At BFC Tax Accountants, we know that understanding when personal income tax is due in Canada is essential for every taxpayer. The Canadian tax system has specific deadlines and rules that can impact your filing obligations.

This guide will walk you through the key dates, exceptions, and considerations for filing your personal income tax in Canada. We’ll also provide practical tips to help you stay on top of your tax responsibilities and avoid potential penalties.

When Does the Canadian Tax Year Start and End?

The Canadian Tax Year Defined

The Canadian tax year aligns with the calendar year, running from January 1 to December 31. This period serves as the foundation for tracking income, expenses, and other financial activities that affect your tax obligations. A clear understanding of this timeframe allows you to organize your financial records effectively and prepare for the upcoming tax season.

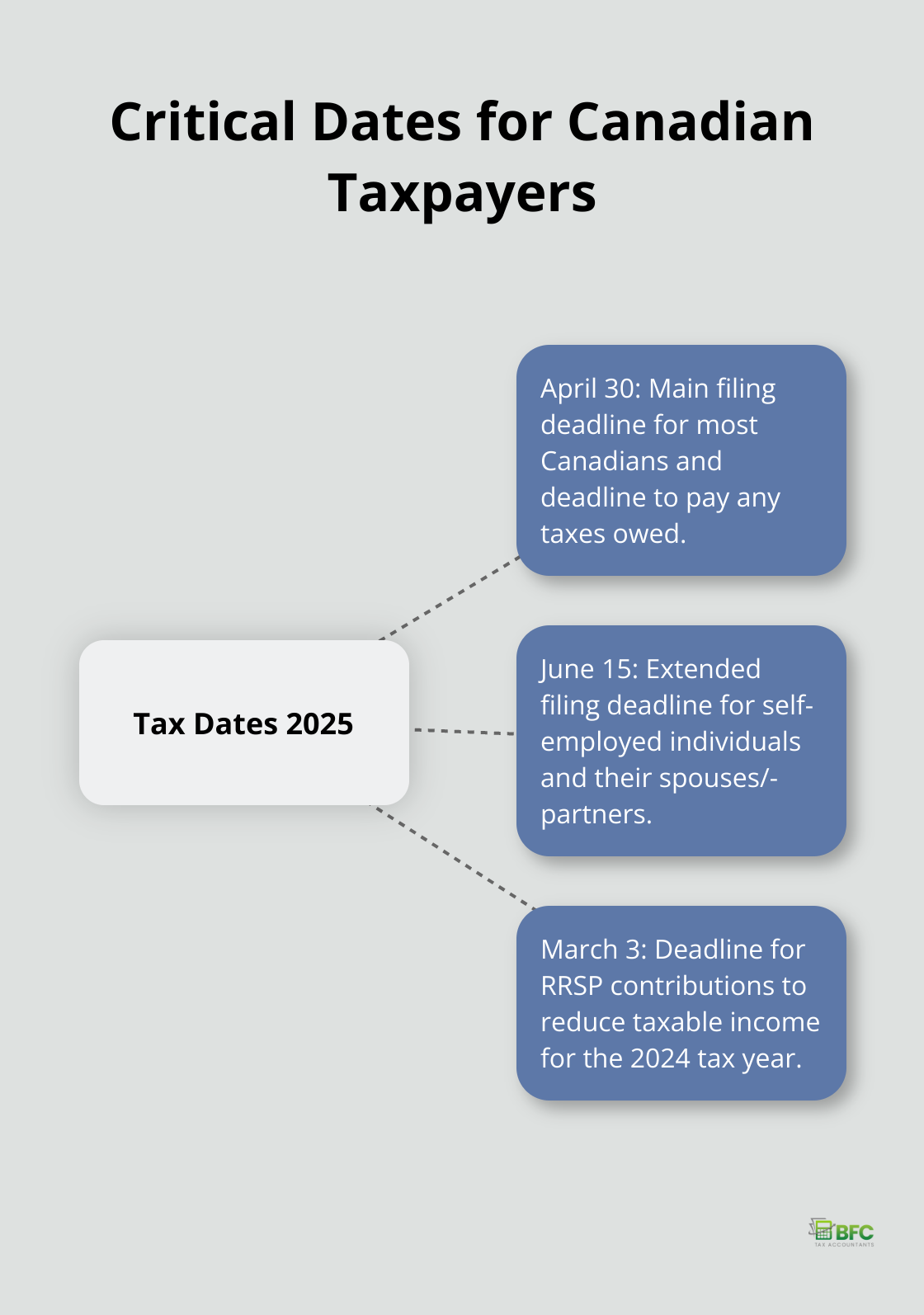

Critical Dates for Canadian Taxpayers

April 30, 2025, stands as the primary deadline for most Canadians to file their 2024 personal income tax returns and pay any taxes owed. This date determines when you must report your income and claim deductions for the previous year. Failure to meet this deadline can result in penalties and interest charges on unpaid taxes.

Self-employed individuals (and their spouses or common-law partners) have an extended filing deadline of June 15, 2025. However, it’s crucial to note that any taxes owed are still due by April 30, 2025, to avoid interest charges.

Who Must File Taxes in Canada?

All Canadian residents with taxable income must file a tax return. This requirement applies to individuals who:

- Owe taxes

- Want to claim a refund

- Need to report income from various sources (e.g., employment, investments, or government benefits)

Non-residents who earned income from Canadian sources or disposed of taxable Canadian property also need to file. Additionally, individuals seeking to claim tax credits or benefits (such as the GST/HST credit or Canada Child Benefit) must file a return, even if they have no taxable income.

Preparing for Tax Season

Starting your tax preparation early can significantly reduce stress and potential errors. We recommend gathering necessary documents well before the filing deadline, including:

- T4 slips

- Receipts for deductions

- Investment income statements

Financial decisions made throughout the year can impact your tax situation. For example, contributing to a Registered Retirement Savings Plan (RRSP) by March 3, 2025, can reduce your taxable income for the 2024 tax year. Planning these actions in advance often leads to substantial tax savings.

The Impact of Timely Filing

Filing your taxes on time offers several advantages:

- Avoidance of late-filing penalties (which can be up to 17% of your unpaid taxes)

- Prompt receipt of any tax refunds you’re entitled to

- Uninterrupted access to government benefits that require up-to-date tax information

With the key dates and requirements for the Canadian tax year established, let’s explore the general tax filing deadlines for individuals in more detail.

When Do You Need to File Your Taxes?

Standard Deadline for Most Canadians

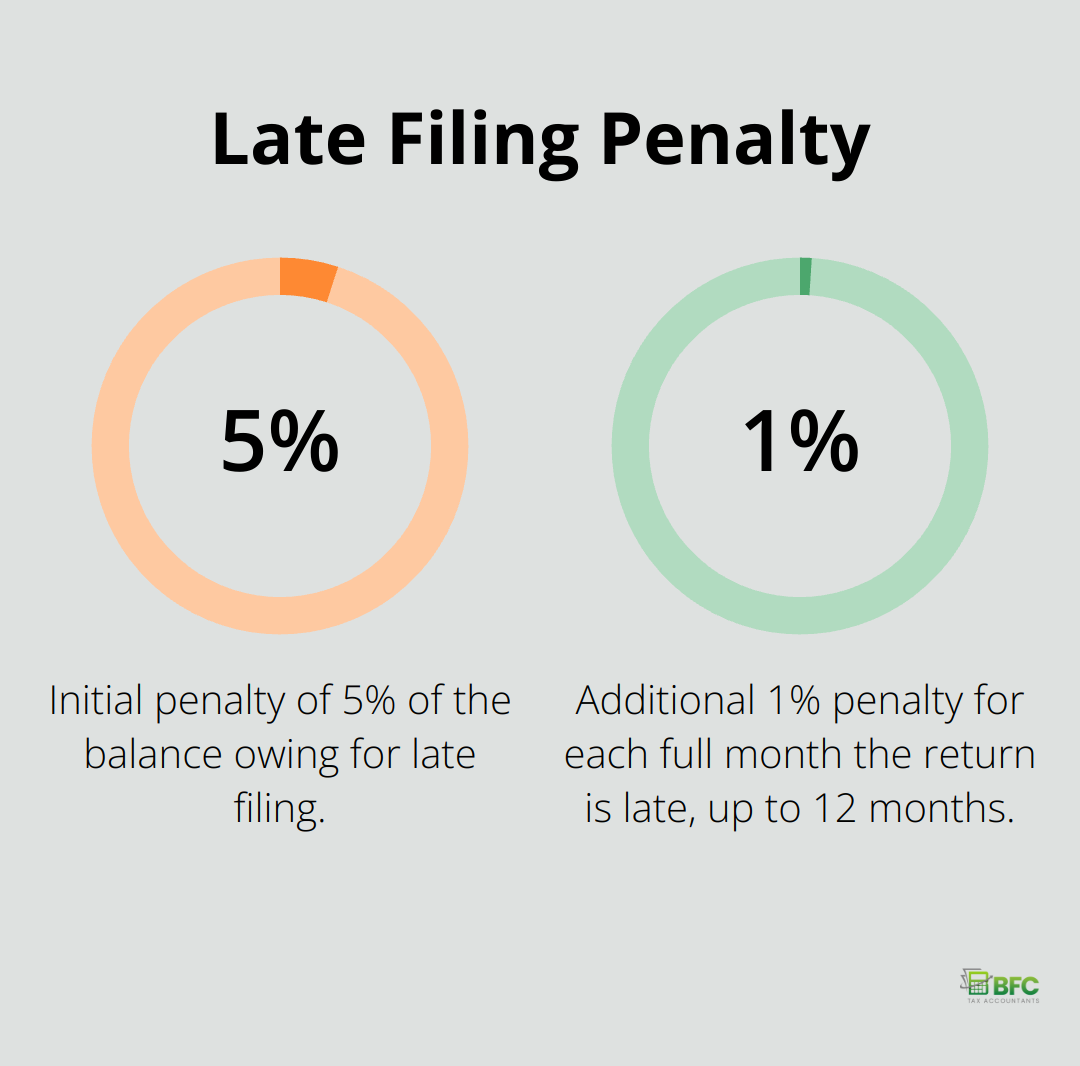

Most Canadian taxpayers must file their 2024 personal income tax return by April 30, 2025. This date also marks the deadline for paying any taxes owed. The Canada Revenue Agency (CRA) enforces this deadline strictly. Late filing results in penalties: 5% of your balance owing, plus 1% for each full month your return is late (up to a maximum of 12 months). The CRA also charges interest on both the unpaid tax and the penalty.

Extended Deadline for Self-Employed Individuals

Self-employed Canadians (and their spouses or common-law partners) have until June 16, 2025, to file their 2024 tax returns. This extension acknowledges the additional complexity of reporting business income and expenses. However, any taxes owed still must be paid by April 30, 2025, to avoid interest charges. Self-employed individuals who expect to owe taxes should estimate their tax liability and pay by April 30, even if they plan to file their return later.

Deadlines for Deceased Taxpayers

For deceased taxpayers, filing deadlines depend on the date of death:

- Deaths between January 1 and October 31, 2024: The deadline is April 30, 2025.

- Deaths between November 1 and December 31, 2024: The deadline is six months after the date of death.

The executor or legal representative must file the deceased’s final tax return. This process often involves various elections and optional returns, which can complicate the filing process.

Consequences of Missing the Deadline

Filing your taxes late can lead to several negative consequences:

- Financial penalties (as mentioned earlier)

- Delayed tax refunds

- Interruption of government benefits that require up-to-date tax information

Planning Ahead for Tax Season

To avoid last-minute stress and potential errors, start your tax preparation early. Gather necessary documents well before the filing deadline, including:

- T4 slips (for employment income)

- Receipts for deductions and credits

- Investment income statements

Consider making strategic financial decisions throughout the year to optimize your tax situation. For example, contributing to a Registered Retirement Savings Plan (RRSP) by March 3, 2025, can reduce your taxable income for the 2024 tax year.

While these deadlines apply to most situations, certain circumstances may affect your filing obligations. Let’s explore some exceptions and extensions to these standard tax filing deadlines.

What If You Can’t Meet the Tax Deadline?

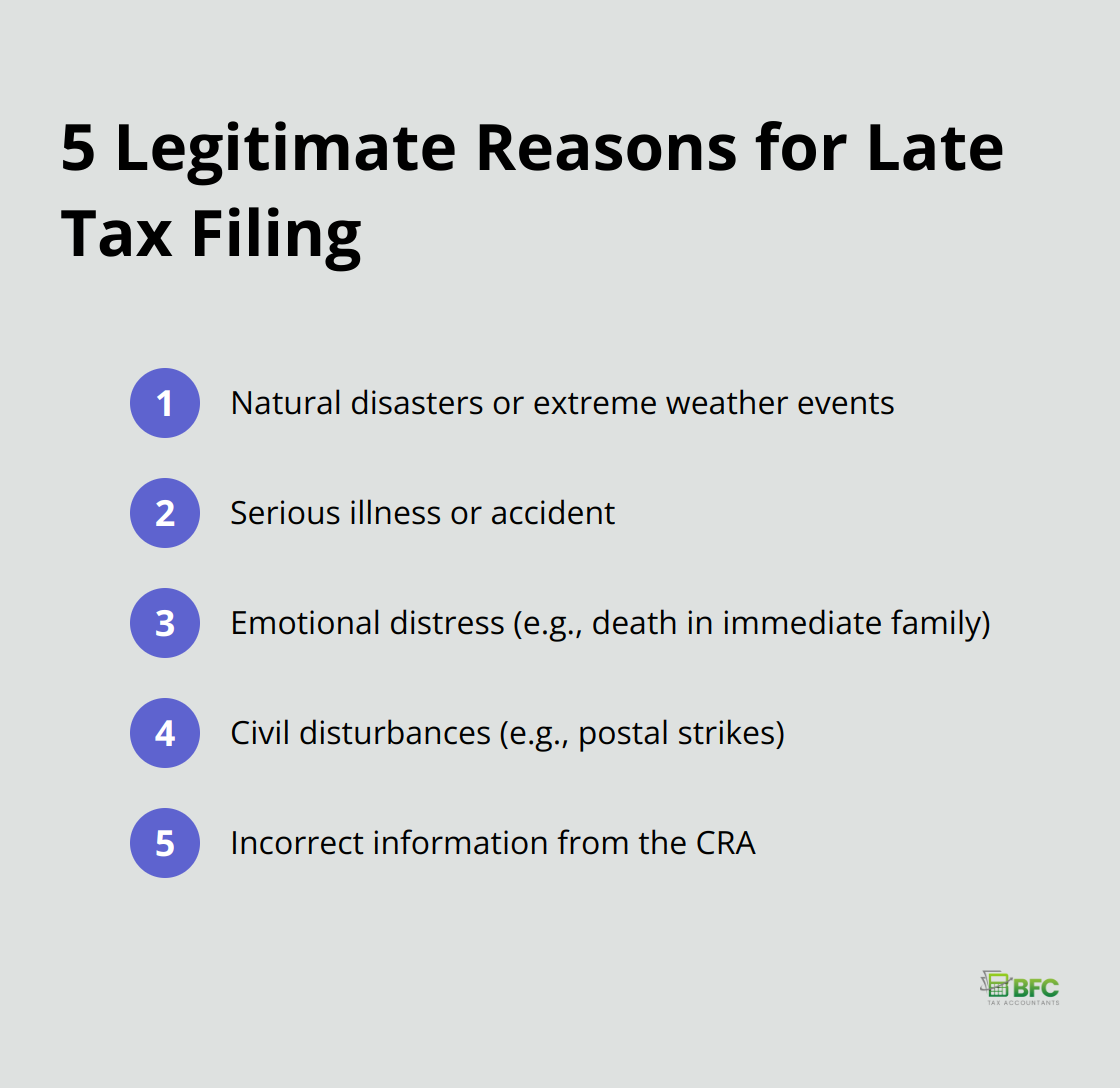

Legitimate Reasons for Late Filing

The Canada Revenue Agency (CRA) acknowledges that certain circumstances may prevent taxpayers from meeting standard deadlines. Valid reasons for late filing include:

If you experience one of these situations, document everything. Keep medical records, news reports, or any other evidence that supports your case. This documentation will prove essential when explaining your situation to the CRA.

Requesting a Tax Filing Extension

Canada doesn’t have a formal process for requesting tax filing extensions. However, you can contact the CRA before the filing deadline to explain your situation. They may grant you an informal extension or provide guidance on how to proceed.

To reach out to the CRA:

- Call the Individual Income Tax Enquiries line at 1-800-959-8281

- Use the My Account online service to send a secure message

- Write a letter to your local tax services office

Prepare to provide details about why you need extra time and when you expect to file. The CRA will consider each case individually.

Consequences of Late Filing

Filing late without a valid reason results in penalties. The late-filing penalty is 5% of your 2024 balance owing, plus an additional 1% for each full month that you file after the due date, to a maximum of 12 months.

For example, if you owe $5,000 and file three months late, your penalty would total $400 (initial penalty of $250 plus an additional $150 for the three months).

The CRA charges compound daily interest on any unpaid amounts starting May 1, 2025. The interest rate changes quarterly and typically exceeds most savings account rates.

Voluntary Disclosure Program

The CRA’s Voluntary Disclosure Program helps taxpayers voluntarily come forward to fix errors or omissions in their tax affairs without facing penalties or prosecution. This program applies to those who failed to report income or claim deductions in previous years. However, you must come forward before the CRA contacts you about the issue.

The program has strict eligibility criteria, and the process can become complex. Professional guidance often proves necessary to navigate this option successfully.

Seeking Professional Assistance

If you struggle to meet the deadline or face complications with your tax situation, consider seeking professional help. Tax experts (such as those at BFC Tax Accountants) can guide you through the process, help minimize potential penalties, and ensure you meet all necessary requirements.

Final Thoughts

Personal income tax in Canada is due on April 30, 2025, for most taxpayers, while self-employed individuals have until June 16, 2025, to file (but must pay any taxes owed by April 30). Timely filing helps you avoid penalties, receive refunds promptly, and maintain access to government benefits. If unexpected challenges prevent you from meeting the deadline, contact the Canada Revenue Agency immediately for guidance.

Tax season doesn’t have to cause stress. Proper planning and professional assistance can help you approach your tax responsibilities with confidence. At BFC Tax Accountants, we offer expert tax services to individuals and businesses in Barrie, Ontario.

Our team can assist you with personal and corporate tax planning and preparation. We strive to ensure you meet all deadlines and maximize your tax savings. Let BFC Tax Accountants help you navigate the complexities of the Canadian tax system and focus on what matters most to you.