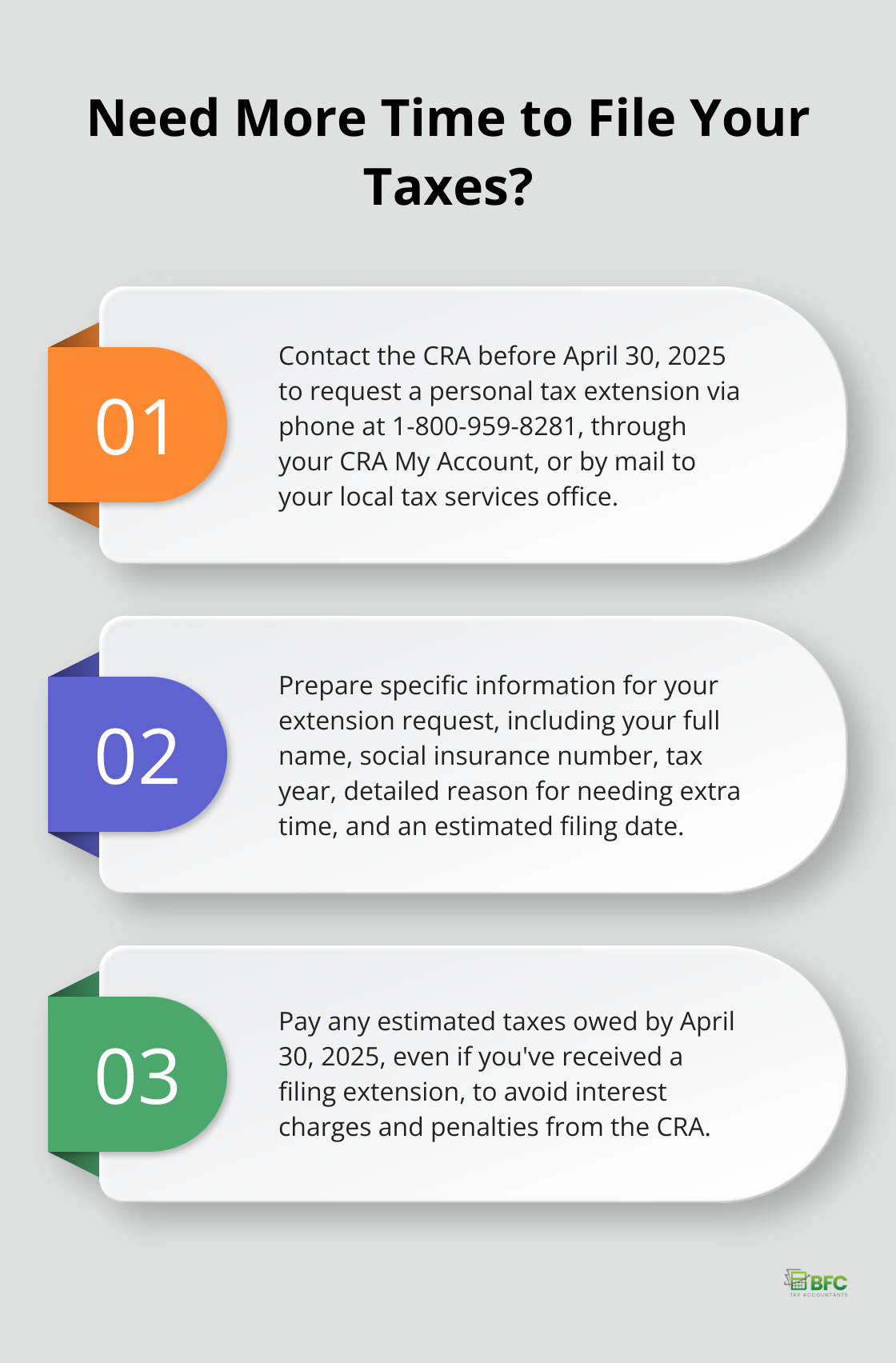

Contacting the CRA

To request a personal tax extension in Canada, you must contact the Canada Revenue Agency (CRA) directly. The CRA offers several methods for this:

- Phone: Call 1-800-959-8281 and select option 1 for online services. Have your tax documents ready to validate your identity.

- My Account: Access your CRA My Account and use the secure messaging feature to submit your request.

- Mail: Send a written request to your local tax services office. Include your name, address, social insurance number, and extension reason.

The CRA advises taxpayers to contact them before the regular filing deadline (April 30, 2025) to avoid potential late-filing penalties.

Required Information

When you request an extension, prepare to provide:

- Your full name and social insurance number

- The tax year for your extension request

- A clear explanation for needing additional time

- An estimated date for filing your return

Provide specific and detailed explanations to increase your approval chances. Common reasons include waiting for essential documents, complex financial situations, or personal emergencies.

Extension Limitations

The CRA may grant you extra time to file your return, but this does not extend the deadline for paying taxes owed. To avoid interest charges, estimate and pay any taxes due by the original April 30 deadline, even if you haven’t filed your return yet.

Automatic Extensions

The CRA has extended the filing deadline to June 16, 2025, for those carrying on business (this extension is automatic and doesn’t require a separate request). If you need additional time beyond this date, follow the process outlined above.

Professional Assistance

Tax extensions can be complex. Many taxpayers choose to work with professional tax services (like Kyei Baffour) to navigate this process. These experts can help estimate tax liability, ensure proper documentation, and communicate effectively with the CRA.

Final Thoughts

The personal tax extension deadline for 2024 brings important changes. Most Canadian taxpayers must file by April 30, 2025, while those reporting capital dispositions have until June 2, 2025. Trust income tax returns with capital dispositions are due by May 1, 2025.

Timely filing and payment prevent penalties and interest charges. Taxes owed must be paid by April 30, 2025, even with an extension to file. Late payments incur interest charges, regardless of filing date.

Tax season complexities can overwhelm many individuals. At BFC Tax Accountants, we help people in Barrie, Ontario and beyond with tax planning and preparation. For comprehensive tax services, visit BFC Tax Accountants to explore our tailored accounting packages (suitable for businesses of all sizes).